Bear Market What It Is, How to Identify, and How to Survive It

A bear market is a prolonged period of falling stock prices, typically a decline of 20% or more from recent highs. It is characterized by widespread pessimism, investor fear, and a general weakening of the economy. Navigating a bear market successfully is one of the most critical skills for preserving and growing long-term wealth.

For investors in the US, UK, Canada, and Australia, understanding bear markets is essential for protecting portfolios on major exchanges like the NYSE, NASDAQ, FTSE, and ASX. Recognizing the signs early can mean the difference between a temporary setback and a permanent loss of capital.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A sustained decline of 20% or more in a broad market index from its most recent peak. |

| Also Known As | Downturn, Market Downturn, Down Market |

| Main Used In | Stock Trading, Portfolio Management, Economic Analysis, Crypto Markets |

| Key Takeaway | Bear markets are a normal, albeit painful, part of the economic cycle; the primary goal is capital preservation. |

| Related Concepts |

What is a Bear Market

A bear market is more than just a “bad week” on Wall Street. It’s a fundamental shift in market sentiment where pessimism and fear become the dominant drivers. Officially, it’s defined as a decline of 20% or more in a major stock market index, like the S&P 500 or the Dow Jones Industrial Average, from its most recent high. This isn’t just a dip for a few stocks; it’s a broad-based decline that affects most sectors, reflecting a loss of confidence in the economy’s future prospects.

Think of the economy as the weather. A market correction (a drop of 10-19%) is like a cold snap or a thunderstorm, unpleasant but short-lived. A bear market, however, is like a long, harsh winter. It lasts for months, sometimes years, and requires a different set of strategies to survive and thrive.

Key Takeaways

The Core Concept Explained

A bear market represents a period of capitulation, where investors are more motivated by fear of further losses than by the potential for future gains. This leads to a self-reinforcing cycle: falling prices cause fear, which leads to more selling, which pushes prices down further. Key characteristics include:

- High Volatility: Sharp rallies (often called “sucker’s rallies”) can occur, but the overall trend remains downward.

- Negative Economic Data: Rising unemployment, falling corporate profits, and slowing GDP growth are common.

- Negative Sentiment: News headlines are overwhelmingly pessimistic.

How to Identify a Bear Market

Since there’s no single formula, identification is based on a combination of price thresholds and economic context.

The 20% Rule and Other Indicators

The most straightforward rule is the 20% decline from a peak,

confirmed when the closing price of a major index sustains at that level. However, savvy investors look for other confirming signals:

- Economic Indicators: A sustained rise in unemployment, a decline in consumer spending, and inverted yield curves are classic harbingers.

- Technical Indicators: The 200-day moving average is a key watchpoint. When the index falls and stays below its 200-day moving average, it signals a long-term downtrend. Other tools like the Moving Average Convergence Divergence (MACD) can show worsening momentum.

- Market Breadth: A healthy market has many stocks participating in gains. In a bear market, breadth weakens, meaning fewer and fewer stocks are holding up the indices.

For a UK-based investor, watching the FTSE 100 break below its 200-day moving average while Bank of England warnings about economic growth intensify would be a strong signal of a potential bear market.

Why Bear Markets Matter to Traders and Investors

- For Investors: Bear markets test your risk tolerance and long-term strategy. A poorly managed portfolio can suffer permanent damage, derailing retirement plans. Understanding bear markets helps you avoid panic selling at the worst possible time.

- For Traders: They represent a sea change in strategy. The “buy the dip” mentality of a bull market can be disastrous. Traders may shift to short-selling, using inverse ETFs, or simply moving to cash to profit from or protect against the decline.

- For Analysts: It forces a focus on fundamental, bottom-up analysis. Companies with strong balance sheets, little debt, and consistent cash flows become the focus, as they are most likely to survive and thrive.

