How to Trade Stocks, Crypto, and Forex A Step-by-Step Guide

Feeling overwhelmed by the chaotic world of financial markets? This step-by-step guide is your solution. We cut through the noise to provide a clear, structured framework for approaching stocks, crypto, and forex. You’ll learn a disciplined process that focuses on strategy and risk management, giving you the confidence to navigate any market.

For aspiring traders in the US, UK, and Australia, understanding the nuances of regulated brokers and tax implications is crucial. This guide will highlight key considerations for these regions, helping you choose the right platform and stay compliant from day one.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To establish a foundational, disciplined methodology for trading across major asset classes. |

| Skill Level | Beginner |

| Time Required | 20+ hours for education and setup; ongoing for analysis and execution. |

| Tools Needed | A reliable broker/exchange, charting software, a trading journal. |

| Key Takeaway | Successful trading is not about predicting the future; it’s about managing risk and executing a proven plan with consistency. |

Many new traders jump in based on a “hot tip” or a feeling, only to see their capital evaporate quickly. They treat trading like gambling. This guide provides the antidote: a systematic process that replaces emotion with analysis and discipline.

The lack of a clear plan leads to impulsive decisions, poor risk management, and inevitable losses. Without a framework, you are simply speculating.

By following this step-by-step process, you will develop the skills to analyze markets, define your risk, and execute trades based on logic rather than fear or greed. This is the foundation for long-term success in the volatile worlds of stocks, crypto, and forex.

What You’ll Need Before You Start

Knowledge Prerequisites:

- Basic financial literacy (understanding of bid/ask prices, what a stock/currency/cryptocurrency represents).

- A fundamental understanding of what drives different markets (e.g., earnings for stocks, economic data for forex, adoption and sentiment for crypto).

Tools & Platforms:

- A Brokerage Account: For stocks and ETFs.

- A Cryptocurrency Exchange: For buying and selling digital assets.

- A Forex Broker: For currency trading.

- Charting Software: Most brokers offer this, but standalone platforms like TradingView are excellent for analysis.

- A Trading Journal: This can be a simple spreadsheet or dedicated software to track your performance.

To get started, you’ll need a reliable platform. For stock traders, brokers like [Broker A] offer user-friendly interfaces and robust educational tools. For those focused on crypto, exchanges like [Exchange B] provide high liquidity and security. Always ensure your chosen platform is regulated in your country, such as by the FCA in the UK or ASIC in Australia.

Find Your Trading Personality: A Self-Assessment

Your personality is your biggest asset or liability in trading. The strategy that works for a patient, analytical person will fail for someone impulsive and adrenaline-seeking. Answer these questions honestly to discover your trading archetype.

Interactive Quiz:

- When I see a trade moving against me, my first instinct is to:

a) Re-check my analysis to see if my original thesis is broken.

b) Immediately close the trade to avoid further loss.

c) Add to my position to lower my average cost.

d) Do nothing; my stop-loss will handle it. - I am most comfortable holding a trade for:

a) A few minutes to a few hours.

b) A few days to a few weeks.

c) Several months or more. - My primary motivation for trading is:

a) The intellectual challenge of solving the market puzzle.

b) The potential for financial freedom and rapid wealth.

c) Building long-term capital in a self-directed way.

Archetype Results & Strategy Match:

- The Analyst (Mostly A’s): You are disciplined and data-driven.

- Your Edge: Systematic strategies like algorithmic trading, swing trading based on technical/fundamental confluence.

- Your Pitfall: “Analysis Paralysis” – over-analyzing and missing entries.

- The Sentinel (Mostly B’s): You are risk-averse and cautious.

- Your Edge: Position trading with wide stop-losses, high probability/low-risk setups, ETF investing.

- Your Pitfall: Taking profits too early and missing larger trends.

- The Pioneer (Mostly C’s): You are confident and conviction-driven.

- Your Edge: Trend-following, breakout trading, investing in high-growth assets (tech stocks, crypto).

