How to Start Trading A Step-by-Step Guide for Beginners

Feeling overwhelmed by the markets but eager to take control of your financial future? Learning how to start trading is the first step towards potentially growing your capital. This definitive step-by-step guide will cut through the noise and give you a clear, actionable path, from choosing a broker to executing your very first trade with confidence.

For aspiring traders in the US, UK, and Canada, understanding the regulatory landscape and available broker platforms is crucial. This guide will help you navigate the initial setup process with a focus on reputable, beginner-friendly brokers in these regions.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To understand the foundational process of starting a trading journey, from education to first trade. |

| Skill Level | Beginner |

| Time Required | 1-2 weeks (for education and setup) |

| Tools Needed | Computer/Smartphone, Brokerage Account, Trading Plan Template |

| Key Takeaway | Successful trading is not about guessing; it’s a disciplined process of education, planning, risk management, and execution. |

Why Learning to Start Trading Correctly is Crucial

Many beginners jump into trading lured by stories of rapid profits, only to lose money quickly. This guide isn’t about getting rich quick; it’s about building a sustainable skillset. Learning the correct way to start trading empowers you to navigate the financial markets with discipline, manage your risk, and make informed decisions rather than emotional gambles.

The Problem It Solves: The overwhelming confusion of where to begin, what to trade, and how to avoid common, costly beginner mistakes.

You will have a structured framework to open and fund a brokerage account, develop a basic trading plan, and execute your first trade while understanding how to protect your capital.

What You’ll Need Before You Start

Before you place a single trade, you need the right foundation and tools. Having these in place prevents frustration and costly errors.

Knowledge Prerequisites: A basic understanding of what stocks, ETFs, and other markets are. You should also be comfortable with fundamental computer skills.

Capital Requirements: Start with capital you are willing to lose. For beginners, a small, dedicated “trading education fund” of a few hundred to a few thousand dollars is recommended, never trade with money earmarked for essentials.

Tools & Platforms:

- A reliable computer and internet connection.

- A smartphone for monitoring markets on the go (optional but helpful).

- A demo/practice trading account.

- A reputable online brokerage platform.

To practice and then execute real trades, you’ll need a reliable brokerage account. Many of the best online brokers for beginners, like Charles Schwab, Fidelity, or Interactive Brokers, offer intuitive platforms, robust educational resources, and demo accounts.

How to Start Trading: A Step-by-Step Walkthrough

Follow these steps in order to build your trading foundation systematically.

Step 1: Educate Yourself and Define Your Goals

Before you spend a dollar, spend time learning. Immerse yourself in the basics of the financial markets. Decide what kind of trader you want to be (e.g., day trader, swing trader, long-term investor), as this will influence every subsequent choice. Set clear, realistic goals for what you want to achieve.

Pro Tip: Dedicate at least 10-20 hours to reading books, taking online courses, and watching reputable financial news sources before funding your account.

Step 2: Choose and Open a Brokerage Account

Your broker is your gateway to the markets. Research and select a broker that fits your needs as a beginner. Key factors include: user-friendly platform, low fees and commissions, quality of educational resources, and good customer support. Once chosen, complete the online application, which includes providing personal and financial information.

Common Mistake to Avoid: Don’t just choose the broker with the flashiest ads. Look at the fee structure carefully, as high commissions can decimate a small account.

Step 3: Develop a Simple Trading Plan

A trading plan is your rulebook. It removes emotion from your decisions. Your first plan should be simple and must include:

- What to trade: (e.g., “I will only trade large-cap US stocks and major ETFs.”)

- Entry/Exit Rules: (e.g., “I will buy when [condition] is met and sell when price hits [target] or falls to [stop-loss].”)

- Risk Management: (e.g., “I will never risk more than 1% of my total capital on a single trade.”)

Formula:

Position Size = (Account Value * Risk per Trade %) / (Entry Price – Stop-Loss Price)

Example Calculation:

- Account Value = $5,000

- Risk per Trade = 1% ($50)

- Entry Price = $100 per share

- Stop-Loss Price = $95 per share

- Position Size = $50 / ($100 – $95) = $50 / $5 = 10 shares

Step 4: Practice with a Demo Account

Nearly all major brokers offer paper trading or demo accounts with virtual money. Use this to practice executing your trading plan in real-market conditions without any financial risk. Test your strategies, get comfortable with the trading platform, and build confidence.

Step 5: Fund Your Account and Place Your First Trade

Once you are consistently profitable in your demo account, it’s time to fund your live account with your pre-determined “education capital.” Start small. Place your first trade by following your plan exactly: log in, find the stock symbol, use a limit order to define your entry price, and always set your stop-loss and take-profit orders immediately.

