Guide to Building Wealth When You Have No Savings at 30

Feeling behind because you’ve hit 30 with little to no savings? You’re not alone, and it’s not too late. This guide provides a clear, actionable path to shift from financial anxiety to confidence. We’ll show you how to build a solid financial foundation, create a powerful savings habit, and make your money work for you, starting today.

For individuals in the US, Canada, UK, and Australia, this guide will help you navigate tax-advantaged accounts like 401(k)s, IRAs, RRSPs, TFSAs, and Superannuation to accelerate your journey.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To create a sustainable financial plan to build savings, invest for the future, and achieve long-term security starting at age 30. |

| Skill Level | Beginner |

| Time Required | 3-4 hours for initial setup; 1-2 hours per month for maintenance. |

| Tools Needed | Budgeting app (e.g., Mint, YNAB), spreadsheet, online brokerage/savings account. |

| Key Takeaway | Consistency and time are your greatest allies. Starting at 30 gives you a 35-year runway until traditional retirement, more than enough time to build significant wealth. |

Why Starting Your Savings Journey at 30 is Crucial

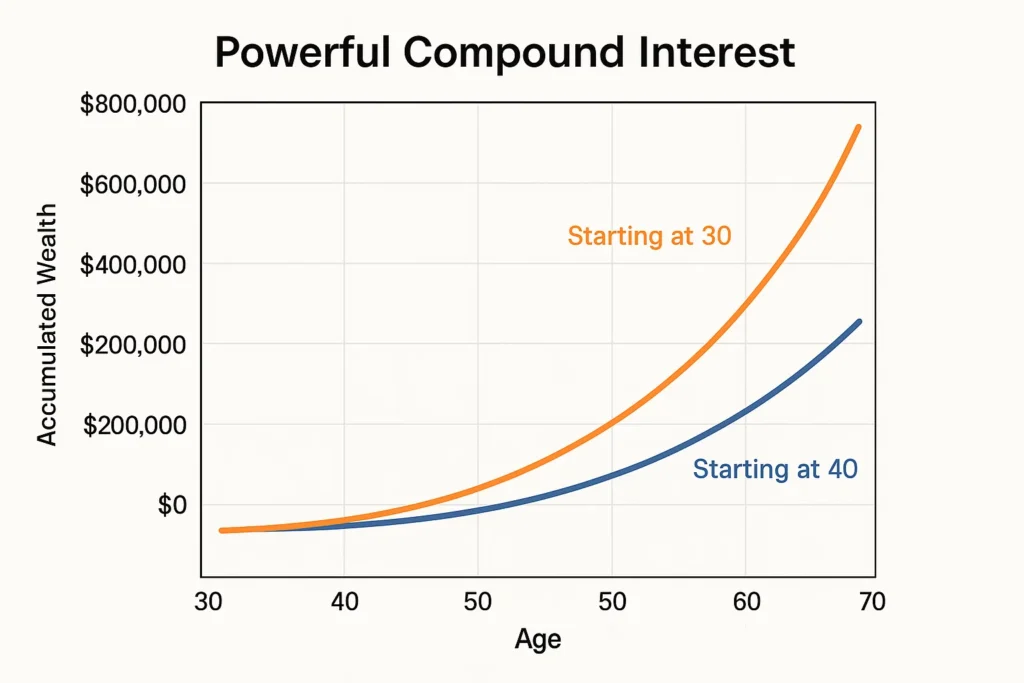

The problem isn’t that you’re starting at 30; it’s the inaction that follows the worry. The problem is a growing gap between your future needs and your current resources, leading to stress and limited choices. But by taking control now, you harness two powerful forces: your peak earning years that lie ahead, and the magic of compound interest. The outcome is a future where you are in charge, not your bills.

The Mindset Shift: From Panic to Power at 30

Hitting 30 with little to show financially can trigger a wave of shame, anxiety, and a sense of permanent failure. The most critical step isn’t mathematical; it’s psychological. You must reframe your narrative.

