How to Achieve Financial Freedom A 7-Step Blueprint

Are you stuck on the hamster wheel of working to pay bills, only to have to work more? Financial freedom is the escape plan, it’s the point where your money works for you so you don’t have to. This definitive guide will provide a clear, actionable path to build the wealth and passive income needed to design a life on your own terms.

For individuals in the US, UK, Canada, and Australia, achieving financial freedom means understanding your specific tax-advantaged accounts (like 401(k)s, ISAs, or Superannuation) and building a strategy that works within your local economy.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To build sufficient passive income to cover your desired lifestyle expenses, freeing you from the necessity of traditional work. |

| Skill Level | Beginner to Intermediate |

| Time Required | A lifetime mindset, but initial plan setup can be done in a weekend. |

| Tools Needed | Budgeting App/Spreadsheet, Brokerage & Retirement Accounts, Financial Calculator. |

| Key Takeaway | Financial freedom is a marathon, not a sprint. It’s achieved through consistent habits, disciplined investing, and a focus on growing the gap between your income and expenses. |

Why Pursuing Financial Freedom is Crucial

Financial freedom isn’t about being idle; it’s about having the choice to work on what you love, without worrying about the paycheck. It’s the ultimate form of security and personal liberty.

The Problem It Solves: The “rat race” is a cycle of dependency, on a job, a boss, or a single stream of income. It creates stress, limits life choices, and leaves you vulnerable to economic downturns or unexpected life events.

Achieving financial freedom gives you control over your most valuable asset: your time. You gain the ability to pursue passions, spend more time with family, and weather financial storms with confidence. For traders and investors, it’s the ultimate validation of your strategy, your portfolio literally becomes your engine of liberty.

What You’ll Need Before You Start

Before you embark on this journey, get these foundational elements in place.

Knowledge Prerequisites: A basic understanding of compound interest, asset classes (stocks, bonds, real estate), and the difference between active and passive income.

Data Requirements: A clear picture of your current financial state: total income, all monthly expenses, total debt (with interest rates), and current asset values.

Tools & Platforms:

- Tracking: A budgeting app (like You Need A Budget or Mint) or a simple spreadsheet.

- Investing: A reliable brokerage account (e.g., Fidelity, Vanguard, Interactive Brokers).

- Calculations: A financial calculator or the Future Value (FV) function in Excel/Google Sheets.

To easily track your investments and execute your strategy, you’ll need a robust brokerage platform. Many of the best online brokers for long-term investors, like Vanguard or Fidelity, offer low-cost index funds and excellent tools perfect for this journey.

How to Achieve Financial Freedom: A Step-by-Step Walkthrough

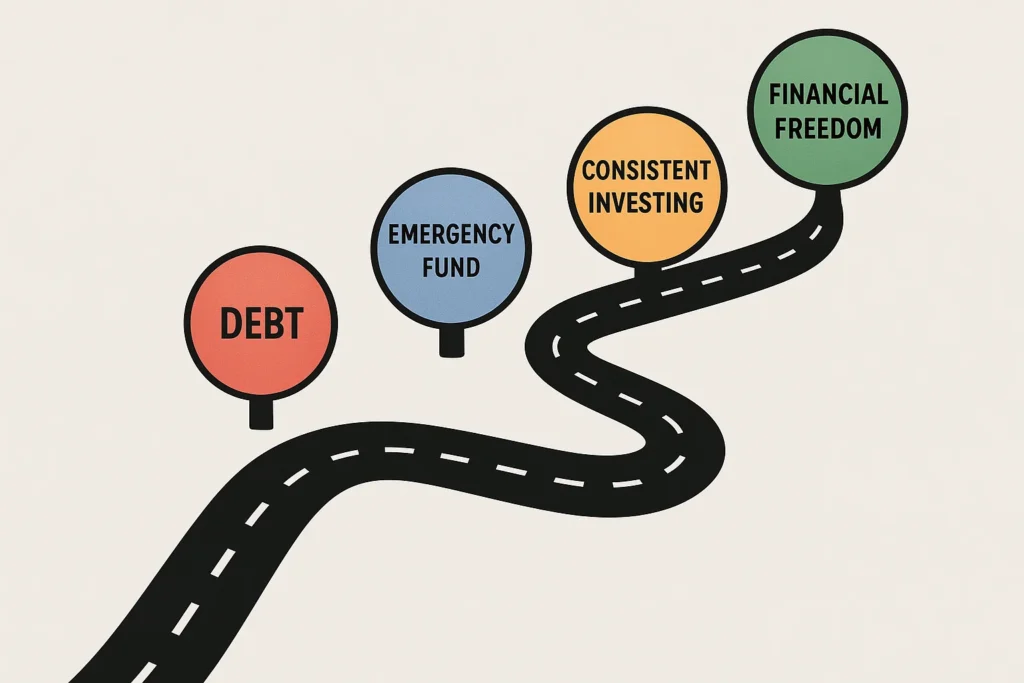

The journey to financial freedom isn’t a mystery, it’s a systematic process of building habits and assets. We will break it down into seven clear, manageable steps, from calculating your ultimate goal to protecting the wealth you create. Follow this walkthrough to transform your finances from a source of stress into a tool for liberation.

