Asset Allocation What Is It, How to Implement, Pros and Cons

Asset allocation is the foundational strategy of dividing an investment portfolio among different asset categories, such as stocks, bonds, and cash. It is the most significant factor shaping your portfolio’s potential for gains and its susceptibility to loss, a factor that frequently has a greater influence than the choice of specific stocks or funds. For investors in the US, UK, Canada, and Australia, mastering asset allocation is key to building wealth through vehicles like 401(k)s, ISAs, RRSPs, and superannuation funds.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | An investment strategy that balances risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance, and investment horizon. |

| Also Known As | Portfolio Diversification, Strategic Allocation |

| Main Used In | Portfolio Management, Retirement Planning, Personal Investing |

| Key Takeaway | Your asset allocation is the single most important decision you will make as an investor, as it is the main driver of long-term returns and risk. |

| Formula | N/A (It is a strategic framework, not a calculation) |

| Related Concepts |

What is Asset Allocation

At its core, asset allocation involves strategically dividing your capital among different types of investments, such as equities, fixed income, and cash. The goal is not to pick the single best-performing investment, but to create a mix of assets that collectively can help you achieve your financial goals while staying within your comfort zone for risk.

Key Takeaways

The Core Concept Explained

Think of asset allocation like building a dinner plate. Think of it as constructing a well-rounded meal; each component plays a vital role in your overall financial health. You allocate a certain portion to protein (stocks for growth), a portion to carbohydrates (bonds for income and stability), and a portion to vegetables (cash or other assets for safety and liquidity). The exact portions depend on your dietary needs (goals) and tastes (risk tolerance).

