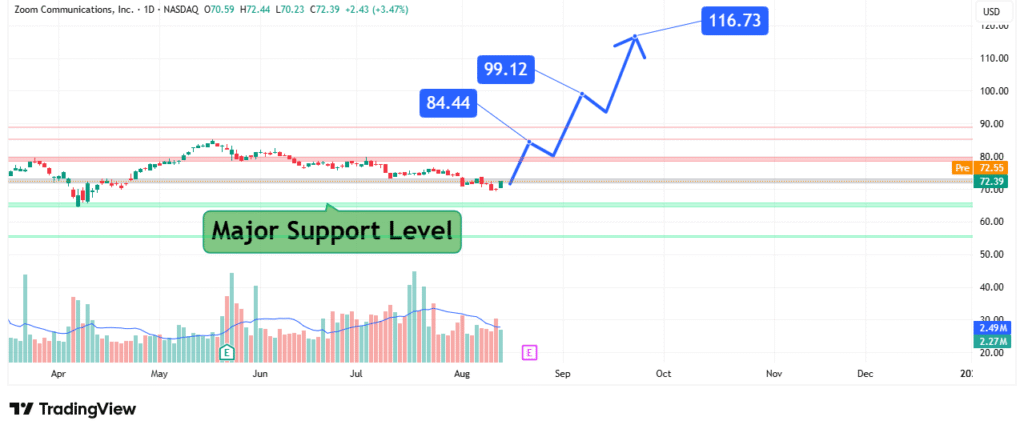

Zoom Stock Eyes $84 Breakout Multi-Target Technical Setup

Zoom Video Communications (ZM) is currently showing signs of recovery after a prolonged downtrend, with the stock trading at $72.39 (+3.47%) as it builds momentum toward multiple price targets. This analysis examines the key technical levels that will determine whether ZM can sustain its upward trajectory and challenge higher resistance levels in the coming weeks.

Current Market Position and Price Action

Zoom’s daily chart reveals several important technical characteristics:

- Current Price: $72.39 (up 3.47% on the day)

- Daily Range: $70.23 (low) to $72.44 (high)

- Immediate Support: $70.00 (psychological level)

- Upper Resistance: $80.00 (first major barrier)

- Volume: 2.49M shares (slightly above average)

The stock has broken out of its recent consolidation pattern with a strong bullish candle, suggesting growing buying interest.

Critical Price Levels and Market Framework

Support Structure (Must Hold for Bullish Case):

- Primary Support Zone: $70.00-$72.00 (recent swing lows)

- Strong Historical Support: $65.00 (2023 low)

- Major Floor: $60.00 (psychological level)

Upside Targets:

- First Target: $84.44 (16.6% upside)

- Second Target: $99.12 (37% upside)

- Final Target: $116.73 (61.3% upside)

The $84.44 and $99.12 levels represent previous support zones that may now act as resistance, while $116.73 was a significant peak in 2023.

Technical Indicators and Momentum Factors

Several technical elements support the analysis:

- Bullish Momentum: Strong 3.47% gain on increased volume

- Volume Profile: Rising volume on up days suggests accumulation

- Relative Strength: Improving against tech sector peers

- Moving Averages: Potential golden cross forming (50/200 DMA)

Potential Price Scenarios and Trading Strategies

Bullish Scenario (Target Achievement):

- Initial Signal: Sustained trading above $72.50

- Confirmation: Break above $80.00 with volume

- Target Execution: Gradual ascent toward $84.44, then $99.12

- Extension Potential: $116.73 if momentum persists

Bearish Risk Scenario:

- Warning Sign: Failure at $75.00 resistance

- Breakdown Signal: Drop below $70.00 support

- Critical Failure: Close below $65.00

Strategic Trading Approach

For investors/traders targeting the upside:

- Entry Strategies:

- Conservative: Wait for break above $80.00

- Moderate: Scale in between $72-$75

- Aggressive: Current levels with tight stops

- Stop Placement:

- Below $70.00 for short-term trades

- Below $65.00 for long-term positions

- Profit-Taking:

- First target at $84.44 (partial)

- Second target at $99.12

- Final target at $116.73

Key Fundamental Factors to Monitor

- Earnings Reports: Revenue growth and guidance

- Competitive Landscape: Market share vs Microsoft Teams

- Enterprise Adoption: Corporate contract renewals

- Macro Environment: Remote work trends

- Profitability Metrics: Operating margin improvements

Conclusion: Cautious Optimism for Recovery

Zoom presents a compelling technical setup with multiple achievable upside targets if current support holds. The path to $84.44 appears reasonable in the near-term, while the $99.12 and $116.73 targets would require sustained fundamental improvements. Traders should remain mindful of the stock’s volatility and manage risk appropriately.