Step 1: Define Your “Freedom Number” and Goals

Freedom is a number, not a vague concept. Calculate your Financial Independence Number by estimating your annual expenses and multiplying them by 25 (the 4% rule). If you need $50,000 a year to live, your target is $1.25 million.

Pro Tip: Don’t just think about current expenses. Factor in healthcare, taxes, and the lifestyle you truly want. This is your “Why” and your North Star.

Step 2: Master Your Cash Flow (The Profit & Loss of You)

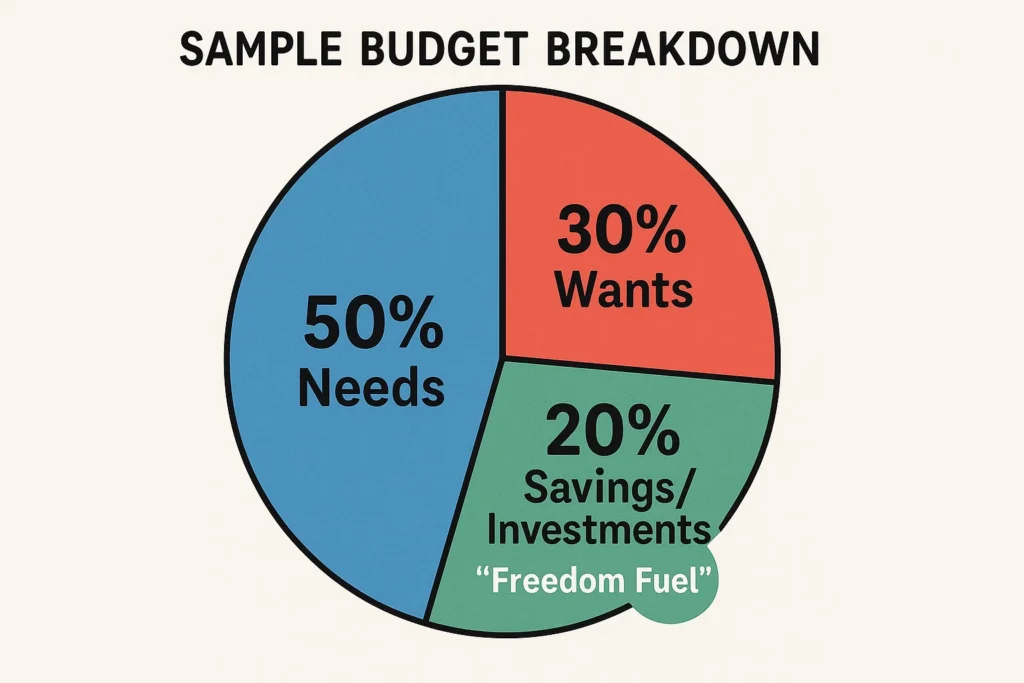

You cannot invest what you don’t save. Track every dollar of income and expense for one month. Categorize them and ruthlessly find areas to cut. The goal is to maximize your savings rate, the percentage of your income you save and invest.

Common Mistake to Avoid: Creating a budget that’s too restrictive. This leads to burnout. Aim for a sustainable plan that trims fat without sacrificing all joy.

