What Are Government Bonds, How They Work, Why You Need Them

Government bonds are debt securities issued by national governments to finance public spending, infrastructure projects, and manage national debt. They are considered one of the safest investment vehicles in the world, offering a predictable income stream with capital preservation. For investors in the US, UK, Canada, and Australia, Treasury bonds, Gilts, and Government Bonds are foundational assets for building a resilient, low-risk portfolio core, providing a counterbalance to volatile equity markets.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A debt security issued by a national government to borrow money from investors, promising periodic interest payments and full repayment of the principal at maturity. |

| Also Known As | Sovereign Bonds, Treasuries (US), Gilts (UK), Bunds (Germany), JGBs (Japan) |

| Main Used In | Fixed-Income Investing, Portfolio Diversification, Risk Management, Capital Preservation |

| Key Takeaway | They represent a high-credit-quality, low-risk asset class crucial for capital preservation and hedging against economic uncertainty, though they carry interest rate and inflation risks. |

| Formula | Price = ∑ (Coupon Payment / (1 + Yield)^t) + (Face Value / (1 + Yield)^n) |

| Related Concepts |

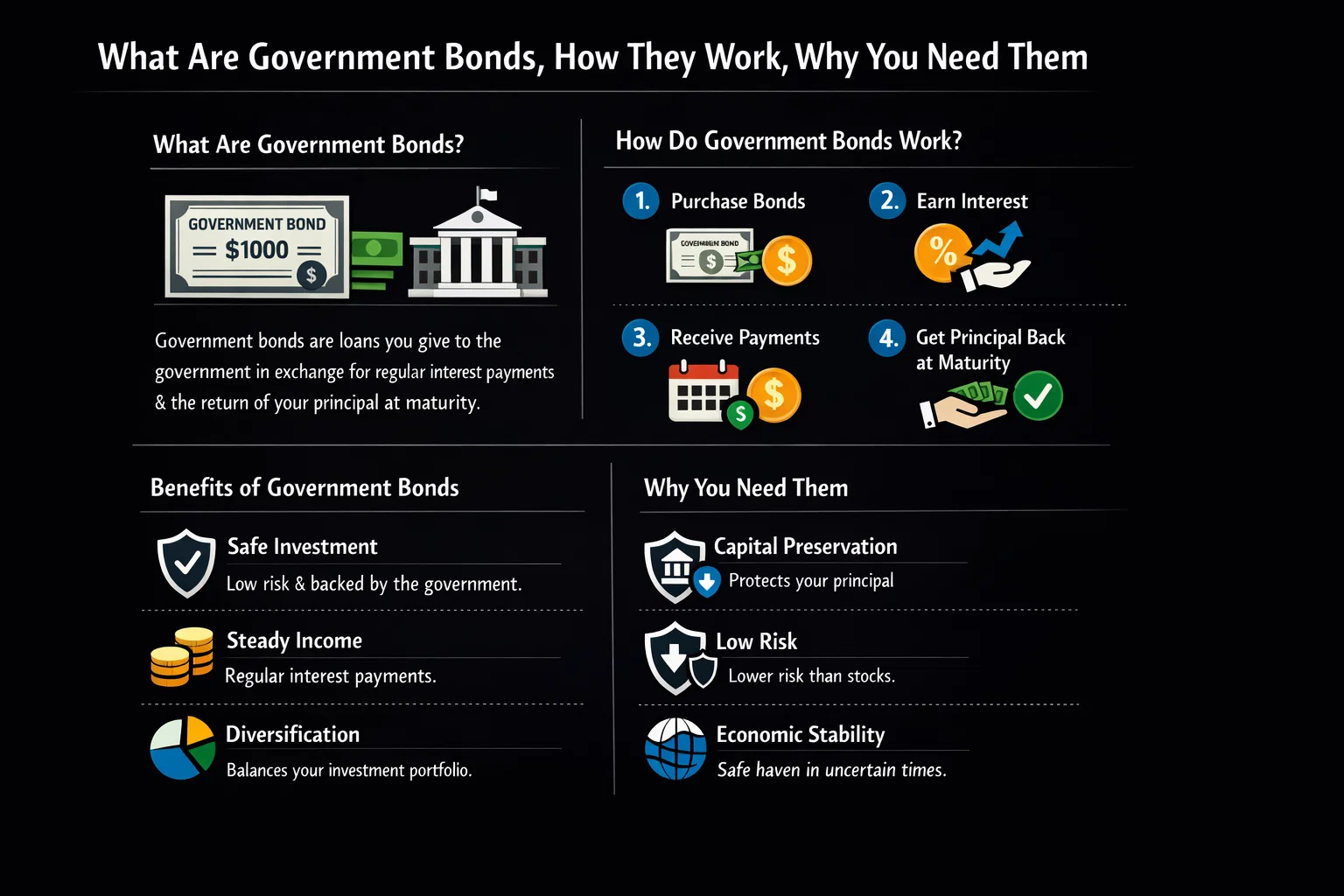

What are Government Bonds

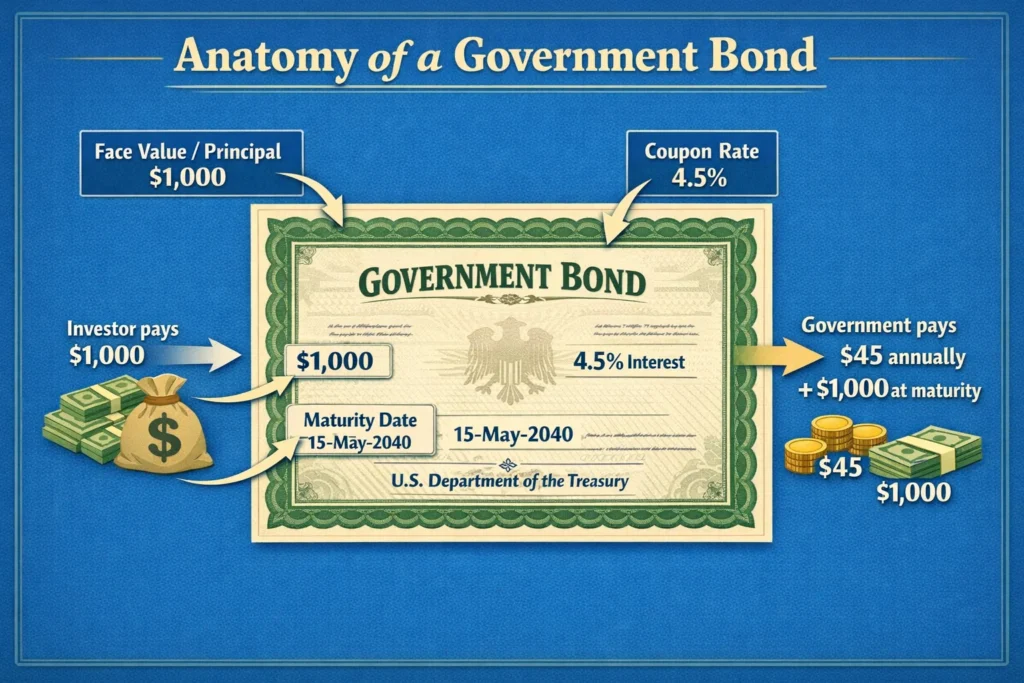

A government bond is essentially a loan you make to a country’s government. In exchange for your capital, the government promises to pay you a fixed rate of interest (the coupon) at regular intervals and to return the full amount you lent (the principal or face value) on a specified future date (the maturity date). They are primary instruments of public debt management and a bedrock of the global financial system. Think of it as giving a highly reliable institution a long-term IOU; they use the funds for building roads, funding schools, or managing national budgets, and they commit their full faith and credit to paying you back.

