Investing in Gold Bullion Guide to Tangible Wealth

Gold bullion is physical gold of high purity, valued by its weight and fineness. It represents the most direct form of owning the precious metal, serving as a foundational asset for wealth preservation, a hedge against inflation, and a safe-haven during economic uncertainty.

For investors in the US, UK, Canada, and Australia, acquiring gold bullion from reputable dealers like the Royal Mint in the UK or Perth Mint in Australia is a cornerstone of a well-diversified, resilient portfolio, offering a tangible counterbalance to paper assets like stocks and bonds.

| Aspect | Detail |

|---|---|

| Definition | Gold bullion refers to gold that is officially recognized as being at least 99.5% pure and is in the form of bars or ingots. |

| Also Known As | Physical Gold, Bullion, Gold Bars, Ingots |

| Main Used In | Portfolio Diversification, Inflation Hedging, Safe-Haven Investing, Central Bank Reserves |

| Key Takeaway | It is a tangible, high-liquidity asset with no counterparty risk, making it a fundamental store of value, but it generates no income and requires secure storage. |

| Related Concepts |

What is Gold Bullion

Gold bullion is the term for pure, or very nearly pure, gold that has been melted down and cast into a bar or minted into a coin. Unlike jewelry or numismatic coins, its value is derived almost exclusively from its gold content and weight, not its craftsmanship or collectible value. Think of it as the “raw currency” of the gold world. It’s the standardized, high-purity form that central banks hold in their vaults and that large-scale investors trade. When people talk about investing in physical gold, they are most often referring to gold bullion.

Key Takeaways

The Core Concept Explained

The core concept of gold bullion is its role as a fundamental, non-correlated asset. It doesn’t generate cash flow like a business (dividends) or promise a return like a bond (interest). Its value is intrinsic and universally acknowledged. A high value for gold bullion in your portfolio indicates a strong emphasis on wealth preservation and risk mitigation. It often performs well when other assets like stocks are performing poorly. Conversely, a low or zero allocation suggests a portfolio focused purely on growth-generating assets, which may be more volatile during economic downturns.

How is Gold Bullion Priced

While there is no “formula” you calculate yourself, the price you pay for gold bullion is determined by a clear structure. The final cost is based on the Gold Spot Price plus a Dealer’s Premium.

Step-by-Step Pricing Breakdown

- The Spot Price: This is the baseline price for one troy ounce of pure gold, traded on global commodities exchanges like the COMEX in the US and the LBMA in London. It fluctuates constantly throughout the trading day.

- The Dealer’s Premium: This is the markup charged by the bullion dealer over the spot price. It covers their costs (manufacturing, security, operations) and profit margin. The premium is usually a percentage of the spot price or a fixed amount per ounce.

Example Calculation:

Let’s say you, an investor in the US, want to buy a 1-ounce gold bar from a reputable online dealer.

- Input Values: Gold Spot Price = $2,000 per oz, Dealer’s Premium = 4% (or $80).

- Calculation: $2,000 (Spot Price) + $80 (Premium) = $2,080 (Your Purchase Price).

- Interpretation: You pay $2,080 for the 1-ounce bar. If you were to sell it back immediately, the dealer might offer you the spot price minus a smaller premium (e.g., $2,000 – $20 = $1,980). This “bid-ask spread” is the cost of the transaction.

When buying in the UK, investors might look to the LBMA Gold Price, while in Canada and Australia, prices are still primarily derived from these major global benchmarks, with premiums set by local mints and dealers.

Why Gold Bullion Matters to Traders and Investors

Gold bullion is a strategic asset class, not just a speculative one.

- For Investors: It is a core tool for portfolio diversification. Because its price movement is often uncorrelated with stocks and bonds, it can reduce overall portfolio volatility and preserve capital during market crashes. It’s a proven hedge against inflation; as the cost of living rises, the value of gold often follows, protecting your purchasing power.

- For Traders: While less common for short-term trading due to premiums, traders might use physical bullion as a long-term bet on macroeconomic trends, such as prolonged monetary easing or currency devaluation. More often, they would use Gold ETFs like GLD for short-term positions.

- For Central Banks & Institutions: They hold massive gold reserves to diversify foreign exchange assets, mitigate risk associated with sovereign bonds, and instill confidence in their national currency.

