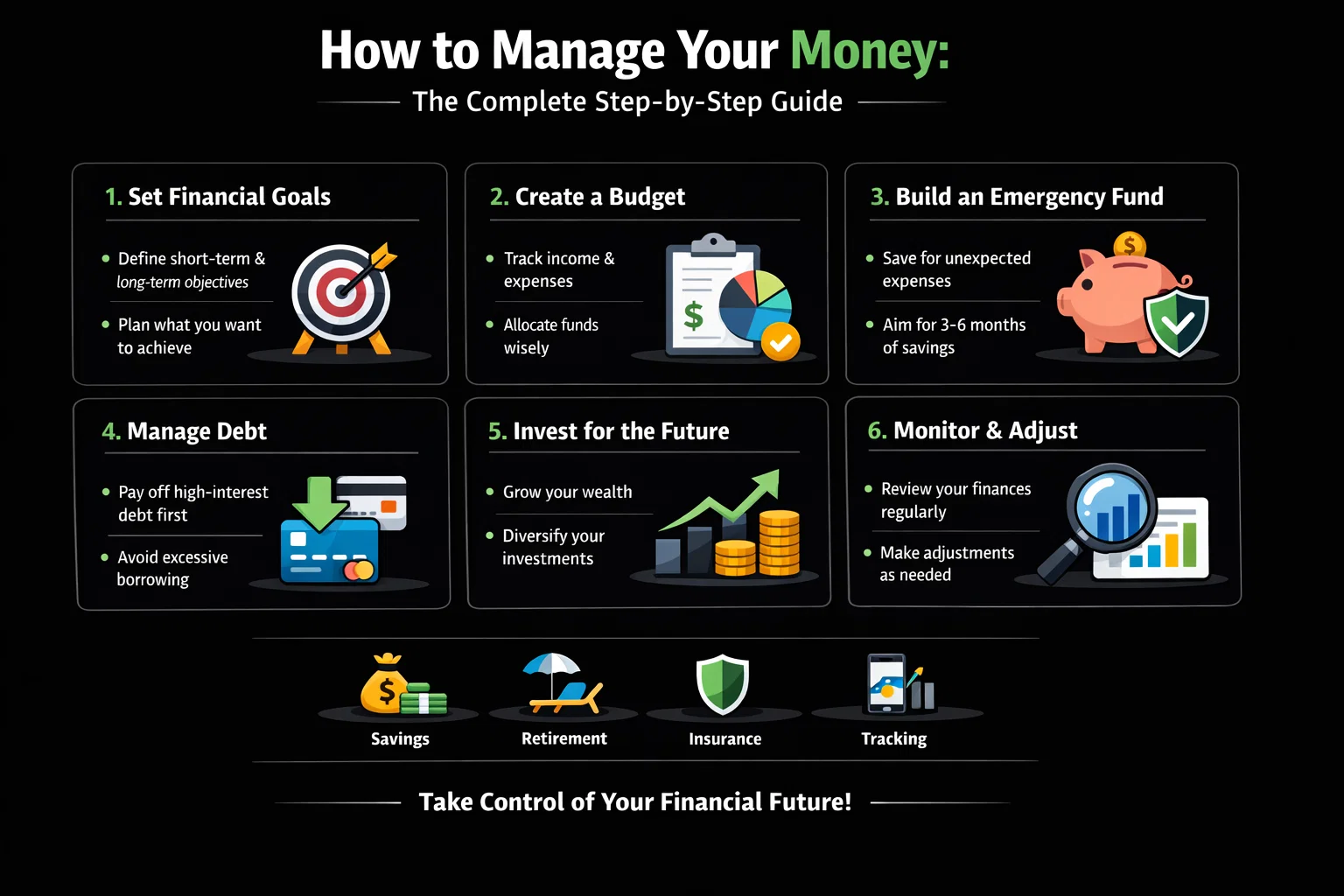

How to Manage Your Money: The Complete Step-by-Step Guide

Feeling overwhelmed by your finances? You’re not alone. Learning how to manage your money is the single most important skill for achieving financial security and freedom. This guide will provide a clear, actionable path to taking control of your income, expenses, and savings, transforming your financial stress into confidence.

