GBPUSD Price Analysis Strong Resistance and Downside Targets Ahead

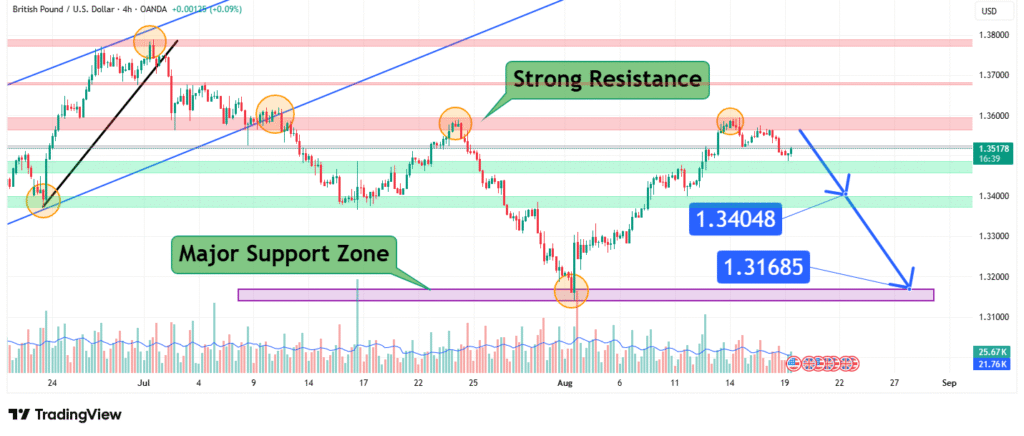

The GBP/USD pair has been trading under pressure after failing to sustain gains above a strong resistance zone. Despite short-term rebounds, the overall price structure suggests weakness, and the pair may be preparing for another leg lower. In this article, we analyze the current technical setup, highlight critical resistance and support zones, and outline our downside price predictions of 1.340 and 1.316 USD.

Current Market Overview

The pair is currently trading near 1.3517, where it faces a significant overhead resistance. Market sentiment has shifted from bullish to neutral-to-bearish after repeated failures at this level. Sellers appear to be regaining control, increasing the likelihood of a retracement toward key support zones.

Trading volumes also indicate reduced buying activity, a sign that bullish momentum is weakening. This shift could open the door for a corrective decline in the near term.

Strong Resistance Zone

The red resistance area around 1.3600 – 1.3700 has proven to be a tough barrier for buyers. Multiple rejections from this level, as highlighted on the chart, confirm it as a major resistance zone. Unless GBP/USD can break and sustain above this range, the pair will likely struggle to establish a stronger bullish trend.

Predicted Downside Targets

- First Target: 1.340 USD

- The first level to watch on the downside is around 1.340 USD. This level sits within a minor support zone where price may attempt a short-term bounce. However, a failure to hold here would likely invite more selling pressure.

- Second Target: 1.316 USD

- If bearish momentum strengthens further, GBP/USD could decline to 1.316 USD, which coincides with the major support zone highlighted on the chart. This level has historically acted as a strong base, making it a crucial price point for traders to monitor.

Major Support Zone

The purple zone around 1.316 USD is the critical support area for the pair. A breakdown below this level could significantly change the broader market structure, potentially triggering deeper bearish moves. On the other hand, if buyers step in strongly here, the pair may consolidate before attempting another rebound.

Market Outlook and Trading Considerations

While the long-term outlook for GBP/USD remains influenced by macroeconomic factors such as interest rates and dollar strength, the short-term technical structure favors the bears. Traders should closely watch price action near 1.340 USD and 1.316 USD for confirmation of potential reversals or breakdowns.

For risk management, short positions should consider stop-loss placements above 1.360 USD, where the resistance zone has repeatedly rejected price advances. Conversely, if GBP/USD breaks above this resistance with strong volume, it could invalidate the bearish targets and trigger a rally.

Conclusion

The GBP/USD pair is currently at a crossroads, facing heavy resistance near 1.3600. If sellers maintain control, the pair could drop toward 1.340 USD and potentially extend losses to 1.316 USD. Traders should stay cautious and adapt their strategies according to how the market reacts around these key technical levels.

How did this post make you feel?

Thanks for your reaction!