How to Secure Angel Investment A Step-by-Step Guide

Struggling to turn your brilliant startup idea into a funded reality? Securing angel investment can provide the crucial capital and mentorship you need to accelerate growth. This comprehensive guide will walk you through the entire process, from preparing your business to closing the deal, giving you the best possible chance of success with angel investors.

For entrepreneurs in the US, Canada, UK, and Australia, understanding local angel networks and tax incentive programs (like the SEIS/EIS schemes in the UK or Qualified Small Business Stock in the US) can significantly enhance your fundraising appeal. We’ll cover how to leverage these geographic advantages.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | Successfully secure angel investment for your startup |

| Skill Level | Beginner to Intermediate Entrepreneurs |

| Time Required | 3-6 months (preparation through closing) |

| Tools Needed | Business plan, financial projections, pitch deck, investor CRM, demo/product |

| Key Takeaway | Angel investment is about more than money—it’s about building relationships with investors who believe in your vision and can provide strategic value beyond capital. |

| Related Concepts |

Why Learning to Secure Angel Investment is Crucial

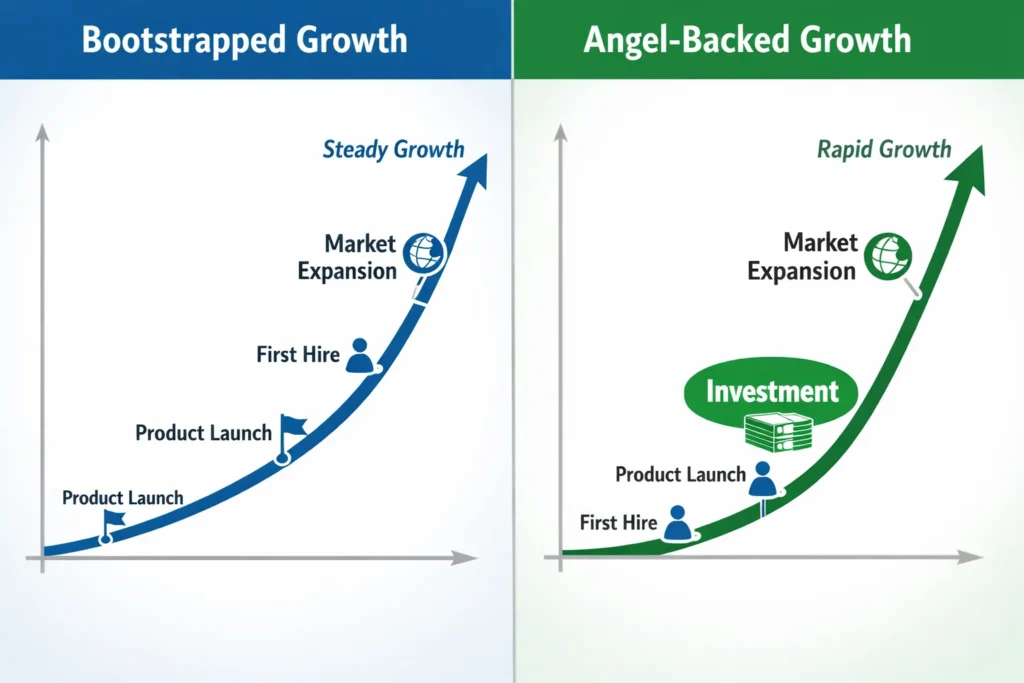

Securing angel investment isn’t just about getting money—it’s about validation, acceleration, and building a foundation for long-term success. While bootstrapping has its merits, angel funding can provide the rocket fuel needed to capture market opportunities before competitors do. According to data from the Angel Capital Association, startups that secure angel investment have a 20-30% higher survival rate after five years compared to those that don’t.

Most startups die from lack of funding, not bad ideas. You might have a brilliant product and passionate team, but without adequate capital for marketing, hiring, and scaling operations, even the best ideas can fail to reach their potential. Angel investors solve this by providing not just capital but also mentorship, industry connections, and strategic guidance.

By successfully securing angel investment, you transform your startup from a scrappy operation into a professionally-backed company with the resources to execute on your vision. You gain credibility with customers and partners, attract better talent, and position yourself for subsequent funding rounds from venture capitalists.

Key Takeaways

What You’ll Need Before You Start

Before you begin your angel fundraising journey, ensure you have these essentials in place. Angel investors are looking for more than just ideas—they want evidence of execution capability and market understanding.

Knowledge Prerequisites:

- Basic understanding of equity financing and dilution

- Familiarity with your market size and competitive landscape

- Knowledge of key metrics for your business model (CAC, LTV, MRR, etc.)

