What Is Book Value, How to Use It for Smarter Investing

Book Value is a fundamental measure of a company’s net worth, representing what shareholders would theoretically receive if the company were liquidated. For value investors in the US, UK, Canada, and Australia, it serves as a crucial benchmark to find potentially undervalued stocks trading below their intrinsic worth.

For investors scrutinizing balance sheets on exchanges like the NYSE, NASDAQ, or the London Stock Exchange (LSE), understanding Book Value is the first step toward prudent value investing.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The net asset value of a company, calculated as total assets minus total intangible assets and liabilities. |

| Also Known As | Net Asset Value (NAV), Shareholders’ Equity |

| Main Used In | Fundamental Analysis, Value Investing, Stock Valuation |

| Key Takeaway | It’s a conservative measure of a company’s worth, but it may not reflect the true market value of its assets or future earning potential. |

| Formula | Book Value = Total Assets – Intangible Assets – Total Liabilities |

| Related Concepts |

What is Book Value

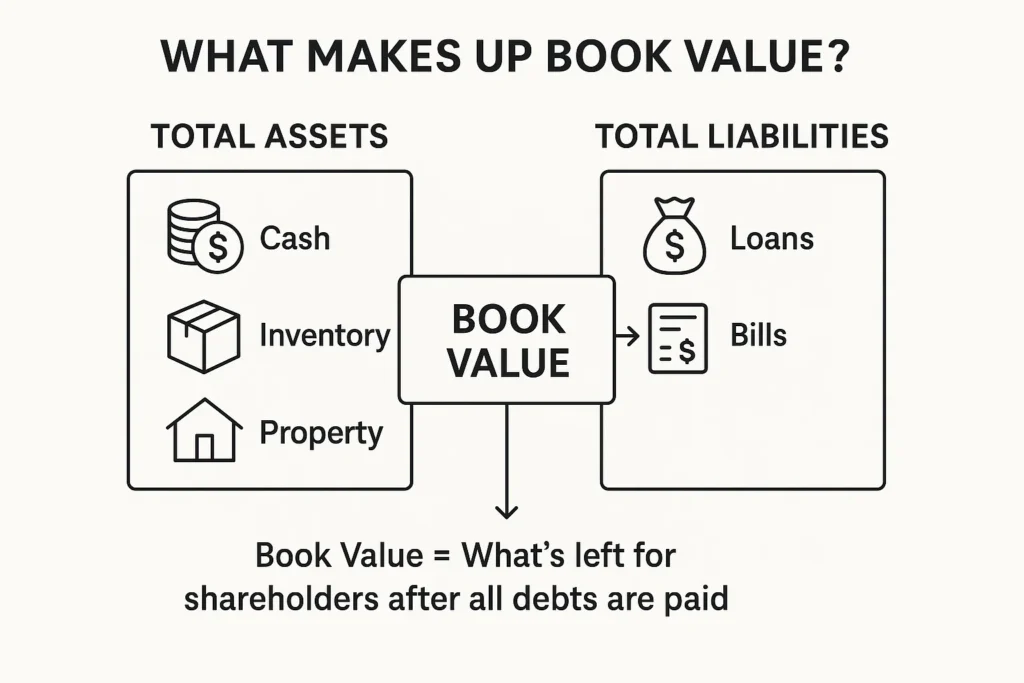

Think of a company’s Book Value as its accounting net worth. If a company were to cease operations today, sell off all its factories, equipment, inventory, and property (its assets), and then pay off all its debts (its liabilities), the cash left over would be its Book Value. This amount belongs to the shareholders. In essence, it’s the value of the company as recorded in its financial books, specifically the balance sheet.

The Core Concept Explained

Book Value measures the historical accounting value of a company, not its current market price. It’s a backward-looking metric, grounded in the original purchase price of assets (minus depreciation). A high Book Value suggests a company has substantial assets to cover its liabilities, which can be a sign of financial stability. However, it doesn’t account for intangible factors like brand value, intellectual property, or future growth prospects, which can be a significant limitation.

Key Takeaways

How to Calculate Book Value

The formula for Book Value is straightforward and pulls data directly from a company’s balance sheet.

Book Value = Total Assets – Intangible Assets – Total Liabilities

This figure is also known as Shareholders’ Equity.

Step-by-Step Calculation Guide

Let’s break down the components using a hypothetical US-based company, Industrial Manufacturing Inc., listed on the NYSE.

- Find Total Assets: The sum of everything the company owns. This includes current assets (cash, inventory) and non-current assets (property, plant, equipment).

- Find Intangible Assets: Non-physical assets like patents, trademarks, brand recognition, and goodwill. We subtract these for a more concrete value.

