What Is Black Swan Event, How to Protect Your Portfolio

A Black Swan Event is an extreme, unforeseen occurrence that deviates beyond normal expectations and has a severe, widespread impact. Coined by scholar Nassim Nicholas Taleb, these events are characterized by their extreme rarity, profound impact, and the widespread insistence they were obvious in hindsight. For investors in the US, UK, Canada, and Australia, understanding Black Swans is not about prediction, but about building robust portfolios that can withstand financial catastrophe.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | An extremely rare, high-impact event that is nearly impossible to predict using standard models. |

| Also Known As | Tail Risk, Extreme Risk Event |

| Main Used In | Portfolio Management, Risk Management, Global Macroeconomics, Crypto Markets |

| Key Takeaway | The goal is not to predict Black Swans but to build antifragile systems that can benefit from volatility and survive disasters. |

| Related Concepts |

What is a Black Swan Event

A Black Swan Event is a metaphor for a complete surprise that has a major effect on the world. Imagine a world where all swans are believed to be white, the discovery of the first black swan in Australia shatters this reality completely. In finance, it’s a market-moving event that existing data, models, and experts failed to see coming. These are not just bad news; they are paradigm-shifting occurrences that rewrite the rules of the game.

Key Takeaways

Why Our Brains Are Wired to Be Blindsided

Understanding the mechanics of a Black Swan is one thing; understanding why we are consistently caught off-guard is another. The answer lies in deep-seated cognitive biases that distort our perception of risk and reality. For traders and investors in the US and UK, recognizing these mental traps is the first line of defense.

- The Narrative Fallacy: Our brains are story-telling machines. We find comfort in simple, logical stories that link cause and effect. This leads us to believe the world is more explainable and predictable than it truly is. Before 2008, the narrative was housing prices are stable and will always rise. After the crash, the new narrative became deregulation and subprime lending caused an inevitable collapse. Both are neat stories that mask the true, chaotic complexity of the event. We confuse a good story with a true one, leaving us vulnerable to shocks that don’t fit our plot.

- Hindsight Bias (The I-Knew-It-All-Along Effect): This is perhaps the most pernicious bias related to Black Swans. After an event occurs, we retroactively believe it was predictable. We selectively recall the few analysts who warned of a crisis and dismiss the overwhelming majority who did not. This bias creates a false sense of learning. If we think we knew it all along, we don’t scrutinize our decision-making process to see why we were actually blindsided. This makes us overconfident and less prepared for the next Black Swan.

- Confirmation Bias: We actively seek information that confirms our existing beliefs and models while ignoring or dismissing contradictory evidence. A value investor might dismiss the meteoric rise of a profitless tech company as a bubble, failing to see the new paradigm until it’s too late. This bias creates echo chambers in the financial markets, whether on Wall Street or in City of London boardrooms, where dissenting voices are silenced, and groupthink prevails.

The Antidote: Actively challenge your own narratives. Seek out disconfirming evidence and opinions that make you uncomfortable. Embrace the idea that much of the market is driven by randomness, not a neat, predictable story.

Staying disciplined in the face of these biases requires a clear-headed strategy. Many successful investors use systematic checklists to avoid emotional decisions. To build your own, explore the behavioral finance resources available at site like The American Psychological Association or a classic resource like Farnam Street’s blog.

