Image Source: [https://www.freepik.com]

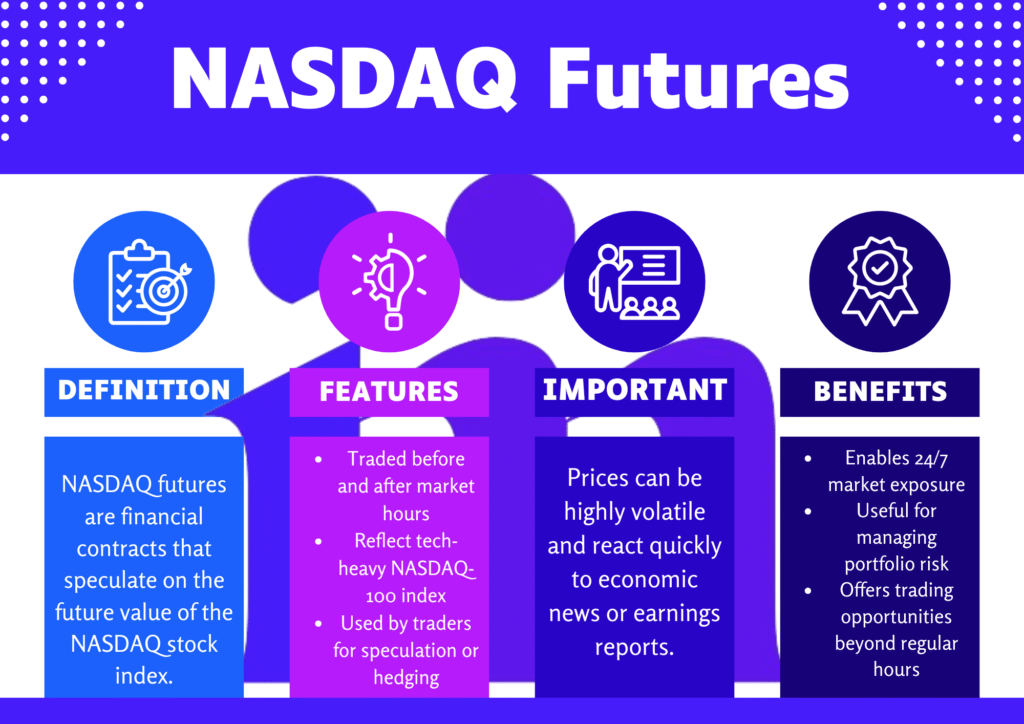

NASDAQ Futures are a powerful financial instrument used by investors and traders to speculate on the future value of the NASDAQ index or to hedge against market risks. As one of the most influential stock market indices, especially in the technology sector, the NASDAQ offers exposure to a diversified group of tech-driven companies. NASDAQ Futures provide a way to gain exposure to this tech-heavy index. This article explores what NASDAQ Futures are, how they work, the benefits they offer, and answers to frequently asked questions.

Key Takeaways

During the COVID-19 crash in March 2020, experienced traders used NASDAQ Futures to hedge against falling tech stock portfolios. By shorting the index through futures contracts, they limited losses or even generated profits while the overall market plunged.

What Are NASDAQ Futures

NASDAQ Futures are financial derivatives that allow market participants to buy or sell contracts representing the anticipated value of the NASDAQ-100 or NASDAQ Composite index at a future date. These contracts are mainly traded on regulated futures exchanges such as the Chicago Mercantile Exchange (CME).

The NASDAQ-100 is made up of 100 of the largest non-financial firms listed on the NASDAQ exchange, with a strong representation from the tech industry. This makes NASDAQ Futures particularly popular among traders and institutional investors looking to speculate on tech market movements or hedge against risks in technology-focused portfolios.

Use Micro E-mini NASDAQ-100 Futures (MNQ) if you’re just starting out. They allow you to gain exposure to the index with far less capital and risk compared to full-sized contracts, making them ideal for strategy testing and learning.

Futures contracts allow investors to lock in a price today for buying or selling the index at a future date. These instruments are widely used for short-term speculation as well as long-term risk management.

How Do NASDAQ Futures Work

NASDAQ Futures allow traders to profit from the price movements of the NASDAQ-100 or NASDAQ Composite index without owning the individual stocks in the index. Here’s how they operate:

- Buying and Selling Contracts: Purchasing a NASDAQ Futures contract means agreeing to buy the index at a specified price on a future date. Selling a futures contract means committing to deliver the index at the agreed-upon price on the contract’s expiration date.

- Leverage: Futures trading involves margin trading, meaning you only need to deposit a portion of the contract’s total value called the initial margin. This allows for greater exposure with less capital but increases both potential returns and risks.