- Find Total Liabilities: The sum of everything the company owes, including short-term debt (accounts payable) and long-term debt (bank loans).

Example Calculation:

| Input Values (in millions USD) | Amount |

|---|---|

| Total Assets | $500 |

| Intangible Assets | $50 |

| Total Liabilities | $300 |

| Calculation | $500 – $50 – $300 = $150 |

| Interpretation | The Book Value of Industrial Manufacturing Inc. is $150 million. This represents the net asset value claimable by shareholders. |

For a more precise analysis, investors in the UK would look at a company’s reports in GBP from the LSE, while those in Canada would use CAD for companies on the TSX. Always refer to filings like the 10-K (SEC) for US companies.

Book Value Per Share: The Metric That Matters for Stock Investors

While total Book Value is useful for analyzing the company as a whole, individual investors need to relate it to the price of a single share. This is where Book Value Per Share (BVPS) becomes critical. It breaks down the company’s net asset value on a per-share basis, allowing for a direct comparison with the current stock price.

BVPS = (Total Shareholders’ Equity – Preferred Equity) / Weighted Average Outstanding Shares

Why BVPS is a Game-Changer:

- Direct Comparability: You can directly compare a $15 stock price to a $20 BVPS to instantly see a potential discrepancy.

- Tracks Value Creation: Increasing BVPS over time is a strong indicator that a company is genuinely creating value for its shareholders by retaining earnings and growing its asset base.

- The Foundation for P/B: The Price-to-Book (P/B) ratio is simply: Stock Price / Book Value Per Share.

Real-World BVPS Calculation: Apple Inc. (Example using FY2023 data)

Let’s look at a real company to see BVPS in action. According to Apple’s Q4 2023 balance sheet:

| Input Values (in billions USD) | Amount |

|---|---|

| Total Shareholders’ Equity | $62.1 B |

| Preferred Stock | $0 (Apple has none) |

| Weighted Average Outstanding Shares | 15.85 B |

| Calculation | ($62.1 B – $0) / 15.85 B = $3.92 |

Interpretation: As of this reporting period, Apple’s Book Value Per Share was approximately $3.92. Given that Apple’s stock price was trading around $190 at that time, this immediately tells you that investors are paying a massive premium over the company’s accounting net worth. This is typical for a growth company whose value is derived from its brand, ecosystem, and future earnings potential, not its physical assets.

Why Book Value Matters to Traders and Investors

- For Investors: It is the bedrock of value investing. Legendary investors seek companies trading at or below their Book Value, believing the market is undervaluing the company’s assets. It’s a margin of safety.

- For Traders: A sudden drop in a stock’s price below its Book Value per share can signal a potential buying opportunity or a oversold condition. Conversely, a high P/B ratio might indicate an overvalued stock.

- For Analysts: It’s a key input in several valuation models and financial ratios. Analysts use it to assess a company’s financial health and compare firms within the same sector, especially for banks and insurance companies where assets and liabilities are primarily financial.