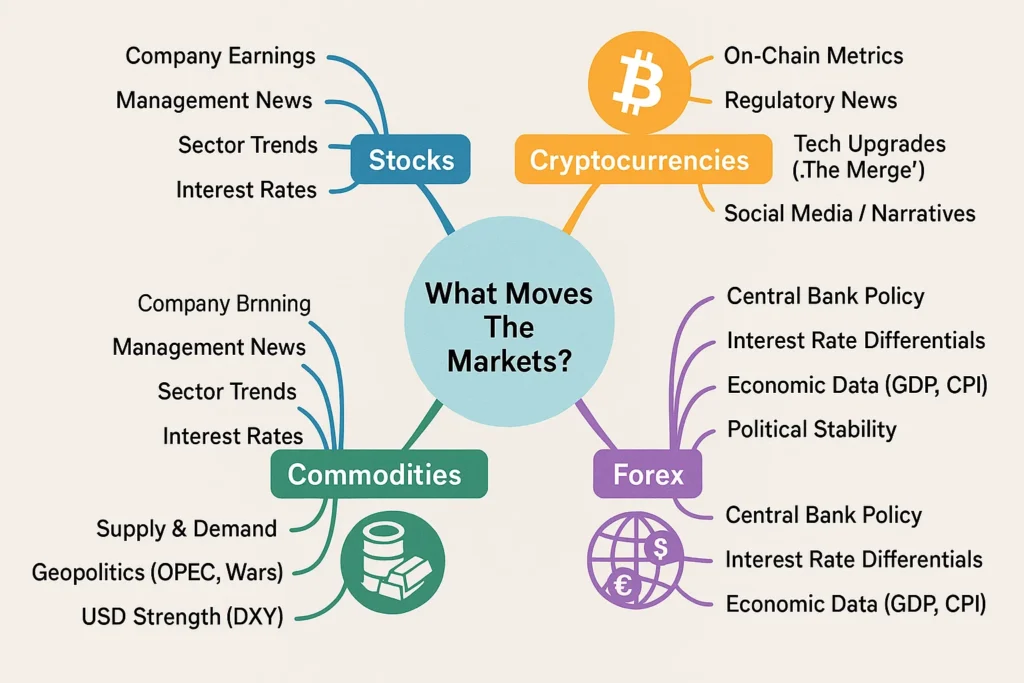

How to Approach Different Asset Classes

Most guides focus only on stocks. But the principles of a trading plan apply everywhere, the execution is different. Here’s a breakdown of the unique nuances for other popular asset classes.

How to Trade Cryptocurrencies

The Unique Mindset: Crypto trading operates 24/7 and is driven by a different set of factors than traditional markets. It’s less about quarterly earnings and more about technological adoption, network effects, regulatory news, and meme-driven sentiment.

- Key Drivers to Watch:

- On-Chain Metrics: Learn to use sites like Glassnode or Messari. Metrics like Network Growth, Exchange Flows, and Active Addresses can signal market sentiment.

- The “Narrative”: Crypto markets move in cycles driven by narratives (e.g., “The Merge,” “DeFi Summer,” “NFTs”). Your job is to identify the dominant narrative, not just the best chart.

- Regulatory Environment: A single tweet from a key regulator can cause massive volatility. Stay informed on news from the SEC, CFTC, and other global bodies.

- Unique Risk Management:

- The “No Stop-Loss” Alternative: In a market known for “stop-loss hunts” (flash crashes that trigger stops before rebounding), consider using a hard mental stop-loss instead of a visible market order. This means you set a price level where you will exit, and you manually execute the trade if it hits, accepting the slight slippage risk to avoid being hunted.

- Beware of Altcoins: While tempting, small-cap “altcoins” can drop 90% and never recover. Never allocate a large portion of your portfolio to them.

To track these complex metrics, you need a specialized platform. Many of the best crypto exchanges for active traders, like Coinbase Advanced Trade or Binance, offer built-in on-chain data and advanced charting tools.

How to Trade Commodities (Gold, Oil, etc.)

The Unique Mindset: Commodity trading is a macro game. You’re not just trading a ticker; you’re trading global economics, geopolitics, and the weather.

- Key Drivers to Watch:

- The U.S. Dollar (DXY): Commodities are priced in USD. A stronger dollar typically makes commodities more expensive for holders of other currencies, pushing prices down. Inverse correlation is key.

- Geopolitical Events: Wars, sanctions, and OPEC+ decisions directly impact supply chains, especially for oil.

- Economic Data & Weather: Inflation reports drive gold (as a hedge). USDA reports on crop yields move agricultural commodities. Hurricane seasons impact oil production in the Gulf of Mexico.