- Settlement: Upon contract expiration, most NASDAQ Futures are cash-settled, meaning gains or losses are settled in cash based on the index’s final value. No physical exchange of stocks takes place.

- Expiration Dates: Futures contracts have fixed expiration dates. Traders must either exit their positions before the contract expires or allow them to be settled accordingly. Many prefer to close out early to avoid potential volatility around expiration.

- Margin Calls: Due to the leveraged nature of futures, traders must maintain a minimum margin level. If the trade goes against them, they may be required to deposit more money to cover potential losses known as a margin call.

NASDAQ Futures are not investments in individual stocks but in the performance of the overall NASDAQ-100 index. This means you’re speculating on index movement, not owning equity in companies like Apple or Microsoft.

How to Invest in NASDAQ Futures

Investing in NASDAQ Futures requires a futures trading account with a registered brokerage that supports futures markets. Here’s a step-by-step guide:

- Open a Futures Trading Account: Choose a reputable broker that offers futures trading and open an account specifically for futures.

- Fund Your Account with Margin: Deposit the required initial margin, which serves as collateral for your trades. Margin requirements depend on the contract size and broker’s terms.

- Choose a NASDAQ Futures Contract: Select a contract that fits your investment strategy. Options vary by expiration date and size.

- Execute Your Trade: Use your broker’s trading platform to place a buy or sell order, including your target price and contract expiry.

- Manage Your Position: Once your order is filled, actively monitor your trade. You can close it early or let it settle based on your market outlook and risk management plan.

As a market analyst, I’ve seen traders succeed or fail in NASDAQ Futures not because of their strategies, but because of how they manage leverage. Even well-planned trades can unravel without disciplined risk control. In my experience, setting stop-losses and not overextending your margin are more important than predicting market direction.

Benefits of NASDAQ Futures

NASDAQ Futures offer several advantages for investors and traders, especially those focused on the tech sector:

- Leverage

These contracts provide high leverage, enabling greater market exposure with a relatively small capital outlay. This can enhance returns for those able to manage the associated risk effectively. - Diversification

Investors gain broad exposure to the tech industry through a single product, reducing the need to buy multiple individual stocks. - Hedging Opportunities

Investors with existing positions in tech equities can use NASDAQ Futures to hedge against potential market downturns, helping manage portfolio risk. - Liquidity

NASDAQ Futures are among the most actively traded futures contracts, offering deep liquidity. This ensures tight spreads and fast execution for both entry and exit. - Transparency

As they are traded on regulated exchanges, futures contracts provide full price transparency, allowing investors to make well-informed decisions using real-time data.

The NASDAQ-100 Futures market is open nearly 23 hours a day, from Sunday evening to Friday evening, allowing traders across the globe to react to news events in real time—even outside regular U.S. stock market hours.

Risks of NASDAQ Futures

Despite their advantages, NASDAQ Futures carry several risks:

- Leverage Risk:

While using leverage can magnify returns, it also significantly increases the risk of losses. Even a small unfavorable movement in the index can lead to steep financial consequences. - Market Volatility:

The technology sector is often volatile. This can lead to rapid price swings in NASDAQ Futures, making risk management essential. - Margin Calls:

If the market shifts unfavorably and the margin is insufficient, traders may be forced to add more funds or risk having their positions closed automatically. - Complexity:

Futures trading involves complex strategies and may not be appropriate for inexperienced investors. A lack of proper knowledge can lead to substantial losses.

Pros and Cons of NASDAQ Futures

| Pros | Cons |

|---|---|

| ✔ Enables enhanced potential returns with lower capital due to leverage | ✘ Futures trading requires deep understanding of market mechanics |

| ✔ Offers exposure to the broader tech sector via the NASDAQ-100 index | ✘ Typically suited for short- to medium-term trading, not long-term holding |

| ✔ High liquidity makes it easy to buy and sell quickly | ✘ Tech stocks can be highly volatile, raising downside risk |

| ✔ Effective tool for hedging risks tied to technology equities | ✘ Leverage also increases risk and potential losses |

Leverage cuts both ways. While leverage has the potential to boost returns, it can also accelerate losses just as quickly. For instance, a 2% shift in the index could eliminate a position that is leveraged 20 times. Always monitor your margin and have a solid exit strategy in place.

Conclusion

NASDAQ Futures are a valuable financial tool for investors and traders looking to speculate on the future direction of the NASDAQ-100 index or hedge exposure to tech-sector volatility. These contracts offer leverage, liquidity, and diversification benefits, making them ideal for short-term traders and portfolio managers alike. However, their complexity and the risks associated with margin trading demand a strong understanding of the futures market and disciplined risk management. When used correctly, NASDAQ Futures can serve as a powerful addition to your trading or investment strategy.