How to Buy Shares Online Guide to Your First Stock Purchase

Want to build wealth and own a piece of a company you believe in, but feel intimidated by the process? Learning how to buy shares online is the key. This step-by-step guide will walk you through the entire process, from choosing a broker to placing your first trade, making the journey from beginner to investor clear and actionable.

For aspiring investors in the US, UK, Canada, and Australia, this guide will help you navigate popular domestic platforms like Fidelity, Vanguard, Hargreaves Lansdown, and CommSec. The principles are universal, but we’ll highlight region-specific considerations.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To successfully research, choose, and execute your first online stock purchase. |

| Skill Level | Beginner. No prior experience needed. |

| Time Required | About 30-60 minutes for setup, plus ongoing research time. |

| Tools Needed | A computer or smartphone, internet access, a funded brokerage account, and personal identification. |

| Key Takeaway | Buying shares online is a straightforward process of opening an account, funding it, researching a stock, and placing an order. The real skill lies in consistent research and disciplined investing. |

| Related Concepts |

Why Learning to Buy Shares Online is Crucial

Taking control of your financial future starts with participation. For decades, stock market investing was gated by high fees and the need for a personal broker. Today, online brokerage platforms have democratized access, allowing anyone to start building a portfolio with small amounts of money. Learning this skill solves the problem of feeling excluded from wealth-building opportunities and empowers you to grow your savings proactively.

The outcome is financial literacy and potential growth. I remember my first purchase—a few shares of a company I understood and used daily. The act of researching, deciding, and clicking “buy” transformed my relationship with money from passive saving to active ownership. It’s not just about potential returns; it’s about understanding how the economy works and having a stake in it.

Key Takeaways

What You’ll Need Before You Start

Before you click “buy,” let’s get your toolkit ready. This isn’t complicated, but having everything prepared makes the process smooth.

Knowledge Prerequisites: A basic understanding of what a share represents (partial ownership in a company) and the core principle that investing carries risk, including the potential to lose your initial investment.

Personal & Financial Requirements:

- Personal Identification: A government-issued ID (Driver’s license, passport) and your Social Security Number (or equivalent like NI Number in the UK, SIN in Canada).

- Bank Account: A checking or savings account to transfer funds to your new brokerage account.

- Investment Capital: Money you are comfortable setting aside for the long term (5+ years). You can start small—many brokers now allow fractional share purchases.

Tools & Platforms: You will need to choose an online brokerage platform. This is your gateway to the stock market.

Choosing the right broker is your most important first decision. To easily execute your trades with low fees and access robust research tools, you’ll need a reliable platform. For beginners in the US, brokers like Charles Schwab, Fidelity, or Interactive Brokers offer great all-around experiences. In the UK, platforms like Hargreaves Lansdown or AJ Bell are popular starting points. I personally started with a platform known for its user-friendly interface, which made my first trade less intimidating.

How to Buy Shares Online: A Step-by-Step Walkthrough

Step 1: Choose and Open an Online Brokerage Account

Your first action is to select a broker. Compare platforms based on:

- Fees/Commissions: Most major brokers now charge $0 for online US stock trades.

- Account Minimums: Many have $0 minimums to open an account.

- User Interface: Look for a clean, intuitive website and mobile app.

- Research & Educational Tools: Essential for beginners.

Opening the account is an online form. You’ll provide personal details, financial information, and answer questions about your investment experience and goals to comply with regulations.

Pro Tip: Don’t get paralyzed by choice. Open an account with one well-reviewed, major broker to start. You can always transfer your account later if needed. I spent two weeks comparing brokers for my first account—time I could have spent learning and investing.

Step 2: Fund Your Account

Once your account is approved (which can be instant or take a few days), you need to deposit money. Navigate to the “Transfer” or “Deposit Funds” section of your brokerage platform. You’ll typically link your bank account via electronic transfer (ACH in the US). Transfers can take 1-3 business days to clear.

