How to Improve Your Financial Wellness This Month

Feeling overwhelmed by your finances? You’re not alone. Improving your financial wellness isn’t about getting rich quick; it’s about building a sense of control, security, and freedom with your money. This step-by-step guide will show you exactly how to diagnose your financial health and implement powerful changes, all within a single month.

For individuals in the US, Canada, and the UK, taking these steps can help you better manage debt, save for goals like a home down payment, and build a stronger safety net against economic uncertainty.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To establish control over your finances, reduce stress, and build a solid foundation for future goals. |

| Skill Level | Beginner |

| Time Required | 4–6 hours over the month (approx. 1–2 hours per week) |

| Tools Needed | Bank/credit card statements, spreadsheet app (Excel/Google Sheets), note-taking app. |

| Key Takeaway | Financial wellness is a behavior, not a number. Small, consistent actions create massive long-term stability and peace of mind. |

Why Improving Your Financial Wellness is Crucial

Financial wellness is the state of having a healthy relationship with your money. It means you can manage your day-to-day expenses, absorb a financial shock, and are on track to meet your future goals. It’s less about the amount in your bank account and more about the feeling of security it provides.

The Problem It Solves: Money is a leading cause of stress, which can harm your health, relationships, and overall happiness. Living paycheck-to-paycheck, feeling in the dark about your spending, and being anxious about debt are clear signs your financial wellness needs attention.

The Outcome: By the end of this month, you will have a clear picture of where your money goes, a simple plan to guide your spending, a starter emergency fund, and a tangible goal to work towards. The outcome is reduced anxiety and empowered decision-making.

The Psychology of Money: Identifying Your Money Mindset

Briefly discuss common money mindsets (e.g., Avoidance, Status, Security). Include a short quiz or reflective questions: “Do you avoid checking your bank account? Do you feel a rush from spending?” This helps readers understand the why behind their behaviors, adding a layer of depth most guides miss.

What You’ll Need Before You Start

Knowledge Prerequisites: No advanced finance knowledge is needed. You only need a willingness to be honest with yourself and a commitment to follow through.

Data Requirements:

- The last 3 months of bank and credit card statements.

- Recent bills (utilities, subscriptions, loan statements).

- Your latest pay stub.

Tools & Platforms:

- A Spreadsheet: Google Sheets or Excel is perfect.

- A Notebook/Digital Notes App: For reflecting on your goals and progress.

- A Calculator: The one on your phone is fine.

To automate the data-gathering process, consider using a budgeting app. Many of the best personal finance apps, like Mint or YNAB (You Need A Budget), can securely connect to your accounts and categorize your spending for you, saving you hours of manual entry.

How to Improve Your Financial Wellness: A Step-by-Step Walkthrough

We’ll break this down into four weekly focus areas to make the process manageable and effective.

Step 1: Diagnose Your Current Financial Health (Week 1)

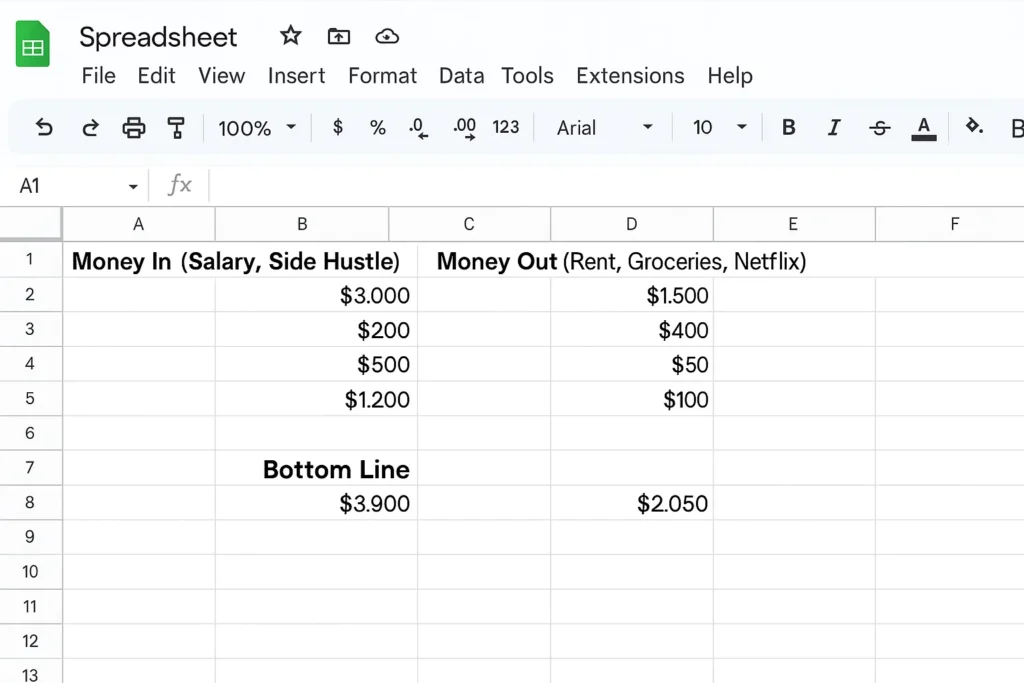

Your first action is to understand where you are right now. This means tracking your Net Worth and your Cash Flow.