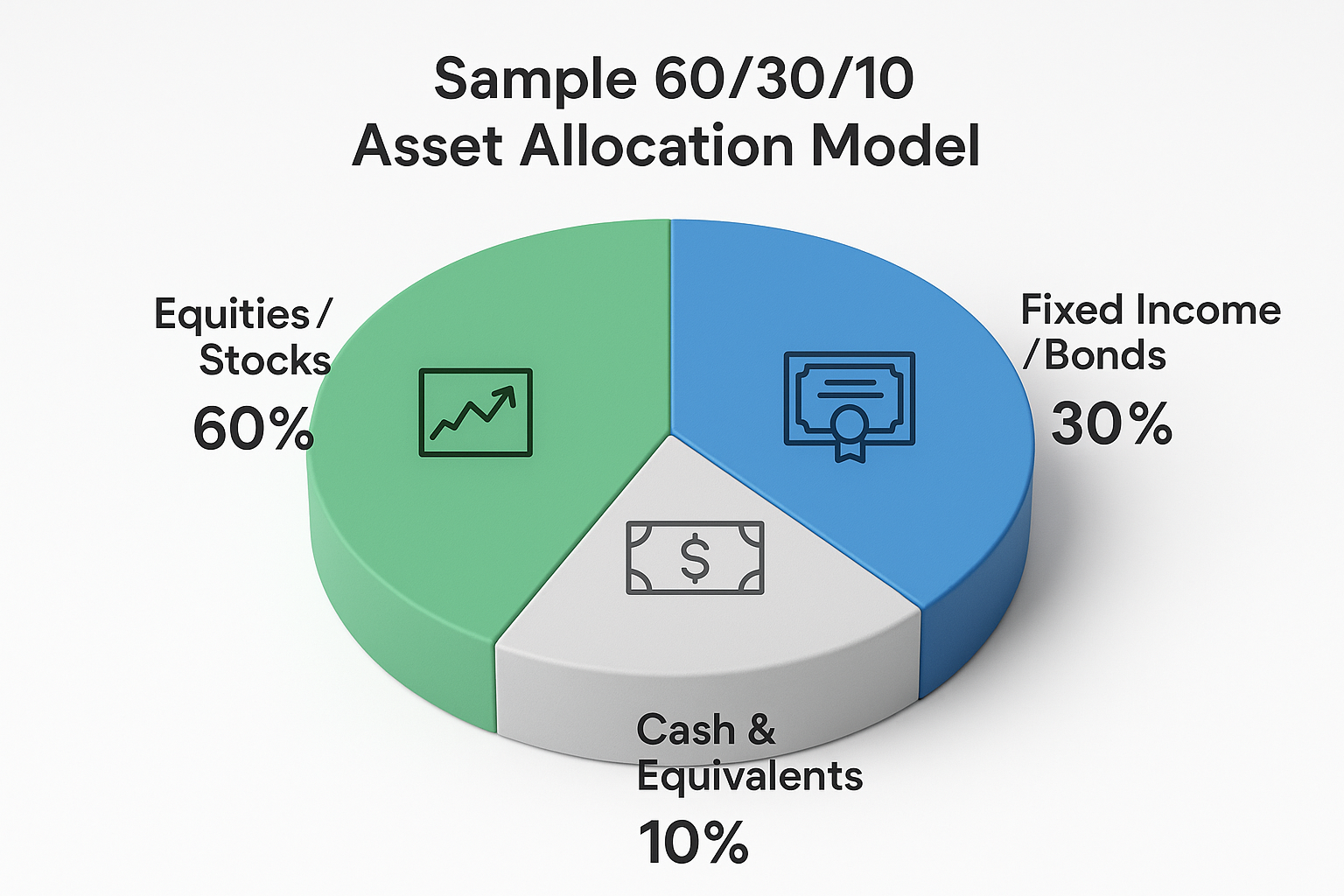

The three primary asset classes are:

- Equities (Stocks): Represent ownership in companies. They present the greatest opportunity for growth but are also accompanied by significant price swings and the potential for substantial loss.

- Fixed Income (Bonds): Represent loans to governments or corporations. Provide regular income and are generally less volatile than stocks, but offer lower growth potential.

Cash and Cash Equivalents: This category encompasses highly liquid and stable instruments like money market accounts, short-term Treasury bills, and high-yield savings accounts. Offers high liquidity and stability but very low returns, often failing to outpace inflation.

Other classes like real estate (REITs), commodities, and cryptocurrencies can be added for further diversification.

How is Asset Allocation Determined

Since it’s a strategy, asset allocation isn’t “calculated” with a single formula. Instead, it is determined by three key personal factors:

- Investment Goal: What are you investing for? (e.g., retirement in 30 years, a down payment on a house in 5 years, income next year).