Key Takeaways

The Core Concept Explained

At its core, a government bond is a contract that defines a future stream of cash flows. The yield is the effective rate of return an investor earns, and it fluctuates based on the bond’s price in the secondary market. A key metric is Yield to Maturity (YTM), which is the total return anticipated if the bond is held until it matures, accounting for its current market price, par value, coupon interest, and time to maturity.

When the Federal Reserve or other central banks raise benchmark interest rates to combat inflation, newly issued bonds come with higher coupons. This makes older bonds with lower coupons less attractive, so their market prices drop to increase their YTM to competitive levels. Conversely, in a rate-cutting environment, existing bonds with locked-in higher coupons become more valuable, pushing their prices up. This interest rate sensitivity is measured by duration—a higher duration means greater price volatility when interest rates change.

How to Calculate Bond Price and Yield

While you don’t “calculate” a bond in the same way as a ratio, understanding its pricing and yield is critical. The price of a bond is the present value of all its future cash flows (coupon payments and principal repayment), discounted at the prevailing market interest rate (yield).

The fundamental bond pricing formula is:

Bond Price = ∑ [C / (1+r)^t] + [F / (1+r)^n]

Where:

- C = Coupon payment per period

- r = Yield per period (market interest rate)

- t = Time period for each coupon

- F = Face value of the bond

- n = Total number of periods to maturity

Step-by-Step Calculation Guide

Let’s walk through a real-world example with a US Treasury Note.

Example: A 5-year US Treasury Note with a face value of $1,000, an annual coupon rate of 3%, and a current market yield (YTM) of 4%.

- Identify Variables:

- Face Value (F) = $1,000

- Annual Coupon (C) = 3% of $1,000 = $30

- Yield (r) = 4% or 0.04

- Years to Maturity (n) = 5

- Calculate Present Value of Coupons: Discount each of the 5 annual $30 payments.

- Year 1: $30 / (1.04)^1 = $28.85

- Year 2: $30 / (1.04)^2 = $27.74

- Year 3: $30 / (1.04)^3 = $26.67

- Year 4: $30 / (1.04)^4 = $25.64

- Year 5: $30 / (1.04)^5 = $24.66

- Total PV of Coupons = $133.56

- Calculate Present Value of Principal:

- $1,000 / (1.04)^5 = $821.93

- Calculate Bond Price:

- Price = $133.56 + $821.93 = $955.49

Interpretation: Because the market yield (4%) is higher than the bond’s coupon rate (3%), the bond must trade at a discount ($955.49) to its $1,000 face value to be attractive to investors. This discount effectively boosts the investor’s return to the required 4% YTM.

Why Government Bonds Matter to Traders and Investors

Government bonds are not just for the conservative saver; they are a dynamic tool for various market participants.

- For Long-Term Investors & Retirees: They are the cornerstone of capital preservation. Income-focused investors, like those in the US building a retirement “bond ladder,” rely on Treasuries for predictable cash flow. They provide ballast in a portfolio, typically rising when riskier assets like stocks fall.

- For Active Traders: The bond market offers opportunities through price speculation. Traders might take positions based on interest rate forecasts from the Federal Reserve or the Bank of England. They also trade the yield curve—the relationship between bonds of different maturities—which is a key economic indicator.

- For Institutional Analysts & Economists: Sovereign bond yields are a vital barometer of a country’s economic health and inflation expectations. A sharply rising yield on long-term bonds can signal market concern about fiscal policy or future inflation. Analysts at firms like BlackRock or Vanguard use this data for global asset allocation decisions.

- For Everyone: They provide a “risk-free rate,” the theoretical return of an investment with zero risk. This rate is the foundation for pricing nearly all other financial assets, from corporate loans to equity valuations using models like the Capital Asset Pricing Model (CAPM).