How to Use Book Value in Your Strategy

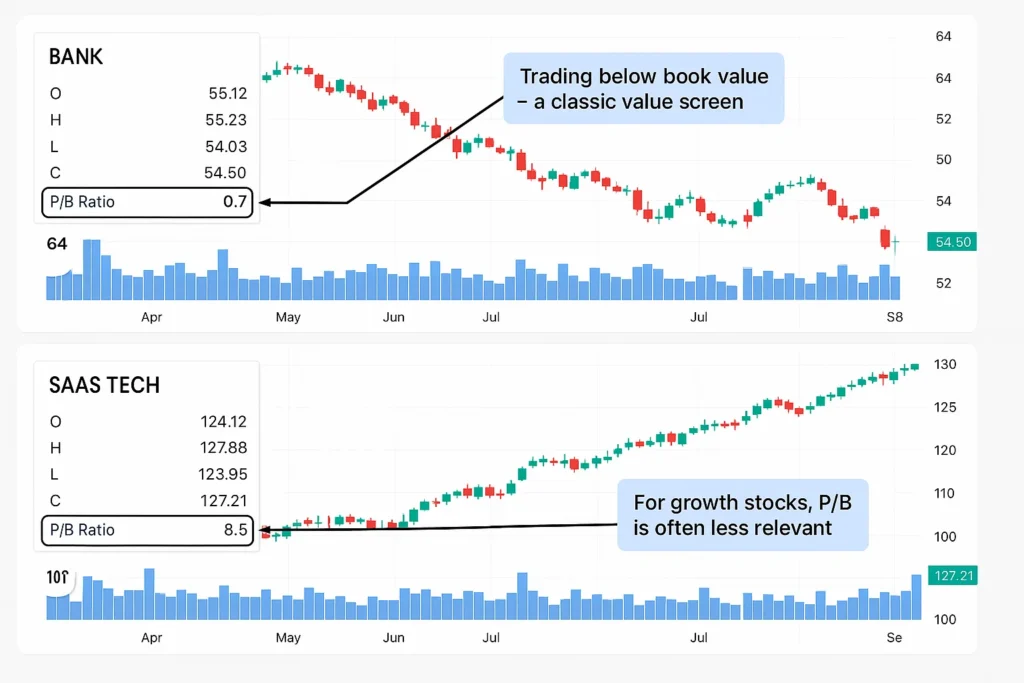

The most common application is through the Price-to-Book (P/B) Ratio.

- Case 1: Identifying Potentially Undervalued Stocks. A P/B ratio below 1.0 implies the market is valuing the company for less than its net assets. For example, if a company’s Book Value per share is $10 and its stock trades at $8 (P/B = 0.8), a value investor might see this as a discount.

- Case 2: Sector Analysis. Book Value is highly relevant for capital-intensive sectors. A utility or manufacturing company with a low P/B might be a better value candidate than a tech company with the same P/B, as the tech company’s value isn’t in its physical assets.

Screening for stocks with a low P/B ratio is a powerful strategy, but you need the right tools. To start your own analysis, check out our review of the Best Online Brokers for Fundamental Analysis, which feature powerful stock screening tools.

- Objectivity: Based on audited financial statements from the balance sheet, making it a relatively hard number.

- Simplicity: The calculation is straightforward and widely understood.

- Useful for Comparisons: Excellent for comparing companies within asset-heavy industries like banking, insurance, and industrials.

- Safety Net: Provides a floor value, which is central to the value investing philosophy.

- Accounting Artefacts: Asset values are based on historical cost minus depreciation, which may not reflect their current market value or replacement cost.

- Ignores Intangibles: It fails to capture the value of a strong brand, skilled workforce, or intellectual property, which are key drivers in today’s economy.

- Sector Irrelevance: It is nearly useless for evaluating service or tech companies whose primary assets (people, ideas) are not on the balance sheet.

- Can Be Manipulated: Accounting rules around depreciation and goodwill impairment can affect the Book Value.

Book Value in the Real World: A Case Study

The 2008 Financial Crisis and Bank Stocks

During the 2008 financial crisis, many major banks like Bank of America and Citigroup saw their stock prices plummet to trade at a significant discount to their stated Book Value. This suggested the market believed their assets (largely mortgage-backed securities) were worth far less than their balance sheets showed—and the market was right. The subsequent wave of write-downs proved their tangible book value was much lower, and the low P/B ratios were a signal of severe distress, not a buying opportunity.

Price-to-Tangible-Book Ratio

For the savvy investor, the standard P/B ratio isn’t always conservative enough. Many companies carry significant intangible assets and goodwill on their balance sheets from acquisitions. These assets can be difficult to value and are often worth far less in a liquidation scenario. This is where the Price-to-Tangible-Book Ratio (P/TB) becomes the true test of a deep value investment.

Tangible Book Value = Total Assets – Intangible Assets – Goodwill – Total Liabilities

P/TB Ratio = Market Capitalization / Tangible Book Value

When the P/TB Ratio is Essential:

- Analyzing Banks and Financial Institutions: For banks, assets are largely loans and investments. The P/TB ratio is considered the gold standard as it strips out the value of their acquired brand names (intangibles), giving a pure look at their financial capital.

- Evaluating Companies that Grew by Acquisition: A company like Verizon or Meta has acquired many other companies, creating massive Goodwill entries on their balance sheets. The P/TB ratio ignores this, revealing the value of their physical, saleable assets.

- Distress Screening: If a company is trading below its Tangible Book Value, it signals the market has extreme pessimism about its future, believing even its physical assets are overvalued or that liquidation is a real possibility.

