What Is Commission and How It Affects Your Trades

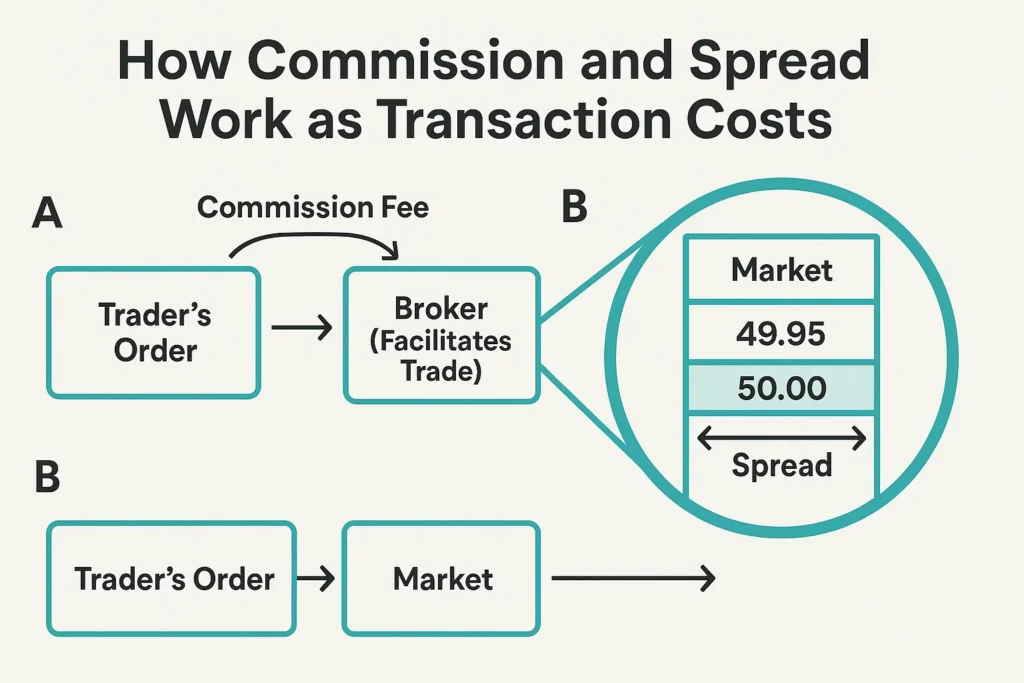

A commission is a service fee charged by a broker or financial advisor for executing transactions or providing investment advice. It’s the direct cost of participating in financial markets, and understanding its structure is crucial for preserving your investment returns. For active traders in the US, UK, Canada, and Australia, navigating commission schedules is a fundamental part of strategy.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A fee charged by a broker or financial agent for facilitating a transaction. |

| Also Known As | Brokerage Fee, Transaction Fee |

| Main Used In | Stock Trading, Real Estate, Insurance, Fund Management |

| Key Takeaway | Commissions are a direct drag on net returns; minimizing them is essential for long-term profitability. |

| Formula | Varies (e.g., Flat Fee, Percentage of Trade Value, Per-Share/Per-Contract) |

| Related Concepts |

What is Commission

A commission is a service-based fee paid to a broker, agent, or advisor for their role in facilitating a financial transaction. Think of it as the “toll” you pay to cross the bridge into the marketplace. Whether you’re buying shares of a company like Apple on the NASDAQ, purchasing a home, or investing in a mutual fund, a professional is enabling that trade, and the commission is their compensation. It’s a direct cost that is separate from the price of the asset itself and is deducted from your account or added to the

The Core Concept Explained

At its core, a commission compensates an intermediary for their expertise, platform, and access to markets. For brokers, it covers the cost of trade execution, maintaining trading infrastructure, and providing customer service. The structure of a commission can significantly impact your net profit or loss. A high commission on a small, frequent trade can turn a winning idea into a net loser. Conversely, a low, flat commission on a large trade has a much smaller relative impact. The shift towards zero-commission trading for stocks and ETFs on major US platforms like Robinhood, Charles Schwab, and Fidelity has been a game-changer for retail investors, but it’s crucial to remember that other costs, like the bid-ask spread and payment for order flow, still exist.

Key Takeaways

How to Calculate Commission

There is no single universal formula for commission. The calculation depends entirely on the broker’s fee schedule and the asset class being traded. The most common structures are:

- Flat Fee: A fixed charge per trade, regardless of size. (e.g., $5 per trade)

- Percentage-Based: A fee based on a percentage of the total transaction value. Common in real estate and managed funds. (e.g., 1% of trade value)

- Per-Unit Fee: A fee charged per share or per contract. Common for options and futures. (e.g., $0.50 per options contract)

Step-by-Step Calculation Guide

Let’s walk through a calculation for a Per-Unit Fee structure, common in options trading.

