What Is Blue Chip Stock, Is It Right for Your Portfolio

Blue chip stocks represent shares in the most established, financially sound, and reliable companies on the market. They are the cornerstones of a conservative, long-term investment strategy, prized for their stability and consistent dividend payments. For investors in the US, UK, Canada, and Australia, building a portfolio around these industry titans is a time-tested path to wealth preservation and steady growth.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | Shares in a nationally recognized, financially stable, and well-established company. |

| Also Known As | Large-Cap Stocks, Defensive Stocks, Bellwether Stocks |

| Main Used In | Long-Term Investing, Portfolio Management, Retirement Planning |

| Key Takeaway | Blue chips are for capital preservation and steady income, not for explosive growth. |

| Related Concepts |

What is a Blue Chip Stock

The term blue chip comes from poker, where the blue chips usually hold the maximum value. In finance, it’s used to describe the crème de la crème of publicly traded companies. These are industry leaders that have demonstrated their resilience through various economic cycles. Think of companies whose products or services are household names, you likely interact with them daily. They are the steady, reliable engines of the economy, not the flashy, high-risk startups.

Key Takeaways

The Core Concept Explained

A blue chip company isn’t defined by a single number but by a collection of strong characteristics. It measures a company’s quality, reliability, and market dominance. A high blue chip status indicates a lower-risk investment suitable for the core of a long-term portfolio. A low or absent status suggests higher risk and volatility.

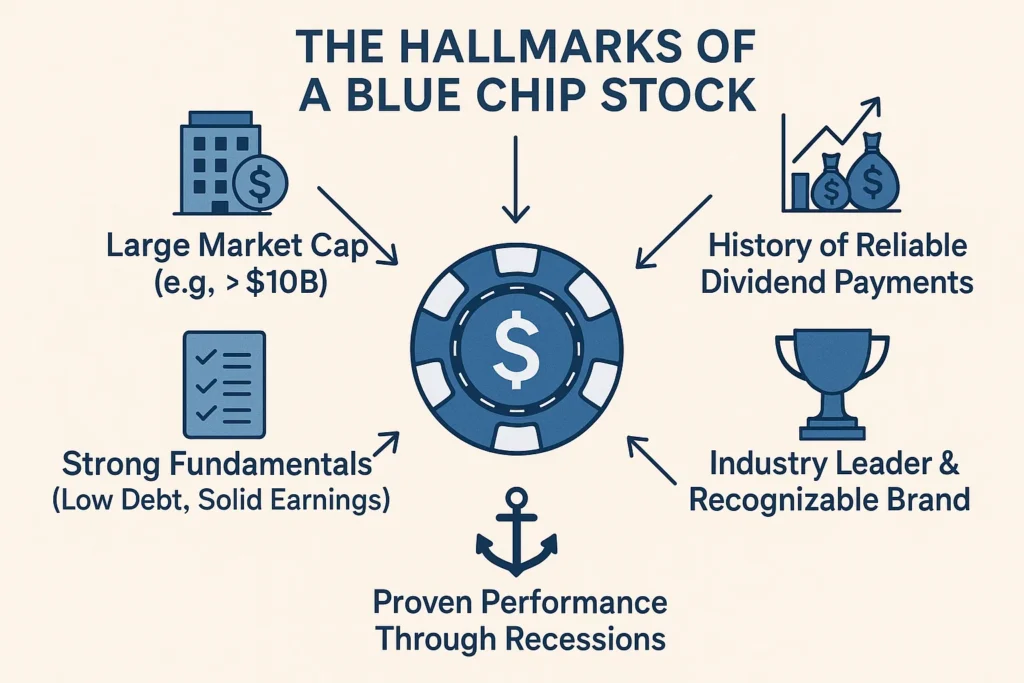

How to Identify a Blue Chip Stock

Since there’s no official formula, investors and analysts use a set of qualitative and quantitative criteria to identify blue chip companies.