Common Mistake to Avoid: Transferring money you might need in the short term. Only invest capital you can afford to leave invested to weather market volatility.

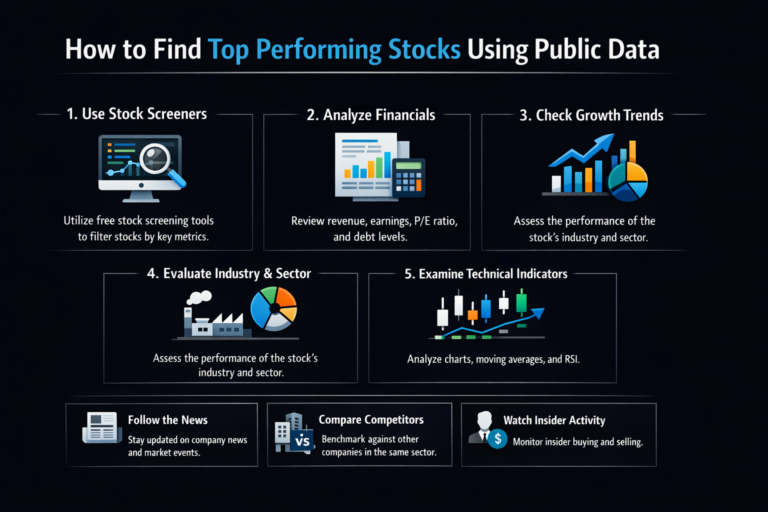

Step 3: Research and Choose Your First Stock

This is the most critical step. Don’t buy based on a social media tip. Start with what you know.

- Brainstorm: List companies whose products or services you use and believe in.

- Research: Use your broker’s tools or free sites like Yahoo Finance or Google Finance. Look at the company’s basics: What do they do? Are they profitable? What is their growth trend?

- Find the Ticker: Every listed company has a unique ticker symbol (e.g., TSLA for Tesla, MSFT for Microsoft).

Example Research: Let’s say you love coffee and always see people at Starbucks (SBUX). A quick look shows they are a globally recognized brand, have consistent store growth, and pay a dividend. It’s a simple starting point for research.

Stock Research: 5-Minute Quick Reference

Key metrics to check before buying any stock

P/E Ratio

EssentialWhat it is: Price-to-Earnings ratio. Compares stock price to company earnings per share.

Quick Check:

15-25 = Reasonable range for growing companies

>30 = Possibly overvalued

<10 = Could be undervalued or troubled

Debt-to-Equity

EssentialWhat it is: Measures company’s financial leverage (debt vs shareholder equity).

Quick Check:

<0.5 = Conservative, low debt

0.5-1.0 = Moderate leverage

>1.0 = High debt – proceed with caution

Revenue Growth

ImportantWhat it is: Year-over-year increase in total sales/revenue.

Quick Check:

>10% = Strong growth

5-10% = Steady growth

<5% or negative = Stagnant or declining

Dividend Yield

OptionalWhat it is: Annual dividend per share divided by stock price (expressed as %).

Quick Check:

2-4% = Sustainable for mature companies

4-6% = Higher risk dividend

>6% = Often unsustainable

Profit Margin

ImportantWhat it is: Net income divided by revenue (how much profit per dollar of sales).

Quick Check:

>15% = Highly profitable

5-15% = Average profitability

<5% = Thin margins, competitive industry

Free Cash Flow

AdvancedWhat it is: Cash left after operating expenses and capital expenditures.

Quick Check:

Consistently Positive = Healthy company

Negative = Burning cash – understand why

Step 4: Place Your Order

Now, execute the trade. In your brokerage platform, find the order ticket.

- Action: Select “Buy.”

- Quantity: Enter the number of shares. (Remember, many brokers allow fractional shares, e.g., 0.5 shares).

- Order Type: This is crucial.

- Market Order: Buys immediately at the best available current price. Fast, but you surrender control over the exact price.