The Core Concept Explained

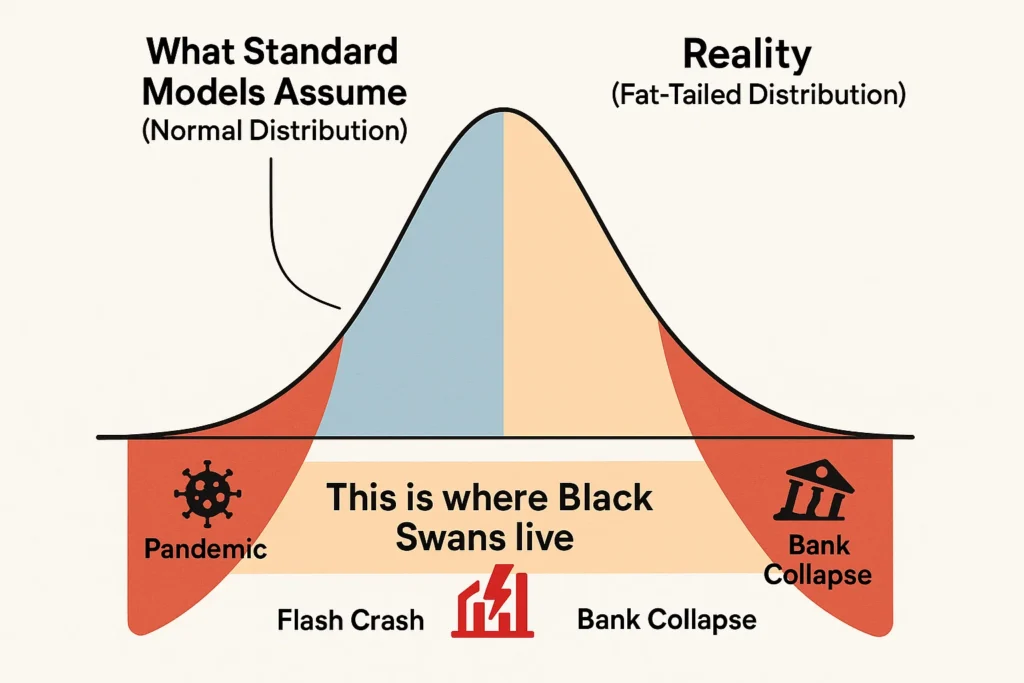

Nassim Nicholas Taleb formalized the concept in his 2007 book The Black Swan. He argues that history is driven not by predictable, gradual changes, but by these large, random jumps. The financial world is dominated by fat-tailed distributions, meaning the probability of extreme events (the tails of the distribution) is much higher than standard models like the bell curve suggest.

The 2008 Global Financial Crisis is a classic example. While some warned of a housing bubble, the sheer scale of the interconnected collapse and the resulting liquidity crisis was a true Black Swan for most market participants and institutions like the U.S. Federal Reserve.

How to Identify a Potential Black Swan

Since Black Swans are, by definition, unpredictable, you cannot calculate them. Instead, you can identify conditions that make a system vulnerable. Look for:

- Increasing Complexity: Highly interconnected global systems (finance, supply chains) where a failure in one part can cascade uncontrollably.

- Homogeneity of Thought: When everyone in a market uses the same models and holds the same beliefs (e.g., housing prices only go up).

- Suppression of Volatility: When central banks or governments artificially suppress small market corrections, it can create a false sense of stability and build pressure for a much larger, systemic blow-up.

Why Black Swan Events Matter to Traders and Investors

- For All Investors: It exposes the fatal flaw in relying solely on historical data for retirement or long-term investment planning. A single event can wipe out decades of gains if a portfolio is not structured correctly.

- For Traders: It explains why stop-losses can sometimes fail dramatically (gapping down) and why leverage is so dangerous, it can magnify losses to the point of ruin during a volatility spike.

- For Analysts: It highlights the severe limitations of risk models like Value at Risk (VaR), which often underestimate the probability of extreme market moves, giving a false sense of security.

How to Use the Black Swan Concept in Your Strategy

You don’t bet on a specific Black Swan; you build a portfolio that is robust to any Black Swan.

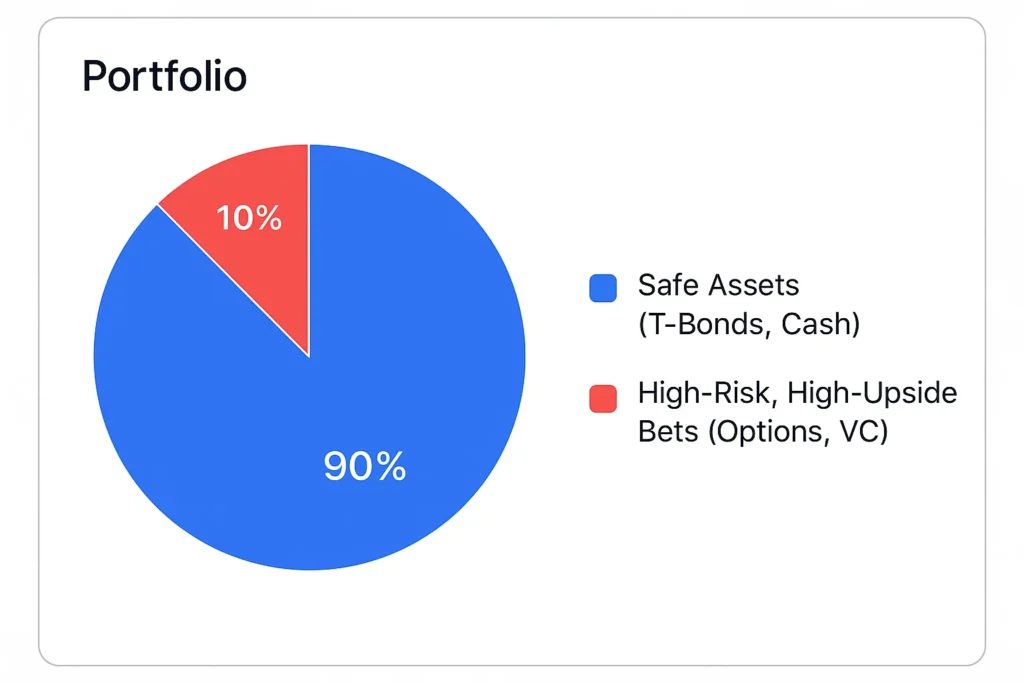

Use Case 1: The Barbell Strategy (Taleb’s Approach)

This involves allocating 85-90% of your portfolio in extremely safe, conservative assets (e.g., U.S. Treasuries, cash). The remaining 10-15% is placed in highly speculative, positively convex assets (like out-of-the-money options or venture capital). The safe assets protect your downside, while the speculative bets have unlimited upside if a volatile event occurs. You are not predicting the event, just positioning yourself to benefit from high uncertainty.

