Last updated: Table of Contents Diversification is the foundational principle of not putting all your eggs in...

Portfolio Management

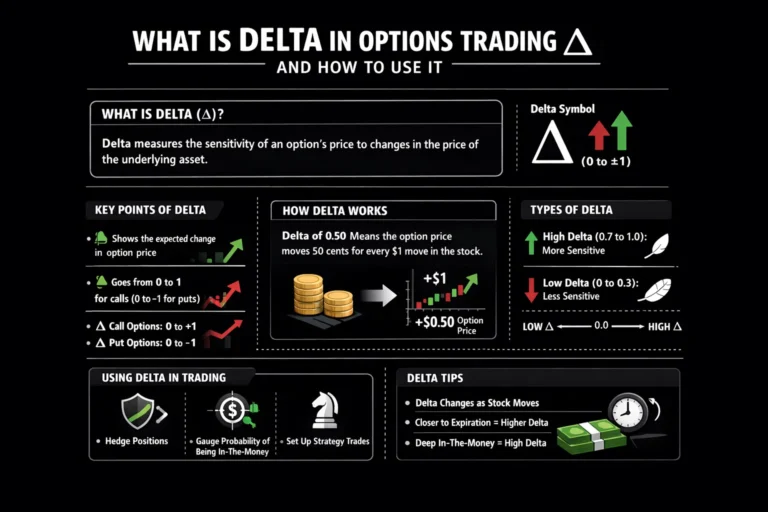

Delta is the indispensable compass for navigating options markets, quantifying both the directional risk of a single...

Index funds are a powerful, low-cost investment vehicle that allows individuals to own a small piece of...

The Consumer Price Index (CPI) is the cornerstone metric for tracking inflation, measuring the average price change...

Cyclical stocks are equities whose performance is intrinsically linked to the broader economic cycle, offering high-reward, high-risk...

Correlation is a fundamental statistical tool in finance that measures how two assets move in relation to...

Market capitalization is a fundamental financial metric that serves as the market's price tag for a public...

Capital gains and losses represent the fundamental profit or loss from selling an investment. This concept is...

A bull market is a powerful and sustained period of rising asset prices, driven by economic strength...

Beta is a foundational financial metric that quantifies a stock's sensitivity to overall market movements, serving as...

A bear market, marked by a sustained 20%+ decline in stock prices, is a challenging but inevitable...

A liquid stock is the one that can be bought or sold easily without major price impact,...