Step 3: Eliminate High-Interest Debt

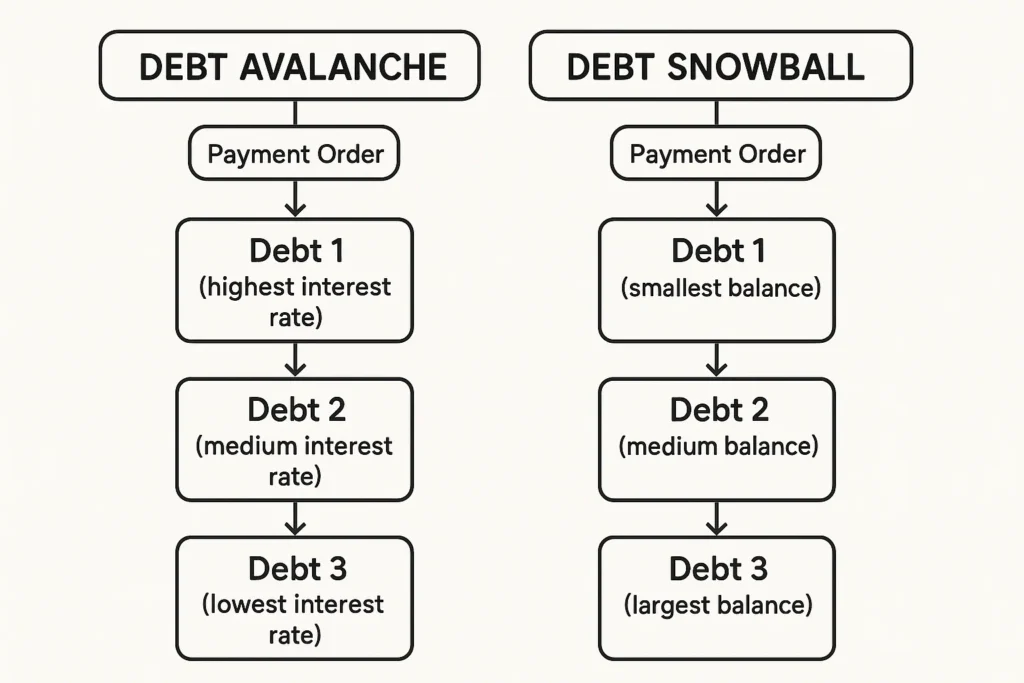

Debt, especially from credit cards, is an anchor on your financial ship. Before aggressive investing, create a plan to pay off all high-interest debt (anything above 7-8% APR). The guaranteed return from eliminating a 20% interest charge is better than most risky investments.

Formula: Use either the Debt Snowball (pay smallest debts first for psychological wins) or Debt Avalanche (pay highest-interest debts first for mathematical efficiency) method.

Step 4: Build Your Fortress of Solitude (Emergency Fund)

Life happens. An emergency fund of 3-6 months’ worth of essential expenses prevents you from going into debt when unexpected costs arise. This is your financial shock absorber. Keep this cash in a high-yield savings account.

Step 5: The Engine Room – Consistent, Automated Investing

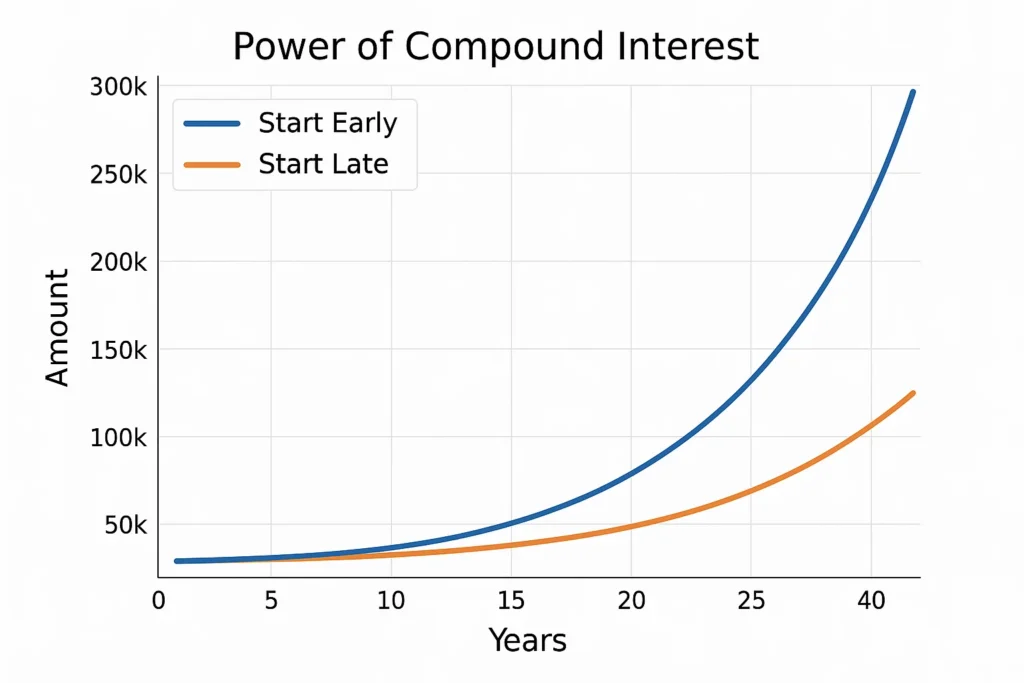

This is where the magic of compound interest takes over. Automate monthly transfers from your checking account to your investment accounts. Your primary focus should be on acquiring income-producing assets.

The Core Strategy: For most, a low-cost, broad-market index fund (like an S&P 500 ETF) is the most reliable engine. It provides diversification and captures the overall market’s growth.

Step 6: Develop Multiple Streams of Income

Don’t rely on a single paycheck. Accelerate your journey by creating additional income streams.

