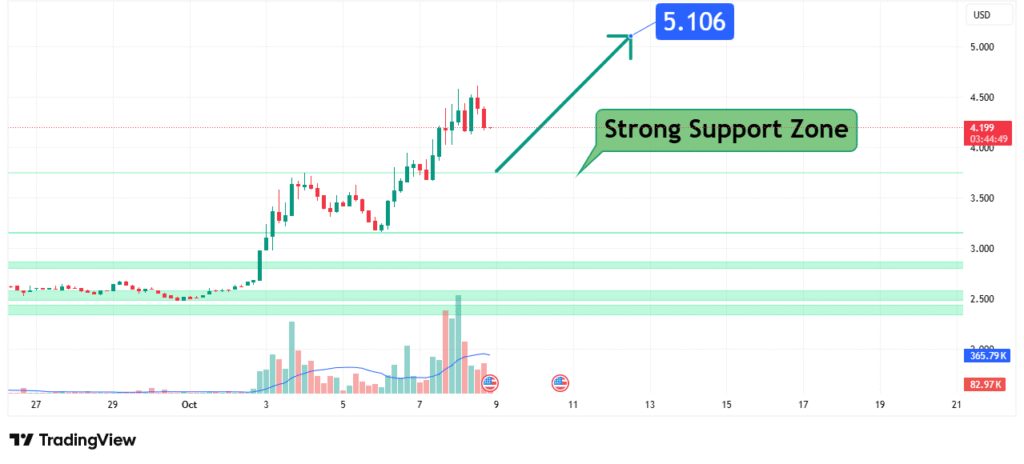

PancakeSwap (CAKE) Price Analysis Bullish Rebound Targets $5.10

CAKE’s price has staged a significant rebound after finding a firm footing at a long-term strong support zone between $2.50 and $3.00. This vigorous recovery suggests a strong bullish bias is in play. Our analysis projects a continuation of this move towards a primary target of $5.1. This prediction is based on a confluence of technical factors, including a successful retest of a major historical support level and a clear breakout from a descending wedge/consolidation pattern evident on the chart.

Current Market Structure and Price Action

The current market structure for CAKE has shifted from bearish to bullish. The price has decisively broken its previous pattern of lower highs, rallying sharply from the multi-month support base. The price is currently trading above the $4.00 psychological level, having cleared several immediate resistance levels with strength. The strong green candles on the chart indicate significant buying pressure and momentum, suggesting the rally has further room to run.

Identification of the Key Support Zone

The most critical technical element on the chart is the Strong Support Zone ranging from approximately $2.50 to $3.00. The strength of this zone is derived from:

- Historical Significance: This level acted as a major launching pad for the rally in early October and has served as a bedrock support area, with the price bouncing from it multiple times.

- Technical Confluence: The zone represents the lows of the recent consolidation range and aligns with a key psychological level ($3.00). The explosive move from this zone confirms its strength.

- Market Psychology: This area represents a clear accumulation zone where sellers were exhausted and buyers aggressively stepped in, creating a fundamental shift in market sentiment from bearish to bullish.

This confluence made it a high-probability level for a bullish reversal, which is now underway.

Technical Target and Rationale

Our analysis identifies the following price target:

Primary Target: $5.10

The $5.10 level is a significant technical and psychological target. It represents the next major resistance zone, which previously acted as support in late September. Furthermore, this level is identified by the 0.618 or 0.786 Fibonacci retracement level (from the chart’s high to the recent low), a common profit-taking zone that often halts or reverses rallies. A break above this level would be a very strong bullish signal.

Prediction: We forecast that CAKE’s price will continue its current bullish impulse, overcoming minor resistances to reach our primary target at $5.10.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close back below the Strong Support Zone, specifically below $2.40. A move back into this zone would indicate a failure of the breakout and a likely retest of the lows.

- Position Sizing: Any long positions taken should be sized so that a loss triggered at the $2.40 invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- PancakeSwap v4 Launch: The upcoming or recent launch of PancakeSwap’s fourth version, with features like custom pool types and a singleton contract to reduce gas fees, could be a core driver of renewed interest and value for the CAKE token.

- DeFi Market Recovery: The general health and rising Total Value Locked (TVL) in the DeFi sector, particularly on BNB Chain, provide a positive tailwind for CAKE, the chain’s leading DEX.

- Tokenomics Improvements: Ongoing efforts to make CAKE’s tokenomics more deflationary and utility-focused through mechanisms like veCAKE and burning are viewed positively by the market.

These factors contribute to a bullish sentiment surrounding the asset, supporting the current technical breakout.

Conclusion

CAKE has demonstrated a powerful bullish reversal from a critical support zone. The weight of evidence suggests this momentum will continue, targeting a move to $5.10. Traders should monitor for sustained buying pressure and manage risk diligently by respecting the key invalidation level at $2.40. The reaction at the $5.10 target will be crucial for determining if a new, longer-term uptrend is beginning.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.