The Yield Curve: Your Economic Crystal Ball

While individual government bonds are important, their collective story told through the yield curve provides powerful insights into market expectations and future economic conditions. The yield curve is a line graph that plots the interest rates (yields) of bonds with equal credit quality but different maturity dates—typically from 3-month Treasury bills to 30-year Treasury bonds.

Why the Yield Curve Matters More Than Any Single Bond

The shape of the curve is closely watched by investors, economists, and policymakers because it reflects collective market sentiment about:

- Future interest rate expectations

- Economic growth forecasts

- Inflation expectations

- Monetary policy trajectory

Three Primary Yield Curve Shapes and Their Signals:

- Normal/Upward-Sloping Curve

- What it looks like: Short-term rates are lower than long-term rates

- What it means: Investors expect healthy economic growth and moderate inflation. They require higher yields to lock money away for longer periods.

- Investor implication: Favors “riding the yield curve” strategies—buying medium-term bonds to capture both yield and potential price appreciation as they “roll down” the curve.

- Inverted/Downward-Sloping Curve

- What it looks like: Short-term rates are HIGHER than long-term rates

- What it means: Investors expect economic slowdown or recession. They anticipate the central bank (like the Federal Reserve) will cut rates in the future, so they’re willing to accept lower yields for long-term safety.

- Historical significance: An inverted curve (specifically when the 10-year yield falls below the 2-year yield) has preceded every US recession since 1955, with a typical lag of 6-24 months.

- Investor implication: Signals defensive positioning—shorter durations, higher cash allocations, quality over yield.

- Flat Curve

- What it looks like: Little difference between short and long-term rates

- What it means: Economic transition period or uncertainty. The market can’t decide between growth and contraction expectations.

- Investor implication: Caution warranted. Consider flexible strategies that can adapt to either scenario.

Yield Curve Trading Strategies for Different Investors:

| Curve Shape | Conservative Strategy | Moderate Strategy | Aggressive Strategy |

|---|---|---|---|

| Steep Normal (Long-term yields > Short-term yields) |

Build a bond ladder across maturities | Barbell strategy (short + long term) | Leveraged steepener trade |

| Flat (Little yield difference) |

Focus on credit quality over yield | Tactical duration positioning | Curve flattener trades |

| Inverted (Short-term yields > Long-term yields) |

Maximize short-term T-bills | Defensive sectors, gold allocation | Curve steepener trades (betting on normalization) |

Smart investors don’t just look at whether bond yields are “high” or “low.” They analyze the RELATIONSHIP between yields across different time horizons. Monitoring the yield curve provides a valuable, market-based forecast that’s often more reliable than individual economic pundits. Whether you’re adjusting your bond portfolio’s duration or making broader asset allocation decisions, understanding curve dynamics is essential.

How to Use Government Bonds in Your Strategy

Case 1: The Safety-First Income Builder (Bond Ladder)

An investor nearing retirement wants predictable income with minimal default risk. They can construct a Treasury bond ladder by purchasing bonds maturing in 1, 2, 3, 4, and 5 years. As each bond matures, the principal is reinvested in a new 5-year bond. This strategy provides regular liquidity, reduces reinvestment risk, and mitigates interest rate risk.

Case 2: The Portfolio Hedge

An equity-heavy investor is concerned about a potential market correction. They can increase their allocation to long-term government bonds or a fund like the iShares 20+ Year Treasury Bond ETF (TLT). Historically, during equity sell-offs, capital flows into these safe-haven assets, causing their prices to rise and offsetting stock losses.

Case 3: Speculating on Central Bank Policy

A trader believes the European Central Bank (ECB) will cut rates sooner than the market expects. They might buy longer-dated German Bunds, as their prices would rise significantly if yields fall. Conversely, if they expect rate hikes, they might short-sell bond futures or buy a bearish ETF.

- High Credit Quality: Exceptionally low default risk, backed by the taxing/currency power of stable sovereign nations (e.g., US, Germany).

- Predictable Income: Provide fixed, scheduled coupon payments, offering excellent cash flow visibility for budgeting and retirement.