Why You Feel This Way:

- The Comparison Trap: Social media and cultural pressure create unrealistic benchmarks. You’re comparing your behind-the-scenes to everyone else’s highlight reel.

- The Ostrich Effect: It’s human nature to avoid painful information. Ignoring your finances feels better in the short term but is catastrophic in the long term.

- All-or-Nothing Thinking: Believing that if you can’t save a huge amount, it’s not worth saving anything at all.

Your New Empowering Narrative:

- You’re Not Behind, You’re Ahead of Your Future Self: The person you will be at 40, 50, and 60 is relying on the decisions you make today. By starting now, you are making a conscious choice to be their hero.

- Your 30s Are Your Prime Launchpad: You likely have more earning potential, life experience, and discipline than you did in your 20s. This is the perfect time to build a sustainable plan.

- Action Cures Anxiety: The feeling of being overwhelmed is paralyzing. The moment you take one small, concrete action, like opening a savings account or tracking a day’s spending, you reclaim a sense of control, and the anxiety begins to subside.

Actionable Mindset Exercise: Write down one financial fear. Now, write down one small action you can take this week to address it. The action is your antidote to the fear.

What You’ll Need Before You Start

To begin this journey, you don’t need a finance degree or a windfall. You just need a few key things:

- Knowledge Prerequisites: Basic understanding of your own income and expenses.

- Data Requirements: Your recent pay stubs, bank statements, and a list of your monthly bills and debts.

- Tools & Platforms: A budgeting tool (app or spreadsheet) and access to a reputable bank or credit union.

To easily track your spending and set budgets automatically, you’ll need a reliable app. Many of the best personal finance apps, like Mint or YNAB, sync directly with your accounts. For investing, robo-advisors like Wealthfront or Betterment simplify the process for beginners.

How to Build Wealth from Scratch: A Step-by-Step Walkthrough

Step 1: Conduct a Financial Triage

Before you can run, you must stop the bleeding. This step is about understanding your exact financial situation without judgment.

- List All Debts: Write down every debt, credit cards, student loans, car loans, with their balances, interest rates, and minimum payments.

- Track Every Dollar: For one month, track every single expense. This reveals your true spending habits.

- Calculate Your Net Worth: (Assets – Liabilities). This is your starting line; it will be negative for many, and that’s okay.

Pro Tip: Use a free app that links to your accounts to automate the tracking process. It’s less painful and more accurate.