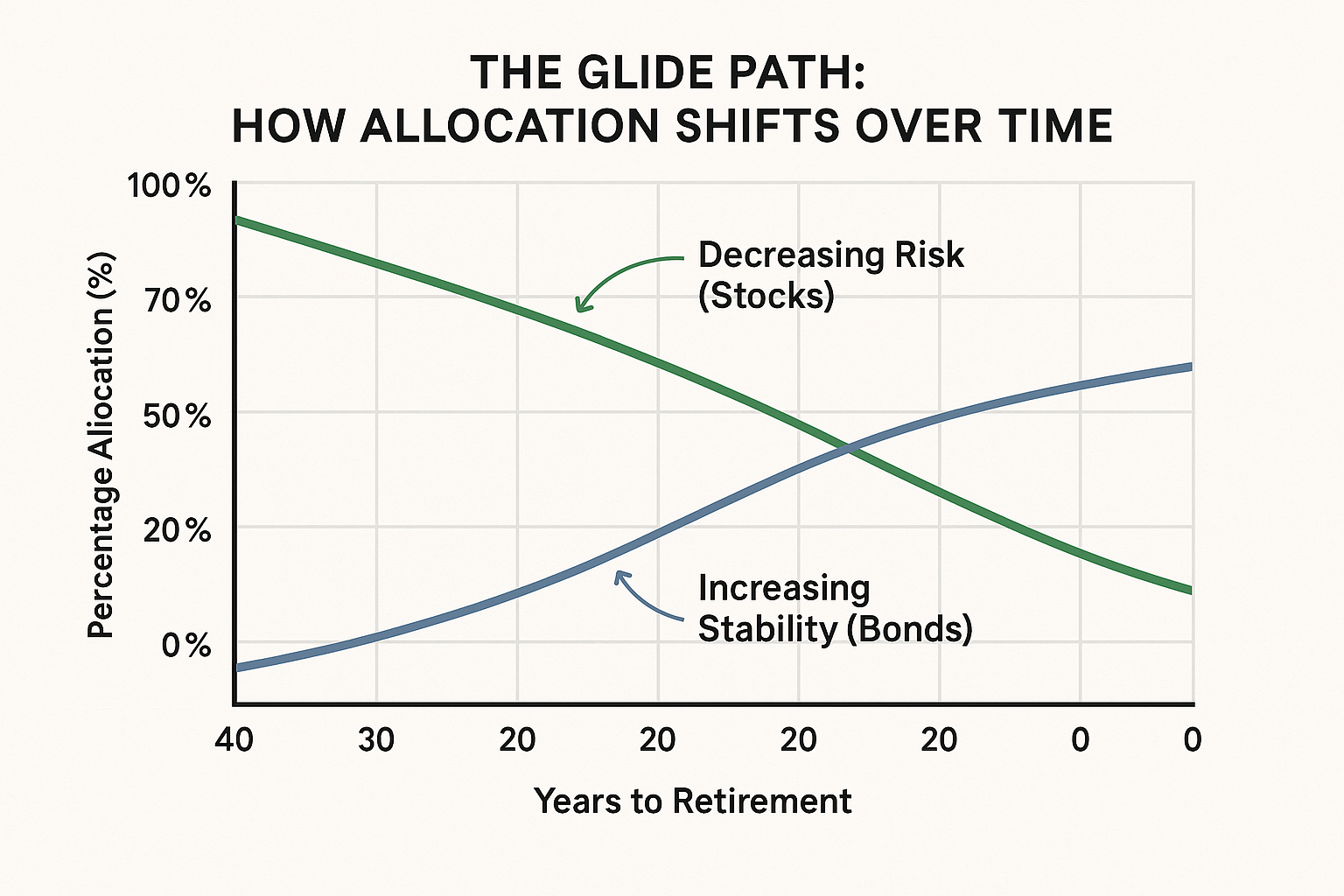

- Time Horizon: How long until you need to access the money? Investors with many years until they need the funds can generally afford to adopt a more growth-oriented strategy with a larger equity weighting.

- Risk Tolerance: How much volatility can you stomach emotionally and financially without panicking and selling?

A common heuristic is the “100 minus age” rule, though it’s considered simplistic by modern standards.

- Formula: % Allocation to Stocks = 100 – Your Age

- Example: A 40-year-old would allocate 60% to stocks and 40% to bonds.

A more nuanced approach uses risk questionnaires to place investors into categories, each with a sample allocation.

| Investor Profile | Time Horizon | Risk Tolerance | Sample Allocation (Stocks/Bonds/Cash) |

|---|---|---|---|

| Conservative | Short-Term (<5 years) | Low | 40% / 50% / 10% |

| Moderate | Mid-Term (5-10 years) | Medium | 60% / 35% / 5% |

| Aggressive | Long-Term (>10 years) | High | 80% / 15% / 5% |

For a UK investor, their stock allocation might be split between a FTSE 100 tracker and a global equity fund, while their bond portion could include UK gilts. A US investor might use S&P 500 and NASDAQ ETFs alongside US Treasury bonds.

Why Asset Allocation Matters to Traders and Investors

Its importance cannot be overstated. Landmark studies, including one from Brinson, Hood, and Beebower (1986), found that over 90% of a portfolio’s variation in returns over time is attributable to asset allocation, not market timing or security selection.

- For Investors: It provides a disciplined framework to avoid emotional decisions, like buying at market peaks (greed) and selling at troughs (fear). It is the bedrock of a buy-and-hold strategy.

- For Retirement Planners: It dictates the growth trajectory of a nest egg. A proper allocation helps ensure you don’t outlive your money.

- For Everyone: It is the most effective tool for managing risk. By holding uncorrelated assets (when stocks zig, bonds often zag), you smooth out your portfolio’s ride.