For individuals in the US, Canada, UK, and Australia, applying these principles can help you navigate your specific financial landscape, from managing student loans and 401(k)s to navigating ISA and Superannuation accounts.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To create a sustainable personal financial system for tracking income, controlling spending, paying down debt, and building wealth. |

| Skill Level | Beginner |

| Time Required | 2–3 hours for initial setup, then approximately 30 minutes per week for maintenance. |

| Tools Needed | Pen and paper, spreadsheet (Excel or Google Sheets), or a budgeting app. Have your bank and credit card statements handy for accurate data. |

| Key Takeaway | Money management is not about restriction—it’s about giving your money clear direction so you can live the life you want. |

Why Learning to Manage Your Money is Crucial

Money management is the foundation upon which all financial success is built. It’s the proactive process of handling your finances through budgeting, saving, investing, and spending. Without a plan, your money controls you. With a plan, you control your destiny.

The Problem It Solves: Living paycheck-to-paycheck, constant financial anxiety, mounting debt, and feeling like you’ll never achieve your big goals like buying a home or retiring comfortably.

You will gain clarity and peace of mind. You’ll break the cycle of debt, build a safety net, and start making meaningful progress toward your dreams. This is the first step in transforming your relationship with money from one of stress to one of empowerment.

What You’ll Need Before You Start

To get started, you don’t need a finance degree, just a willingness to be honest and organized.

Knowledge Prerequisites: A basic understanding of your monthly income and your major expense categories (like rent, car payment, utilities). No complex financial knowledge is required.

Data Requirements:

- 3 months of bank statements (checking & savings)

- 3 months of credit card statements

- Recent pay stubs

- A list of all your debts (balances, interest rates, minimum payments)

Tools & Platforms:

- The Analog Method: A notebook, pen, and a calculator.

- The Digital Method (Recommended): A spreadsheet like Google Sheets or Microsoft Excel.

- The Automated Method: A budgeting app like Mint, YNAB (You Need A Budget), or PocketSmith.

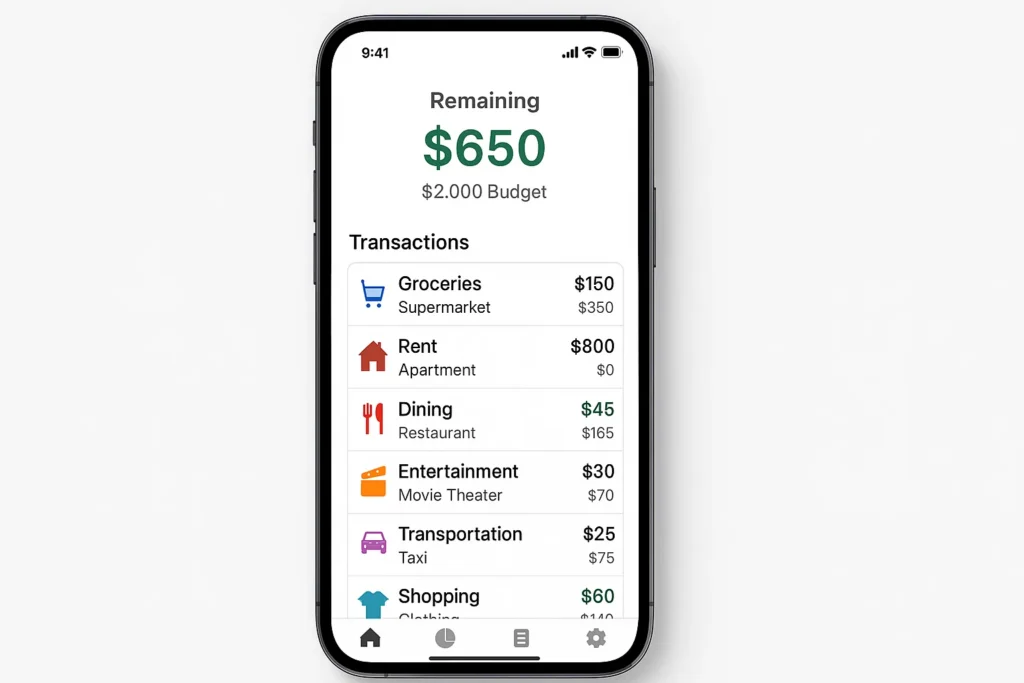

To easily track all your accounts in one place, you’ll need a robust budgeting tool. Many of the best personal finance apps, like YNAB or Monarch Money, connect directly to your bank accounts to automate tracking.

How to Manage Your Money: A Step-by-Step Walkthrough

Follow these steps to build your financial management system from the ground up.