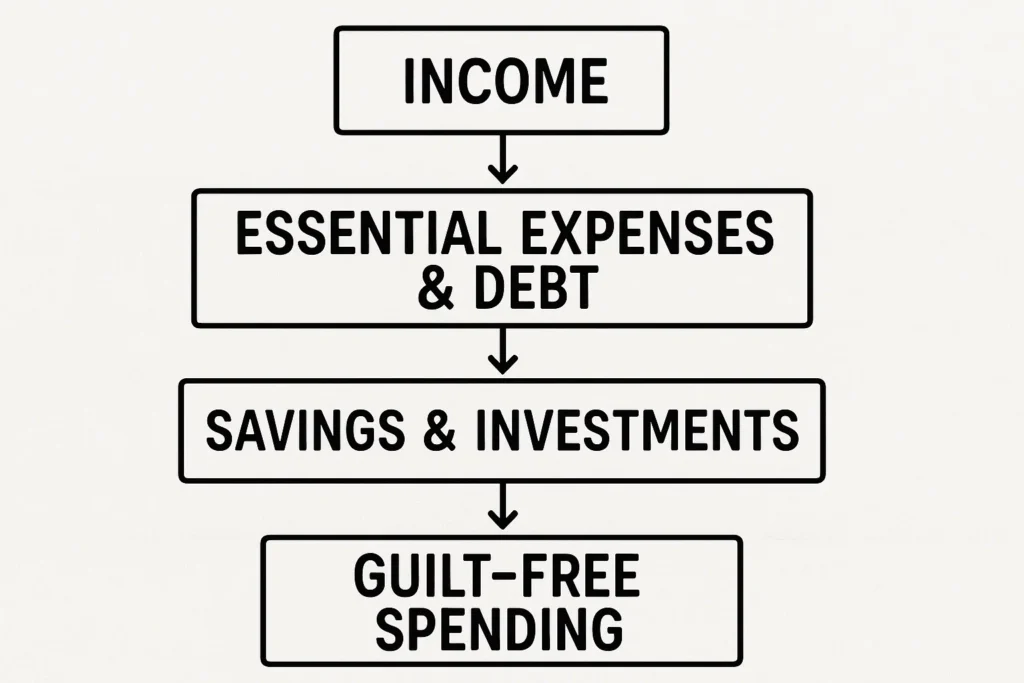

Step 2: Create a Zero-Based Budget

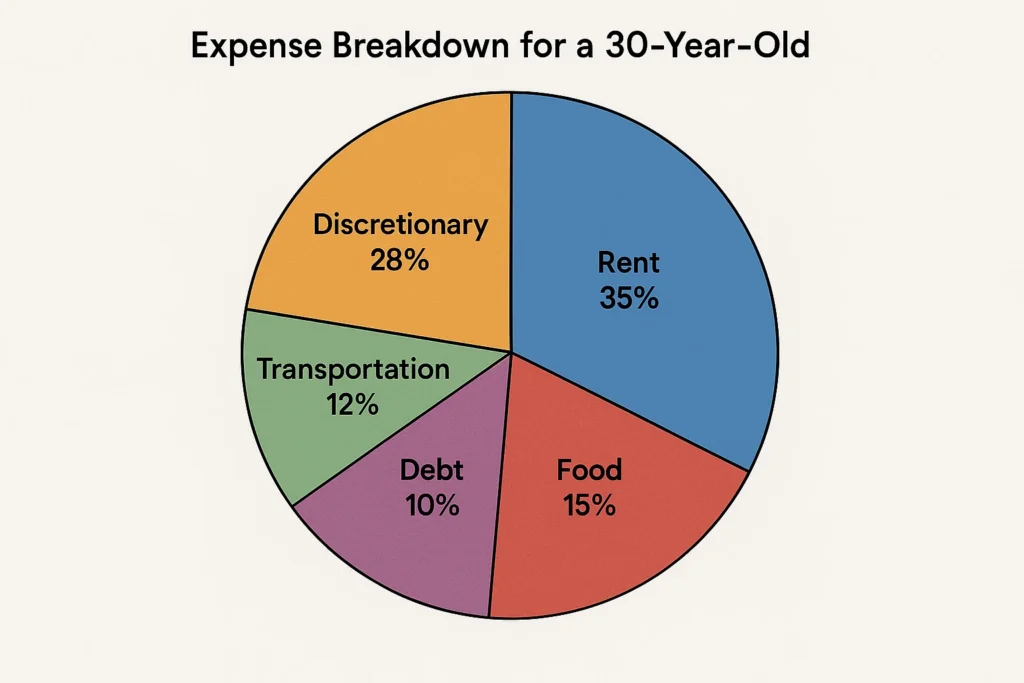

Now, give every dollar a job. A zero-based budget means your income minus your expenses equals zero. You choose where each dollar goes before the month starts.

- Start with essential expenses (rent, utilities, groceries, minimum debt payments).

- Allocate money to your new savings goals.

- The remaining money is for discretionary spending.

Common Mistake to Avoid: Creating an overly restrictive budget that you can’t stick to. Allow for some fun money to avoid burnout.

Step 3: Build Your Emergency Fund

This is your financial shock absorber. It prevents you from going into debt when an unexpected expense arises.

- Initial Goal: Save $1,000 as fast as possible.

- Full Goal: Build up to 3-6 months’ worth of essential living expenses.

- Location: Keep this money in a separate, high-yield savings account where it’s safe and accessible.

Pro Tip: Set up an automatic transfer to your savings account right after you get paid. Pay yourself first.

