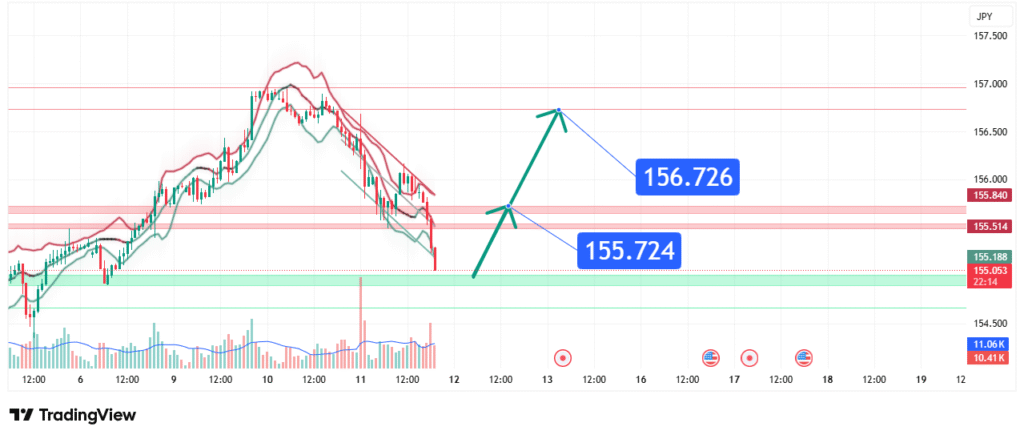

USDJPY Price Forecast Correction Towards Support at 155.7 in Sight

USD/JPY’s price has experienced a significant bullish rally but is now facing strong rejection and showing momentum divergence near the 157.00 area. This price action suggests a bearish corrective bias is forming for a short-term pullback within the broader uptrend. Our analysis projects a move down towards key support targets at 155.7 and 156.7. This prediction is based on a confluence of technical factors, including a potential double-top formation, bearish divergence on oscillators, and a retest of a major resistance zone.

Current Market Structure and Price Action

The long-term market structure remains bullish. However, on the shorter-term 4-hour chart, the structure is showing signs of buyer exhaustion and potential reversal. The price has failed to break convincingly above the 157.00 level on multiple attempts, creating a potential double-top pattern. The price is currently trading below a newly formed resistance trendline and is threatening to break below immediate support. Recent price action has shown bearish engulfing patterns and long upper wicks near the highs, indicating that sellers are actively capping the rally and a downward correction is increasingly probable.

Identification of the Key Resistance Zone

The most critical technical element is the Strong Resistance Zone between 156.7 and 157.0. The strength of this zone is derived from:

- Historical Significance: This area represents the recent multi-week highs where price has been rejected multiple times, forming a clear ceiling.

- Technical Confluence: The zone aligns with a major psychological level (157.00) and the upper bounds of the recent bullish channel. The chart shows clear sell-volume spikes in this region.

- Market Psychology: This level acts as a major profit-taking zone for longs who entered the trade at lower levels. The inability to break higher leads to frustration and long liquidation, fueling a correction.

This confluence makes it a high-probability zone for initiating a bearish move.

Technical Targets and Rationale

Our analysis identifies the following support targets for the anticipated pullback:

Primary Target (PT1): 155.7

This level represents the most recent significant swing low and a previous resistance-turn-support zone. It is a logical first destination for a standard 50% Fibonacci retracement of the latest upswing and a common area for buyers to re-enter.

Secondary Target (PT2): 156.7

This is the initial and more conservative target, representing a key support level from the chart and the 38.2% Fibonacci retracement level. It’s a likely area for the initial bounce or consolidation during the correction.

Prediction: We forecast that the price will reject from the 156.7-157.0 resistance zone and move down, first testing the immediate support at PT2: 156.7, before extending the correction towards the stronger support at PT1: 155.7.

Risk Management Considerations

This is a counter-trend correction play within a larger uptrend, necessitating precise risk management.

- Invalidation Level (Stop-Loss): The entire bearish correction thesis is invalidated if the price achieves a 4-hour close above 157.30. This level is above the recent double-top highs and would signify a bullish breakout, negating the corrective setup and likely leading to a continuation of the rally.

- Position Sizing: Any short positions taken should be sized conservatively, understanding this is a pullback trade within a trend. A loss should represent a small, pre-defined percentage of capital (e.g., 1-1.5%).

Fundamental Backdrop

The technical setup is framed by high-impact fundamental forces:

- Interest Rate Divergence: The core driver remains the wide yield gap between hawkish Federal Reserve policy and the ultra-dovish Bank of Japan (BoJ). Any hints of a BoJ policy shift or a dovish Fed tilt could accelerate the predicted correction.

- Japanese Intervention Risks: The Ministry of Finance (MoF) has a history of intervening to weaken the JPY around these multi-decade highs. The threat of intervention acts as a constant cap on USD/JPY rallies and supports corrective scenarios.

- US Economic Data: Strong US data supports the bullish trend, while weak data could be the catalyst for the profit-taking and correction we are anticipating.

Conclusion

USD/JPY is at a technical resistance zone where bullish momentum has stalled. The weight of evidence suggests a bearish corrective move is due, targeting a pullback first to 156.7 and then towards 155.7. Traders should monitor for a break below the immediate support near 155.50 as confirmation. This is a correction within an uptrend, not a trend reversal. Manage risk diligently by respecting the key invalidation level at 157.30. The reaction at the 155.7 target will be crucial for determining the next major directional move.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Forex trading involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.