- Understanding of term sheet basics and common investor rights

Data Requirements:

- 12-24 month financial projections with clear assumptions

- Traction metrics (users, revenue, growth rate)

- Market research and validation data

- Team bios and relevant experience documentation

- Customer testimonials or case studies (if available)

Tools & Platforms:

- Professional pitch deck (Canva, PowerPoint, or specialized tools like Pitch)

- Financial modeling spreadsheet (Excel/Google Sheets or specialized tools like Foresight)

- Investor relationship management (Streak, HubSpot, or Airtable)

- Demo or MVP of your product

- Online data room for due diligence (Google Drive, Dropbox, or specialized platforms)

To create professional financial projections that impress investors, consider using specialized startup financial modeling tools. Platforms like LivePlan or ProjectionHub offer templates specifically designed for fundraising. For managing your investor pipeline, CRM tools like Streak (free for Gmail users) can help track conversations and follow-ups efficiently.

How to Secure Angel Investment: A Step-by-Step Walkthrough

Step 1: Preparation and Company Readiness

Before approaching any investors, ensure your house is in order. This means having a minimum viable product (MVP) with some user traction, a cohesive team with complementary skills, and clear documentation. According to data from AngelList, startups with at least $10,000 in monthly revenue are 5x more likely to secure angel funding than pre-revenue companies.

Pro Tip: Create an “Investor Update” template and start sending monthly updates to a small group of advisors 3-6 months before you plan to fundraise. This builds relationships and demonstrates transparency—qualities angels love.

Step 2: Building Your Investor Pipeline

Don’t put all your hopes on one investor. Create a target list of 50-100 potential angels, categorized by:

- Tier 1: Perfect fit (industry expertise, check size matches your need, known to your network)

- Tier 2: Good fit (relevant background, appropriate check size)

- Tier 3: Possible fit (general interest in startups, geographic proximity)

Common Mistake to Avoid: Mass emailing your pitch deck. Angels receive hundreds of pitches weekly. Instead, seek warm introductions through mutual connections on LinkedIn, from your advisors, or at industry events.

Step 3: Crafting and Delivering Your Pitch

Your pitch deck should tell a compelling story in 10-15 slides. The classic structure includes:

- Problem (Why this matters)

- Solution (Your product)

- Market Size (TAM, SAM, SOM)

- Business Model (How you make money)

- Traction (Proof it works)

- Competition (Your advantage)

- Team (Why you’re the right people)

- Financial Projections (The numbers)

- The Ask (How much and what for)

Formula for Success: Practice your pitch until you can deliver it naturally without slides. The best pitches feel like conversations, not presentations. Time yourself—aim for 20 minutes for the presentation plus 40 minutes for Q&A.

Example Pitch Metrics:

- Pre-money Valuation: $3M (based on $50k MRR and 20% MoM growth)

- Amount Raising: $500k

- Use of Funds: 40% Product, 30% Marketing, 20% Team, 10% Legal/Admin

- Runway Created: 18 months

Step 4: Navigating Due Diligence and Closing

Once an angel expresses serious interest, due diligence begins. They’ll examine your financials, legal documents, customer contracts, and team backgrounds. Prepare a virtual data room with organized documents.

What Due Diligence Typically Covers:

- Financial Diligence: Historical financials, projections, cap table, burn rate

- Legal Diligence: Incorporation documents, IP assignments, founder agreements

- Product Diligence: Technology stack, roadmaps, technical debt

- Market Diligence: Competitive analysis, market trends, regulatory environment

Understanding the Angel Investor Mindset

Angel investors aren’t just evaluating your business—they’re evaluating you. Understanding their psychological drivers increases your success rate.

What Angels Really Care About:

- Founder Passion & Resilience: Can you withstand the inevitable setbacks?

- Market Vision: Do you see opportunities others miss?

- Execution Capability: Have you delivered results with limited resources?

- Coachability: Will you accept advice and feedback?

- Integrity: Are you transparent about challenges?

The FOMO Factor:

Create urgency by:

- Mentioning other investor interest (truthfully)

- Showing rapid traction metrics

- Highlighting limited market window

- Demonstrating competitive momentum

Case Study: “SaaS founder Maria secured a $300k angel round by sharing her detailed 90-day plan showing exactly how she’d deploy funds. She included specific milestones and metrics, demonstrating both vision and execution capability. This concrete plan addressed angel concerns about capital efficiency.”

How to Use Angel Investment to Accelerate Your Startup

Securing the check is just the beginning. How you deploy capital determines your success.