Use Case 2: Robust Diversification

True diversification isn’t just about different stocks. It’s about non-correlated assets. Consider assets that may perform well during a crisis, such as:

- Long-term Treasury bonds (a flight-to-safety trade).

- Gold and other precious metals.

- Tail Risk Hedging through specific option strategies.

Implementing a sophisticated hedging strategy requires access to powerful options trading tools. To find a platform that suits your needs, check out our independent review of the authoritative site like BrokerChooser or Investopedia’s broker comparisons.

- Promotes Realism: It correctly identifies that the world is far more random and risky than financial models suggest.

- Encourages Prudence: It pushes investors to focus on downside protection and survivability above all else.

- Explains Historical Shocks: It provides a coherent framework for understanding why experts are consistently blindsided by major crises.

- Potentially Fatalistic: It can be misinterpreted as since we can’t predict anything, there’s no point in analysis, which is not the message.

- Overuse of the Term: Market corrections and predictable crises are often mislabeled as Black Swans, diluting the term’s meaning.

- Hedging is Costly: Continuously protecting a portfolio against remote risks, like buying tail risk insurance, can be expensive and drag on performance during calm periods.

Black Swan Event in the Real World: A Case Study

The COVID-19 Pandemic (2020)

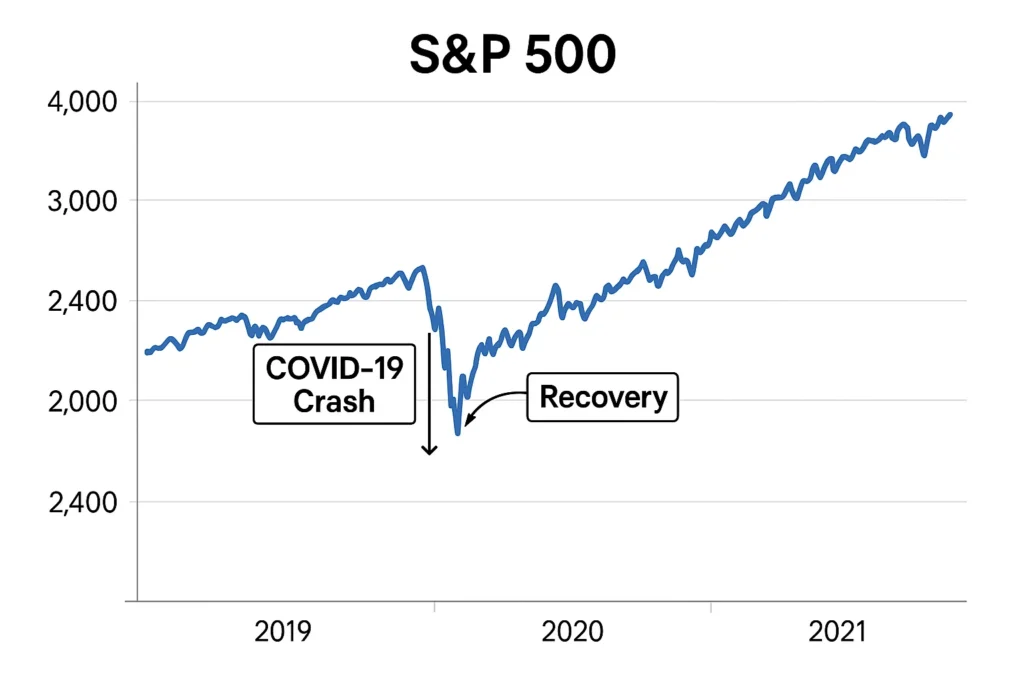

The rapid global spread of the coronavirus and the subsequent government-mandated lockdowns represent a modern Black Swan.

- Extreme Rarity: A global pandemic of this scale was considered a low-probability event by most governments and businesses.

- Severe Impact: The S&P 500 plummeted over 30% in a month. Global GDP contracted sharply. Unemployment in the US and UK skyrocketed to levels not seen in decades. The Volatility Index (VIX), a key fear gauge, spiked to its highest level in history.

- Hindsight Bias: After the fact, many claimed that pandemic preparedness plans (or lack thereof) made the outcome obvious.

The event also showed how central banks like the U.S. Federal Reserve would respond: with unprecedented monetary stimulus, which itself created a new set of market dynamics.

