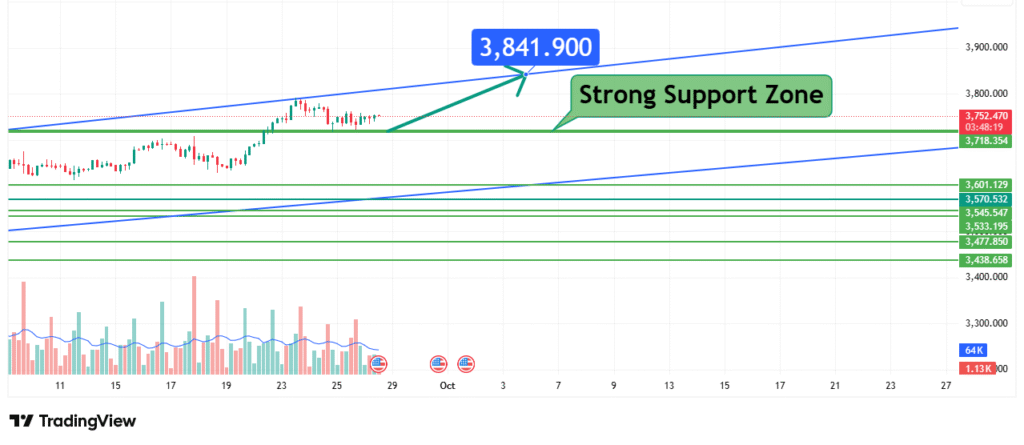

Gold (XAUUSD) Price Analysis Bullish Continuation Targets $3,840

Gold has established a formidable uptrend, reaching new all-time highs. The price is currently undergoing a healthy consolidation above a Strong Support Zone, indicating a potential pause before the next leg higher. Our analysis projects a bullish continuation, targeting a retest and potential breach of the recent high at $3,840. This prediction is based on the strength of the underlying trend, the defense of key support, and the absence of any significant bearish reversal patterns.

Current Market Structure and Price Action

The market structure for Gold is unambiguously bullish, characterized by a series of higher highs and higher lows. The price action shows a strong impulsive wave followed by a corrective pullback. This pullback has found support above the $3,700 level, forming a potential bull flag or simple consolidation pattern. This type of price action after a strong rally typically resolves with a continuation of the dominant trend.

Identification of the Key Support Zone

The most critical technical element on the chart is the Strong Support Zone between approximately $3,710 and $3,750.

- Historical Significance: This zone represents the breakout area from the previous consolidation. Old resistance, once broken, often becomes new support. The price is currently respecting this principle.

- Technical Confluence: The zone contains several recent daily lows and aligns with the 38.2% Fibonacci retracement level (a common pullback depth in a strong trend).

- Market Psychology: This area represents a point where traders who missed the initial rally see a “discount” to enter, while others add to their positions, creating a pool of demand.

This multi-faceted support confluence makes it a high-probability level for a bullish reaction.

Technical Target and Rationale

Our analysis identifies a clear primary price target.

- Primary Target (PT1): $3,840

Rationale: This target is the obvious and most recent all-time high. In a strong bullish trend, the first objective is always to retest the prior peak. A break above this level would confirm the resumption of the uptrend and open the path to uncharted territory, with $3,900 and $4,000 as subsequent psychological targets. Achieving this target from the current price would represent a gain of approximately 2.3%.

Prediction: We forecast that Gold will hold above the support zone and initiate a new impulsive wave towards our primary target at $3,840.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish continuation thesis is invalidated if the price breaks down and achieves a sustained daily close below the support zone, specifically below $3,700. This level would indicate a failure of the support and a potential deeper correction towards the next significant support near $3,600.

- Position Sizing: Any positions taken should be sized so that a loss triggered at the $3,700 invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is powerfully supported by the current fundamental landscape:

- Federal Reserve Policy Expectations: The market’s anticipation of the end of the Fed’s hiking cycle and eventual rate cuts is a primary driver. Lower interest rates reduce the opportunity cost of holding non-yielding Gold.

- Geopolitical Tensions: Ongoing global conflicts reinforce Gold’s status as a ultimate safe-haven asset, driving demand from central banks and investors seeking protection.

- Weakening US Dollar: Any sustained weakness in the US Dollar (DXY) is inherently bullish for Gold, as it becomes cheaper for holders of other currencies.

Conclusion

Gold is in a powerful bull market and is currently taking a breather above a crucial support zone. The weight of evidence suggests a bullish resolution is the path of least resistance, targeting a move to retest the $3,840 high. Traders should monitor for a break above the consolidation’s resistance with increasing momentum. Risk must be managed diligently by respecting the key invalidation level at $3,700. A successful breach of the $3,840 target will confirm the next phase of the bullish trend.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.