How to Navigate a Bear Market in Your Strategy

Use Case 1: The Long-Term Investor (Defensive Strategy)

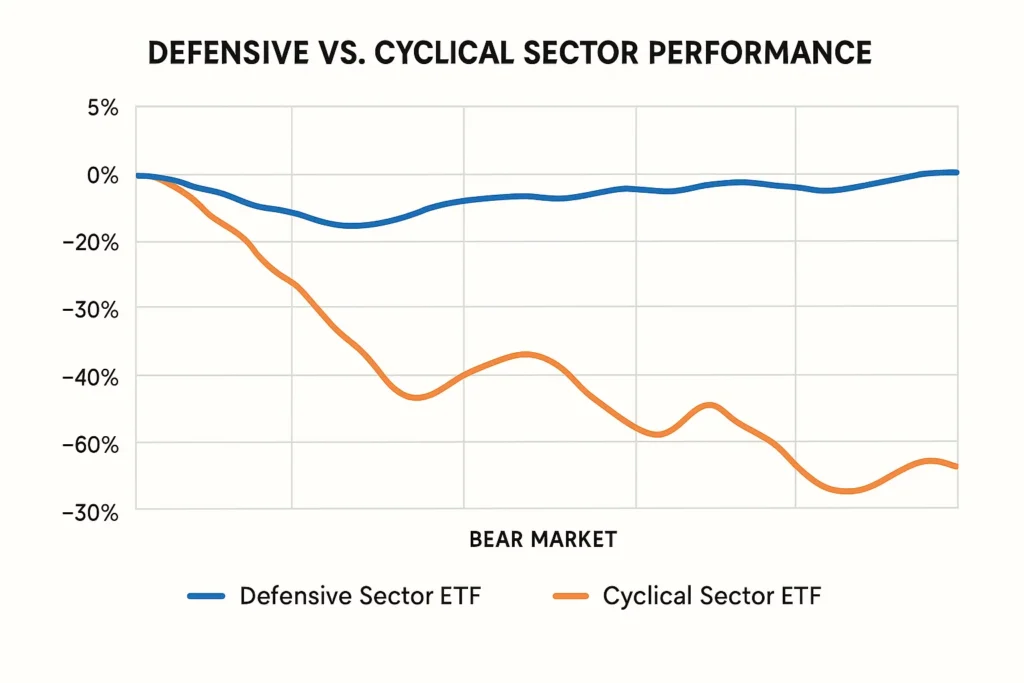

- Action: Focus on capital preservation. Rebalance your portfolio towards defensive sectors like consumer staples, utilities, and healthcare, which are less sensitive to economic cycles.

- Action: Continue dollar-cost averaging. This disciplined approach allows you to buy more shares at lower prices, lowering your average cost basis over time.

- Action: Review and rebalance. Ensure your asset allocation still matches your risk tolerance.

Use Case 2: The Active Trader (Offensive Strategy)

- Action: Short-Selling. This involves borrowing shares to sell, hoping to buy them back later at a lower price. (High risk and requires a margin account).

- Action: Use Inverse ETFs. These funds are designed to move in the opposite direction of an index, providing a hedge or a way to profit from the decline.

- Action: Raise Cash. Sometimes the best trade is to step aside. Holding cash provides dry powder to deploy when the market eventually recovers.

A bear market requires the right tools. To execute strategies like short-selling or trading inverse ETFs, you need a robust brokerage platform. We’ve reviewed the best brokers for advanced traders to help you find the right fit.

The Bear Market Playbook: Tailored Strategies for Your Life Stage

A one-size-fits-all approach doesn’t work in investing, especially during a bear market. Your strategy should be heavily influenced by your investment timeline and financial goals. Here’s a tailored guide for three key life stages.

The Young Accumulator (Ages 20-40)

- Mindset: See this as a fire sale on assets. You have 20-30 years until retirement, so time is your greatest asset.

- Strategy: Aggressive Accumulation.

