Loan Calculator Calculate Monthly Payments, Interest & Total Cost

Loan Calculator

Fill in the details below to calculate your monthly loan payments and total interest costs

Your Loan Summary

Monthly Payment Breakdown

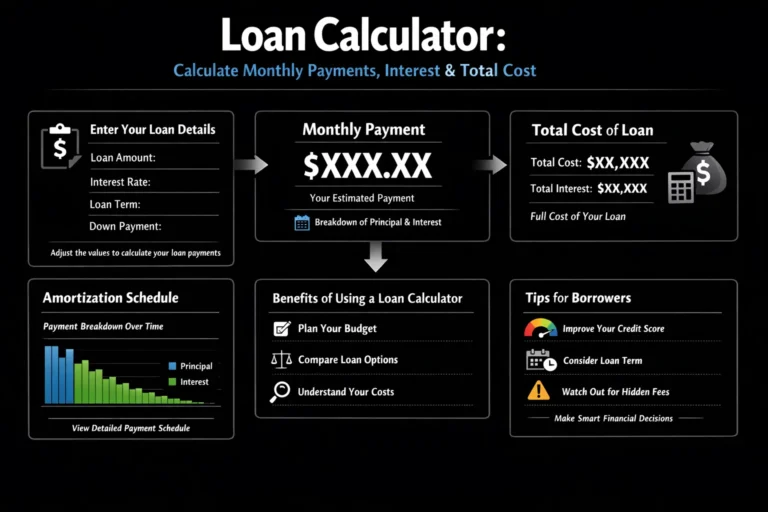

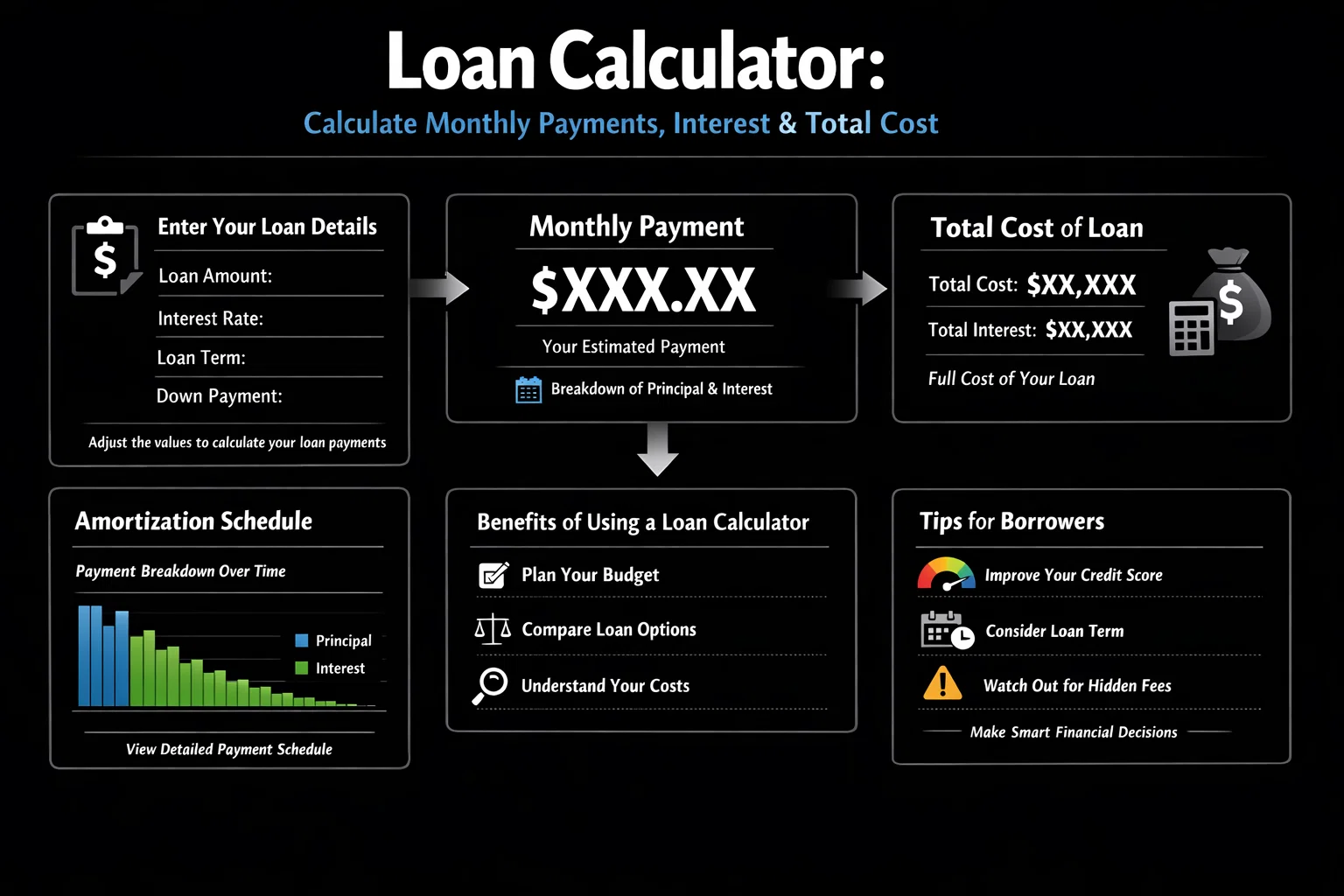

How to Use the Loan Calculator

Step-by-step instructions:

- Enter Loan Amount – Input the total amount you plan to borrow. This is the principal amount before interest.

- Set Interest Rate – Use the slider or enter the annual percentage rate (APR) your lender has quoted. Rates typically range from 3-20% depending on loan type and credit score.

- Choose Loan Term – Adjust the years and months sliders to set your repayment period. Common terms are 3-5 years for auto loans, 15-30 years for mortgages.

- Select Start Date – Choose when your loan payments will begin. This affects the payoff date calculation.

- Add Extra Payments (Optional) – If you plan to pay more than the minimum each month, enter that amount to see how quickly you’ll pay off the loan.

- Choose Currency – Select your preferred currency (USD, GBP, CAD, AUD, EUR) for accurate local representation.

Understanding Your Results:

- Monthly Payment – The amount you’ll pay each month, including principal and interest

- Total Interest Paid – The total cost of borrowing over the loan’s lifetime

- Total Repayment – Principal + Interest = what you’ll pay back in total

- Principal/Interest Ratio – Shows what percentage of your payments go toward the actual loan vs. interest

- Payoff Date – The date your loan will be fully paid off based on your payment schedule

- Amortization Schedule – A detailed breakdown of every payment showing how much goes to principal vs. interest

How Loan Payments Are Calculated

The loan payment calculation uses the standard amortization formula:

Monthly Payment = P × [r(1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal (loan amount)

- r = Monthly interest rate (annual rate ÷ 12)

- n = Total number of payments (loan term in months)

Example Calculation:

Let’s say you borrow $25,000 at 5.5% APR for 5 years:

- Principal (P) = $25,000