Example Calculation: Buying Options Contracts

- Input Values:

- Broker’s Commission: $0.75 per options contract

- Number of Contracts Bought: 10 contracts

- Premium (Price) of Option: $2.00 per share (One contract is 100 shares)

- Calculation:

- Cost of the Options: 10 contracts * 100 shares/contract * $2.00/share = $2,000

- Commission Cost: 10 contracts * $0.75/contract = $7.50

- Total Debit from Account: $2,000 (Asset Cost) + $7.50 (Commission) = $2,007.50

- Interpretation: To break even on this trade, the position needs to appreciate enough to cover not just the $2,000 premium but also the $7.50 in commissions. For a small, short-term trade, this commission can represent a significant hurdle.

For investors in the UK trading on the London Stock Exchange (LSE), commissions might be quoted in GBP and include a stamp duty. Similarly, Canadian investors on the TSX would see commissions in CAD. Always check your broker’s specific fee schedule for your region.

Why Commission Matters to Traders and Investors

Commissions directly eat into your bottom line. Their importance cannot be overstated, as they are one of the few aspects of investing you can directly control.

- For Traders: High commissions can decimate the profits from high-frequency or scalping strategies that rely on small, frequent price movements. A day trader making 20 trades a day with a $5 commission pays $100 daily in fees—a significant hurdle to overcome before becoming profitable.

- For Investors: For long-term buy-and-hold investors, while the impact of a single commission is small, it can add up over a lifetime of investing. More importantly, high commissions on mutual funds (like load fees) can severely impact the power of compounding returns.

- For Analysts: When evaluating a company like a brokerage firm (e.g., Charles Schwab or Interactive Brokers), analysts scrutinize commission income as a key revenue stream. The trend towards zero-commission trading has forced these firms to innovate with other revenue sources, like cash sweep programs and margin lending.

How to Use Commission Knowledge in Your Strategy

Understanding commissions allows you to optimize your trading and investing for cost efficiency.

- Use Case 1: Choosing the Right Broker for Your Style

- Scenario: You are a long-term investor who makes 4-5 trades per year to rebalance your portfolio.

- Application: A broker with a slightly higher flat fee but superior research tools and customer service might be preferable to a bare-bones platform. The total annual commission cost is low, so service quality is a higher priority.

- Use Case 2: Scaling into a Position

- Scenario: You want to invest $10,000 in a stock but are worried about volatility.

- Application: If commissions are high, buying all $10,000 at once might be more cost-effective than making five separate $2,000 purchases and paying a fee each time. With zero-commission stock trades, this concern is eliminated, allowing for flexible dollar-cost averaging.

- Use Case 3: Trading Options and Futures

- Scenario: You are an active options trader who trades 100 contracts per week.

- Application: A difference of $0.10 per contract in commission translates to $10 per week ($0.10 * 100 contracts) or $520 per year. Negotiating a lower per-contract rate or choosing a broker known for low derivatives fees is critical for profitability.

To implement these strategies effectively, you need a broker that aligns with your cost and feature needs. We’ve done the heavy lifting to find the best platforms. Check out our in-depth review of the Best Online Brokers for Low-Cost Trading to find your perfect match.

- Aligns Interests Compensates brokers and advisors for executed work, incentivizing action.

- Clear Compensation Fees are typically transparent and disclosed on trade confirmations.

- Access to Expertise Pays for the trading platforms, research, and market access brokers provide.

- Drag on Returns Directly reduces net profit and hinders the power of compounding over time.

- Conflict of Interest Can incentivize excessive trading (churning) to generate more fees.

- Invalidates Strategies High costs can make frequent-trading strategies unprofitable.

How Commissions Differ Around the World

While the US has moved towards zero-commission equity trading, the structure and prevalence of commissions vary significantly in other major markets. Understanding these differences is key for international investors.

- In the United Kingdom: Brokers in the UK, such as Hargreaves Lansdown or AJ Bell, often charge a percentage-based commission (e.g., 0.45% per trade) with a minimum fee, alongside a quarterly platform fee. UK investors must also factor in the Stamp Duty Reserve Tax (SDRT) of 0.5% on purchases of UK-listed shares.

- In Europe (e.g., Germany, France): Similar to the UK, percentage-based fees are common. However, the rise of neobrokers like Trade Republic (Germany) and BUX (Netherlands) has introduced a low, flat-fee model, though not always zero.

- In Asia (e.g., Hong Kong, Singapore): Commissions are typically higher and are often a percentage of the trade value with a minimum charge. Brokers in Hong Kong, for instance, might charge 0.25% of the trade value. There is also a Stamp Duty on stock transactions in Hong Kong.

Key Takeaway: The “zero-commission” model is predominantly a US equity phenomenon. When investing internationally, always research the local broker fees, taxes, and regulations to understand your true cost of trading. A great resource for understanding UK-specific fees is the official MoneyHelper guide to investment charges.