The Blue Chip Checklist

You can be confident a stock is a blue chip if it meets most of these criteria:

- Large Market Capitalization: Usually in the tens or hundreds of billions. For example, in the US, companies like Apple (NASDAQ: AAPL) and Johnson & Johnson (NYSE: JNJ) fit this bill, while in the UK, you’d look at companies in the FTSE 100 index like HSBC (LON: HSBA).

- History of Dividend Payments: A long, unbroken track record of paying dividends, with many being Dividend Aristocrats (S&P 500 companies that have increased dividends for 25+ consecutive years).

- Strong Brand Name and Moat: The company has a powerful, widely recognized brand and a sustainable competitive advantage (a moat) that protects its market share.

- Financial Health: Low debt levels, consistent revenue and earnings growth, and high credit ratings from agencies like S&P or Moody’s.

- Index Inclusion: Many blue chips are components of major market indices like the Dow Jones Industrial Average (DJIA), the S&P 500, or the UK’s FTSE 100.

Why Blue Chip Stocks Matter to Traders and Investors

- For Long-Term Investors: They are the bedrock of a buy and hold strategy. They provide portfolio stability and reduce overall volatility. The reliable dividend income can be reinvested or used as a passive income stream, which is crucial for retirement planning. For investors in Canada or Australia, holding blue chips like Royal Bank of Canada (TSX: RY) or BHP Group (ASX: BHP) offers a stake in the core of the national economy.

- For Traders: While not typically for day trading, swing traders might use blue chips during periods of market pullbacks, viewing them as safe havens to park capital or trade within predictable ranges. Their high liquidity also makes them easy to buy and sell.

- For Analysts: Blue chips are often used as benchmarks for their respective industries. Their performance and valuation metrics (like P/E ratios) set a standard against which smaller competitors are measured.

The Psychology of Investing with Blue Chips

While the financial metrics of blue chip stocks are clear, their greatest advantage might be psychological. Investing is as much a test of temperament as it is of intelligence. Blue chips provide a behavioral anchor that can prevent costly emotional decisions.

- Reducing the Fear of Missing Out (FOMO): In a market frenzy around the latest meme stock or tech IPO, it’s easy to feel left out. Holding a portfolio of high-quality blue chips provides conviction. You own stakes in the world’s best companies, which allows you to confidently ignore short-term speculative noise and avoid buying into bubbles at their peak.

- Providing Resilience During Volatility: When the market drops 20%, a speculative portfolio might fall 50% or more, triggering panic selling. A blue-chip-heavy portfolio will likely decline less, making it easier to stay the course. This emotional stability is invaluable, as the biggest losses often occur when investors sell in a panic during a downturn and miss the subsequent recovery.

- The Sleep Well at Night (SWAN) Factor: This is an unofficial but critical metric for long-term investors. Knowing that your capital is invested in companies with decades of proven resilience, strong cash flows, and a low risk of bankruptcy reduces anxiety. This peace of mind encourages a disciplined, long-term buy and hold approach, which is a key driver of investment success.

Actionable Tip: The next time the market is in a downturn, instead of checking your portfolio’s value, check the underlying health of your blue-chip companies. Are they still profitable? Have they cut their dividend? If the fundamentals are sound, the stock price will eventually recover. This mindset shift, from watching price to assessing business health, is a superpower for the individual investor.

How to Use Blue Chip Stocks in Your Strategy

Use Case 1: The Foundation of a Core-Satellite Portfolio

- Strategy: Allocate a large portion (e.g., 60-70%) of your portfolio to a diversified basket of blue chips across different sectors (technology, healthcare, consumer staples, finance). This core is designed for steady growth and income. The remaining satellite portion can be used for higher-risk, higher-reward investments.

Use Case 2: Dividend Reinvestment Plan (DRIP)

- Strategy: Many blue-chip companies offer DRIPs, allowing you to automatically reinvest your dividend paybacks to purchase more shares, compounding your returns over time. This is a powerful, hands-off wealth-building tool. You can learn more about setting up a DRIP directly through your broker or from resources like the SEC’s investor education website.

