What Are Corporate Bonds and How Do They Work

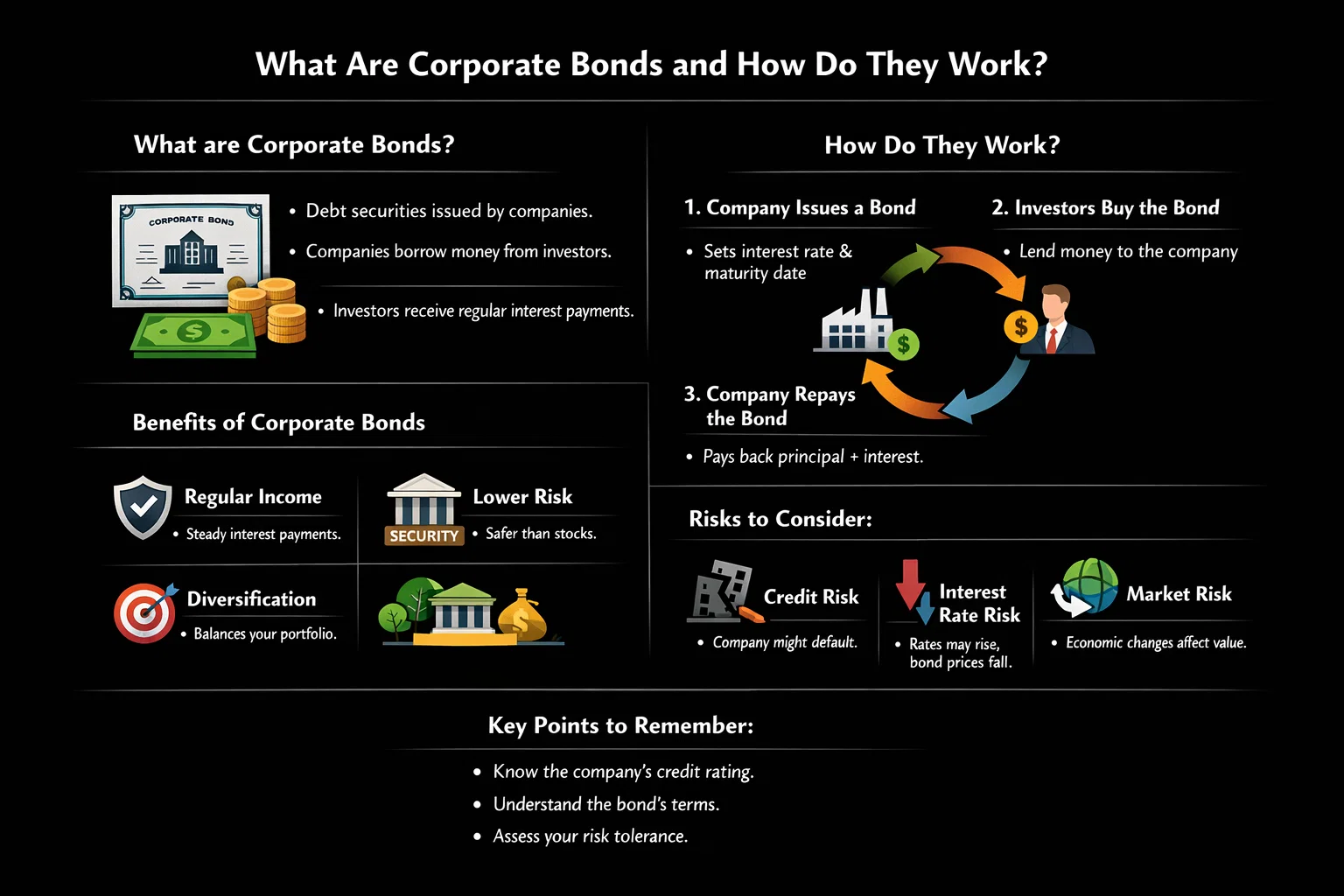

Corporate bonds are debt securities issued by companies to raise capital for growth, acquisitions, or operations. They offer investors a predictable income stream and are a core component of a diversified portfolio. For investors in the US, UK, Canada, and Australia, corporate bonds listed on major exchanges like the NYSE or LSE provide a critical avenue for income generation and capital preservation beyond government securities.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A corporate bond is a debt obligation issued by a company to raise capital, in which the issuer promises to pay the bondholder interest and return the principal on a specified maturity date. |