Net Worth: List everything you own (assets: savings, investments, car value) and everything you owe (liabilities: credit card debt, student loans, mortgage). Your Net Worth is Assets – Liabilities. This is your financial snapshot.

Cash Flow: For one month, track every single dollar that comes in and goes out. Categorize your spending (e.g., Housing, Food, Transportation, Entertainment).

Pro Tip: Don’t judge yourself during this step. The goal is to collect data, not to feel guilty. You can’t change what you don’t measure.

Step 2: Create a Simple, Empowering Budget (Week 2)

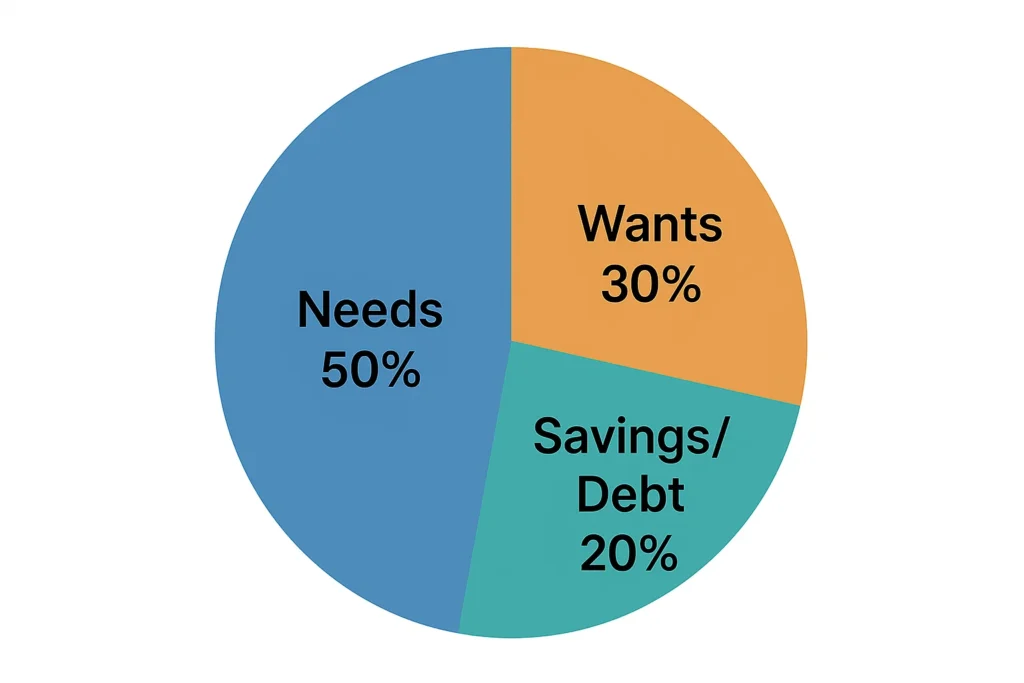

Using the data from Step 1, create a budget that works for you. We recommend the 50/30/20 rule for its simplicity:

- 50% of your take-home pay goes to Needs (rent, groceries, minimum debt payments).

- 30% goes to Wants (dining out, hobbies, subscriptions).

- 20% goes to Savings & Debt Repayment (emergency fund, retirement, extra debt payments).

Common Mistake to Avoid: Creating an overly restrictive budget that you can’t stick to. Your budget is a tool for freedom, not a instrument of punishment. If the 50/30/20 split doesn’t fit, adjust it! The key is the habit of planning.

