Sonic (SON) Primed for $0.3596 The Trade Setup You Should Watch

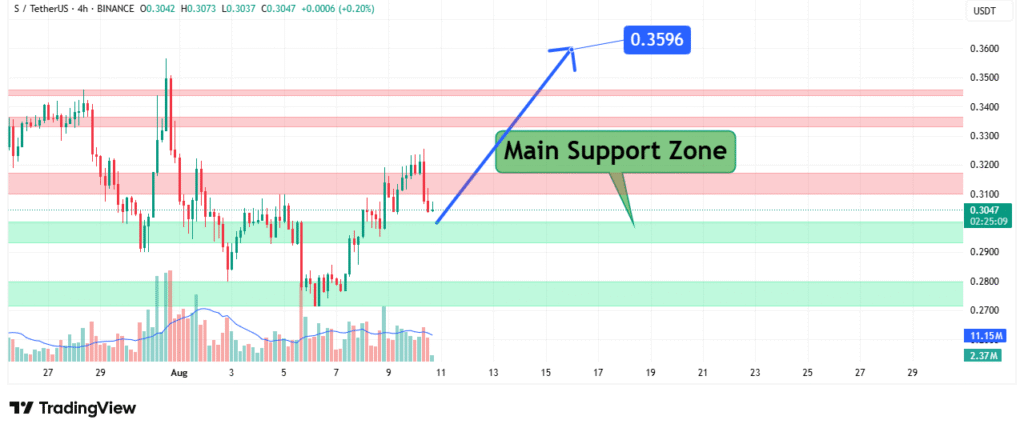

The Sonic (SON) price chart reveals a cryptocurrency consolidating within a clearly defined support zone, presenting traders with a compelling technical setup. Currently navigating between multiple support levels, SON shows potential for a significant move toward our $0.3596 target price. This analysis breaks down the crucial support and resistance levels that will determine whether SON can stage a sustainable recovery or face further downside pressure.

Current Market Structure and Price Action

Sonic’s technical landscape presents several important characteristics:

- Key Support Zone: $0.2700-$0.3100 (multiple confluence levels)

- Immediate Resistance: $0.3500 (psychological barrier)

- Primary Target: $0.3596 (noted on chart as significant level)

- Recent Activity: Consolidation within support range

The chart shows SON has established a strong base of support between $0.2700 and $0.3100, with this zone being tested multiple times in recent trading sessions.

Critical Price Levels and Market Framework

Support Structure (Must Hold for Bullish Case):

- Primary Support Cluster: $0.2700-$0.3100 (high-volume zone)

- Strong Historical Support: $0.2258 (previous swing low)

- Absolute Floor: $0.2000 (major psychological level)

Resistance Pathway to Target:

- Initial Hurdle: $0.3500 (psychological resistance)

- Breakout Level: $0.3596 (primary target)

- Upper Potential: $0.4000 upon successful breakout

- Extension Targets: $0.4500+ in strong market conditions

The $0.3596 level holds particular significance as it’s prominently marked within the support zone, suggesting it may represent a key flipped level that could now act as resistance-turned-target.

Technical Considerations and Momentum Factors

Several technical elements shape the current outlook:

- Volume Clusters: Notable activity at $0.2700-$0.3100 (11.15M-7.27M)

- Price Memory: Strong historical reactions at $0.3047 and $0.3100

- Market Structure: Higher timeframe trend remains intact

- Momentum Indicators: Potential basing pattern developing

The presence of multiple support levels within a tight band ($0.2700-$0.3100) creates a high-probability bounce zone for buyers to defend.

Potential Price Scenarios and Trading Strategies

Bullish Scenario (Target Achievement):

- Initial Signal: Sustained hold above $0.3000

- Confirmation: Break above $0.3500 with volume

- Target Execution: Test of $0.3596 resistance

- Extension Potential: $0.4000+ if momentum continues

Bearish Risk Scenario:

- Warning Sign: Breakdown below $0.2700

- Accelerated Decline: Potential test of $0.2258

- Critical Failure: Close below $0.2000 support

Strategic Trading Approach

For traders targeting $0.3596:

- Entry Planning:

- Conservative: Wait for break above $0.3500

- Moderate: Scale in between $0.3000-$0.3100

- Aggressive: Current levels with tight stops

- Stop Placement:

- Below $0.2700 for most positions

- Tighter stops below $0.3000 for short-term trades

- Profit Targets:

- First take-profit at $0.3500 (partial)

- Final target at $0.3596

- Consider trailing stops beyond $0.3500

Key Market Factors to Monitor

- Ecosystem Developments: Sonic network upgrades

- Exchange Activity: Volume spikes at key levels

- Broader Market Sentiment: Altcoin market trends

- On-Chain Metrics: Wallet activity and token distribution

Conclusion: High-Conviction Setup with Clear Parameters

Sonic presents one of the more compelling technical setups in the altcoin market, with clearly defined support levels and a achievable price target. The $0.2700-$0.3100 support zone offers traders a favorable risk/reward proposition, while the path to $0.3596 appears reasonable if broader market conditions cooperate.