How to Store Your Gold Bullion Securely

Secure storage is non-negotiable. Here are the primary options, from least to most secure.

Home Storage

- Method: High-quality, UL-rated safe, bolted to the foundation in a concealed location.

- Pros: Immediate access and full privacy.

- Cons: High risk of theft, potential for damage (fire, flood), and likely inadequate insurance coverage under a standard homeowner’s policy.

Bank Safety Deposit Boxes

- Method: Renting a box at a local bank branch.

- Pros: More secure than a home safe. Moderate cost.

- Cons: Access is limited to bank hours. Contents are typically not insured by the bank. Potential for seizure or restricted access during banking crises.

Professional Bullion Vaults

- Method: Storing with a specialized, non-bank, private vaulting company.

- Pros: Maximum security (24/7 monitoring, armed guards, alarms, insurance). Full insurance coverage for your holdings. Often offers segregated storage, meaning your specific bars are identified and set aside.

- Cons: Ongoing storage fees. You do not have immediate, physical access.

How to Use Gold Bullion in Your Strategy

Use Case 1: The Core Diversifier (5-10% Rule)

Many financial advisors suggest allocating 5-10% of a portfolio to gold. This provides a meaningful hedge without sacrificing too much growth potential from other assets. An investor would purchase bullion bars or coins and hold them for the long term in a secure vault.

Use Case 2: The Safe-Haven Flight

During times of geopolitical tension or a stock market crash, investors often “fly to safety” by increasing their gold allocation. A practical move could be to use dollar-cost averaging during volatile periods to build a position in gold bullion.

Use Case 3: The Inflation Protection Plan

If you are concerned about long-term currency devaluation due to excessive government spending and money printing, allocating a portion of your savings to gold bullion acts as a form of financial insurance.

To start building your physical gold portfolio, you’ll need a reliable and trustworthy dealer. We’ve reviewed and ranked the best bullion dealers for security, pricing, and customer service to help you make a safe first purchase.

- Tangible Asset: It’s real, physical money you can hold, with no reliance on a digital ledger or a company’s solvency.

- Portfolio Insurance: Acts as a proven safe-haven during economic crises and stock market downturns.

- High Liquidity: Gold is recognized and can be sold for cash anywhere in the world.

- Privacy & Control: Owning physical bullion gives you direct control over your asset, outside the banking system.

- No Yield: Gold does not pay dividends or interest. Your return is solely based on capital appreciation.

- Storage & Insurance Costs: Securing your bullion in a safe or a professional vault incurs ongoing expenses.

- Transaction Costs: The bid-ask spread can be significant, especially for smaller bars and coins.

- Price Volatility: While a safe-haven, the gold price can still experience significant short-term fluctuations.

Choosing Your Bullion: Bars vs. Coins

Once you decide to invest, you need to choose the form. The main choice is between bars and coins, each with distinct advantages.

Gold Bars

- Pros: Typically have a lower premium over the spot price than coins. Offered in an extensive variety of sizes, ranging from 1 gram to 400 ounces.

- Cons: Less recognizable to the general public. Larger bars are highly illiquid for individuals.

- Best For: Investors focused on maximizing the amount of gold for their money and who have a secure, long-term storage plan.

Gold Bullion Coins

- Pros: Highly recognizable and liquid due to government backing (e.g., American Eagle, Canadian Maple Leaf). Legal tender status can sometimes offer advantages (e.g., in some jurisdictions, they may be considered collectibles for tax purposes). Easier to sell in small quantities.

- Cons: Carry a higher premium over the spot price compared to bars of similar size.

- Best For: New investors and those who value maximum liquidity and ease of sale.

