Image Source: [https://www.freepik.com]

Swing trading is a popular method among active investors who seek to profit from short- to medium-term price fluctuations, typically holding positions for several days to a few weeks. Unlike day traders who open and close trades within the same session, swing traders maintain their positions over a longer duration to capture broader market moves. This approach presents ample opportunities to profit from price fluctuations and can be applied across various asset classes, including stocks, forex, commodities, and cryptocurrencies. This article will explore Swing Trading, define what it is, explain how it works, outline the different types of Swing Trading strategies, and answer frequently asked questions (FAQs) to give you a comprehensive understanding of this trading method.

Key Takeaways

What is Swing Trading

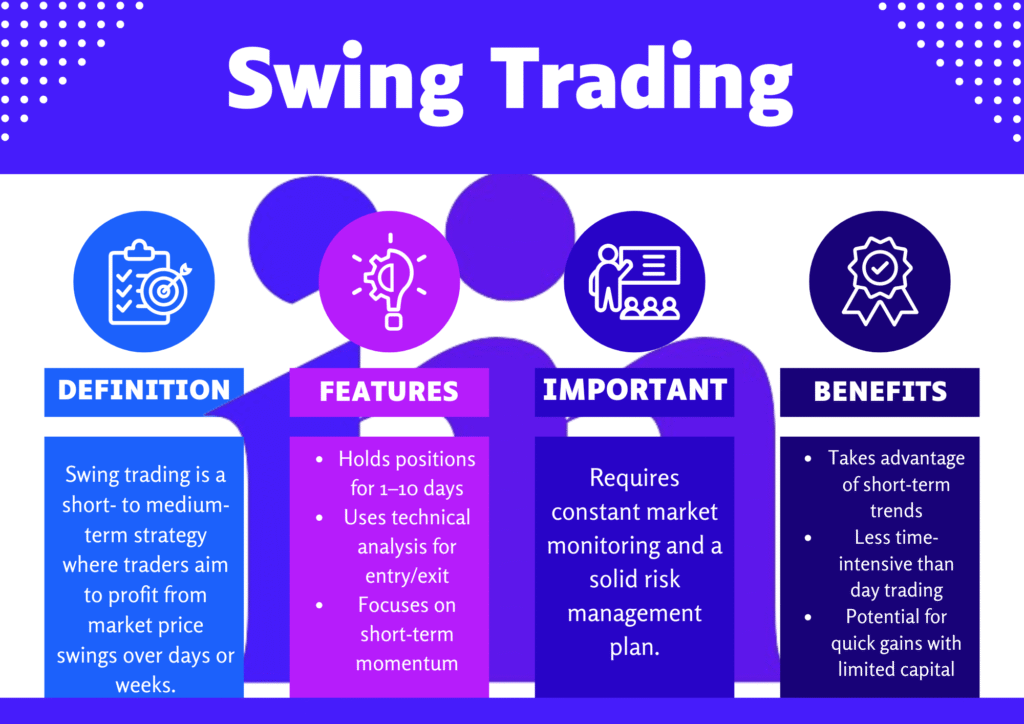

Swing Trading is a trading strategy designed to profit from short to medium-term price swings within a financial asset. The objective is to benefit from “swings” in price by timing entries and exits at advantageous points. Unlike long-term investing, where assets are held for months or years, swing traders usually maintain positions for days or weeks. These traders depend on technical indicators, market trends, and chart patterns to anticipate future price movements.

Swing trading isn’t a shortcut to overnight success. It requires time, patience, and practice. Many traders make the mistake of treating it like day trading, jumping in and out without a plan. Successful swing traders stick to a tested strategy, keep emotions in check, and adapt based on market conditions.

A swing trader identifies a potential price movement, takes a position near the start of the move, and exits before the trend reverses. Timing is crucial success hinges on entering trades when a price is expected to rise or fall and exiting at a predefined target level.

How Swing Trading Works

Understanding the mechanics of Swing Trading is vital for anyone considering this approach. Key components include technical analysis, chart interpretation, risk management, and trend identification.

1. Identifying Trends

Swing traders analyze price patterns to forecast future movement direction. They use tools such as moving averages, support and resistance levels, and trendlines to detect and confirm trends. The goal is to enter trades early in a new price movement whether upward or downward before the trend peaks or bottoms out.

2. Technical Analysis

Most swing traders depend heavily on technical analysis to evaluate price action and identify favorable trade setups. This includes examining historical price data, chart formations, and indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands. These tools help traders anticipate potential reversals or trend continuations.

