USDJPY Price Analysis Bullish Momentum Targeting 150.98

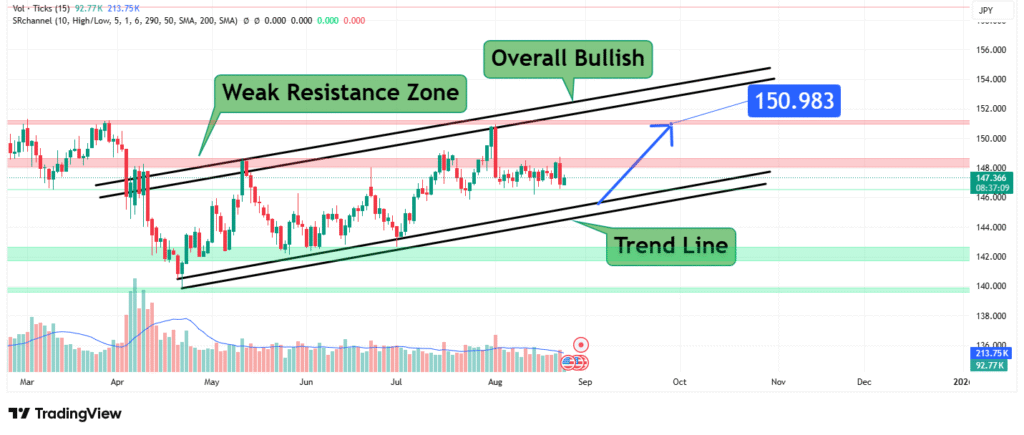

The USD/JPY pair continues to demonstrate a strong bullish bias, with price action respecting a well-defined ascending channel. Technical indicators and price structure suggest that buyers remain in control, with a potential upside target near 150.98 in the coming weeks.

Current Market Structure

The chart illustrates that USD/JPY has been consolidating within a rising parallel channel since May, consistently finding support at the lower trend line and facing supply pressure near the upper resistance boundary. Despite short-term fluctuations, the overall trajectory remains bullish.

- Trend Line Support: The ascending lower boundary of the channel has acted as a reliable support level, with buyers stepping in each time the price approached this zone.

- Resistance Zone: A weak resistance area is identified near 148.00–149.00. While sellers have temporarily capped upside momentum here, the lack of strong rejection signals suggests limited selling pressure.

- Volume Activity: Trading volume shows a gradual decline during the consolidation phase, typically a sign of accumulation before a potential breakout continuation.

Technical Outlook

- Overall Trend: The long-term trend is bullish, supported by higher highs and higher lows within the channel.

- Key Levels to Watch:

- Immediate Support: Around 146.50–147.00, aligned with the trend line.

- Resistance Zone: 148.50–149.00 remains the short-term hurdle.

- Target Level: A bullish breakout points toward 150.98, the projected upper channel resistance.

- Momentum Indicators: While not displayed in the chart, RSI and MACD (on higher timeframes) are likely showing continued bullish momentum, given the structure.

Fundamental Context

Beyond technicals, USD/JPY’s strength is supported by broader macroeconomic dynamics:

- U.S. Dollar Strength: The Federal Reserve’s hawkish stance and resilient U.S. economic data continue to support dollar demand.

- Japanese Yen Weakness: The Bank of Japan’s ultra-loose monetary policy and yield curve control measures weigh heavily on the yen.

- Risk Sentiment: Periods of global uncertainty often trigger safe-haven yen flows, but recent risk-on sentiment has favored the dollar.

Together, these fundamentals align with the bullish technical structure, reinforcing the case for continued upward momentum.

Price Prediction: 150.98 in Focus

Based on both technical and macroeconomic factors, the next major upside target is 150.98. This aligns with the projected resistance of the ascending channel and psychological round-number resistance at 151.00.

Should the price maintain support above 146.50, the bullish case remains intact. A clean breakout above 149.00 would further validate the path toward the 150.98 target.

Risk Considerations

- Trendline Break: A sustained move below 146.50 would weaken the bullish setup and potentially open downside risk toward 144.00.

- BOJ Intervention: The Bank of Japan has historically intervened when yen weakness becomes excessive. Traders should remain cautious around 150–152, a zone that has previously attracted intervention risk.

- U.S. Economic Data: Surprising shifts in inflation, jobs, or Fed policy rhetoric could trigger volatility in USD/JPY.

Conclusion

The USD/JPY pair remains firmly bullish within its ascending channel, with technicals and fundamentals aligning for further upside. While short-term resistance around 148.50–149.00 may cap immediate gains, the broader structure supports a rally toward 150.98.

Traders should watch the trendline support closely for signs of continuation, while remaining mindful of intervention risks as the pair approaches the 151.00 psychological level.

Chart Source: TradingView

Disclaimer: This analysis is based on technical patterns and is for informational purposes only. It does not constitute financial advice. Trading precious metals involves significant risk, and you should conduct your own research before making any investment decisions.

How did this post make you feel?

Thanks for your reaction!