Gold Bullion in the Real World: A Case Study

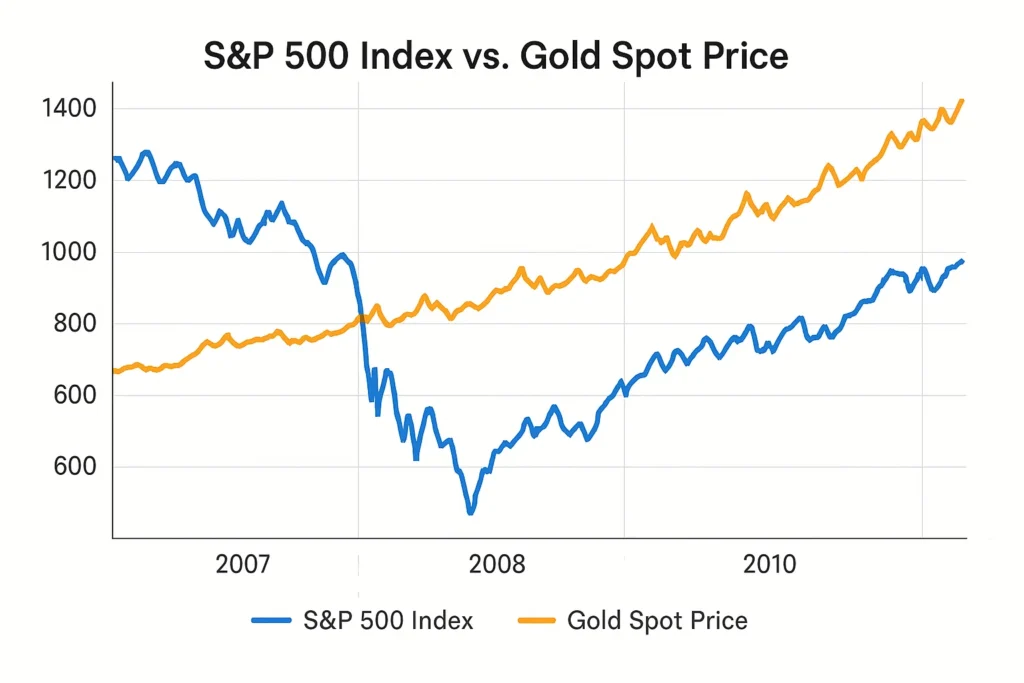

The 2008 Global Financial Crisis is a textbook example of gold bullion’s role as a safe-haven. As major banks like Lehman Brothers collapsed and stock markets (like the S&P 500) plummeted over 50%, panic gripped investors. In this environment, gold bullion shone.

While the S&P 500 fell from a high of ~1,565 in October 2007 to a low of ~676 in March 2009, the price of gold increased from around $700 per ounce in 2007 to over $1,000 per ounce by early 2009. Investors who had allocated a portion of their portfolio to physical gold saw these holdings act as a critical buffer, preserving wealth while their equity investments crumbled. This flight to quality underscored gold’s unique property of being a store of value when confidence in financial institutions and paper assets evaporates.

This pattern was repeated during the COVID-19 market shock in 2020 and during periods of high inflation in the 1970s, demonstrating its recurring role for investors in the US and other developed markets.

Gold Bullion (Physical) vs Gold ETFs (e.g., GLD)

| Feature | Gold Bullion (Physical) | Gold ETFs (e.g., GLD) |

|---|---|---|

| What you own | Direct, physical ownership of the metal. | Shares in a trust that holds gold; a paper claim. |

| Counterparty Risk | None. | Yes (risk associated with the fund sponsor and custodian). |

| Storage | You are responsible (home safe, bank vault). | Handled by the fund (costs are covered by the expense ratio). |

| Liquidity | High, but with a bid-ask spread. | Extremely high, trades like a stock on an exchange. |

| Costs | Dealer premium, storage, insurance. | Management expense ratio (MER). |

Conclusion

Ultimately, understanding gold bullion provides a critical lens for evaluating long-term wealth preservation and portfolio resilience. While it is a powerful tool for diversification and hedging against inflation and systemic risk, as we’ve seen, it’s not a growth asset and comes with carrying costs. By thoughtfully incorporating physical gold into your overall strategy—typically as a 5-10% core holding—you can build a more robust, data-driven portfolio capable of weathering economic storms. Start by researching reputable dealers and considering your storage options to take the first step.

Ready to add the security of physical gold to your portfolio? The right custodian is essential. We’ve meticulously reviewed the best gold IRA companies and bullion dealers to help you make an informed and secure first purchase.

Related Terms

- Spot Price: The current market price at which gold can be bought or sold for immediate delivery. This is the benchmark for pricing all gold products.

- Gold ETFs (Exchange-Traded Funds): A securities that tracks the gold price and trades on a stock exchange. It offers exposure to gold without the need for physical storage.

- Numismatic Coins: Collectible coins whose value is based on rarity, condition, and demand, rather than solely on their gold content.