Use Case 3: Defensive Positioning in a Volatile Market

- Strategy: When economic indicators point to a potential downturn, investors often rotate capital from cyclical stocks into more defensive stocks like consumer staples (e.g., Procter & Gamble) or utilities, which are less sensitive to economic cycles.

Building a blue chip portfolio requires a reliable brokerage platform. To find the best fit for your long-term investing goals, it’s crucial to compare fees, research tools, and dividend reinvestment options.

Advanced Strategy: Generating Enhanced Income with Blue Chips

For investors seeking to actively manage their blue-chip holdings, a strategy known as selling covered calls can enhance income beyond traditional dividends. This is a more advanced tactic suitable for a portion of your portfolio.

What is a Covered Call?

It’s an options strategy where you, as a shareholder, sell a call option on a stock you already own. You collect an immediate cash payment (called a premium) from the buyer. In return, you agree to sell your shares at a predetermined price (the strike price) by a certain date.

Why Blue Chips are Perfect for This:

Their high liquidity means there is always a active options market, and their lower volatility leads to more predictable outcomes compared to volatile growth stocks.

A Real-World Example with a Tier-1 Stock:

Imagine you own 100 shares of Apple (AAPL), currently trading at $190 per share. You’re happy with your position but wouldn’t mind selling at $200.

- The Trade: You sell one covered call contract (representing 100 shares) with a $200 strike price, expiring in 30 days. You receive a premium of $2.00 per share, or $200 total.

- Two Potential Outcomes:

- AAPL stays below $200: The option expires worthless. You keep the $200 premium and still own your shares. You can then sell another call next month. This income is in addition to Apple’s dividend.

- AAPL rises above $200: Your shares get called away and sold for $200 each. You keep the original $190 value, the $200 premium, and the gain from $190 to $200. Your total profit is capped, but it hit your target price.

- Stability and Lower Volatility: Their size and market position make them less prone to wild price swings than smaller companies.

- Reliable Dividend Income: They provide a predictable income stream, which is ideal for retirees.

- Lower Risk of Bankruptcy: Their financial strength makes a total loss of investment highly unlikely.

- Transparency and Liquidity: Being widely followed by analysts and heavily traded, information is plentiful, and shares are easy to buy or sell.

- Slower Growth Potential: Their massive size makes explosive, multi-bagger growth very difficult to achieve.

- Not Recession-Proof: While resilient, they can still decline significantly during a major bear market (e.g., 2008 financial crisis).

- Can Be Overvalued: High investor demand can sometimes push their prices to levels where future returns may be diminished.

- Dividend Cuts Are Possible: While rare, even blue chips can cut dividends during severe distress, impacting income-focused investors.

