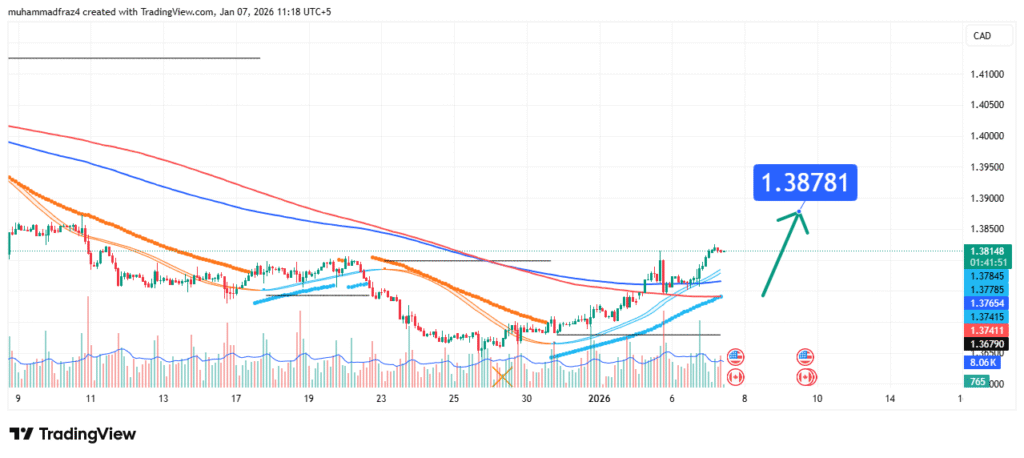

USDCAD Price Forecast Eyeing a Rally to 1.38781

USD/CAD

Current Market Structure and Price Action

The current market structure is bullish, characterized by a series of higher highs and higher lows. The price is currently interacting with the immediate support and consolidation zone near 1.38148. Recent price action shows a period of tight range compression, indicating a coiling of energy that typically precedes a directional breakout. The proximity to recent highs suggests a bullish breakout towards the 1.39000 area may be imminent.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone between 1.37785 and 1.38148. The strength of this zone is derived from:

- Historical Significance: This zone previously acted as resistance and has now been converted into support, a classic bullish behavior. The level near 1.37855–1.38148 has seen multiple touches.

- Technical Confluence: The area aligns with the recent breakout point and the latest swing low, creating a cluster of technical importance.

- Market Psychology: This area represents a point where previous sellers (at resistance) have been overcome. A successful hold here would reinforce bullish sentiment and attract new buyers for the next leg up.

This confluence makes it a high-probability level for a bullish continuation.

Technical Targets and Rationale

Our analysis identifies the following price targets:

Primary Target (PT1): 1.38781

This level represents the next significant technical hurdle and a logical extension from the current consolidation range. It acts as an intermediate step towards the larger psychological resistance at 1.39000 and 1.39500.

Secondary Target (PT2): 1.39500

This is a more ambitious target, representing a stronger historical and psychological resistance zone. A decisive break above 1.39000 would open the path toward this level.

Prediction: We forecast that the price will hold above the key support zone, break above immediate resistance near 1.38500, and move towards PT1 at 1.38781, with potential for an extension to PT2.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close below 1.37415. This level represents a clear break below the recent higher low structure and the key support confluence, signaling a failure of the bullish continuation pattern.

- Position Sizing: Any positions taken should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Oil Price Correlation: As a key oil exporter, CAD is sensitive to crude oil prices (WTI). A stable or weaker oil price environment is typically supportive for USD/CAD.

- Central Bank Divergence: The monetary policy outlook between the Federal Reserve and the Bank of Canada is a primary driver. Hawkish Fed rhetoric or dovish BoC shifts would be bullish for the pair.

- Economic Data: Key releases include US and Canadian inflation, employment data, and GDP figures, which can cause volatility and validate the technical direction.

These factors currently contribute to a neutral-to-bullish sentiment for USD/CAD, supportive of a technical breakout.

Conclusion

USD/CAD is in a bullish consolidation phase at a critical support zone. The weight of evidence suggests a bullish resolution, targeting a move first to 1.38781 and potentially towards 1.39500. Traders should monitor for a confirmed breakout above 1.38500 and manage risk diligently by respecting the key invalidation level at 1.37415. The reaction at the initial target will be key for assessing the strength of the uptrend.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.