- Your Pitfall: Turning a trade into an “investment” and letting losses run due to ego.

How to Read the Market’s Mood

Is the market moving upwards, downwards, or in a consolidation range? Is volatility high or low? Your success depends on matching your strategy to the current market regime.

| Market Regime | Key Characteristics | Best Strategy Fit | Strategy to Avoid |

|---|---|---|---|

| Bull Trend | Higher Highs & Higher Lows; Strong volume. | Trend Following, Buy-the-Dip. | Shorting, Counter-trend trading. |

| Bear Trend | Lower Highs & Lower Lows; Fear & panic. | Short-selling, Put Options, Sitting in Cash. | Buying “cheap” stocks in a falling knife market. |

| Ranging / Choppy | Bouncing between clear Support & Resistance. | Range-Bound Strategy (Buy low, sell high). | Breakout trading (false breakouts are common). |

| High Volatility | Large, unpredictable price swings (e.g., during news). | Volatility Strategies (Straddles, Iron Condors). | Leveraged directional bets. |

| Low Volatility | Small, slow price movements; complacency. | Selling Premium (e.g., selling options). | Buying cheap options (which may expire worthless). |

Start your week by asking: What is the current regime for the S&P 500, Bitcoin, and EUR/USD? This 5-minute exercise will immediately improve your strategy selection.

How to Build a Trading Plan: A Step-by-Step Guide

Step 1: Education and Self-Assessment

Before placing a single trade, you must invest in your education and understand yourself. What is your risk tolerance? How much time can you dedicate? Are you a patient swing trader or do you thrive on fast-paced action?

Pro Tip: Start with a demo account! Almost every major broker offers one. This allows you to practice your step-by-step process with virtual money in real-market conditions.

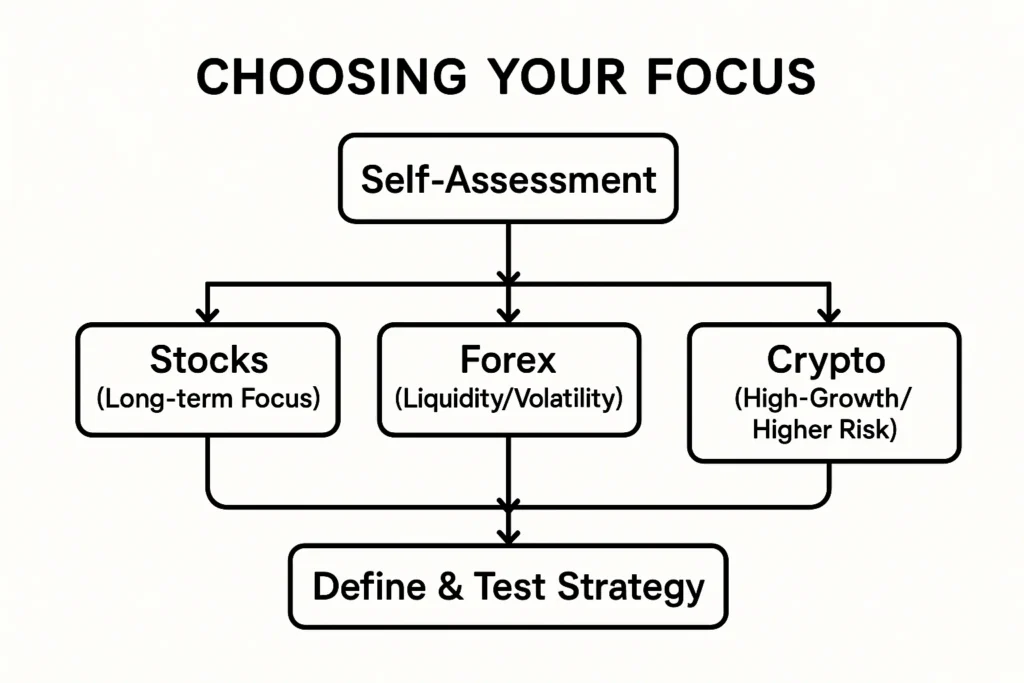

Step 2: Choose Your Market and Define Your Strategy

Don’t try to master everything at once. Focus on one market initially.