- Portfolio Diversifier: Historically show negative correlation with equities during market stress, reducing overall portfolio volatility.

- High Liquidity: Major bonds like US Treasuries trade in the world’s most liquid markets, allowing easy entry and exit.

- Tax Benefits (in some cases): For example, US Treasury interest is exempt from state and local income taxes.

- Interest Rate Risk: Bond prices fall when market interest rates rise, leading to potential capital losses if sold before maturity.

- Inflation Risk: Fixed payments can lose purchasing power if inflation exceeds the bond’s yield, resulting in a negative real return.

- Reinvestment Risk: Maturing bonds or coupons may need to be reinvested at lower future rates, reducing income potential.

- Low Yield Environment: In periods of monetary easing, yields can be minimal, offering poor income and limited upside.

- Opportunity Cost: Capital in low-yield bonds may miss higher returns from other assets like equities during strong bull markets.

Beyond Treasuries: A Guide to Global Government Bonds

While US Treasury bonds dominate global finance, understanding the landscape of international sovereign debt opens doors to diversification, currency plays, and relative value opportunities. Each market has unique characteristics, risks, and conventions that every sophisticated fixed-income investor should understand.

The Major Players: Characteristics and Risks

1. United States Treasury Securities

- Market Size: ~$26 trillion (largest in the world)

- Credit Rating: AA+ (S&P), Aaa (Moody’s)

- Key Instruments: T-Bills (<1 year), T-Notes (2-10 years), T-Bonds (20-30 years), TIPS (inflation-protected)

- Unique Feature: Global reserve currency status creates constant demand regardless of yield levels

- Trading Consideration: Extreme liquidity; benchmark for global risk pricing

- Primary Risk: US political dysfunction (debt ceiling battles), though default is still considered nearly unthinkable

2. United Kingdom Gilts

- Market Size: ~£2.5 trillion

- Credit Rating: AA- (S&P), Aa3 (Moody’s)

- Key Instruments: Conventional Gilts, Index-Linked Gilts (inflation-protected)

- Unique Feature: “Gilt-edged” refers to historical certificates with gold edges

- Trading Consideration: Issued by UK Debt Management Office (DMO); pension fund demand creates structural buyers

- Primary Risk: Brexit aftermath, higher inflation sensitivity than pre-2016

3. German Bunds (Eurozone Benchmark)

- Market Size: ~€1.5 trillion

- Credit Rating: AAA (S&P), Aaa (Moody’s)

- Key Instruments: Bubills (<1 year), Schätze (2 years), Bobl (5 years), Bund (10+ years)

- Unique Feature: Considered the “risk-free” benchmark for the Eurozone

- Trading Consideration: Negative yields were common 2019-2022; closely tied to European Central Bank policy

- Primary Risk: Exposure to broader Eurozone stability issues (Italy, Greece debt concerns)

4. Japanese Government Bonds (JGBs)

- Market Size: ~¥1,100 trillion (¥10 quadrillion)

- Credit Rating: A+ (S&P), A1 (Moody’s)

- Key Instruments: Super-long (40-year) JGBs are unique to this market

- Unique Feature: Bank of Japan owns ~50% of market; yield curve control policy

- Trading Consideration: Extremely low volatility due to BoJ dominance; currency hedge is CRITICAL for foreign investors

- Primary Risk: Massive debt-to-GDP ratio (~260%), demographic decline, potential policy shift

5. Canadian Government Bonds

- Market Size: ~$1.3 trillion CAD

- Credit Rating: AAA (S&P), Aaa (Moody’s) – rare AAA among G7

- Unique Feature: Often yields 20-50 basis points more than comparable US Treasuries (“Canada premium”)