- Double Down on DCA: If you were contributing $500/month to your index funds, try to increase it. Your dollars are now buying more shares.

- Sector Watch: Consider tilting your contributions towards high-growth sectors that have been unfairly beaten down. This is the time to build a foundation in tech and innovation at a discount.

- Action: Do not check your portfolio daily. The paper losses are irrelevant on your long timeline. Focus on your contribution rate.

The Preretiree (Ages 50-65)

- Mindset: Capital Preservation is Paramount. You have less time to recover from major losses, so your goal is to protect what you’ve built.

- Strategy: The “All-Weather” Portfolio Review.

- The 2-Year Cash Cushion: Ensure you have at least two years’ worth of living expenses in cash, CDs, or short-term Treasury bills. This is your “panic prevention” fund, so you never have to sell stocks at a loss to pay the bills.Rebalance Defensively: This is the time to ensure your portfolio alignment. Shift towards high-quality dividend stocks (from companies with a long history of maintaining payouts) and investment-grade bonds.

- Action: Conduct a thorough portfolio stress test. How would a 40% drop impact your retirement date? Adjust accordingly.

The Retiree (Ages 65+)

- Mindset: Income Stability and Capital Preservation. Your portfolio is your paycheck.

- Strategy: Secure the Income Stream.

- Live Off Your Cushion: Rely on the 2+ years of cash you built in the preretirement phase. This allows your equity holdings time to recover.Focus on “Needs” vs. “Wants”: Cover your essential living expenses (housing, food, healthcare) with guaranteed or highly stable income sources, Social Security, pensions, and annuity payments. Use portfolio withdrawals only for discretionary “wants.”

- Action: Consider pausing withdrawals from the equity portion of your portfolio if possible. If you must sell, sell from the more stable, fixed-income portion to let your stocks recover.

Advanced Tactic: Tax-Loss Harvesting

One of the most powerful silver linings of a bear market is the opportunity for tax-loss harvesting. This strategy allows you to use investment losses to lower your tax bill.

- What it is: Selling an investment that is down to realize a capital loss. This loss can then be used to offset capital gains from other investments or, if losses exceed gains, up to $3,000 of ordinary income per year.

- How to do it (Example):

- You bought 100 shares of “Tech Giant A” at $150 per share ($15,000 total). It’s now trading at $90 ($9,000 total).

- You sell all 100 shares, realizing a $6,000 capital loss.

- You can use this $6,000 loss to offset gains from other sales. If you have no gains, you can deduct $3,000 from your ordinary income this year and carry the remaining $3,000 forward to next year.

- The Critical Wash-Sale Rule: The IRS will disallow your loss if you buy “substantially identical” securities 30 days before or after the sale. You cannot simply sell and immediately buy back the same stock.

- The Workaround: You can immediately use the proceeds to buy a similar but not identical investment. For example, you could sell an S&P 500 ETF (like IVV) and immediately buy a different S&P 500 ETF (like VOO) or a total market index fund. This maintains your market exposure while staying compliant.

Why it’s a Bear Market Superpower: This strategy turns a paper loss into a tangible tax credit, effectively getting a discount from the government on your future taxes. It improves your portfolio’s after-tax returns, a key marker of sophisticated investing.

- Sets a Clear Threshold: The 20% rule provides an objective, widely accepted definition, removing emotion from the initial diagnosis.

- Manages Expectations: Understanding that bear markets are a normal part of investing helps prevent panic and promotes disciplined long-term thinking.

- Highlights Economic Risk: It forces a focus on macroeconomic factors and fundamental analysis, making investors more thorough.

- It’s a Lagging Indicator: By the time a 20% decline is officially recognized, a significant portion of the damage may have already occurred.

- Can Trigger Panic: The “bear market” label itself can become a self-fulfilling prophecy, amplifying fear and selling pressure.