- Limit Order: You set the maximum price you’re willing to pay. The order only executes at that price or better. This is my recommended choice for beginners.

Pro Tip from my experience: For my first trade, I used a market order and bought at a price slightly higher than I expected because the stock moved in the seconds between clicking “review” and “submit.” Since then, I always use a limit order. It gives me peace of mind and prevents overpaying due to a momentary spike.

Example Order Ticket:

- Symbol: SBUX

- Action: Buy

- Quantity: 5

- Order Type: Limit Order

- Limit Price: $95.00

- Time in Force: Good ‘Til Cancelled (GTC)

Review all details carefully, then click “Submit Order.”

How to Use Your New Investment in Your Overall Strategy

Buying the share is just the beginning. Now, integrate it into a thoughtful plan.

Scenario 1: The “Starter” Strategy: This is your first step. Your action plan is to practice patience and observation. Don’t check the price daily. Instead, set a calendar reminder to review the company’s quarterly earnings reports. Has the story you invested in changed?

Scenario 2: Building a Portfolio: One stock is not a portfolio. Your next action should be to plan for diversification. After your first purchase, start researching an ETF (Exchange-Traded Fund) that tracks a broad index like the S&P 500 (e.g., SPY or VOO). This gives you instant diversification across hundreds of companies.

Case Study: When I bought my first shares in a tech company, I put all my early investment capital into it. When the sector dipped, my entire portfolio was down. I learned the hard way that a single stock purchase should be part of a larger, diversified plan. Now, I use individual stocks for a portion of my portfolio, with the core in low-cost index ETFs.

Common Mistakes When Buying Shares Online

Pitfall 1: Chasing “Hot Tips” or Fear of Missing Out (FOMO).

- Solution: Develop an “investing checklist” based on your own research. If a stock doesn’t pass your checklist, don’t buy it, no matter how much hype it has.

Pitfall 2: Using Market Orders Unthinkingly.

- Solution: Default to limit orders, especially for more volatile stocks or during market open/close when prices can jump around.

Pitfall 3: Checking Your Portfolio Too Frequently.

- Solution: This leads to emotional trading. Set a schedule (e.g., once a month or quarterly) to review your investments. Turn off price notifications on your phone.

Pitfall 4: Not Understanding What You Own.

- Solution: Before you buy, write down in one sentence why you are buying this company. If you can’t explain it simply, you shouldn’t own it.

Investment Readiness Checklist

Complete these 7 checks before placing your first trade

- Low Cost & Accessibility Zero-commission trading and no account minimums have opened the markets to everyone.

- Control & Empowerment You make the decisions, learn by doing, and directly manage your financial future.

- Speed & Convenience Research and trade 24/7 from any device, executing strategies in real-time.

- Educational Journey The process itself builds invaluable financial literacy and market understanding.

- Fractional Shares Allows you to invest in expensive companies (like Amazon) with very little capital.

- Emotional Decision-Making Without a broker’s guidance, fear and greed can lead to poor timing (buying high, selling low).

- Information Overload The sheer volume of data, news, and opinions online can be paralyzing for beginners.

- Lack of a Personalized Plan A platform doesn’t ask about your full financial picture (debt, emergency fund, goals). You must create this discipline yourself.

- Potential for Over-trading Easy access can tempt you to trade too frequently, racking up subtle costs and taxes.

- Market Risk You directly bear the risk of loss. There is no guarantee of returns, and individual stocks can become worthless.

Taking It to the Next Level

Mastered your first trade? Here’s how to deepen your practice:

1. Dive into Fundamental Analysis: Move beyond “I like the product.” Learn to read a company’s 10-K annual report (filed with the SEC) to understand its financial health, risks, and management discussion. Focus on key metrics like revenue growth, profit margins, and debt levels. Websites like The Motley Fool or Investopedia offer great primers on this.