How to Use Asset Allocation in Your Strategy

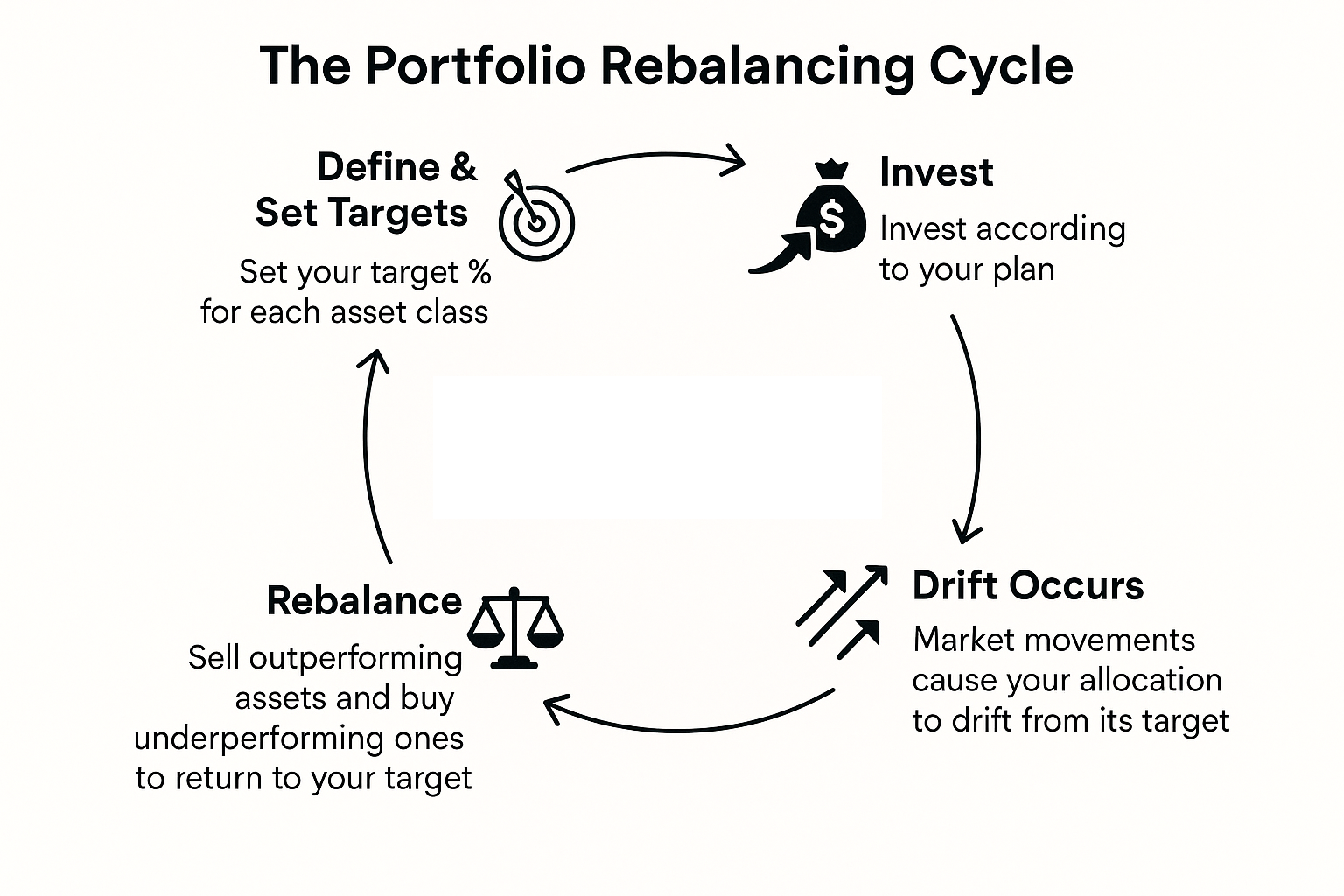

Putting an asset allocation plan into action is not a one-time event but an ongoing practice of maintenance and adjustment.

- Define Your Parameters: Determine your goal, time horizon, and risk tolerance. Use an online questionnaire from a reputable source like Vanguard or Fidelity for guidance.