Step 4: Tackle High-Interest Debt

Debt, especially from credit cards, is a wealth-destroying machine. Your goal is to eliminate it.

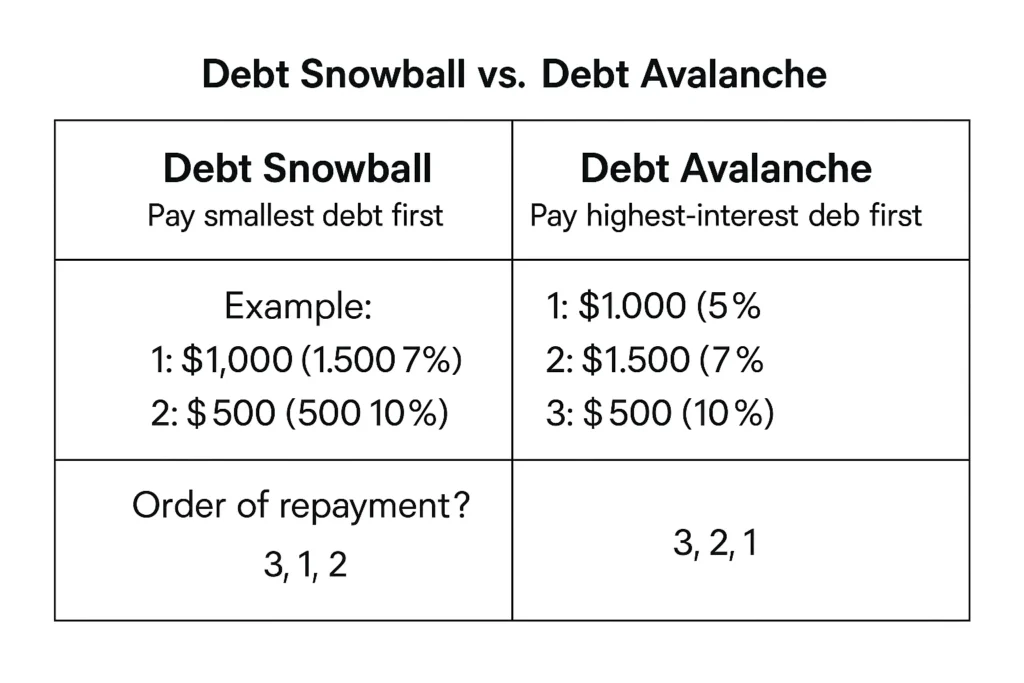

- Strategy: Use either the Debt Snowball (pay off smallest debts first for psychological wins) or the Debt Avalanche (pay off highest-interest debts first to save more on interest).

- Formula: Minimum payments on all debts + any extra cash toward your target debt.

Step 5: Begin Investing for the Long Term

This is how you build real wealth. At 30, your time horizon is your superpower.

- Start with your employer’s retirement plan (e.g., 401(k)), especially if there’s a company match. This is free money.

- Open an IRA (Roth or Traditional). This gives you more control over your investments.

- Invest in low-cost, diversified index funds or ETFs. Don’t try to pick individual stocks.

Example: If you invest $500/month with an average 7% annual return, you’ll have over $1 million by age 67.

How to Use Your New Financial Plan in Your Life

Scenario 1: The Overwhelmed Debtor: Your focus is 80% on Step 4 (Debt) and 20% on Step 3 (Small Emergency Fund). Once high-interest debt is gone, you re-allocate that money to full emergency funding and investing.

Scenario 2: The Debt-Free but Saver: You have no debt but no savings. Your focus should be a 50/50 split between rapidly building your emergency fund (Step 3) and beginning to invest (Step 5).

Case Study: Meet Alex, 30, with $0 savings and $8,000 in credit card debt. By following these steps, he first saved a $1,000 emergency fund in two months. He then used the debt avalanche method to pay off his credit card in 14 months. Now, he’s investing $400/month into his 401(k) and a Roth IRA, and he’s on track to be a millionaire by 60.