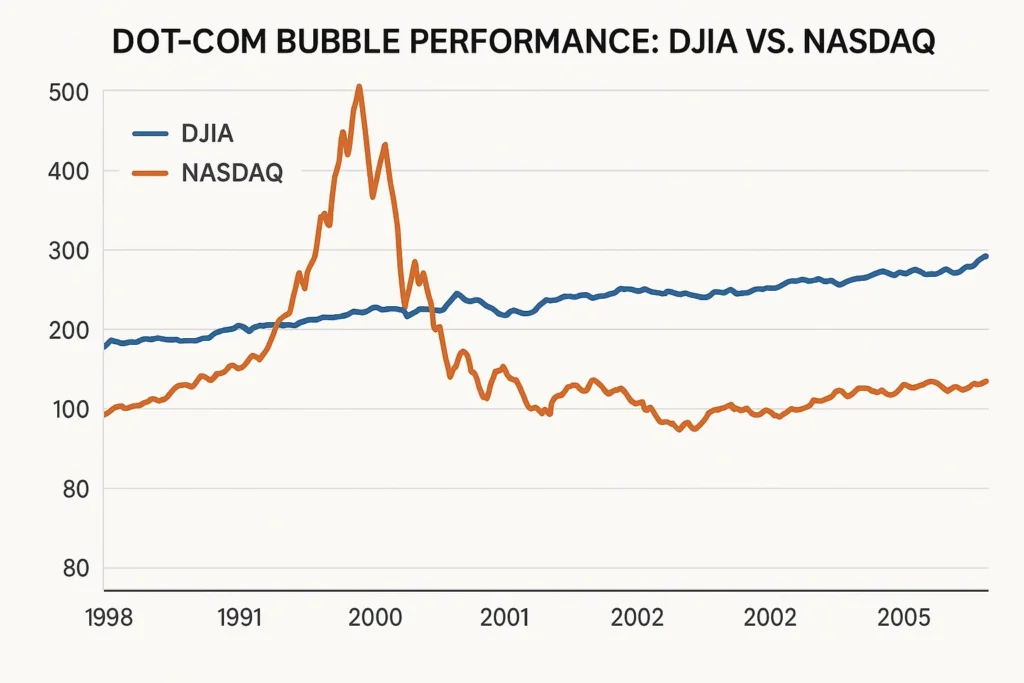

Blue Chip in the Real World: The Dot-Com Bubble

The dot-com bubble of the late 1990s and its subsequent crash in 2000-2002 is a perfect case study of blue-chip resilience. During the bubble, speculative tech stocks with no earnings saw their valuations soar. Meanwhile, established blue chips in boring sectors like consumer goods were largely ignored.

When the bubble burst, the NASDAQ composite (heavy with tech stocks) fell over 75%. However, the Dow Jones Industrial Average (DJIA), a index comprised of 30 prominent blue-chip stocks, experienced a much milder decline of about 30% from its peak. More importantly, the blue-chip index recovered its losses years before the NASDAQ did. This event underscored the role of blue chips in protecting capital during periods of extreme market euphoria and correction.

A Starter Blue Chip Watchlist for Global Diversification

While not financial advice, the following companies are widely regarded as archetypal blue chips from various sectors and regions. Use this list as a starting point for your own research to understand what makes a company a durable industry leader.

| Company (Ticker) | Sector | Home Country | Blue Chip Rationale & Key Metric |

|---|---|---|---|

| Microsoft (MSFT) | Information Technology | USA | A leader in cloud (Azure), software, and AI. Metric: Consistently high profit margins (>30%) and a AAA credit rating (rarer than a perfect SAT score). |

| Novo Nordisk (NVO) | Healthcare | Denmark | Global leader in diabetes and weight-loss medications. Metric: Dominant market share in its niche, with resilient, recession-proof demand. |

| LVMH (MC.PA) | Consumer Discretionary | France | The world’s largest luxury goods conglomerate (Louis Vuitton, Dior). Metric: Powerful pricing power and brand moat that protects during economic cycles. |

| Canadian National Railway (CNR.TO) | Industrials | Canada | Operates a crucial transcontinental railway network. Metric: Possesses a massive economic moat—you can’t build a new cross-country railroad. Learn more about economic moats on Investopedia. |

| Samsung Electronics (005930.KS) | Technology | South Korea | A global leader in semiconductors and consumer electronics. Metric: Heavily weighted in the South Korean KOSPI index, offering a direct stake in Asian tech innovation. |

How to Use This List:

- Research: Don’t just buy the name. Look up their annual reports (often called 10-K filings in the US on the SEC’s EDGAR database).

- Diversify: You don’t need to own them all. The goal is to build a basket of uncorrelated leaders.

- Consider ETFs: For instant diversification, an ETF like the iShares Core S&P 500 ETF (IVV) holds US blue chips, or the Vanguard FTSE Developed Markets ETF (VEA) provides international exposure.