- Preferred Method for Beginners:

- Avoid futures and margin complexities initially. Trade Commodity ETFs like GLD (Gold) or USO (Oil). This gives you direct exposure to the price movement without the operational hassles of taking physical delivery or managing futures contracts.

How to Trade Forex (The FX Market)

The Unique Mindset: Forex is about relative strength. You’re always trading one currency against another (e.g., EUR/USD). Your analysis focuses on the economic health and interest rate differentials between two countries.

- Key Drivers to Watch:

- Central Bank Policy: This is the #1 driver. Follow the Federal Reserve (USD), European Central Bank (EUR), and Bank of Japan (JPY). Watch for interest rate decisions and the accompanying statements.

- Economic Calendars: Releases like Non-Farm Payrolls (US), CPI inflation data, and GDP reports cause significant volatility. Trade around these events or avoid them as a beginner.

- Carry Trade: A strategy where you sell a currency with a low-interest rate and buy a currency with a high-interest rate, profiting from the “carry.” This adds a layer of complexity beyond simple price speculation.

The Trader’s Mind: Psychology Routines Most Blogs Ignore

Everyone says “control your emotions,” but no one tells you how. Here are concrete routines.

- The Pre-Market “Mental Inventory”:

- Before the market opens, spend 5 minutes writing down your answers to these questions:

- “What is my market bias today (bullish/bearish/neutral) and why?”

- “What economic data or news is released today that could impact my plans?”

- “What is my #1 rule I will NOT break today?” (e.g., “I will not move my stop-loss.”)

- This ritual centers you and activates your analytical brain before the emotional pressure begins.

- Before the market opens, spend 5 minutes writing down your answers to these questions:

- The Post-Trade “Detachment Ritual”:

- After closing a trade, win or lose, physically step away from your screens for 10-15 minutes. Go for a walk, make a coffee, do some stretches.

Why it works: It breaks the addictive cycle of immediately looking for the next trade and allows your nervous system to reset. This prevents “revenge trading” after a loss and “overconfidence trading” after a win.

How to Use Your Trading Plan in Live Markets

The real test begins when real money is on the line. Your plan is your anchor.

Scenario 1: A Trade Hits Your Take-Profit: Congratulations! Follow your plan and exit the trade. Don’t get greedy and hold on hoping for more; this often leads to giving back profits. Record the trade in your journal.

Scenario 2: A Trade Hits Your Stop-Loss: This is a successful trade. You managed your risk exactly as planned. Do not move your stop-loss further away. Accept the small, predefined loss and look for the next opportunity. Protecting capital is your number one job.

Case Study: “Sarah, a new trader, bought shares of Company XYZ at $50. Her plan dictated a stop-loss at $48 and a profit target at $55. The stock dipped to $48 the next day, and she was stopped out for a small loss. The following week, the stock fell to $40. By sticking to her plan, Sarah saved herself from a much larger, emotionally-driven loss.”

Common Mistakes When Starting to Trade (And How to Fix Them)

Pitfall 1: Trading Without a Plan (or Ignoring It).

Solution: Your trading plan is non-negotiable. Write it down and do not deviate based on fear or greed.

Pitfall 2: Risking Too Much on a Single Trade.

Solution: Adhere to the 1% rule religiously. This ensures a string of losses won’t wipe out your account.

Pitfall 3: Chasing Losses (Revenge Trading).

Solution: After a loss, step away from the screen. Do not immediately jump into another trade to “win your money back.” This leads to emotional, poorly-planned decisions.

Building Your Trading Toolkit: Beyond the Basic Broker

The pros use more than just a broker platform. Assemble this toolkit to gain an edge.

- Economic Calendar: (e.g., ForexFactory, Investing.com) To track high-impact news events.

- Market Scanner: (e.g., Finviz, Trade Ideas) To automatically find stocks or cryptos that meet your specific criteria (e.g., “Stocks above 200-day MA with unusually high volume”).

- Trading Journal Software: (e.g., TraderVue, EdgeWonk) Don’t just use a spreadsheet. Advanced journals let you tag trades by strategy, record screenshots of your charts, and analyze your performance metrics to see what’s truly working.

- Sentiment Gauges: (e.g., CNN Fear & Greed Index, AAII Investor Sentiment Survey) To gauge market euphoria or fear, which is often a contrarian indicator.