Tailoring Your Plan: A Blueprint for Your Income Level

A one-size-fits-all plan doesn’t work. Your specific strategy depends heavily on your take-home pay. Below are tailored blueprints for different income brackets. The percentages are guidelines for your total pre-tax income.

If You Earn Around $40,000 – $55,000 Per Year

- Your Focus: Foundation and Cash Flow. Your primary goal is to create a stable financial base and eliminate high-interest debt that cripples your limited budget.

- Sample Allocation:

- Emergency Fund (Step 3): Get to $1,000 ASAP. Then, slowly build to a full 3-month fund as a long-term goal.

- Debt (Step 4): This is your #1 priority after the mini emergency fund. Use the Debt Snowball method for the motivational wins.

- Investing (Step 5): Start small. If you have a 401(k) match, contribute just enough to get the full match, it’s an instant 100% return. If not, start with 3-5% in a Roth IRA. Your main wealth-building tool right now is getting out of debt.

- Key Strategy: Aggressive Budgeting. Every dollar saved from your budget has a massive impact. Focus on your top three expenses: Housing, Food, and Transportation. Can you find a roommate, meal prep more, or use public transit?

If You Earn Around $60,000 – $85,000 Per Year

- Your Focus: Balance and Acceleration. You have significant margin to work with if you can control lifestyle inflation.

- Sample Allocation:

- Emergency Fund (Step 3): Build a full 3-4-month fund relatively quickly.

- Debt (Step 4): Use the Debt Avalanche method to save on interest. You can tackle debt and save simultaneously.

- Investing (Step 5): Target a 12-15% savings rate. This should include maximizing your 401(k) match and fully funding a Roth IRA ($6,000/year or whatever the current limit is).

- Key Strategy: Automation. Set up computerized transfers to your reserves and investment accounts on payday. This makes wealth-building effortless and prevents you from accidentally spending your surplus.

If You Earn $90,000+ Per Year

- Your Focus: Maximization and Aggressive Growth. Your biggest threat is lifestyle creep. Your goal is to channel your high income into assets before you get used to spending it.

- Sample Allocation:

- Emergency Fund (Step 3): Build a robust 4-6-month fund.

- Debt (Step 4): Eliminate all non-mortgage debt within 12-18 months. You have the cash flow to do it.

- Investing (Step 5): Target an 18-20%+ savings rate. Max out your 401(k) ($22,500+ per year) and your Roth IRA. Any extra can go into a taxable brokerage account.

- Key Strategy: Pay Yourself First at Scale. Live on 70-80% of your income from day one of a new salary. Automate the remaining 20-30% directly to savings and investments.

Common Mistakes When Starting Late

- Pitfall 1: Trying to do everything at once and getting overwhelmed.

- Solution: Focus on one step at a time. Master your budget before aggressively attacking debt. Build your emergency fund before complex investing.

- Pitfall 2: Comparing your Chapter 1 to someone else’s Chapter 20.

- Solution: Unfollow social media accounts that trigger financial envy. Your journey is unique. Focus on your own progress graph.

- Pitfall 3: Letting one setback derail your entire plan.

- Solution: A budget is a guide, not a straitjacket. If you overspend one month, adjust and move on. The goal is progress, not perfection.

- Clarity and Reduces Stress: You know exactly where your money is going and why.

- Builds Powerful Habits: The system creates automatic, positive financial behaviors.

- Harnesses Compound Interest: Starting at 30 still gives you decades for your money to grow exponentially.

- Requires Discipline: It’s not a get-rich-quick scheme. It requires consistent monthly effort.

- Delayed Gratification: You will have to say no to some things today to secure your tomorrow.

- Market Risk: Investing involves volatility, but a long-time horizon smooths out the risk.

Taking It to the Next Level

Once you’ve mastered the basics and have your cash flow and investments on autopilot, you can explore advanced strategies:

- Tax-Efficient Investing: Learn about asset location, placing less tax-efficient investments in tax-advantaged accounts.

- Financial Independence (FI): Explore the FIRE (Financial Independence, Retire Early) movement. While aggressive, its principles can help you accelerate your goals.