Step 1: Triage Your Financial Situation

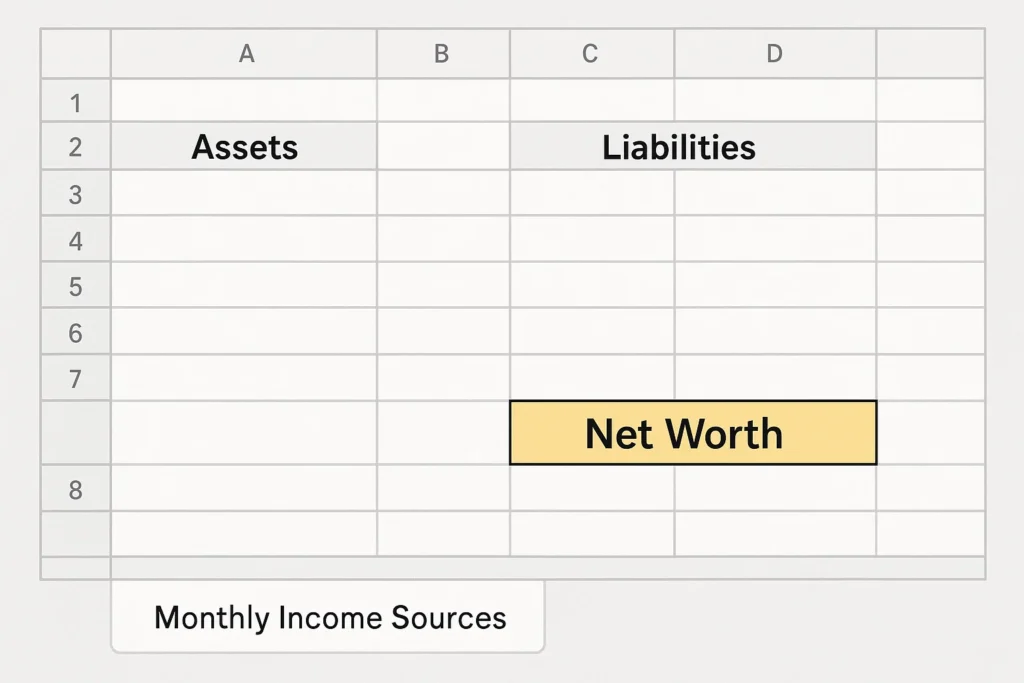

Before you can plan the future, you must understand the present. Gather all your financial documents (from the Prerequisites section) and create a “Financial Snapshot.”

Pro Tip: Don’t judge yourself during this step. This is a fact-finding mission, not a trial. Be brutally honest.

Action:

- Calculate Your Net Worth: List all your Assets (what you own: savings, retirement accounts, home value) and subtract all your Liabilities (what you owe: loans, credit card debt). This is your net worth. Track this number over time.

- List All Income: Write down all your sources of monthly take-home pay.

- List All Expenses: Categorize every single expense from the last 3 months.

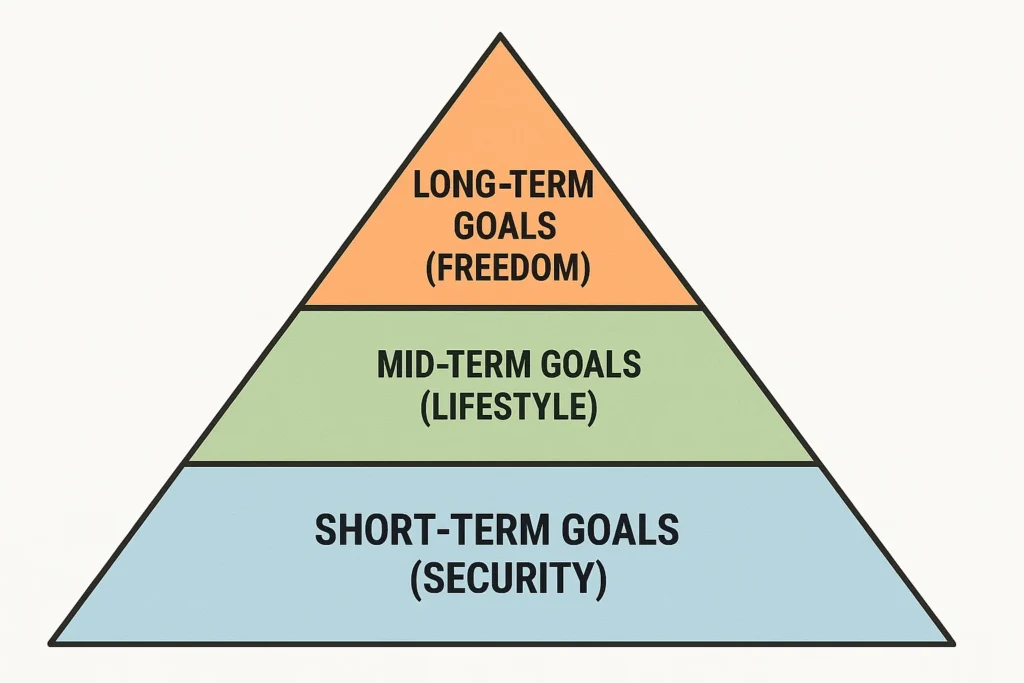

Step 2: Set Powerful Financial Goals

Your budget is a tool to achieve your goals. Without goals, it’s just a restrictive spreadsheet. Define what you’re working towards.