When I first started swing trading, I underestimated how much patience matters. I used to jump in and out too quickly, fearing I’d miss out or lose gains. Over time, I learned that waiting for confirmation and letting trades develop over days—not minutes—was where the real edge came in. The discipline to stick to your strategy and not react emotionally is what separates consistent swing traders from impulsive ones.

3. Entry and Exit Points

At the core of Swing Trading is determining optimal entry and exit points. Traders typically enter a position after identifying a pullback or consolidation phase, anticipating a favorable price move. Exit strategies are just as important positions are closed when a price target is hit or when indicators suggest a trend is reversing.

4. Risk Management

Effective risk management is essential to minimize potential losses. Traders commonly use stop-loss orders, which automatically exit trades if the price moves unfavorably beyond a set level. Likewise, take-profit orders are used to lock in gains once a predetermined profit target is reached.

Always backtest your swing trading strategy before going live. Use at least 6–12 months of historical data to see how your strategy performs in different market conditions trending, consolidating, or volatile. This gives you the confidence to stick with your plan when real money is on the line.

Types of Swing Trading

Different Swing Trading strategies exist, each with its unique approach to the market. Knowing these methods can help traders choose the best fit for their style.

1. Trend Following

This strategy involves identifying a strong, established market trend and entering trades that align with the direction of the trend. Traders remain in the position as long as the trend holds, exiting when signs of reversal appear. This strategy is most effective in markets that demonstrate consistent directional momentum.

2. Counter-Trend Trading

Counter-trend traders seek to profit from short-term reversals in overbought or oversold markets. They enter trades opposite to the prevailing trend, expecting a temporary price correction. For instance, they may short an asset during an extended uptrend, anticipating a pullback. While potentially profitable, this strategy carries higher risk due to trading against the trend.

3. Breakout Trading

Breakout traders focus on entering positions when prices move beyond established support or resistance levels. A breakout from a price consolidation range often marks the beginning of a new directional trend. Swing traders using this method enter trades immediately after the breakout and ride the momentum.

4. Mean Reversion

Mean reversion trading is based on the idea that prices tend to return to their historical average after significant deviations. If a stock is significantly overbought or oversold, mean reversion traders expect a return to a more typical price range. This method is particularly useful in range-bound or sideways markets.

According to a study by the North American Securities Administrators Association (NASAA), over 70% of new traders lose money in their first year due to lack of risk management and discipline two areas swing trading can help improve when practiced properly.

Benefits of Swing Trading

Swing Trading offers multiple advantages, making it attractive for both beginner and experienced traders.

1. Flexibility

Unlike day trading, which demands constant market monitoring, swing trading allows for more flexibility and less screen time. Because trades last several days or weeks, it’s easier to balance trading with other personal or professional commitments.

2. Profit Potential

By capitalizing on short- to medium-term price moves, Swing Trading can generate significant returns. Traders can profit more quickly than long-term investors, without waiting months or years for gains.

3. Lower Stress

Swing traders are also not under pressure to act instantly, which reduces emotional decision-making and trading fatigue. This slower pace allows for more deliberate analysis and decision-making, reducing emotional stress.

4. Lower Capital Requirements

Since trades are less frequent and held longer, Swing Trading typically requires less capital than high-frequency day trading. Trading fees and commissions are also reduced due to fewer transactions.

During the market turbulence caused by the COVID-19 outbreak in March 2020, price volatility reached extreme levels across global markets. A swing trader who noticed the V-shaped recovery pattern in tech stocks could have entered trades during pullbacks in companies like Apple or Amazon and held them for 1–2 weeks for substantial returns without needing to be glued to the screen all day.

Pros and Cons of Swing Trading

| Pros | Cons |

|---|---|

| ✔ Possibility for significant gains by capturing price swings over the short to mid term. | ✘ Risk of significant losses if market moves unfavorably. |

| ✔ Less time-intensive than day trading; allows more freedom. | ✘ Developing strong technical analysis capabilities is essential something beginners may find challenging at first. |

| ✔ Opportunity to trade across various markets (stocks, forex, crypto). | ✘ Holding trades overnight introduces gap risk due to market-moving events outside regular trading hours. |

| ✔ Lower capital needed compared to day trading. | ✘ Less effective in highly volatile or unclear market conditions. |

Holding positions overnight exposes you to gap risk when price opens significantly higher or lower due to after-hours news. This can trigger large, unexpected losses. Always set stop-loss orders and consider reducing exposure before major earnings or economic announcements.

Conclusion

In summary, Swing Trading is a flexible and potentially lucrative trading strategy well-suited for traders looking to profit from short to medium-term price movements. By understanding how it works, mastering its key strategies, and managing associated risks, traders can build a solid foundation for success. When combined with effective technical analysis and sound risk management practices, Swing Trading can be a powerful approach in today’s dynamic financial markets.