- Active Side Hustles: Freelancing, consulting, a part-time job.

- Passive Income: Dividends from your investments, rental income from real estate, royalties from a digital product.

Step 7: Protect Your Wealth and Optimize

As your wealth grows, protection becomes key. This includes having the right insurance (health, life, disability, umbrella) and understanding tax-advantaged accounts (like IRAs, 401(k)s, ISAs) to keep more of what you earn.

The Psychology of Wealth: Mastering Your Money Mindset

The biggest barriers to financial freedom are often psychological, not mathematical.

- Scarcity vs. Abundance Mindset: Shift from “I can’t afford this” to “How can I afford this?” This opens up creative problem-solving.

- Delayed Gratification: Learn to sacrifice short-term wants for long-term goals. Every dollar not spent on a latte is a soldier in your freedom army.

- Handling Market Volatility: The market will fall by 10-50% periodically. Your ability to not panic-sell is a superpower. This is achieved through education and a solid long-term plan.

How to Use Your Financial Plan in Your Life Strategy

Scenario 1: The Aggressive Saver: You have a 40%+ savings rate. You’re on the fast track (potentially achieving freedom in 10-15 years). Your focus should be on tax optimization and avoiding lifestyle inflation as your salary grows.

Scenario 2: The Beginner with Debt: You’re at a 5% savings rate with student loans. Your immediate focus is Steps 2 and 3. Every raise or bonus should be split between debt repayment and increasing your savings rate.

Case Study: Sarah, a marketing manager, earned $75,000. She tracked her spending, cut unnecessary subscriptions and dining out, and increased her savings rate from 10% to 30%. She automated $1,500 a month into a low-cost S&P 500 index fund. While her ‘Freedom Number’ is a long way off, her consistent system has her on a predictable path to reach it in under 20 years.

Common Mistakes on the Path to Freedom (And How to Fix Them)

Pitfall 1: Lifestyle Inflation. As your income rises, your spending rises with it.

Solution: Automate your savings and investments first. Live on the remainder, just as you did before the raise.

Pitfall 2: Trying to Time the Market. Waiting for a “crash” to invest leads to missing out on long-term gains.

Solution: Embrace dollar-cost averaging. Investing a fixed amount regularly is more important than timing the market perfectly.

Pitfall 3: Chasing “Get Rich Quick” Schemes.

Solution: Stick to the boring, proven path of consistent investment in broad-based index funds. If it sounds too good to be true, it is.

- Proven & Reliable: Over long periods, the global stock market has consistently trended upwards.

- Passive & Simple: Requires minimal time and no stock-picking skill after the initial setup.

- Diversified: Automatically spreads risk across hundreds or thousands of companies.

- Low Cost: Index funds have minimal fees, which compound in your favor over time.

- No “Home Runs”: You will never beat the market with this strategy; your goal is to match it.

- Requires Patience: It involves enduring market downturns without panicking and selling.

- Time Horizon: This is a long-term strategy (20+ years). It is not suitable for short-term goals.

Tracking Your Progress: Are You On Track?

How do you know if you’re actually getting closer to your goal? Implement a simple annual review.

- Calculate Your “Freedom Ratio”: (Passive Income) / (Monthly Expenses). When this ratio hits 1.0, you’re free. Track its growth every year.

- Net Worth Tracking: Use a simple spreadsheet or app (like Personal Capital) to track your net worth growth over time. This is the ultimate scorecard.

- Benchmarking: Compare your portfolio’s performance to a relevant index (like the S&P 500) to ensure your strategy is working as intended.

Taking It to the Next Level

Once you’ve mastered the basics of index investing, you can explore advanced avenues to accelerate or enhance your freedom.

- The FIRE Movement: Learn about “FIRE” (Financial Independence, Retire Early), which involves extreme savings rates (50-70%) to achieve freedom in your 30s or 40s.

- Real Estate Investing: Explore using rental properties to create a consistent, inflation-resistant passive income stream.

- Tax-Efficient Withdrawal Strategies: As you near your goal, learn the most efficient ways to draw down your portfolio to make it last a lifetime.

Financial Freedom vs Being Rich vs Traditional Retirement

| Feature | Financial Freedom | Being Rich | Traditional Retirement |

|---|---|---|---|

| Measures | Passive Income vs. Expenses | Net Worth | Age & Employment Status |

| Focus | Choice and Security | Accumulation | Cessation of Work |

| Primary Mindset | Building a sustainable engine. | Having a large number. | Reaching a certain age. |

Conclusion

You now possess the fundamental blueprint to escape the rat race. The path is clear: know your number, control your cash flow, eliminate debt, and invest the rest consistently in quality assets. Remember, the power of this process lies not in complexity, but in unwavering consistency. The best period to commence was yesterday; the second-best time is now.