- Trading Consideration: Strong banking system, commodity-linked economy

- Primary Risk: Housing market sensitivity, trade dependency on US

Emerging Market Sovereign Debt: Higher Yield, Higher Risk

For yield-seeking investors, emerging market (EM) government bonds offer significantly higher returns but with substantially increased risk:

| Country | Typical 10-Year Yield | Key Risk Factors | Suitable For |

|---|---|---|---|

| Mexico | 8-10% | US economic dependence, drug cartel violence, peso volatility | Moderately aggressive investors |

| Brazil | 10-12% | Political instability, fiscal management, commodity dependence | Risk-tolerant investors |

| Indonesia | 6-8% | Commodity dependence, infrastructure gaps, currency volatility | Patient, long-term investors |

| Turkey | 15-25% | Hyperinflation, unorthodox monetary policy, political uncertainty | Speculators only |

EM Bond Investment Vehicles Comparison

| Vehicle Type | Typical Yield Range | Primary Risk | Access Method | Best For |

|---|---|---|---|---|

| Local Currency Bonds | 5-15% | Currency Depreciation | Specialized funds, some brokerages | Investors with strong currency views |

| Hard Currency Bonds (USD) | 4-10% | Default/Credit Risk | Most brokerages, ETFs (EMB) | Currency risk-averse investors |

| EM Bond ETFs | 4-9% | Liquidity + Manager Risk | Any brokerage account | Most individual investors |

| Active EM Bond Funds | 3-12% | Manager Skill + Fees | Fund platforms, advisors | Hands-off, professional management |

The Currency Consideration: Your Most Important Decision

When investing in non-domestic government bonds, currency movement often matters MORE than yield differentials.

Example: A UK investor buying US Treasuries

- Scenario 1: US Treasury yields 4%, GBP strengthens 5% vs USD → Net loss in GBP terms

- Scenario 2: US Treasury yields 4%, GBP weakens 3% vs USD → 7% total return in GBP terms

Hedging Strategies:

- Unhedged: Pure play on both bond and currency (highest risk/volatility)

- Fully Hedged: Captures only the yield differential (eliminates currency risk)

- Selectively Hedged: Hedge based on currency outlook (requires active view)

Building a globally diversified bond portfolio isn’t about randomly picking foreign bonds with the highest yields. It requires understanding each market’s unique drivers, assessing currency risk consciously, and recognizing that political and institutional factors matter as much as economics. For most individual investors, accessing these markets through professionally managed global bond funds or ETFs that handle currency hedging decisions is the most practical approach.

Government Bonds in the Real World

A powerful recent case study is the global bond market rout of 2022. In response to surging post-pandemic inflation, central banks like the US Federal Reserve and the Bank of England embarked on the most aggressive interest rate hiking cycle in decades.

- The Catalyst: Inflation in the US peaked above 9% in June 2022. The Fed signaled a shift from near-zero rates to rapid increases.

- The Impact on Bonds: As the Fed Funds rate rose, yields on newly issued US Treasury bonds skyrocketed to compete. This caused the market price of existing bonds with lower locked-in coupons to plunge.

- The Numbers: The benchmark iShares Core U.S. Aggregate Bond ETF (AGG), which holds a mix of government and high-quality corporate bonds, fell over 15% in 2022. Long-dated Treasuries, being more sensitive to rate changes, fared even worse, with TLT dropping nearly 30%. This was a stark reminder that “safe” bonds are not immune to significant capital loss in a rising rate environment.

- The Takeaway: This period highlighted the very real interest rate risk of bonds. Investors who thought of bonds only as stable income generators experienced notable paper losses. It underscored the importance of understanding duration and the need for strategies like bond ladders or holding to maturity to avoid realizing those losses.

Advanced Bond Strategies for Different Economic Environments

While government bonds are often considered passive investments, advanced investors use them actively to capitalize on economic cycles, policy shifts, and market dislocations. These strategies require more engagement but can significantly enhance returns and risk management.

Four Advanced Strategies for Sophisticated Investors

1. The Barbell Strategy

Concentrate holdings at opposite ends of the maturity spectrum (short-term and long-term) while avoiding intermediate maturities.