Common Mistake to Avoid: Setting only long-term goals. You need short-term wins to stay motivated.

Action:

- Short-Term Goals (0-1 year): Build a $1,000 emergency fund, pay for a vacation, pay off a specific credit card.

- Mid-Term Goals (1-5 years): Save for a down payment on a house, buy a new car with cash, start a business.

- Long-Term Goals (5+ years): Save for retirement, pay off your mortgage, fund your children’s education.

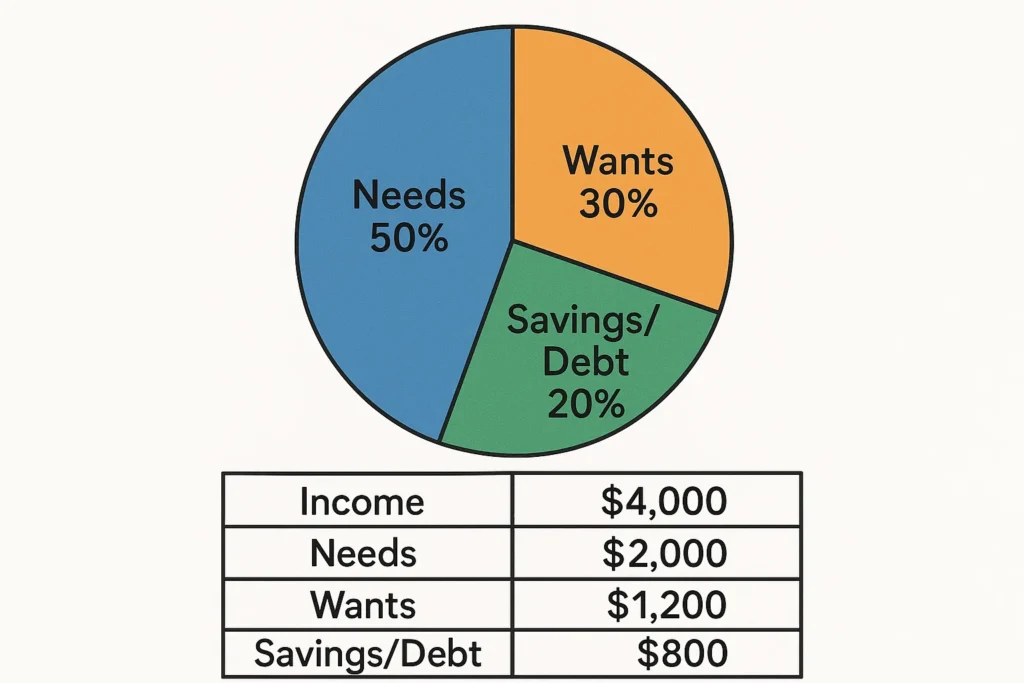

Step 3: Create Your First Budget

This is where you give every dollar a job. We’ll use the popular 50/30/20 rule as a starting framework.

Formula:

- 50% of Net Income goes to Needs (Rent, Utilities, Groceries, Minimum Debt Payments).

- 30% of Net Income goes to Wants (Dining out, Entertainment, Shopping, Hobbies).

- 20% of Net Income goes to Savings & Debt Repayment (Emergency fund, retirement, extra debt payments).

Example Calculation:

- Monthly Net Income: $4,000

- Needs (50%): $2,000

- Wants (30%): $1,200

- Savings/Debt (20%): $800

Step 4: Choose and Implement a Tracking System

A budget on paper is useless if you don’t track your spending against it. Choose one method and stick with it for a month.

Action:

- App Method: Link your accounts. Categorize transactions as they happen.

- Spreadsheet Method: Download your transactions weekly and categorize them in your sheet.

- Envelope/Cash Method: Withdraw cash for your “Wants” categories and use envelopes. When the cash is gone, you stop spending.

The Psychology of Money: Overcoming Your Mental Blocks

Often, the biggest barrier to effective money management isn’t knowledge, but mindset. Understanding your money scripts is crucial.