- Real Estate Investing: Consider if owning rental property aligns with your skills and risk tolerance.

The Catch-Up Playbook: Supercharging Your Savings

If you’re highly motivated to close the gap faster, here are powerful, advanced strategies beyond the basics.

1. The Side Hustle Arbitrage

Don’t just get a side gig to earn extra cash. Be strategic about it.

- The Rule: Dedicate 100% of your side hustle income after taxes to a specific financial goal.

- Example: All freelance design money goes directly to my Roth IRA. or All Uber earnings go straight to my debt avalanche. This creates a powerful, direct link between your extra effort and your financial progress, making it incredibly motivating.

2. Master Mini-Sprints

Instead of a year-long grind, try 3-month sprints focused on one goal.

- How it works: For 90 days, you go into an aggressive, hyper-focused mode on one target (e.g., Save $3,000, Pay off $2,500 of debt). You cut all non-essential spending. After the sprint, you return to your normal, sustainable budget for a few months to avoid burnout, then launch the next sprint.

3. Strategic Geo-Arbitrage (If Possible)

This is a high-impact, life-changing lever.

- The Concept: If your job is remote or you can change locations, moving to a lower cost-of-living area while maintaining your salary (or a strong local wage) can free up thousands of dollars per year for savings.

- Less Drastic Version: Simply moving to a more affordable apartment in your current city can have a similar, though smaller, effect.

4. Exploit Tax-Advantaged Catch-Up Contributions

Once you turn 50, the IRS allows you to contribute extra to retirement accounts. While this is a future tool, knowing it exists is part of the plan. It means the system is designed to help those who need to accelerate later in life.

Your Decade of Transformation

Wealth is not built in a day, but it is built daily. Understanding the long-term, non-linear nature of this journey is key to staying motivated. Here’s a realistic vision of what your next decade could look like.

Phase 1: The Foundation Years (Years 0 – 2)

- Focus: Triage, Budgeting, Debt Destruction, and Initial Emergency Fund.

- How It Feels: The hardest phase. You’re making sacrifices without seeing major rewards. It feels like pushing a boulder uphill.

- Key Milestone: You become net debt-free (excluding a mortgage). Your budget is a well-oiled machine. The financial anxiety has significantly decreased.

Phase 2: The Growth Engine Ignites (Years 3 – 5)

- Focus: Fully funding your emergency fund (3-6 months). Consistently hitting your 15%+ investment target. Your invested assets start to show meaningful growth.

- How It Feels: The boulder starts to roll on its own. You see your net worth graph turn positive and begin to curve upwards. You feel a profound sense of control and confidence.

- Key Milestone: Your investment account balances surpass your emergency fund. Compound interest is now visibly working for you.

Phase 3: The Acceleration Phase (Years 6 – 10)

- Focus: Maximizing contributions. Your career advances and salary increases allow you to save even more. You explore advanced topics like tax-efficient investing or saving for a down payment.

- How It Feels: Exciting and empowering. Your financial momentum is undeniable. You are no longer just getting by; you are actively building the future you want.

- Key Milestone: Your investment portfolio generates more in annual growth than you contribute from your salary. This is a psychological tipping point where your money is doing the heavy lifting.

Structured Financial Plan vs Winging It/Passive Income

| Feature | Structured Financial Plan | Winging It / Passive Saving |

|---|---|---|

| Approach | Proactive, intentional | Reactive, based on what’s left over |

| Wealth Building | Systematic and predictable | Erratic and highly dependent on income |

| Stress Level | Low (once established) | High (constant financial anxiety) |

| Outcome | Financial security and choice | Perpetual cycle of living paycheck-to-paycheck |

Conclusion

You now have a proven, step-by-step blueprint to go from $0 to financial security. The math is on your side. Remember, the single most important step is to start. Your 40-year-old self will look back and thank you for the decisions you make today. Don’t aim for perfection; aim for starting. Open that savings account, look at your budget, and take one small action right now.