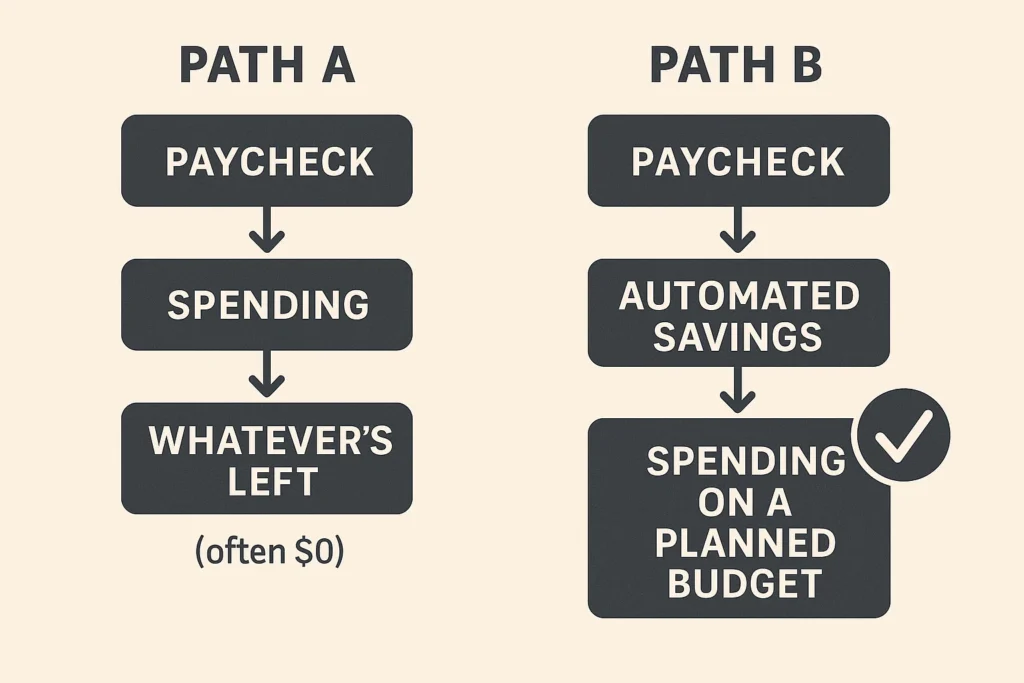

Step 3: Automate Your Financial Priorities (Week 3)

This is the most powerful step for building lasting habits. Willpower fails; systems succeed.

- Set up a separate Savings Account: Name it “Emergency Fund” or “Future Me.”

- Automate Transfers: The day after your paycheck hits your account, set up an automatic transfer to your savings account (aim for that 20% from your budget). Also, set up autopay for all your essential bills to avoid late fees.

Formula: Financial Wellness = (Income – Savings) / Spending. Pay your future self first, then live on the rest.

Example Calculation:

- Input Values: Take-Home Pay = $3,000, Target Savings Rate = 20% ($600).

- Calculation: $3,000 – $600 = $2,400 left for Needs and Wants for the month.

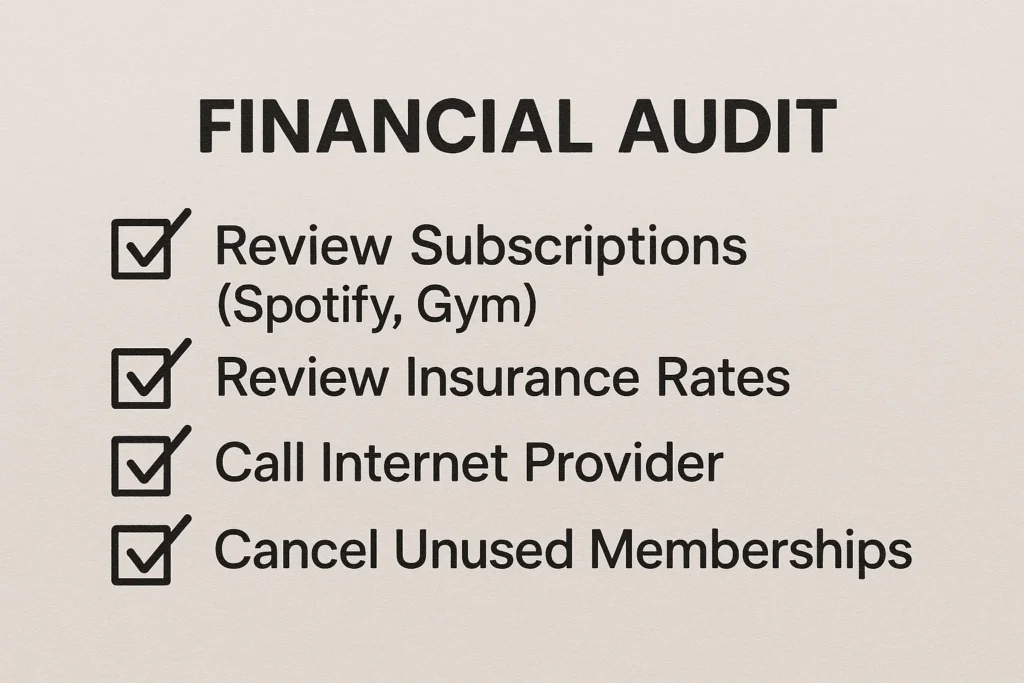

Step 4: Conduct a Financial Audit & Set a SMART Goal (Week 4)

Now, put your new system to work. Review your subscriptions and recurring bills. Can you cancel anything? Can you negotiate your internet or insurance bill? Then, set one specific financial goal for the next 3 months.