| Also Known As | Corp Bonds, Investment-Grade Bonds, High-Yield Bonds, Junk Bonds |

| Main Used In | Fixed Income Investing, Portfolio Diversification, Income Generation |

| Key Takeaway | They provide regular income and are generally less risky than stocks but carry more risk and offer higher yields than government bonds, with credit quality being the primary risk factor. |

| Formula | N/A (Price = Σ [Coupon / (1 + Yield)^t] + [Face Value / (1 + Yield)^n]) |

| Related Concepts |

What are Corporate Bonds

Think of a corporate bond as an “IOU” from a company directly to you, the investor. Instead of going to a bank for a loan, a large corporation like Apple or Ford can raise billions by breaking that loan into thousands of smaller pieces; bonds and selling them to the public on the debt capital market. In exchange for your capital, the company contracts to pay you regular interest (the coupon) and return your full principal on a specific future date (the maturity date). This makes you a creditor of the company, not an owner (shareholder).

The Core Concept Explained

At its core, a corporate bond represents a trade-off between risk and return. The key metric is the yield, which is the annual return an investor can expect if the bond is held to maturity. This yield is primarily determined by two factors: 1) Interest Rates: When prevailing rates (like the US Federal Funds Rate) rise, existing bond prices typically fall, and vice versa. 2) Credit Risk: The financial health of the issuing company, as assessed by rating agencies (S&P, Moody’s, Fitch). A lower credit rating (e.g., BBB- vs. AA) means higher risk of default, so the company must offer a higher yield to attract buyers. This spectrum creates the market segmentation between investment-grade bonds (lower risk, lower yield) and high-yield bonds (higher risk, higher yield).

Key Takeaways

How are Corporate Bonds Priced and Valued

While there’s no single “formula” for a bond, its price in the secondary market is determined by discounting all its future cash flows (coupon payments and principal) back to their present value. The discount rate used is the prevailing market yield for bonds with similar risk and maturity.

Key Calculation Metrics

- Coupon Rate: The annual interest rate stated on the bond. A $1,000 bond with a 5% coupon pays $50 per year.

- Current Yield: (Annual Coupon Payment / Current Market Price). If the above bond trades at $900, its Current Yield is $50/$900 ≈ 5.56%.

- Yield to Maturity (YTM): The most important measure. It’s the total annual return anticipated if the bond is held until it matures, factoring in its current market price, par value, coupon interest, and time to maturity. It’s calculated using a complex present value formula, best done with a financial calculator or software.

Example Calculation:

Consider a US corporate bond from a company like 3M, listed on the NYSE.

- Face Value: $1,000

- Coupon Rate: 4% (Pays $40 annually, or $20 every 6 months)

- Years to Maturity: 10 years

- Market Price: $950 (The bond is trading at a discount)

Yield to Maturity (YTM) Approximation:

Using a simplified method: YTM ≈ [Coupon + (Face Value – Price)/Years] / [(Face Value + Price)/2]

YTM ≈ [$40 + ($1,000 – $950)/10] / [($1,000 + $950)/2] = [$40 + $5] / [$975] = 4.62%

Interpretation: The YTM of 4.62% is higher than the 4% coupon rate because the investor bought the bond at a discount. This represents the annualized total return, including both the interest payments and the $50 capital gain when the bond matures at $1,000.

Why Corporate Bonds Matter to Traders and Investors

- For Income Investors & Retirees: They are a cornerstone for generating reliable, periodic income. In a low-interest-rate environment, even investment-grade corporate bonds from blue-chip companies often offer better yields than government bonds or savings accounts.

- For Portfolio Managers: They are essential for asset allocation and risk management. Adding bonds to an equity-heavy portfolio can smooth out returns and reduce drawdowns during market corrections. High-yield bonds can offer equity-like returns with different risk drivers.