- Mechanics:

- 50% in 1-3 year T-notes (for liquidity, low rate sensitivity)

- 50% in 20-30 year T-bonds (for higher yield, potential capital appreciation if rates fall)

- When to use: In uncertain rate environments or when the yield curve is flat

- Advantage: Combines safety of short-term with income of long-term; outperforms a bullet (single maturity) portfolio in many scenarios

- Real Example: In 2023, a barbell of 2-year notes (yielding ~4.7%) and 30-year bonds (yielding ~4.3%) would have captured high yields while maintaining flexibility

2. Bond Ladder Optimization

- Beyond Basic Laddering: Instead of equally spacing maturities, create a “step ladder” weighted toward anticipated rate peaks.

- Tactical Approach:

- When rates are expected to peak soon: Weight the ladder toward shorter maturities that will reinvest at higher rates

- When rates are expected to fall: Extend the ladder and lock in longer-term yields

- Dynamic Management: Actively adjust rung sizes based on forward rate expectations

- Tools Needed: Forward rate curve analysis, economic outlook assessment

3. Rate Anticipation Swaps

- Concept: Actively trade between different maturities based on interest rate forecasts

- Example Swaps:

- “Riding the Curve”: Buy a 5-year note, hold for 2 years as it becomes a 3-year note (typically appreciating as duration shortens), then sell

- “Bull Flattener Trade”: Buy long-term bonds while shorting intermediate bonds when expecting economic slowdown

- “Bear Steepener Trade: Short long-term bonds while buying short-term bonds when expecting rising inflation

- Risk Level: Medium to High (requires correct interest rate view)

- Best For: Active investors with strong macroeconomic views

4. Relative Value Arbitrage

- Concept: Exploit pricing discrepancies between similar government bonds

- Opportunities:

- On-the-run vs. Off-the-run: Newly issued Treasuries (“on-the-run”) often trade at premium to slightly older, identical bonds (“off-the-run”)

- Treasury vs. Futures Basis Trade: Exploit price differences between actual bonds and futures contracts

- Yield Curve Relative Value: Identify mispriced points on the yield curve

- Complexity: High (typically institutional territory)

- Access Point for Individuals: Through specialized bond mutual funds or ETFs

The 60/40 Portfolio Reimagined: Modern Bond Allocation

The traditional 60% stocks/40% bonds portfolio needs updating for today’s environment. Here’s a sophisticated approach:

Traditional 60/40: 40% in aggregate bond index

Enhanced 60/40:

- 15% Short-term Treasuries (T-bills, 1-3 year notes) – for liquidity, low correlation

- 10% Intermediate TIPS – for inflation protection

- 10% Long-term Treasuries – for recession hedging/negative correlation

- 5% International Sovereign Bonds (hedged) – for diversification

- Total Bond Allocation: Still 40%, but better structured for multiple scenarios

Performance During Different Environments:

| Economic Scenario | Traditional 60/40 | Enhanced 60/40 | Why Enhanced Wins |

|---|---|---|---|

| Rising Rates + Rising Inflation | Poor (bonds get hit hard) |

Better (TIPS protect, short-term less sensitive) |

Inflation protection via TIPS, lower overall duration, flexible allocation |

| Recession + Falling Rates | Good (bonds rally) |

Excellent (long-term Treasuries surge) |

Higher allocation to long-duration bonds amplifies rate-cut benefits, strategic positioning |

| Stagflation (Stagnation + Inflation) |

Very Poor | Less Poor | TIPS provide inflation hedge, international diversification reduces domestic stagflation impact |

| Normal Growth + Low Inflation | Solid | Comparable/Slightly Better | Similar core performance with lower volatility and better downside protection |

Implementation Considerations

For Individual Investors:

- Start Simple: Master basic laddering before attempting barbells or swaps

- Use ETFs for Tactical Moves: Instead of trading individual bonds, use ETFs like:

- SHY (1-3 year Treasuries) for short end

- IEI (3-7 year Treasuries) for intermediate

- TLT (20+ year Treasuries) for long end

- Mind the Taxes: Active trading generates taxable events; consider tax-advantaged accounts

- Cost Matters: Transaction costs eat into bond returns more than stock returns

When NOT to Use Advanced Strategies:

- If you cannot monitor positions regularly

- If you have a time horizon under 3 years

- If you don’t understand the risks (especially interest rate and liquidity risks)

- During periods of extreme market stress when liquidity dries up

Government bonds are far from passive investments for sophisticated allocators. By understanding and selectively implementing advanced strategies—from simple barbells to more complex relative value plays—investors can transform their fixed-income allocation from a static ballast into an active return generator and risk management tool. The key is matching the strategy to your economic outlook, risk tolerance, and time commitment level. Remember: in bond investing, sometimes the best action is disciplined inaction—holding to maturity avoids realizing losses in volatile markets.

Government Bonds vs Corporate Bonds

It’s crucial to distinguish government bonds from other fixed-income securities and related metrics.

| Feature | Government Bonds | Corporate Bonds |

|---|---|---|

| Issuer | National Government (e.g., US Treasury, UK DMO) | Corporation (e.g., Apple Inc., Toyota) |

| Primary Risk | Interest Rate Risk, Inflation Risk | Credit Risk (Default), Interest Rate Risk |

| Typical Yield | Lower (Reflects lower sovereign risk) | Higher (Includes a “credit spread” for extra risk) |

| Investor Goal | Capital Preservation, Safe Income, Hedging | Higher Income, Sector/Company Exposure |

| Market Influence | Central Bank Policy, Macroeconomics, Inflation | Company Fundamentals, Industry Health, Economic Cycle |

Conclusion

Ultimately, understanding government bonds is essential for constructing a prudent, resilient investment portfolio. They are not a monolithic “safe” asset but a sophisticated tool for income generation, capital preservation, and strategic hedging. As we’ve explored, their advantages in safety and diversification are tempered by real risks from inflation and rising interest rates. By incorporating them thoughtfully—whether through direct purchases, bond funds, or as part of a laddering strategy—you can build a financial foundation that withstands market volatility. Start by assessing your own risk tolerance and time horizon, then explore how sovereign debt instruments from issuers like the US Treasury or the UK Debt Management Office can help you achieve your goals.

Ready to build a portfolio that balances growth with safety? The right brokerage platform is key to accessing government bonds efficiently. We’ve analyzed and compared the best online brokers for fixed-income investing to help you find the perfect fit for your strategy.

Related Terms:

- Yield to Maturity (YTM): The total annual return you can expect if you hold a bond until it matures. It’s the most comprehensive measure of a bond’s return.

- Duration: A measure of a bond’s sensitivity to interest rate changes, expressed in years. Higher duration = greater price volatility when rates move.

- Bond ETF: Exchange-Traded Funds that hold a basket of bonds, providing easy, diversified exposure to the bond market without buying individual securities.

- Inflation-Protected Securities (e.g., TIPS): Government bonds whose principal value is adjusted based on inflation, directly combating inflation risk.

- Credit Rating: An assessment of a bond issuer’s creditworthiness, with AAA being the highest. Government bonds from stable countries typically have the highest ratings.

Frequently Asked Questions About Government Bonds

Recommended Resources

- For Official Information & Direct Purchases (US): TreasuryDirect.gov – The US Department of the Treasury’s site for buying bonds directly.

- For Authoritative Definitions & Context: Investopedia: Government Bond – A reliable external resource for foundational knowledge.

- For Economic Data & Yields: Federal Reserve Economic Data (FRED) – An unparalleled database for tracking historical bond yields and economic indicators.

- For In-Depth Analysis: The Securities Industry and Financial Markets Association (SIFMA) – Provides market data and factsheets on US fixed-income markets.