Interpret the Results: A successful month isn’t about perfect adherence to your budget. It’s about being aware. Did you overspend on dining? Now you know to adjust next month’s budget. Did you successfully automate your savings? Celebrate that win!

The Money Minute Daily Habit

Introduce a micro-habit: “Spend 60 seconds each day reviewing your transactions from the previous day in your banking app.” This prevents a month’s worth of spending from becoming an overwhelming data-entry task and builds constant awareness.

How to Use Your Newfound Financial Clarity

Scenario 1: You Discover You’re Spending Too Much on “Wants”: Don’t slash your budget brutally. Identify one or two categories to reduce (e.g., “takeout coffee” or “impulse online purchases”) and reallocate that money to savings or debt.

Scenario 2: You Have High-Interest Credit Card Debt: Your primary goal (after building a small $500 emergency fund) should be to attack this debt. Apply the “debt avalanche” technique (paying off highest-interest debt first) to save most of your money.

Case Study: Sarah, a marketing manager, used this process and discovered she was spending $250/month on unused subscriptions and fast food. By canceling the subscriptions and meal-prepping, she freed up $150 to automatically pay down her credit card debt, reducing her payoff timeline by over a year.

Common Mistakes When Improving Financial Wellness

Pitfall 1: Trying to change everything at once. This leads to burnout.

Solution: Focus on one step per week. Master tracking your spending before you overhaul your budget.

Pitfall 2: Not planning for irregular expenses. (e.g., car maintenance, holiday gifts).

Solution: Create “sinking funds” in your budget. Set aside a small amount each month for these predictable, non-monthly costs.

Pitfall 3: Comparing your journey to others. Your friend’s salary or windfall is irrelevant to your path.

Solution: Focus on your own Net Worth statement and progress. Your only competition is who you were yesterday.

Negotiating Bills and Cutting Costs

Provide simple, word-for-word scripts readers can use.

- For Internet/Cable: “Hi, I’m reviewing my bills and saw your competitor is offering [deal]. I’d like to stay with you, but I need a better rate to justify it. What can you do?”

- For Subscriptions: “I’m canceling due to cost. Do you have any limited-time retention offers available?” This provides readers actionable tools, not just advice.

- Immediate Reduction in Stress: Just having a plan can dramatically lower financial anxiety.

- Builds Powerful Habits: The one-month timeframe is long enough to form new, positive money habits.

- Creates Clarity and Control: You will know exactly where your money is going and why.

- Foundation for Complex Goals: This is the essential first step for investing, buying a home, or early retirement.

- It’s a Starting Point: This one-month plan builds the foundation; it won’t make you wealthy on its own.

- Requires Honesty and Discipline: You will only get out of it what you put in.

- Doesn’t Solve Deep Debt or Income Issues: For severe financial problems, professional credit counseling may be needed.

Taking It to the Next Level

Once you’ve mastered the basics this month, here’s how to deepen your financial mastery:

- Optimize Your Credit Score: Understand how credit utilization and payment history impact your score. Check your report for free annually and work on building a strong credit profile.

- Introduction to Investing: With your budget and emergency fund in place, explore opening a Roth IRA or contributing more to your employer’s 401(k). Learn about low-cost index funds.

- Increase Your Financial Literacy: Dedicate 20 minutes a week to reading a personal finance book or listening to a reputable podcast.

Building a Life Fund Beyond Your Emergency Fund

Once the emergency fund is established, introduce the concept of separate sinking funds for personal goals like a Vacation Fund, Gift Fund, or New Laptop Fund. This teaches them to save for fun things guilt-free, making the entire process more sustainable and positive.

Financial Wellness Plan vs Basic Budgeting

| Feature | Financial Wellness Plan | Basic Budgeting |

|---|---|---|

| Scope | Holistic (Mindset, Habits, Goals, Numbers) | Narrow (Tracking Income & Expenses) |

| Primary Goal | Reduce stress and build long-term security | Control spending in the short-term |

| Includes Net Worth? | Yes, for a full snapshot | Rarely |

| Focus | Behavior and systems | Numbers and categories |

Conclusion

You now have a clear, actionable blueprint to transform your relationship with money in just one month. The journey to financial wellness is built on the small, consistent steps of tracking, planning, and automating. Remember to be patient with yourself and celebrate the small wins. Your financial peace of mind is worth the effort.