- For Traders: Bonds trade in active secondary markets. Traders can profit from price movements driven by changes in interest rates (e.g., Fed policy), credit spreads (the yield difference over Treasuries), or company-specific news. Exchange-Traded Funds (ETFs) like HYG (High Yield Corporate Bond ETF) offer liquid exposure.

- For Economic Analysts: The corporate bond market is a vital economic indicator. Widening credit spreads often signal rising fear and potential economic stress, while narrowing spreads indicate confidence.

How to Use Corporate Bonds in Your Investment Strategy

Use Case 1: Building a Conservative Income Ladder

- Action: Purchase a series of investment-grade bonds (from companies like Johnson & Johnson or Microsoft) with staggered maturity dates (e.g., 1, 3, 5, 7 years). As each bond matures, you receive principal back to reinvest, reducing interest rate risk.

- Why it works: It provides predictable cash flow and capital preservation for near-term financial goals.

Use Case 2: Strategic Diversification with High-Yield

- Action: Allocate a small portion (e.g., 5-10%) of your portfolio to a diversified high-yield bond ETF like JNK or a actively managed mutual fund.

- Why it works: This “satellite” position can enhance overall portfolio yield. The diversification across many issuers mitigates the default risk of any single company. For insights on selecting the right fund platform, consider researching the best online brokers for fixed income trading.

Use Case 3: Trading the Credit Cycle

- Action: During economic recoveries, when default risks are falling but yields are still attractive, an investor might increase exposure to BBB-rated bonds (the lowest investment-grade tier). Conversely, during late-cycle expansions, they might shift to higher-quality AA or A-rated bonds.

- Why it works: This active approach aims to capture capital appreciation from narrowing credit spreads while managing downgrade risk.

Advanced Strategy: Building a Corporate Bond Ladder

A bond ladder is a powerful technique to manage interest rate risk and create a steady income stream.

- How it Works: Instead of buying one bond with a 10-year maturity, you buy ten bonds, each maturing in one of the next ten years. For example, allocate capital to bonds from solid US companies like Procter & Gamble (PG) maturing in 2025, Intel (INTC) in 2026, and so on.

- The Benefit: Each year, one bond matures, giving you a chunk of principal back. You can then reinvest that cash in a new bond at the long end of the ladder (e.g., a new 10-year bond). This averages out your exposure to interest rate fluctuations and provides ongoing liquidity.

- Implementation Tip: For retail investors, building a ladder with individual bonds can be capital-intensive and complex. Consider using a suite of corporate bond ETFs with different maturities (e.g., SHYG for short-term high yield, VCIT for intermediate-term corporate) to simulate a ladder more efficiently.

- Higher Yield: Offer better income than government securities like Treasuries or Gilts.

- Predictable Income: Fixed coupon payments aid in financial planning and budgeting.

- Seniority & Safety: Bondholders are prioritized over shareholders in bankruptcy proceedings.

- Diversification: Low correlation with stocks helps reduce overall portfolio volatility.

- Accessibility: Easily purchased through ETFs, mutual funds, or brokerages.

- Default Risk: The issuer may fail to pay, especially with lower-rated “junk” bonds.

- Interest Rate Risk: Rising market rates cause the price of existing bonds to fall.

- Liquidity Risk: Some bonds can be difficult to sell quickly without a price cut.

- Call Risk: Issuers may redeem bonds early, cutting off your income stream.

- Inflation Risk: Fixed payments lose purchasing power if inflation surges.

Corporate Bonds in the Real World: The Fall and Rise of Ford (2008-2012)

The Global Financial Crisis provides a stark case study in corporate bond risk and opportunity. In 2008, Ford Motor Company (F), facing a brutal auto market downturn and liquidity crunch, saw its bonds downgraded deeply into “junk” status. Its 7.45% bonds due in 2031 plunged to as low as 30 cents on the dollar in late 2008, implying a massive yield and a high probability of default.