Scenario 1: Product-Market Fit Not Yet Proven

If you’re pre-PMF, allocate 70% of funds to product development and user research. Focus on achieving that “aha” moment where users can’t live without your product. Use the remaining 30% for essential hires and minimal marketing to test channels.

Scenario 2: Strong Early Traction

With proven PMF, allocate 50% to growth marketing, 30% to team expansion, and 20% to product enhancements. Your goal is scaling efficiently while maintaining or improving unit economics.

Case Study: “HealthTech Startup ‘MedTrack’ secured $400k from angel investors at a $2.5M valuation. They allocated funds as follows: $200k to complete regulatory certification, $120k to hire two sales reps, and $80k for marketing. Within 9 months, they grew from $15k to $85k MRR, achieved certification, and raised a $2M Series A at a $12M valuation—a 5x increase from their angel round.”

Beyond the Check: Building Lasting Investor Relationships

Your relationship with angels shouldn’t end after the wire transfer hits. Regular investor updates (monthly or quarterly) keep them engaged and can lead to follow-on investments and introductions.

Effective Update Structure:

- Highlights: 3-5 key accomplishments

- Metrics: Key performance indicators (revenue, users, burn, runway)

- Challenges: What’s not working and what you’re doing about it

- Asks: Specific help needed (introductions, hiring, customer referrals)

- Financials: Simplified P&L and cash position

Pro Tip: Create a separate, more detailed update for board members and major angels versus a general update for all investors. Tools like Visible.vc or Humi can streamline this process.

Common Mistakes When Seeking Angel Investment

Pitfall 1: Valuing Your Startup Too High (or Too Low)

Solution: Research comparable companies on platforms like PitchBook, Crunchbase, or AngelList. Use standard valuation methods: (1) Comparable transactions, (2) Revenue multiples (typical: 10-20x ARR for SaaS), (3) Scorecard method. Be prepared to justify your valuation with metrics.

Pitfall 2: Taking the First Offer Without Shopping Around

Solution: Create competition by having multiple conversations simultaneously. Even if you have a great first offer, use it to generate interest from other investors. This improves terms and ensures you find the right partner, not just any partner.

Pitfall 3: Neglecting the “Why Now” in Your Pitch

Solution: Clearly articulate why this is the perfect moment for your solution and for investment. Is there a regulatory change, technology shift, or market gap creating urgency? Investors need to understand the time-sensitivity of the opportunity.

Pitfall 4: Underestimating the Time Commitment

Solution: Fundraising is a full-time job. Designate a founder (usually the CEO) as primarily responsible, with others supporting. Plan for 3-6 months of focused effort. Use tools to track conversations and follow-ups systematically.

Pitfall 5: Accepting Problematic Terms Without Understanding Implications

Solution: Educate yourself on term sheet nuances. Watch for: (1) Multiple liquidation preferences (avoid if possible), (2) Full-ratchet anti-dilution (ask for weighted average instead), (3) Overly restrictive governance rights. Consider hiring a startup lawyer for your first term sheet review.

- Speed & Flexibility: Angel rounds close faster (30-90 days) with more founder-friendly terms than institutional VCs.

- Strategic Value: Brings industry expertise, connections, and hands-on mentorship beyond just capital.

- Validation & Social Proof: Angel backing increases credibility with customers, partners, and future investors.

- Founder Alignment: Typically take common stock or simple preferred shares, keeping interests aligned with founders.

- VC Pathway: Successful angel rounds create momentum and metrics for subsequent venture capital fundraising.

- Check Size Limits: Individual angels typically invest $25k-$100k, requiring syndication for meaningful rounds.

- Cap Table Complexity: Managing 10-20 small investors creates administrative overhead and communication challenges.

- Limited Follow-on: Angels may not have capital reserves for subsequent rounds, creating future fundraising pressure.

- Experience Variability: Some angels lack startup experience and may offer conflicting or impractical advice.

- Risk Aversion: Investing personal wealth can make some angels more cautious than institutional investors.

Regional Angel Investment Landscapes

Angel investment norms vary significantly by region. Understanding these differences helps tailor your approach.