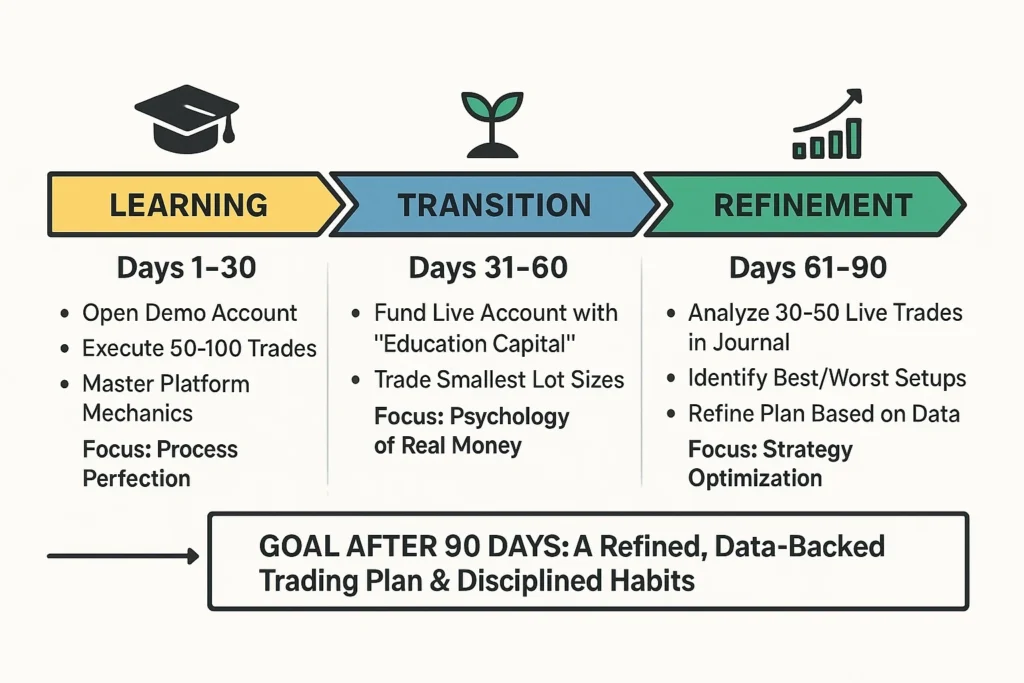

The First 90 Days Action Plan for a New Trader

This is a unique, time-based framework most guides don’t provide.

- Days 1-30: The Demo Phase

- Goal: Execute 50-100 demo trades.

- Focus: Not on P&L, but on process. Did you follow your plan every single time? Can you place a trade, set a stop-loss, and set a take-profit in under 60 seconds?

- Days 31-60: The “Small Lots” Live Phase

- Goal: Transition to a live account with the smallest possible position size your broker allows.

- Focus: Get used to the psychological impact of real money. The goal is to make the money feel “real” while the risk is still minimal.

- Days 61-90: The Review & Refine Phase

- Goal: Analyze your first 30-50 live trades.

Use your trading journal. What is your win rate? What is your average profit vs. average loss (Profit Factor)? Is one specific setup consistently losing money? Refine your plan based on this hard data, not your feelings.

- Builds Discipline: Establishes crucial risk-management habits from day one.

- Reduces Emotional Trading: A plan acts as a system, reducing fear and greed.

- Provides a Structured Learning Path: This step-by-step approach prevents overwhelm.

- Capital Preservation: The primary focus is on learning to lose less, which is the key to winning more long-term.

- Requires Patience and Discipline: It’s not a “get-rich-quick” scheme.

- Initial Learning Curve: Requires a significant time investment in education.

- No Guarantee of Profits: Even a great process can have losing periods due to market volatility.

- Can Feel Slow: Starting with small position sizes means profits will be small initially.

Taking It to the Next Level

Once you’ve mastered the basics and have a few months of live trading experience, you can explore more advanced concepts.

Advanced Order Types: Learn about trailing stop-losses, options for hedging, and other conditional orders.

Technical & Fundamental Analysis: Deepen your analysis skills by studying advanced chart patterns, technical indicators (like RSI and MACD), and fundamental valuation methods.

For a deeper dive into analyzing price charts, read our complete guide to Technical Analysis for Beginners. To understand how to evaluate companies, check out our guide on Fundamental Analysis.

Trading vs Long-Term Investing

| Feature | Trading | Long-Term Investing |

|---|---|---|

| Time Horizon | Short-term (Days to Months) | Long-term (Years to Decades) |

| Primary Goal | Profit from price fluctuations | Wealth accumulation via compounding |

| Activity Level | High | Low |

| Analysis Focus | Technical & Short-term Fundamentals | Long-term Fundamentals |

Conclusion

You now have a clear, disciplined framework for beginning your trading journey. Remember, profitable trading is a marathon, not a race. It hinges on continuous education, strict risk management, and the emotional discipline to stick to your plan.

Start today by working through Step 1: dedicate time to your education and define your trader profile. The markets will always be there, but a solid foundation is something you must build for yourself.

Related Guides You Should Read Next:

- How to Read a Stock Chart

- A Beginner’s Guide to Risk Management

- Technical Analysis vs. Fundamental Analysis