- Stocks: Analyze company fundamentals and broader economic trends.

- Forex: Focus on macroeconomic data and interest rate differentials between countries.

- Crypto: Monitor technological developments, regulatory news, and on-chain metrics.

Your strategy is your rulebook. Will you be a trend-follower, a range-trader, or a breakout trader?

Common Mistake to Avoid: Jumping between strategies after a few losing trades. Stick to one approach long enough to see if it works.

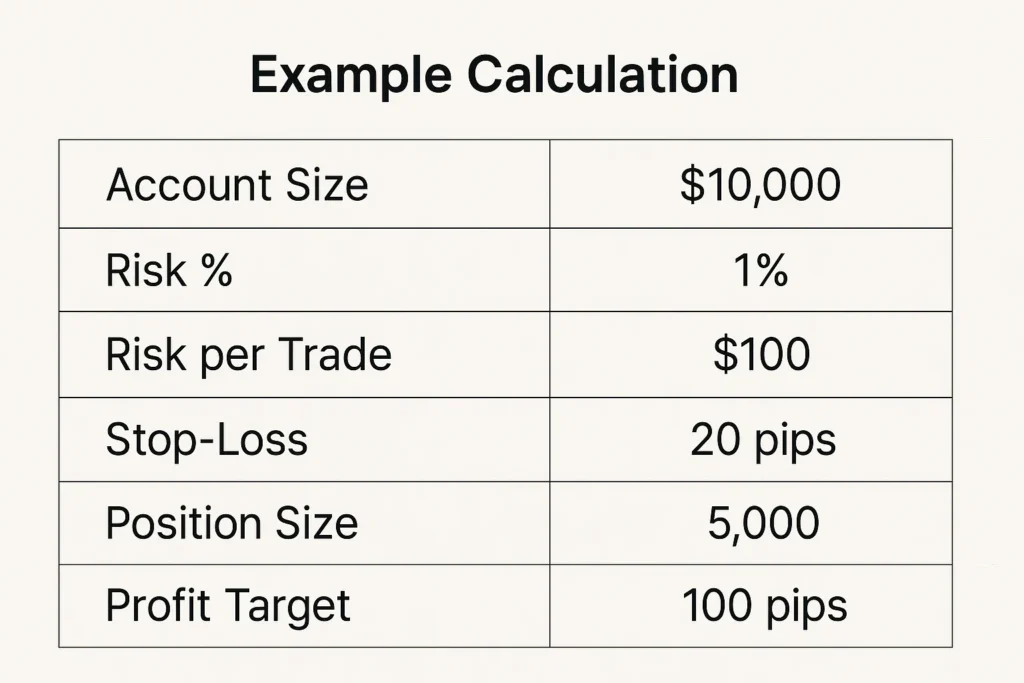

Step 3: Master Risk Management (The Most Important Step)

This is what separates professionals from amateurs. Your primary goal is capital preservation.

Formula:

- Risk-Per-Trade: Never risk more than 1-2% of your total trading capital on a single trade.

- Risk-Reward Ratio: Only take trades that offer a potential reward at least 1.5 to 2 times greater than the risk.

Example Calculation:

- Account Size: $10,000

- Max Risk (1%): $100 per trade

- Trade Setup: You buy a stock at $100 and place a stop-loss at $95. Your risk is $5 per share.

- Position Size: $100 / $5 = 20 shares. This is the maximum you can buy to stay within your risk limit.

- Profit Target: With a 1:2 Risk-Reward Ratio, your target should be at least $110 ($10 profit per share, which is 2x your $5 risk).

Step 4: Execute, Journal, and Analyze

Place your trade according to your plan. Once the trade is closed—win or lose—record it in your journal. Note the entry/exit reasons, the outcome, and, most importantly, your emotional state.