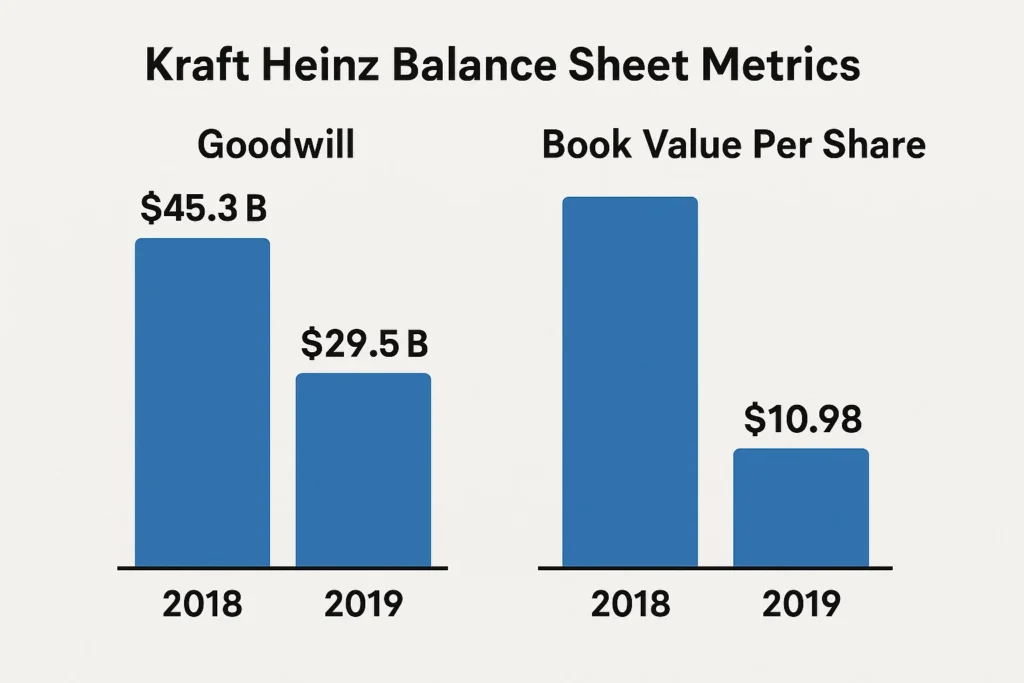

Case Study: The Kraft Heinz Implosion

Kraft Heinz (KHC) is a textbook example of why Tangible Book Value matters. For years after the merger, its balance sheet was bloated with over $90 billion in Goodwill and Intangible Assets. In 2019, the company was forced to write down the value of its Kraft and Oscar Mayer brands by $15.4 billion, slashing its Book Value overnight.

- Before the Write-down: Standard P/B ratio looked low, potentially signaling a value stock.

- After the Write-down: The Tangible Book Value, which many analysts were already watching, was much closer to the true picture. The massive write-down proved that the standard Book Value was artificially inflated, and the P/TB ratio would have been a much clearer warning sign for investors.

Screening for stocks with a low P/TB ratio requires a powerful platform. In our review of the Best Fundamental Analysis Software, we specifically test the screening capabilities for advanced metrics like Tangible Book Value.

Book Value vs Market Value

| Feature | Book Value | Market Value (Market Cap) |

|---|---|---|

| What it measures | Accounting net worth | The market’s perception of worth |

| Basis of Calculation | Historical cost on balance sheet | Current stock price × shares outstanding |

| Volatility | Stable, changes slowly | Highly volatile, changes by the second |

| Primary Use | Finding undervalued assets | Gauging a company’s public valuation |

Conclusion

Book Value provides a critical, conservative baseline for assessing a company’s intrinsic worth. As we’ve explored, it is an indispensable tool for value investors seeking a margin of safety, particularly in asset-heavy sectors. However, its limitations such as ignoring intangible assets and relying on historical cost, mean it should never be used in isolation. A comprehensive analysis must combine Book Value with other metrics, an evaluation of future earnings potential, and a qualitative assessment of the business. By understanding both the power and the pitfalls of Book Value, you can make more informed, data-driven investment decisions.

Ready to screen for stocks using the Price-to-Book ratio and other fundamental metrics? The right brokerage platform is essential. We’ve meticulously reviewed and ranked the 5 Best Online Brokers for Value Investors to help you build a stronger portfolio.

Related Terms

- Price-to-Book (P/B) Ratio: The primary tool for applying Book Value to stock valuation.

- Tangible Book Value: A more stringent version of Book Value that excludes all intangible assets, providing a hard asset floor.

- Market Capitalization: The total market value of a company’s equity, which is constantly compared to Book Value.

- Return on Equity (ROE): A profitability metric calculated as Net Income / Shareholders’ Equity, showing how efficiently a company uses its Book Value to generate profits.

Frequently Asked Questions

Recommended Resources

- U.S. SEC.gov EDGAR Database – To access company 10-K and 10-Q filings for balance sheet data.

- Investopedia: Book Value Definition – For a deep dive into the term and its nuances.

- The Intelligent Investor by Benjamin Graham – The foundational text on value investing and the use of Book Value.

How did this post make you feel?

Thanks for your reaction!