- Annual rate = 5.5% = 0.055

- Monthly rate (r) = 0.055 ÷ 12 = 0.004583

- Term = 5 years = 60 months (n)

Monthly Payment = $25,000 × [0.004583(1.004583)^60] / [(1.004583)^60 – 1] = $477.53

Total Interest = ($477.53 × 60) – $25,000 = $3,651.80

Total Repayment = $28,651.80

How to Apply These Results to Your Financial Strategy

Scenario 1: Comparing Loan Offers

Use the calculator to compare different lenders. A 0.5% lower interest rate on a $25,000, 5-year loan saves you approximately $330 in total interest.

Scenario 2: Choosing Loan Term

Shorter terms mean higher monthly payments but less total interest. A 3-year vs. 5-year term on $25,000 at 5.5%:

- 3-year: $755/month, $2,180 total interest

- 5-year: $477/month, $3,652 total interest

You save $1,472 in interest by choosing the 3-year term.

Scenario 3: Impact of Extra Payments

Adding just $50/month to your $25,000 loan at 5.5%:

- Pays off loan 11 months earlier

- Saves approximately $650 in interest

Common Mistakes to Avoid:

- Not considering all fees (origination fees, closing costs)

- Focusing only on monthly payment, not total interest

- Ignoring prepayment penalties

- Not shopping around for the best rate

Advanced Calculation Scenarios

Scenario 1: Variable vs. Fixed Rate Loans

Use the calculator to model different rate scenarios. Input your starting rate, then manually adjust for potential rate increases to see worst-case scenarios.

Scenario 2: Bi-Weekly Payments

Instead of one monthly payment, make half-payments every two weeks. This results in 26 half-payments = 13 full payments per year, paying off your loan faster. To model this, calculate the extra monthly payment equivalent: (13-12) × regular payment ÷ 12.

Scenario 3: Loan Refinancing Analysis

Calculate your current loan’s remaining balance and remaining term. Then use the calculator with that balance, a new rate, and new term to see potential savings.

Scenario 4: Debt Consolidation

If consolidating multiple loans, add up all balances for the principal, calculate the weighted average interest rate, and compare the new consolidated payment against your current total payments.