Case Study: The Swiss Franc Shock (2015) – A Mini Black Swan for Traders

While pandemics and global financial crises are system-wide Black Swans, smaller, sector-specific Black Swans can be just as devastating for market participants. The Swiss Franc (CHF) shock of January 15, 2015, is a textbook example of how a single central bank decision can trigger a market earthquake.

The Setup: For over three years, the Swiss National Bank (SNB) had enforced a currency peg, committing to buy unlimited foreign currency to hold the Swiss Franc at a rate of at least 1.20 Euros per Franc. This was done to fight deflation and protect Swiss exports. The market viewed this peg as a sure thing, and countless retail and institutional traders built strategies around its permanence, often using massive leverage.

The Event: At the height of the European quantitative easing program, the SNB unexpectedly announced it was immediately abandoning the peg. The statement came as a complete shock, with no warning to the market.

The Impact: What happened next was a bloodbath for those on the wrong side of the trade.

- The Franc soared by over 30% against the Euro in minutes.

- The liquidity in the market evaporated, meaning stop-loss orders were filled at disastrous levels far beyond their set price, a phenomenon known as gapping.

- Retail forex brokers like Alpari UK were driven into insolvency because client losses exceeded their capital. Several hedge funds, including a fund within J.P. Morgan, blew up.

- For every trader who was short the Franc, it was a catastrophic, ruinous event. For the few who were long or out of the market, it was a windfall.

Why It Was a Black Swan:

- Extreme Rarity: The SNB had repeatedly reaffirmed its commitment to the peg just days before. The sudden, unilateral abandonment was considered unthinkable.

- Severe Impact: Losses were measured in billions of dollars. Companies and individuals were wiped out.

- Hindsight Bias: Afterwards, commentators claimed the peg was unsustainable, making the event seem predictable. But in the moment, the overwhelming market consensus was that the peg would hold.

The Lesson for Traders Today: This event is a stark reminder for crypto traders and forex traders in Australia, Canada, and beyond:

- Beware of Sure Things: Any trade predicated on a central bank, government, or other large entity always acting predictably is inherently risky.

- Leverage is a Double-Edged Sword: It magnifies gains, but during a Black Swan, it magnifies losses to the point of total ruin.

- Stop-Losses Are Not Guarantees: In a true liquidity crisis, your stop-loss can fail to protect you.

The Swiss Franc shock underscores the critical importance of choosing a well-capitalized and regulated broker. To ensure your broker can withstand extreme market volatility, always verify their regulatory status with bodies like the UK’s Financial Conduct Authority (FCA)] or the U.S. Securities and Exchange Commission (SEC).

Black Swan Event vs Grey Rhino Event

| Feature | Black Swan Event | Grey Rhino Event |

|---|---|---|

| What it is | A high-impact, highly improbable, unforeseen event. | A high-impact, highly obvious and probable threat that is neglected. |

| Predictability | Effectively zero. | High. The threat is known but ignored. |

| Primary Use | Understanding fundamental uncertainty and tail risk. | Highlighting managerial and policy incompetence. |

| Example | 9/11 attacks, COVID-19 pandemic. | The 2008 subprime mortgage crisis (warnings were ignored). |

Conclusion

Black Swan theory is a powerful antidote to financial overconfidence. It teaches that the greatest risk lies in the unknown unknowns, the events we haven’t even considered. As we’ve seen, its value is not in prediction, but in preparation. By accepting the inherent limitations of forecasting and the inevitability of extreme events, you can shift your focus from trying to beat the market to simply ensuring you survive it. This means embracing robust diversification, considering asymmetric payoff strategies, and avoiding the siren song of excessive leverage. Start by stress-testing your portfolio: what would happen to your investments if another 2008 or 2020 occurred tomorrow?

Building a resilient portfolio starts with the right foundation. To compare accounts that offer robust trading tools and access to safe-haven assets, we recommend reviewing the latest offerings on authoritative financial news site like Bloomberg or Financial Times‘ broker section.

Related Terms:

- Tail Risk Hedging: The active strategies used to protect against Black Swan Events.

- Antifragility: A concept also from Taleb describing systems that gain from volatility, shocks, and stress.

- Value at Risk (VaR) Limitations: Explains the critical weaknesses of a common risk-management tool.

- Knightian Uncertainty: A distinction between measurable risk and immeasurable uncertainty, where Black Swans reside.

Frequently Asked Questions

Recommended Resources

- Nassim Taleb’s official page for The Black Swan

- U.S. Securities and Exchange Commission (SEC) page on investor education about risk

- Federal Reserve paper on the 2008 financial crisis

- The Black Swan: The Impact of the Highly Improbable by Nassim Nicholas Taleb

- Fooled by Randomness by Nassim Nicholas Taleb

How did this post make you feel?

Thanks for your reaction!