2. Explore Different Order Types: Beyond market and limit orders, learn about stop-loss orders (to automatically sell if a price drops to a certain level, limiting losses) and trailing stop orders (which follow a rising price to lock in gains).

3. Automate Your Investing: The true power of online platforms is automation. Set up a recurring investment plan to transfer a fixed amount from your bank account each month and automatically purchase shares or an ETF. This is “dollar-cost averaging” in action and builds discipline.

4. Understand Tax Implications: Learn the basics of capital gains tax. In many countries, profits from shares held for over a year (long-term) are taxed at a lower rate than those held for less (short-term). This should influence your trading frequency.

To make your research effortless, many advanced brokers offer powerful screening tools. Platforms like TD Ameritrade’s thinkorswim or Interactive Brokers provide professional-grade analytics for serious investors ready to take the next step.

Your First Investment: Interactive Scenario

Adjust the variables below to see how your first investment might perform

Conservative Scenario

Based on 5% average return (blue-chip stocks + dividends)

Moderate Scenario

Based on 8% average return (S&P 500 historical average)

Aggressive Scenario

Based on 12% average return (growth stocks/tech focus)

Projected Growth Over Time

Key Insights from Your Scenario:

Your investment grows 59% in your selected timeframe.

Adding $100/month would grow your total to $8,291.

The moderate scenario reflects long-term market averages, not guaranteed returns.

Disclaimer: This is an educational simulation using compound interest calculations. Actual investment returns vary and past performance doesn’t guarantee future results. Always consult with a financial advisor before making investment decisions.

Your First 90 Days as an Investor – A Practical Plan

Week 1-2: The Setup & First Purchase

- Action: Complete Steps 1-4 from this guide. Buy your first shares.

- Mindset Goal: Celebrate the act of taking control. The outcome of this single trade is less important than the experience gained.

Month 1: Observation & Education

- Action: Do NOT buy anything else. Observe your investment. Read one beginner investing book (e.g., The Little Book of Common Sense Investing by John Bogle).

- Mindset Goal: Detach from daily price movements. Understand that volatility is normal.

Month 2-3: Building a Framework

- Action: Define your investment goals (e.g., “Save for a down payment in 10 years”) and risk tolerance. Use this to draft a simple asset allocation (e.g., 70% in a broad market ETF, 30% in individual stocks you research).

- Action: Make your second purchase—a broad-market ETF (like VTI or VOO) to begin diversification.

- Mindset Goal: Shift from “I bought a stock” to “I am building a portfolio with a purpose.”

Buying Individual Shares vs Index Fund vs Robo Advisors

| Feature | Buying Individual Shares | Investing in Index ETFs | Using a Robo-Advisor |

|---|---|---|---|

| Control & Customization | High. You choose every company. | Medium. You choose the index/theme. | Low. The algorithm builds and manages the portfolio. |

| Potential Return | Can be very high (or low) based on stock selection. | Matches the market return (less fees). | Aims for market return, adjusted for your risk profile. |

| Diversification | Low (unless you buy many stocks). High company-specific risk. | Very High. One ETF holds hundreds of companies. | High. Typically uses a basket of ETFs. |

| Time & Knowledge Required | High. Requires ongoing research and monitoring. | Low. “Set and forget” after initial choice. | Very Low. Fully automated after setup. |

| Best For | Investors who enjoy research and want to bet on specific companies. | Most investors seeking market growth with minimal effort. | Beginners who want a hands-off, professionally designed portfolio. |

Conclusion

You now possess the fundamental skill to participate in the world’s greatest wealth-building arena. By following this step-by-step guide, you’ve moved from curiosity to ownership. Remember, the mechanics of buying are simple; the art lies in the research, patience, and discipline that come before and after the click of the “buy” button.

Start today by opening that brokerage account with a modest initial deposit. Make your first investment in a company you believe in, using a limit order. Then, commit to the ongoing journey of learning. The market will teach you more than any guide ever can.