Rent Affordability Calculator Know Your Monthly Rent

Rent Affordability Calculator

Fill in your financial details below to calculate how much rent you can afford

Your Rent Affordability Results

Budget breakdown visualization will appear here

Budget Assessment

Your personalized assessment will appear here after calculation.

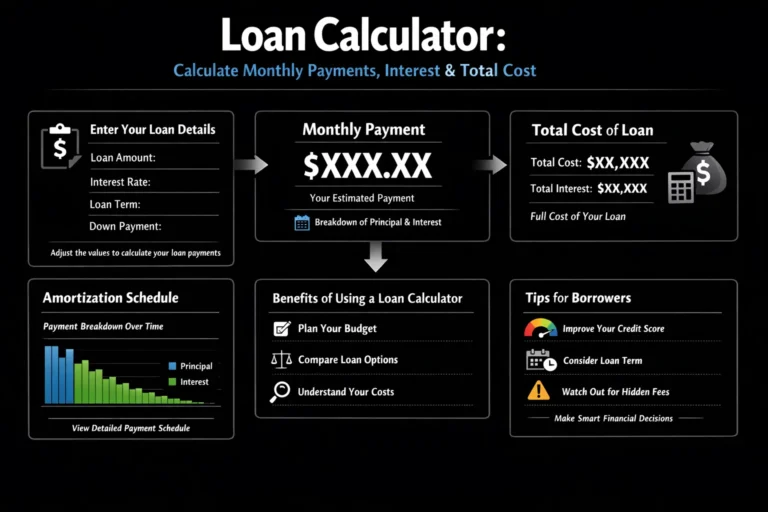

How to Use the Rent Affordability Calculator

Step-by-step instructions:

- Enter Your Monthly Gross Income: Input your total pre-tax monthly income from all sources (salary, freelance work, investments, etc.)

- Input Monthly Essential Expenses: Include regular expenses like groceries, utilities, transportation, insurance, and subscriptions

- Add Monthly Debt Payments: Include all loan payments (student loans, car loans, credit card minimums)

- Set Your Savings Goal: Use the slider to select what percentage of your income you want to save each month

- Adjust Rent-to-Income Ratio: The default is 30%, but you can adjust based on your comfort level

- Include Other Housing Costs: Add costs like renter’s insurance, parking fees, or pet deposits

- Optional: Enter Desired Rent: See how a specific rent amount fits your budget

- Click “Calculate Affordability“: Get instant results and personalized recommendations

Interpretation of Results:

- Maximum Recommended Rent: The highest rent you can afford while maintaining your savings goals

- 30% Rule Rent Limit: Traditional guideline suggesting rent should not exceed 30% of gross income

- 50/30/20 Budget Rent: Rent amount that fits the popular budgeting framework

- Remaining Monthly Budget: Money left after all expenses, debt, savings, and rent

- Housing Cost Ratio: What percentage of your income would go toward rent

- Budget Status: Assessment of your housing affordability (Very Comfortable to Strained)

How Rent Affordability is Calculated

Explanation of Methodology:

This calculator uses multiple financial planning principles to determine rent affordability:

- 30% Rule: The traditional guideline suggests that no more than 30% of your gross monthly income should go toward rent. This rule originated from U.S. public housing standards in the 1960s and has become a standard benchmark.

- 50/30/20 Budget Rule: This modern budgeting framework allocates:

- 50% to Needs (rent, groceries, utilities, minimum debt payments)

- 30% to Wants (dining out, entertainment, hobbies)

- 20% to Savings and Debt Repayment

- Comprehensive Calculation: The calculator considers:textAvailable for Rent = Monthly Income – Essential Expenses – Debt Payments – Savings Goal – Other Housing Costs

Example Calculation:

If you earn $4,000 monthly with $800 expenses, $300 debt, 15% savings goal ($600), and $100 other housing costs:

- 30% Rule: $4,000 × 0.30 = $1,200

- Available for Rent: $4,000 – $800 – $300 – $600 – $100 = $2,200

- Maximum Recommended Rent: Minimum of above values = $1,200

How to Apply These Results to Your Rental Strategy

Actionable Advice:

- If Results Show “Very Comfortable” Budget: You have flexibility to choose a nicer apartment, save more aggressively, or allocate funds to other financial goals. Consider locations with better amenities or shorter commutes.

- If Results Show “Comfortable” Budget: Stick close to your recommended maximum. Look for apartments that offer good value rather than luxury features. Prioritize location and safety over square footage.

- If Results Show “Moderate” Budget: Consider finding a roommate to split costs, looking for apartments slightly outside premium locations, or negotiating for utilities included in rent.

- If Results Show “Strained” Budget: You may need to adjust other expenses, increase income through side work, or consider temporary housing solutions while improving your financial situation.

Common Mistakes to Avoid:

- Ignoring Hidden Costs: Don’t forget about security deposits, moving costs, and utility setup fees

- Underestimating Expenses: Be realistic about your spending habits

- Maxing Out Your Budget: Leave room for unexpected expenses and rent increases

- Forgetting Future Goals: Consider how your rent affects long-term savings for emergencies, retirement, or major purchases

Advanced Rent Calculation Scenarios

Complex Use Cases:

- Multiple Income Households: For couples or roommates, calculate combined income but also consider individual financial responsibilities and potential income changes.

- Variable Income (Freelancers/Gig Workers): Use your average monthly income over the past 12 months, but be conservative. Landlords often require proof of consistent income.

- Student Budgeting: Students should consider using net income (after tuition and books) and explore student housing options, which may have different affordability calculations.

- Short-Term vs Long-Term Rentals: Short-term rentals (under 6 months) often cost 20-40% more than long-term leases. Factor this into temporary housing decisions.

Comparison of Strategies:

- Conservative Approach (25% Rule): More financial flexibility but may mean sacrificing location or amenities

- Balanced Approach (30% Rule): Standard recommendation for most urban areas

- Aggressive Approach (35%+ Rule): Only recommended for high-income earners with low other expenses

Important Considerations for Rent Budgeting

What the Calculator Doesn’t Account For:

- Local Market Conditions: In high-cost cities like San Francisco, New York, or London, the 30% rule may be unrealistic. Consider local averages from resources like Zillow Research or RentCafe.

- Credit Score Impact: Landlords may require higher income multiples if you have poor credit. The standard is often 3x rent in monthly income.

- Future Income Changes: Consider job stability, potential raises, or career changes when committing to a lease.

- Emergency Fund: Always maintain 3-6 months of expenses in savings before allocating maximum to rent.

When to Consult a Financial Professional:

- If your housing costs consistently exceed 40% of income

- When considering major lifestyle changes (buying vs renting)

- If you have significant debt alongside housing decisions

- When planning for major financial goals (home purchase, retirement)

Frequently Asked Questions About Rent Affordability

Other Financial Calculators You Might Find Useful

- Mortgage Affordability Calculator: Determine how much house you can afford based on income, debt, and down payment

- Debt-to-Income Ratio Calculator: Calculate your DTI ratio to understand your overall debt burden

- Cost of Living Calculator: Compare living expenses between different cities or neighborhoods

- Savings Goal Calculator: Plan how much to save each month to reach your financial goals

- Budget Planner Tool: Create a comprehensive monthly budget based on your income and expenses