Rent vs Buy Calculator Compare Costs, Equity Growth

Rent vs Buy Calculator

Compare total costs of renting versus buying a home over time. See the financial breakeven point and equity growth.

Rent vs Buy Comparison Results

Cost comparison visualization will appear here

Monthly Cost Breakdown

Renting Costs

Buying Costs

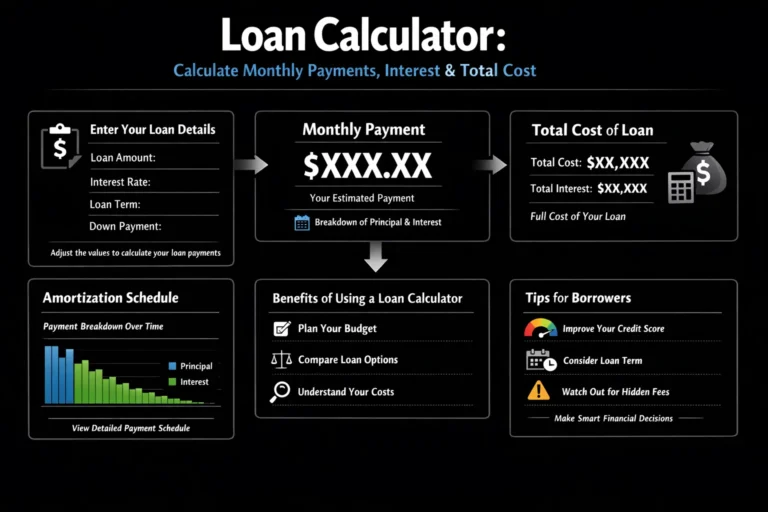

How to Use the Rent vs Buy Calculator

Step-by-step Instructions:

- Select your currency – Choose USD, GBP, CAD, or AUD based on your location

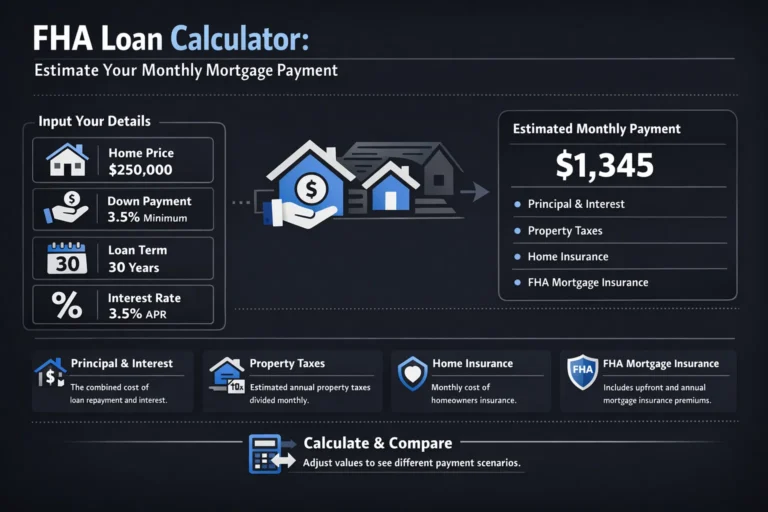

- Enter home purchase price – The price of the home you’re considering buying

- Set down payment percentage – Use the slider or input field (20% is standard to avoid PMI)

- Adjust mortgage details – Set interest rate, loan term, and other financing parameters

- Enter homeownership costs – Property taxes, insurance, maintenance, and closing costs

- Input rental information – Current rent and expected annual increases

- Set market assumptions – Expected home appreciation and investment returns

- Choose time period – How long you plan to stay in the home

- Click “Calculate Comparison” – View detailed results and financial recommendation

Input Field Explanations:

- Home Purchase Price: Total cost of the property you’re considering

- Down Payment: Initial cash payment (affects loan amount and PMI)

- Mortgage Interest Rate: Annual interest rate on your home loan

- Property Tax Rate: Annual property tax as percentage of home value

- Annual Maintenance: Estimated upkeep costs (1-2% of home value is standard)

- Closing Costs: One-time fees for purchasing (typically 2-5% of purchase price)

- Monthly Rent: Current or expected rental payment

- Home Appreciation: Expected annual increase in property value

Interpreting Results:

- Positive Net Cost Difference: Renting is financially better

- Negative Net Cost Difference: Buying is financially better

- Breakeven Point: Number of years until buying becomes advantageous

- Equity Built: Wealth accumulated through mortgage payments and appreciation

How Rent vs Buy is Calculated

Methodology:

The calculator uses a comprehensive time-value-of-money analysis comparing two scenarios over your specified time period:

Renting Scenario:

- Monthly rent payments increasing annually

- Renters insurance costs

- Opportunity cost of not investing your down payment

Buying Scenario:

- Mortgage payments (principal + interest)

- Property taxes (increasing with home value)

- Home insurance premiums

- Maintenance costs (1-2% of home value annually)

- Private Mortgage Insurance (if down payment < 20%)

- Closing costs (one-time upfront fees)

- Home equity accumulation through:

- Principal portion of mortgage payments

- Home value appreciation

Key Formula Components:

- Mortgage Payment: Calculated using standard amortization formula

- Equity Calculation: Final home value minus remaining mortgage balance

- Net Cost Difference: (Total buying costs – Total renting costs) – Home equity built

- Investment Opportunity: Down payment + closing costs invested at assumed return rate

Sample Calculation:

For a $350,000 home with 20% down, 6.5% interest, 30-year loan:

- Monthly mortgage: $1,770

- Monthly ownership costs: ~$2,400 total

- After 7 years: ~$85,000 equity built

- Compared to renting at $1,800/month increasing 3% annually

How to Apply These Results to Your Financial Strategy

Actionable Advice Based on Results:

If Buying is Recommended:

- Start saving for down payment and closing costs immediately

- Check your credit score and work on improving it for better mortgage rates

- Get pre-approved for a mortgage to understand your buying power

- Research first-time homebuyer programs in your area

- Factor in additional costs like moving expenses, furniture, and immediate repairs

If Renting is Recommended:

- Invest the difference between rent and potential mortgage payments

- Build emergency fund to 6-12 months of expenses

- Maximize retirement contributions with the flexibility renting provides

- Consider renting investment properties instead of primary residence

- Re-evaluate annually as your financial situation and market conditions change

Adjusting Inputs to Achieve Goals:

- To make buying more attractive: Increase time period, find lower-priced home, or save larger down payment

- To make renting more attractive: Invest savings aggressively, choose more affordable rental, or reduce investment return assumption

Common Mistakes to Avoid:

- Underestimating maintenance costs (budget 1-2% of home value annually)

- Ignoring transaction costs when selling (typically 6-10% of sale price)

- Forgetting about property tax increases as home value appreciates

- Overestimating home appreciation rates (use conservative 3-4% long-term average)

- Not accounting for lifestyle factors like job stability or family plans

Advanced Calculation Scenarios

Complex Use Cases:

1. House Hacking Strategy

- Buying multi-unit property, living in one unit, renting others

- Calculator adjustment: Reduce monthly housing cost by rental income

- Impact: Often makes buying immediately advantageous

2. Rapid Equity Building

- Make extra mortgage payments or choose 15-year loan

- Adjustment: Increase monthly payment, reduce interest paid

- Result: Faster breakeven point and greater long-term wealth

3. Geographic Arbitrage

- Rent in high-cost area, buy investment property elsewhere

- Consideration: Management costs, different appreciation rates

- Calculator use: Run separate scenarios for primary residence and investment

4. Temporary Relocations

- Plan to move in 3-5 years for career or family

- Critical factor: High transaction costs make short-term ownership risky

- Strategy: Consider rent-to-own or lease options

5. Retiree Downsizing

- Sell current home, rent vs buy smaller property

- Include: Capital gains considerations, reverse mortgage options

- Key question: Preserve liquidity vs lock in housing costs

Comparison of Strategies:

- 20% down vs 3-5% down: PMI costs vs investment opportunity

- 15-year vs 30-year mortgage: Higher payments vs flexibility

- Fixed vs adjustable rate: Predictability vs potential savings

- Urban vs suburban: Higher appreciation vs lower entry costs

Important Considerations

What the Calculator Doesn’t Account For:

Psychological Factors:

- Pride of ownership and emotional value of home

- Stability and control over living space

- Flexibility of renting vs commitment of owning

Market Uncertainties:

- Unexpected home value depreciation

- Interest rate volatility

- Rental market disruptions

- Economic recessions affecting both values and employment

Personal Circumstances:

- Job security and relocation likelihood

- Family size changes (growing or shrinking household)

- Health considerations affecting housing needs

- Inheritance or other windfalls

Tax Implications (Vary by Country):

- Mortgage interest deductions (US, Canada partial)

- Capital gains exemptions on primary residence

- Property tax deductions

- First-time homebuyer credits

Assumptions Made:

- Consistent investment returns (market averages)

- Steady rental and appreciation increases

- No major home repairs or capital improvements

- Consistent property tax rates

- No changes to mortgage terms (refinancing not considered)

When to Consult Professionals:

- Financial advisor: Complex investment comparisons

- Tax professional: Country-specific tax implications

- Real estate agent: Local market expertise

- Mortgage broker: Current loan products and rates

- Estate planner: Long-term wealth transfer considerations