How to Use Your Trading Plan in Live Markets

Scenario 1: A Winning Trade: You followed your plan perfectly and took profits at your target. The action is to record the trade, note what worked, and then wait for the next high-probability setup according to your strategy. Avoid the temptation to jump back in immediately.

Scenario 2: A Losing Trade: Your stop-loss was hit, and you lost exactly 1% of your capital. This is a successful trade because you managed risk. The action is to review your journal. Was the stop-loss logical? Did market conditions change? If the setup was valid, the loss is just part of the business.

Case Study: “A forex trader in the UK recognized a possible downtrend on the EUR/USD pair. Their strategy required a break of a key support level. The break occurred, they entered a short position, placed a stop-loss 50 pips above their entry, and set a target 100 pips away (a 1:2 risk-reward). The trade hit its target. By journaling, they confirmed their breakout strategy was effective in that volatile session.”

Common Mistakes When Starting to Trade And How to Fix Them

Pitfall 1: Not Using a Stop-Loss. Solution: A stop-loss is non-negotiable. It is your insurance policy. Always enter a trade with a predetermined exit point for a loss.

Pitfall 2: Letting Losses Run and Cutting Profits Short (The Trader’s Curse). Solution: Adhere to a positive risk-reward ratio. This ensures your winning trades can be larger than your losing ones, which is key to long-term profitability.

Pitfall 3: Overtrading. Solution: Only trade when your strategy’s criteria are met. It’s okay to be in cash. Forcing trades out of boredom or frustration is a recipe for losses.

- Removes Emotion: A strict plan helps you avoid impulsive decisions driven by fear and greed.

- Provides Measurability: You can track your strategy’s performance objectively in your journal.

- Manages Risk: The 1% rule and stop-losses protect your capital from catastrophic losses.

- Creates Consistency: The step-by-step process can be repeated, which is the path to mastery.

- Requires Discipline: The hardest part is following the plan, especially during losing streaks.

- Not a “Get-Rich-Quick” Scheme: This is a skill that requires continuous learning and practice.

- Can Miss “Gut-Feel” Opportunities: A rigid system might miss trades that fall outside its rules but could be profitable.

Taking It to the Next Level

Strategy Refinement: Once you have 6-12 months of journaled trades, analyze your data. Are you better at trading certain patterns or market conditions? Double down on your strengths and work to eliminate recurring errors.

Automating the Process: For those with a proven manual strategy, explore automating it using trading bots (especially in crypto) or through platforms that support algorithmic trading.

For a deeper dive into technical analysis, read our complete guide to Candlestick Patterns or the Moving Averages.

Disciplined Trading Plan vs Investing (Buy & Hold) vs Speculating/Gambling

| Feature | Disciplined Trading Plan | Investing (Buy & Hold) | Speculating/Gambling |

|---|---|---|---|

| Time Horizon | Short to Medium-term | Long-term (Years+) | Very Short-term |

| Primary Focus | Risk-Managed Profits | Capital Appreciation | Making a Quick Buck |

| Analysis Method | Technical & Fundamental | Primarily Fundamental | Hype, Fear, FOMO |

| Activity Level | Active | Passive | Impulsive |

Conclusion

You now have a blueprint for approaching the markets not as a gambler, but as a disciplined trader. The core of this guide isn’t a secret indicator; it’s the framework of education, planning, risk management, and review. Remember, consistency trumps brilliance every time.

Your action plan is clear: Start with education, choose one market, define your strategy on a demo account, and practice the step-by-step process until it becomes second nature. The market will always be there; the key is to be prepared.

To make implementing your strategy easier, download our free, pre-built Trading Plan and Journal Template. And if you’re ready to choose a platform to start your demo trading, check out our in-depth reviews of the Best Trading Platforms for Beginners.

Related Guides You Should Read Next

- How to Perform Technical Analysis: A Beginner’s Guide

- Fundamental Analysis for Stock Traders

- Psychology of Trading: Mastering Your Mindset