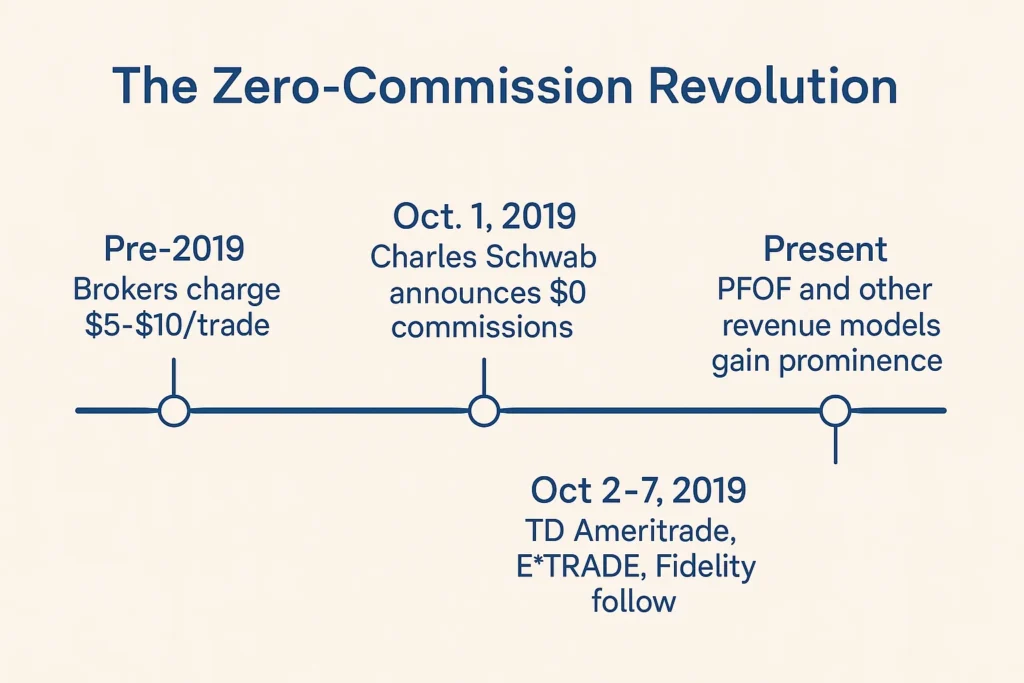

Commission in the Real World: The Zero-Commission Revolution

The most significant recent real-world example of commissions is the industry-wide shift to zero-commission trading for US-listed stocks and ETFs, which began in earnest in 2019.

The Case Study: The October 2019 Brokerage War

For decades, online brokers like TD Ameritrade, E*TRADE, and Charles Schwab charged standard commissions of $5 to $10 per trade. In October 2019, the disruptive broker Robinhood, which had built its entire model on zero-commission trading, was gaining massive market share. In a stunning move, Charles Schwab announced it would eliminate commissions for online equity trades. Within days, TD Ameritrade, E*TRADE, and Fidelity followed suit.

Impact and Interpretation:

This event fundamentally changed the landscape for retail investors. It dramatically reduced the cost of entry and made strategies like dollar-cost averaging more feasible. However, it also shifted broker revenue to other sources, primarily Payment for Order Flow (PFOF), where brokers sell their customers’ trade orders to market makers like Citadel Securities. This has led to debates about trade execution quality and potential conflicts of interest, reminding us that while explicit commissions can be zero, the cost of trading is never truly free.

Conclusion

Ultimately, understanding commission is fundamental to being a cost-conscious and successful market participant. It is a controllable variable that directly impacts your net profitability. While the zero-commission revolution has been a boon for stock traders, it’s crucial to remain vigilant about other costs and fee structures, especially in asset classes like options, futures, and international markets. By carefully selecting your broker based on your trading style and scrutinizing every fee, you ensure that more of your hard-earned money stays in your portfolio, working for you. Start by reviewing your own broker’s fee schedule today—you might be surprised at what you find.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for low-cost trading to help you get started.

Commission vs Spread

| Feature | Commission | Spread |

|---|---|---|

| What it is | A fee paid to the broker for the service of executing the trade. | The difference between the bid (selling) price and the ask (buying) price of an asset. |

| Who pays it | The trader/investor to their broker. | The trader/investor is effectively paying it to the market maker via a less favorable entry price. |

| Transparency | Explicitly listed as a separate line item on a trade confirmation. | Implicit and built into the price of the asset; not a separate fee. |

| Primary Control | You choose your broker and can negotiate rates. | Determined by market liquidity; you have little control. |

Related Terms

- Spread: The difference between the bid and ask price, representing an implicit transaction cost.

- Expense Ratio: The annual fee charged by mutual funds and ETFs, expressed as a percentage of assets.

- Management Fee: A fee charged by an investment manager for managing a portfolio, similar to a commission for ongoing service.

- Payment for Order Flow (PFOF): The practice of brokers selling their customers’ trade orders to market makers, which is how many zero-commission brokers make money.

Frequently Asked Questions

Recommended Resources

- Spread: The Hidden Cost of Trading

- Payment for Order Flow: The Truth Behind Zero-Commission Trading

- SEC.gov: The U.S. Securities and Exchange Commission’s page on [Understanding Fees and Expenses] is an authoritative source.

- FINRA.org: The Financial Industry Regulatory Authority provides a [Fund Analyzer] tool to compare mutual fund and ETF costs, including commissions.

- Investopedia: Their Commission Definition offers a clear, concise explanation and related content.