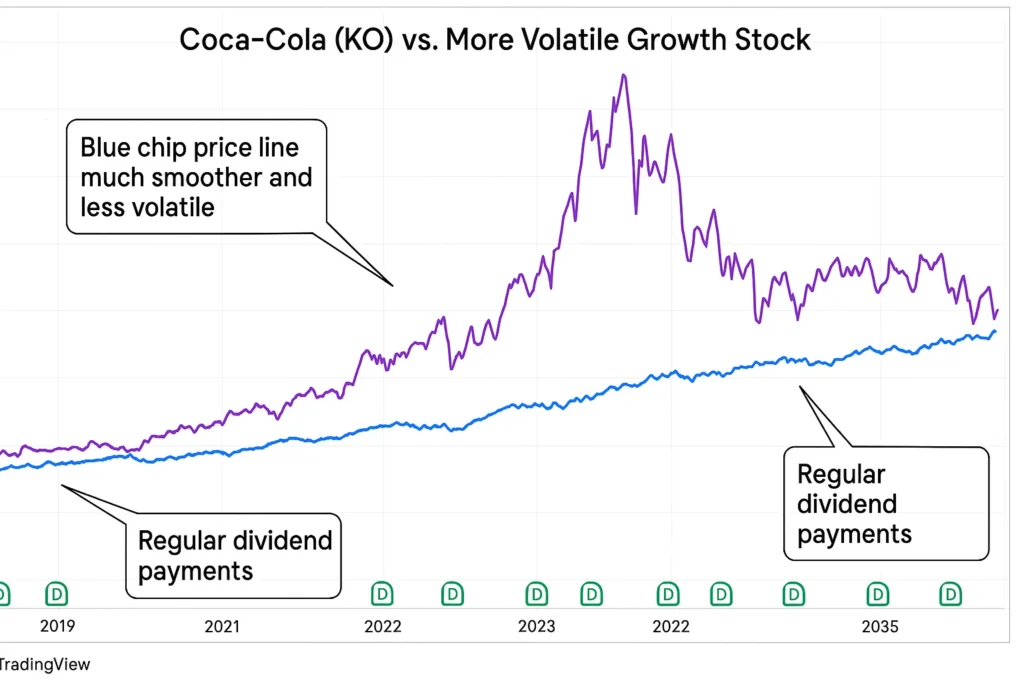

Blue Chip Stock vs Growth Stock

| Feature | Blue Chip Stock | Growth Stock |

|---|---|---|

| Primary Goal | Capital Preservation & Income | Capital Appreciation |

| Typical Company Size | Large-Cap | Often Small or Mid-Cap |

| Dividends | Usually pays consistent dividends | Rarely pays dividends; reinvests earnings |

| Volatility & Risk | Lower | Higher |

| Example | Coca-Cola (KO) | A pre-profitability tech startup |

Conclusion

Understanding and investing in blue-chip stocks provides a robust foundation for long-term financial security. They are the defensive linemen of your portfolio, offering stability, reliable income, and a lower-risk path to participating in the market’s growth. As we’ve seen, their primary limitations are slower growth and a lack of immunity to broad market downturns. Therefore, they are best used as the core of a diversified strategy, complemented by other assets. Start by researching the components of major indices like the Dow Jones or FTSE 100 to identify your first blue-chip investments.

Related Terms

- Dividend Yield: The yearly dividend payment divided by the stock’s price. A key metric for income investors evaluating blue chips.

- Market Capitalization: The total dollar value of a business’s outstanding stocks. Blue chips are, by definition, large-cap stocks.

- Defensive Stock: A sub-category of blue chips (e.g., utilities, consumer staples) that are less sensitive to economic cycles.

Frequently Asked Questions

Recommended Resources

- U.S. Securities and Exchange Commission (SEC) – Investor.gov: For foundational education on investing.

- Investopedia – Blue Chip Stock Definition: For a deep dive into the term and its nuances.

- S&P Global: To research company credit ratings and financial health.

- S&P Dow Jones Indices: To see the components of the Dow Jones Industrial Average and S&P 500.

- FTSE Russell: To see the components of the UK’s FTSE 100 index

How did this post make you feel?

Thanks for your reaction!