Silicon Valley/North America:

- Typical Check Size: $50k-$100k per angel

- Common Structures: SAFE notes, priced rounds

- Key Platforms: AngelList, Gust, local syndicates

- Special Notes: Highly competitive, expect sophisticated investors

Europe:

- Typical Check Size: €25k-€75k per angel

- Common Structures: Convertible loans, equity

- Tax Incentives: SEIS/EIS (UK), similar schemes in France/Germany

- Special Notes: More relationship-focused, slower decision cycles

Asia:

- Typical Check Size: Varies widely ($25k-$200k)

- Common Structures: Equity, strategic partnerships

- Key Focus: Market access, commercialization speed

- Special Notes: Often seek board seats, active involvement

Emerging Markets:

- Typical Check Size: $10k-$50k

- Common Structures: Equity, revenue sharing

- Key Focus: Scalability to developed markets

- Special Notes: May value “global potential” over local traction

Taking Angel Fundraising to the Next Level

Angel Syndicates and SPVs:

For rounds exceeding $500k, consider working with a lead angel who can create a Special Purpose Vehicle (SPV) to pool smaller investments. Platforms like AngelList and SyndicateRoom facilitate this. This keeps your cap table clean (the SPV counts as one investor) while accessing smaller checks.

Strategic vs. Financial Angels:

Advanced founders strategically mix angel types:

- Strategic Angels: Industry executives who provide customer introductions and credibility

- Financial Angels: Professional investors focused on returns

- Celebrity Angels: Provide marketing value and brand awareness

- Platform Angels: Represent larger networks (like Y Combinator alumni)

International Angel Considerations:

If targeting angels in different countries, understand:

- US Angels: Expect SAFE notes or priced rounds, sophisticated about terms

- European Angels: Often prefer simpler structures, influenced by local tax incentives

- Asian Angels: May focus on market access and commercialization partnerships

Alternative Angel Financing Structures

While equity is most common, consider these alternatives:

Convertible Notes:

Debt that converts to equity in your next priced round. Typically include:

- Discount Rate: 15-25% discount on the next round’s price

- Valuation Cap: Maximum valuation at which notes convert

- Interest Rate: 2-8% (accrues, then converts)

SAFE Notes (Simple Agreement for Future Equity):

Popularized by Y Combinator, SAFEs are not debt (no interest, no maturity date). They’re simpler than convertible notes but require understanding of:

- Post-money vs. Pre-money SAFEs: Post-money (YC standard) is clearer about dilution

- Pro Rata Rights: Whether SAFE holders get to maintain ownership in future rounds

Revenue-Based Financing (RBF):

Angels provide capital in exchange for a percentage of monthly revenue until a cap (typically 1.5-3x the investment) is reached. Ideal for businesses with:

- Steady revenue but don’t want dilution

- Clear unit economics

- Revenue predictability

Managing Your Board and Investor Relations

Successfully closing is just the beginning. Effective governance maintains investor confidence and supports growth.

Board Composition Considerations:

- If angels take a board seat, ensure they bring relevant expertise

- Consider independent directors for balance

- Keep board size manageable (3-5 members ideal for early stage)

- Establish clear meeting rhythms and reporting

Communication Protocols:

- Monthly Updates: Key metrics, milestones, challenges

- Quarterly Deep Dives: Strategy review, financial analysis

- Annual Planning: Budget approval, major initiatives

- Ad Hoc: Major developments (positive or negative)

Handling Investor Requests:

- Set boundaries early on time commitments

- Create processes for introduction requests

- Establish response time expectations

- Use tools like Google Groups or specialized platforms for updates

When Things Go Wrong:

- Communicate challenges early and often

- Present solutions, not just problems

- Be transparent about timeline impacts

- Maintain trust through difficult periods

Angel Investment vs Venture Capital vs Bootstrapping

| Feature | Angel Investment | Venture Capital | Bootstrapping |

|---|---|---|---|

| Typical Stage | Pre-seed / Seed (early validation) | Series A+ (proven traction, scaling) | Any stage (self-funded growth) |

| Check Size Range | $25k – $500k (individual/syndicate) | $1M – $10M+ (institutional funds) | Personal savings/revenue ($0 – unlimited) |

| Decision Timeline | 1-3 months (individual decisions) | 3-6 months (partnership approval) | Immediate (self-funded) |

| Equity Dilution | 10-25% (common/simple preferred) | 15-35% (complex preferred terms) | 0% (full founder ownership) |

| Primary Value Beyond Capital | Mentorship, industry connections, hands-on help | Scaling expertise, follow-on funding, portfolio network | Complete control, slower but sustainable growth |

Conclusion

You now possess a comprehensive roadmap for securing angel investment—from preparation through closing. Remember that successful fundraising is a combination of preparation, storytelling, and relationship-building. Start today by assessing your company’s readiness against the checklist in Step 1, beginning to build your investor network, and crafting your compelling narrative.

The journey from idea to funded startup is challenging but immensely rewarding. With the right approach, you can find not just capital, but true partners who believe in your vision and will help you build something extraordinary.