- Choose Your Percentages: Based on your parameters, set target percentages for each asset class (e.g., 70% stocks, 25% bonds, 5% cash).

- Select Your Investments: Choose the specific vehicles to fill each allocation. This is where you pick ETFs, mutual funds, or individual stocks and bonds.

- Rebalance Periodically: Over time, market movements will cause your allocation to drift from its target. A stock market rally might push your 70% stock allocation to 80%. Rebalancing involves selling some of the outperforming asset and buying more of the underperforming one to return to your target. This enforces the discipline of “buy low, sell high.”

Choosing the right investments is crucial. To implement this strategy effectively, you’ll need access to a brokerage platform that offers a wide range of low-cost ETFs and mutual funds.

- Risk Management: It is the most powerful tool for controlling portfolio volatility.

- Discipline: It establishes a logical framework to help investors steer clear of making impulsive decisions driven by market fear or greed.

- Diversification: It helps mitigate the negative effect that the downturn of one particular investment can have on the entire portfolio.

- Customization: Can be tailored to any investor’s unique situation.

- Does Not Eliminate Risk: It manages risk but cannot prevent losses in a broad market downturn.

- No Guarantee of Performance: A conservative allocation may not generate the returns needed to meet a long-term goal.

- Requires Maintenance: Portfolios must be monitored and rebalanced to stay on track.

Asset Allocation in the Real World: A Case Study

The 2008 Global Financial Crisis is a stark example of asset allocation at work.

- The Scenario: The S&P 500 (stocks) lost approximately -37% in 2008. However, the Bloomberg Barclays US Aggregate Bond Index (bonds) gained +5.24%.

- The Impact: An investor with a 100% stock portfolio would have seen their account value plummet by over a third. An investor with a 60% stock / 40% bond allocation would have experienced a significantly smaller loss, estimated around -20%. While still painful, the bond portion acted as a crucial shock absorber, preventing financial ruin and allowing the portfolio to recover more quickly in the subsequent bull market.

This played out in major markets worldwide: the UK’s FTSE 100 fell -31.3%, while gilts provided stability. This highlights the universal importance of allocation across US, UK, and other global markets.

Asset Allocation vs Diversification

It’s easy to confuse asset allocation with diversification. They are related but distinct.

| Feature | Asset Allocation | Diversification |

|---|---|---|

| What it is | The high-level strategy of dividing money between asset classes (stocks vs. bonds). | The tactical practice of spreading money within an asset class (different stocks, different bonds). |

| Primary Goal | To balance risk and reward according to personal goals. | Its aim is to lessen the overall damage caused by the underperformance of an individual stock or bond. |

| Example | Deciding to put 70% in stocks and 30% in bonds. | Within the 70% stock allocation, investing in 50 different companies across various sectors. |

Conclusion

Ultimately, asset allocation is not about finding the secret formula to beat the market; it’s about building a resilient portfolio structured to help you achieve your specific financial goals. This strategy is the practical application of the timeless wisdom to avoid concentrating risk in one place. Though chasing hot stocks and predicting market moves grabs attention, the methodical, long-term approach of crafting and upholding a strategic asset mix is the real engine of sustained wealth creation.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for long-term investing to help you build and manage a diversified portfolio.

Related Concepts

- Diversification: This is the tactical phase that follows once the high-level strategy is set.

- Modern Portfolio Theory (MPT): The academic foundation for why asset allocation works, emphasizing the importance of correlation.

- Rebalancing: The maintenance required to keep an allocation on track.

Frequently Asked Questions

Recommended Resources

- Guide to Choosing the Right ETFs for Your Allocation

- A Step-by-Step Guide to Portfolio Rebalancing

- Vanguard’s Investor Questionnaire (Authoritative tool for determining allocation)SEC Article on Asset Allocation (Authoritative source)

- The seminal study: Brinson, Gary P., L. Randolph Hood, and Gilbert L. Beebower. “Determinants of Portfolio Performance” Financial Analysts Journal, 1986.

How did this post make you feel?

Thanks for your reaction!