Investors who believed in Ford’s long-term survival and its ability to avoid a government bailout (unlike GM and Chrysler) had a tremendous opportunity. Ford aggressively restructured, and as its prospects improved, so did its bond prices. By 2012, those same bonds were trading near par value ($100). Investors who bought at the lows not only locked in a huge yield but also realized massive capital gains—a classic “credit recovery” play in the high-yield bond market.

The Impact of Macroeconomic Cycles on Corporate Bonds

Your corporate bond strategy should adapt to the broader economic environment.

- Early Cycle/Recovery: After a recession, companies’ earnings improve, default risks fall, and credit spreads narrow. This is an ideal time for taking on moderate credit risk (BBB-rated bonds) to capture yield and potential price appreciation.

- Late Cycle/Expansion: The economy is hot, interest rates may be rising from central bank action. Focus on higher-quality issuers (A or AA-rated) and shorter-duration bonds to mitigate interest rate and potential downgrade risk.

- Recession: Defaults rise, and credit spreads widen dramatically. This is a high-risk period for corporate bonds, especially high-yield. Investors should prioritize quality and liquidity, holding government bonds or cash, though it can present buying opportunities for brave, long-term capital.

- Tracking This: Follow indicators like the US Treasury yield curve, the ICE BofA High Yield Index Option-Adjusted Spread, and comments from the Federal Reserve for clues on the cycle’s phase.

Corporate Bonds vs Government Bonds

| Feature | Corporate Bonds | Government Bonds (e.g., US Treasuries) |

|---|---|---|

| Issuer | Private Corporations (e.g., Apple, Coca-Cola) | National Governments (e.g., US Treasury, UK Gilts) |

| Primary Risk | Credit/Default Risk (Issuer’s financial health) | Interest Rate Risk (Virtually no default risk) |

| Tax Treatment | Taxable (Interest subject to income tax) | Federal Taxable, State Tax-Exempt (US) |

| Typical Yield | Higher (Compensation for credit risk) | Lower (Considered “risk-free” benchmark) |

| Primary Use | Portfolio Yield, Diversification | Capital Preservation, Safe Haven |

Conclusion

Ultimately, corporate bonds are a versatile tool that can serve multiple roles: as an income engine, a portfolio stabilizer, or a tactical asset for capturing credit market opportunities. While they offer a safer claim on a company’s assets than stocks, they are not risk-free, as interest rate fluctuations and issuer creditworthiness are constant considerations. By understanding the spectrum from investment-grade to high-yield, and by using funds for diversification or ladders for income management, you can effectively incorporate them into a balanced financial strategy. To begin, analyze your income needs and risk tolerance, then explore bond ETFs or consult a fixed-income screener on your brokerage platform.

Ready to build a resilient income portfolio? The right brokerage account is essential for accessing the corporate bond market. We’ve reviewed the best online brokers for bond investors to help you find one with robust research tools, low fees, and a wide selection of fixed-income products.

Related Terms

- Yield to Maturity (YTM): The total expected return if the bond is held to maturity.

- Credit Spread: The yield difference between a corporate bond and a comparable government bond, reflecting perceived credit risk.

- Bond Duration: A measure of a bond’s sensitivity to interest rate changes. Essential for managing interest rate risk.

- Secured vs. Unsecured Bonds: Secured bonds are backed by specific collateral, while unsecured (debentures) are not.

- Callable Bonds: Bonds that the issuer can redeem before maturity, a feature that disadvantages bondholders when rates fall.

Frequently Asked Questions About Corporate Bonds

Recommended Resources

- For In-Depth Learning: The U.S. Securities and Exchange Commission (SEC)‘s Office of Investor Education provides excellent materials on bonds. Read their guide on Corporate Bonds for authoritative, unbiased information.

- For Credit Research: Access the free public sections of rating agency websites like Moody’s Investors Service or S&P Global Ratings to understand their methodology and read sample credit reports.

- For Market Data & News: Reputable financial news sites like The Financial Times and Bloomberg offer deep coverage of credit markets and interest rate trends.

- For Academic Foundation: Explore concepts like duration and yield calculation in more detail on educational platforms like Khan Academy’s Fixed Income section.