- Doesn’t Predict Duration or Depth: Knowing it’s a bear market doesn’t tell you how long it will last or how far prices will fall. The 2000–2002 bear market saw a ~49% decline, while the 2020 COVID crash was a swift ~34%.

The Ripple Effect: How a Bear Market Impacts Everything Else

While stocks grab the headlines, a sustained bear market sends shockwaves across the entire financial ecosystem. Understanding these ripple effects is crucial for a holistic view.

| Asset Class / Sector | Typical Bear Market Impact | Rationale |

|---|---|---|

| Real Estate | 📉 Slower price growth or declines; harder to get mortgages. | Economic uncertainty causes people to delay home purchases. Tighter lending standards from banks reduce the buyer pool. |

| Bonds (Fixed Income) | 📈 High-Quality Bonds (e.g., Treasuries) often RISE. | A “flight to safety” occurs. Investors sell risky stocks and pile into the perceived safety of government bonds, driving their prices up. |

| Commodities | 📉 Mixed. Industrial metals (copper) fall on lower demand. Gold may hold or rise as a safe-haven. | Weakening global economy reduces demand for raw materials. Gold’s status as a store of value can attract scared capital. |

| Cryptocurrencies | 📉 Often fall sharply and correlate with tech stocks. | In a risk-off environment, speculative assets are sold first. They are now seen as “risk-on” assets, not inflation hedges, in a downturn. |

| Job Market | 📉 Hiring freezes and layoffs, especially in cyclical sectors. | Companies cut costs to preserve profitability as their revenues decline, leading to workforce reductions. |

| The US Dollar (DXY) | 📈 Often strengthens. | As the world’s reserve currency, the USD is seen as a safe harbor during global storms. This can hurt multinational US companies. |

Key Insight: Notice the pattern? In a bear market, capital flows away from risk and towards safety. This “flight to quality” is the dominant force that reshapes the entire financial landscape.

Bear Market in the Real World: The Global Financial Crisis (2007-2009)