Important Considerations

What This Calculator Doesn’t Account For:

- Origination Fees – Many loans have upfront fees (1-5%) that affect the true cost

- Prepayment Penalties – Some loans charge fees for paying off early

- Variable Interest Rates – This calculator assumes a fixed rate for the entire term

- Payment Frequency – Calculates monthly payments only

- Tax Implications – Mortgage interest may be tax-deductible in some countries

- Insurance Requirements – Some loans require PMI or other insurance

- Inflation – Doesn’t account for the changing value of money over time

Assumptions Made:

- Interest compounds monthly (standard for most loans)

- Payments are made on time every month

- Interest rate remains constant

- No additional fees or charges

When to Consult a Financial Professional:

- For mortgages over $500,000 or complex financing situations

- When considering adjustable-rate mortgages (ARMs)

- If you have poor credit or unusual income situations

- For business loans or investment property financing

- When dealing with international loans or multiple currencies

Frequently Asked Questions About Loan Calculators

APR (Annual Percentage Rate) includes the interest rate plus other fees and costs associated with the loan, such as origination fees, closing costs, and mortgage insurance. It gives you a more complete picture of what you’ll actually pay. The interest rate is simply the cost of borrowing the principal and doesn’t include these additional fees. When comparing loans, always compare APR rather than just the interest rate to understand the true cost.

Your credit score directly impacts the interest rate you qualify for. According to FICO, as of 2023:

• 760-850 (Excellent): 5.5% average APR

• 700-759 (Good): 6.2% average APR

• 660-699 (Fair): 7.8% average APR

• 620-659 (Poor): 9.5%+ average APR

On a $25,000, 5-year loan, the difference between excellent and poor credit could cost you over $3,000 in additional interest. Improving your credit score before applying can save thousands.

The choice depends on your financial situation and goals:

Shorter terms (1-5 years): Higher monthly payments but significantly less total interest. Best if you have strong cash flow and want to minimize borrowing costs. Example: 3-year vs 5-year on $25,000 at 5.5% saves $1,472 in interest.

Longer terms (6-30 years): Lower monthly payments but much higher total interest. Best if you need to manage monthly cash flow or are financing a large purchase like a home. However, you’ll pay substantially more over time.

Consider your monthly budget, job stability, and how quickly you want to be debt-free when deciding.

Amortization is the process of paying off a loan through scheduled, equal payments over time. Each payment is split into two parts:

Interest portion: The cost of borrowing for that month, calculated on the remaining balance.

Principal portion: The amount that reduces your actual loan balance.

In the early years of a loan, most of your payment goes toward interest. As the balance decreases, more of your payment applies to principal. This is why making extra payments early in the loan term has such a dramatic effect—you’re reducing the balance that accrues interest for the remaining term.

Extra payments go directly toward your principal balance, which has a compounding benefit:

1. Lower principal means less interest accrues each month

2. More of your regular payment goes toward principal

3. The cycle accelerates until the loan is paid off

Example: On a $25,000 loan at 5.5% for 5 years, adding just $50/month:

• Regular payoff: 60 months, $3,652 interest

• With $50 extra: 49 months, $2,998 interest

• Save 11 months and $654 in interest

Even small extra payments can make a significant difference over time.

Yes! This calculator works for any fixed-rate amortizing loan, including:

• Mortgages: 15, 20, or 30-year terms

• Auto loans: Typically 3-7 years

• Personal loans: Usually 1-7 years

• Student loans: 5-20 year terms

• Business loans: Various terms

• Debt consolidation loans

For mortgages, remember that your actual payment may also include property taxes, homeowners insurance, and PMI if your down payment is less than 20%. Use our Mortgage Calculator for a complete picture.

The 28/36 rule is a common guideline used by lenders to determine how much you can afford to borrow:

28% rule: Your total housing costs (mortgage payment, property taxes, insurance) shouldn’t exceed 28% of your gross monthly income.

36% rule: Your total debt payments (housing + car loans + credit cards + student loans + other debts) shouldn’t exceed 36% of your gross monthly income.

Example: If your monthly gross income is $6,000:

• Maximum housing payment: $1,680

• Maximum total debt: $2,160

Use our Debt-to-Income Calculator alongside this loan calculator to ensure you’re within healthy borrowing limits.

Glossary of Terms

- APR (Annual Percentage Rate) – The yearly cost of borrowing including interest and fees

- Principal – The original amount borrowed

- Interest – The cost of borrowing money, expressed as a percentage

- Amortization – The process of paying off debt with regular payments over time

- Fixed Rate – An interest rate that doesn’t change over the loan term

- Variable Rate – An interest rate that can fluctuate based on market conditions

- Loan Term – The length of time to repay the loan

- DTI (Debt-to-Income Ratio) – Monthly debt payments divided by monthly income

- Collateral – An asset used to secure a loan

- Default – Failure to repay a loan according to terms

- Prepayment – Paying extra toward principal before it’s due

- Refinancing – Replacing an existing loan with a new one, usually with better terms