- Identify Your Money Mindset: Are you an avoider, a worrier, or a status seeker? Recognizing your default behavior is the first step to changing it.

- Practice Conscious Spending: Instead of saying “I can’t afford that,” reframe it to “I’m choosing to spend my money on my goal instead.” This empowers you.

- Celebrate Small Wins: Paid off a small debt? Stuck to your grocery budget? Celebrate it! This positive reinforcement builds lasting habits.

How to Use Your Budget in Your Financial Strategy

Your budget is a living document. Use it to make active decisions.

Scenario 1: You Have a Surplus: If you have money left in a category at the end of the month, don’t just spend it! “Roll with the punches” by moving it to a goal, like your debt snowball or emergency fund.

Scenario 2: You Have a Deficit: If you overspend in one category (e.g., dining out), you must cover it by reducing another category (e.g., entertainment). This forces conscious trade-offs.

Case Study: “Sarah, a graphic designer, was consistently overspending on food delivery. Her budget revealed she was spending $600/month. By reallocating $400 of that to her ‘Wants’ and committing to cooking more, she freed up $200/month to attack her credit card debt, paying it off 18 months early.”

Common Mistakes When Managing Your Money

Pitfall 1: Setting an Unrealistic Budget. Being too strict leads to burnout.

- Solution: Start with the 50/30/20 rule as a guideline, then adjust based on your actual spending data from Step 1.

Pitfall 2: Forgetting Irregular Expenses.

- Solution: Identify annual bills (car insurance, Amazon Prime) and divide the total by 12. Save that amount each month in a separate “Sinking Fund.”

Pitfall 3: Not Communicating with Your Partner.

- Solution: Have a weekly 20-minute “Money Date” to review the budget together. This prevents arguments and ensures you’re a team.

- Provides Clarity and Control: You know exactly where your money is going.

- Reduces Financial Stress: Eliminates the fear of the unknown and gives peace of mind.

- Accelerates Goal Achievement: Systematically allocates funds toward your short- and long-term goals.

- Prevents and Reduces Debt: Helps you avoid overspending and manage credit wisely.

- Encourages Better Habits: Regular tracking fosters discipline and smarter financial decisions.

- Requires Discipline and Time: It’s an ongoing process, not a one-time fix.

- Can Feel Restrictive: If not framed around meaningful goals, it may feel like financial punishment.

- Needs Regular Updates: Income and expenses change, so your system must be reviewed frequently.

- Life Is Unpredictable: Budgets need flexibility to handle emergencies and unexpected events.

- Initial Setup Can Be Tedious: Collecting statements and building a structure takes effort upfront.

Taking It to the Next Level

Once you’ve mastered basic budgeting for 3-6 months, it’s time to level up.

The Zero-Based Budget: This is the gold standard. Every single dollar of income is assigned a job until your income minus your expenses equals zero. This gives you maximum control.

The Debt Avalanche/Snowball Method: For aggressive debt repayment. The Avalanche (mathematically best) targets highest-interest debt first. The Snowball (psychologically motivating) targets smallest-balance debt first for quick wins.

Automating Your Finances: Set up automatic transfers to savings and investment accounts right when you get paid. This makes wealth-building effortless.

For a deeper dive into destroying your debt, read our complete guide to the Debt Snowball vs. Avalanche Method.

Money Management Through Life’s Stages

Your financial strategy should evolve as you do.

- In Your 20s: Focus on building a solid foundation. Master budgeting, establish an emergency fund, start retirement savings (compound interest is your superpower!), and manage student debt.

- In Your 30s & 40s (Wealth Accumulation): Your earnings peak. Accelerate retirement savings, save for a home and children’s education, and ensure you have adequate insurance (life, disability).

- In Your 50s & Beyond (Pre-Retirement & Retirement): Shift to capital preservation. Maximize “catch-up” retirement contributions, create a detailed retirement income plan, and focus on estate planning (wills, trusts).

Budgeting vs Simple Expense Tracking

| Feature | Budgeting | Simple Expense Tracking |

|---|---|---|

| Core Principle | Proactive planning for your money. | Reactive tracking of where it went. |

| Mindset | Forward-looking, goal-oriented. | Backward-looking, analytical. |

| Primary Use | Achieving financial goals and controlling spending. | Understanding past spending habits. |

Conclusion

You now possess the fundamental blueprint for financial success. By understanding your cash flow, setting powerful goals, and creating a living budget, you’ve moved from being a passenger to the pilot of your financial life. Remember, perfection is not the goal—progress is. Your first budget will be wrong, and that’s okay. The key is to start today.