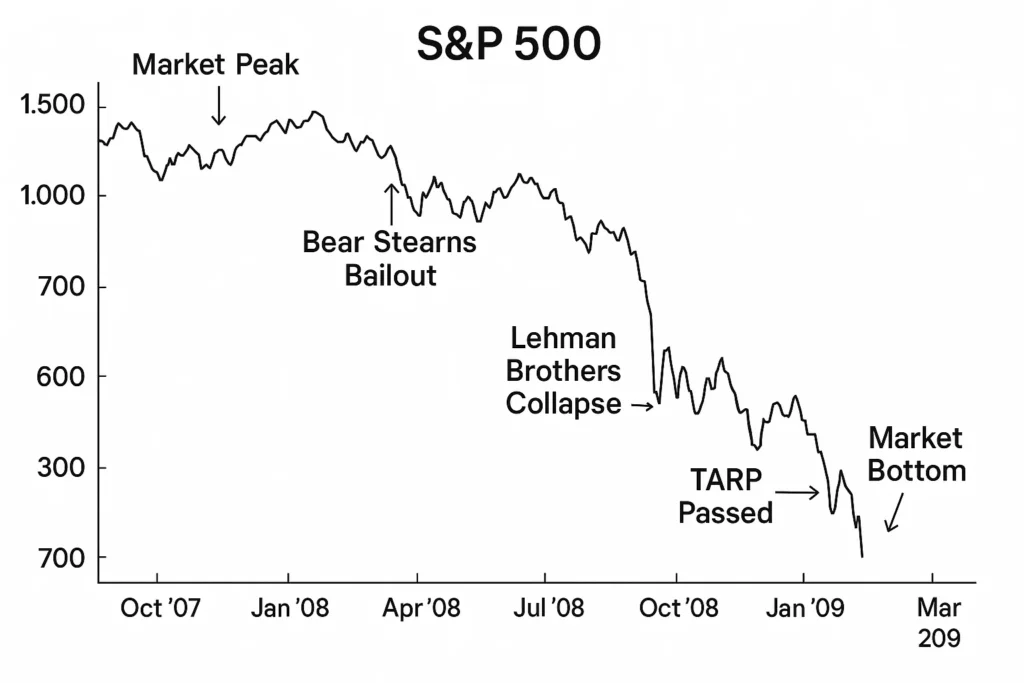

The bear market triggered by the subprime mortgage crisis is a quintessential example. Following a peak in October 2007, the S&P 500 began a steep descent. The collapse of Lehman Brothers in September 2008 turned a severe downturn into a full-blown panic. The index ultimately fell approximately 57% from its peak to its bottom in March 2009.

This period was characterized by:

- Economic Recession: The US and global economies entered the worst recession since the Great Depression.

- Widespread Fear: The VIX (Volatility Index), known as the “fear gauge,” spiked to unprecedented levels.

- Government Intervention: Massive bailouts (TARP) and unprecedented monetary policy (quantitative easing) were deployed to stabilize the system.

Bear Market vs Market Correction vs Recession

| Feature | Bear Market | Market Correction | Recession |

|---|---|---|---|

| What it is | A ~20%+ decline in stock prices. | A ~10–19% decline in stock prices. | A decline in economic output (GDP) for two consecutive quarters. |

| Time Horizon | Months to years (avg. ~14 months). | Weeks to months. | Typically 6–18 months. |

| Primary Cause | Loss of investor confidence, economic contraction. | Short-term overvaluation, minor shocks. | Broad economic weakness (spending, employment, income). |

| Relationship | Often coincides with a recession. | A common precursor to a bear market. | The economic reality that often drives a bear market. |

Conclusion

Ultimately, understanding a bear market is not about predicting its start with perfect accuracy, but about being prepared for its inevitability. As we’ve explored, it is a period defined by a 20% decline, driven by fear and economic weakness, and requiring a strategic shift from growth to preservation. While its onset can be frightening, history shows that bear markets are always temporary, eventually giving way to new bull markets. By incorporating defensive strategies, maintaining discipline through dollar-cost averaging, and avoiding emotional decisions, you can not only protect your portfolio but also position it for significant growth during the subsequent recovery.

Ready to build a portfolio that can weather any market storm? The foundation is a reliable brokerage account. We’ve meticulously reviewed and ranked the best online brokers for long-term investors to help you get started on the right foot.

Related Terms

- Bull Market: The opposite of a bear market; a period of rising prices and investor optimism.

- Secular Bear Market: A long-term trend (10-20 years) that consists of sharp bull markets within a longer-term bearish trend, where the market makes no net progress.

- Dead Cat Bounce: A short, temporary recovery in a declining trend that is followed by a continuation of the downtrend; synonymous with a “sucker’s rally.”

- Capitulation: The point of peak panic selling, often seen as a sign of a market bottom.

Frequently Asked Questions

- Long-Term US Government Bonds: As investors flee to safety, bond prices often rise.

- The US Dollar (USD): Often strengthens as it’s considered the world’s reserve currency.

- Certain Commodities: Gold is the classic safe-haven asset, though its performance can be volatile.

- Defensive Sector ETFs: Sectors like utilities and consumer staples tend to be more resilient.

- Technical: The index forms a base, stops making new lows, and begins to trade in a tight range. A breakout above this base on high volume is a positive sign.

- Fundamental: Key economic data (like unemployment claims or consumer confidence) stops worsening and begins to stabilize or improve.

- Monetary: Central banks stop raising interest rates or begin to lower them, signaling potential recovery.

Recommended Resources

- SEC.gov: Investor Bulletin: Bear Markets – For authoritative, unbiased information.

- Investopedia: Bear Market Definition – For a deep dive into the term.

- The Federal Reserve: Monetary Policy Reports – To understand the policy response to downturns.

How did this post make you feel?

Thanks for your reaction!