How to Start Investing The Complete Beginner's Step-by-Step Guide

Feeling overwhelmed by the stock market but want your money to work for you? Learning how to start investing is your gateway to building wealth and achieving financial freedom. This complete guide will walk you through every step, from overcoming initial fears to making your first investment with clear, actionable advice tailored for absolute beginners.

For beginners in the US and Canada, understanding tax-advantaged accounts like 401(k)s, IRAs (US) or RRSPs, TFSAs (Canada) is crucial for maximizing returns. In the UK, ISAs offer similar benefits. This guide will reference these region-specific options where applicable.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | Learn to start investing with confidence and build a portfolio that grows your money over time |

| Skill Level | Absolute Beginner (no prior experience needed) |

| Time Required | 2-4 hours to get started, 1-2 hours monthly for maintenance |

| Tools Needed | Computer/smartphone, internet connection, basic calculator, brokerage account |

| Key Takeaway | Consistent investing in diversified assets over time is more important than timing the market perfectly |

| Related Concepts |

Why Learning to Invest is Crucial for Your Financial Future

Investing isn’t just for the wealthy or financially savvy—it’s a fundamental skill that can transform your financial life. While saving money in a bank account protects your principal, it often fails to outpace inflation, meaning your purchasing power actually decreases over time. According to the U.S. Bureau of Labor Statistics, the average annual inflation rate from 1913 to 2023 was approximately 3.14%. This means money sitting idle loses value every year.

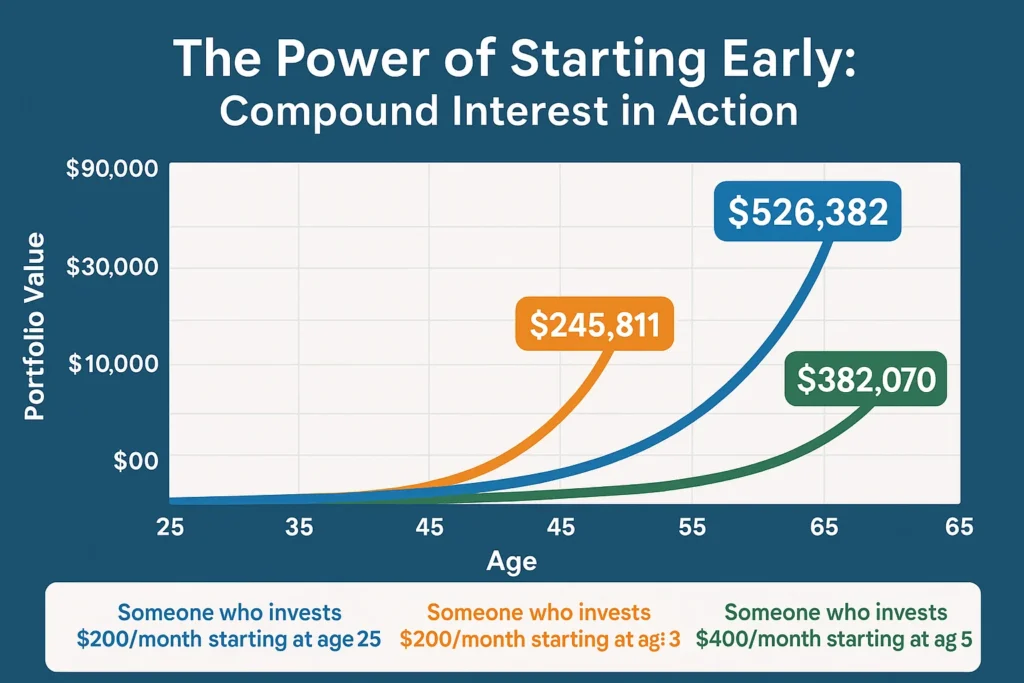

For Beginners: Learning to invest solves the problem of stagnant savings and creates opportunities for wealth accumulation that traditional saving cannot match. The power of compound interest—earning returns on your returns—means that even small, regular investments can grow significantly over decades.

The Problem It Solves: The anxiety of not having enough for retirement, the stress of living paycheck to paycheck, and the frustration of watching inflation erode your hard-earned savings.

The Outcome: By mastering basic investing principles, you’ll gain confidence in managing your money, build a portfolio that grows independently of your active work, and create multiple income streams that can lead to financial independence.

Key Takeaways

What You’ll Need Before You Start Investing

Before making your first investment, ensure you have these essentials in place. Proper preparation prevents poor investment decisions and sets you up for long-term success.

Knowledge Prerequisites:

- Basic understanding of financial terms (explained in this guide)

- Awareness of your current financial situation (income, expenses, debts)

- Familiarity with your financial goals (short-term and long-term)

Financial Foundation Requirements:

- Emergency Fund: 3-6 months of living expenses in a high-yield savings account

- Debt Management: High-interest debt (credit cards >7%) should be paid down first

- Budget Understanding: Know your monthly cash flow to determine investable amounts

Tools & Platforms:

- Brokerage Account: Choose between traditional brokerages (Fidelity, Vanguard, Charles Schwab) or newer apps (Robinhood, Webull, SoFi Invest)

- Research Tools: Free resources like Yahoo Finance, Morningstar, or your brokerage’s research platform

- Calculator: For determining investment amounts and projecting growth

- Document Organization: System for tracking statements and tax documents

To get started, you’ll need a reliable brokerage account. Many beginner-friendly platforms now offer commission-free trading and educational resources. While we maintain editorial independence, platforms like Fidelity and Charles Schwab consistently rank highly for beginners due to their educational resources and customer support. The SEC’s Investor.gov website also offers excellent free educational materials for new investors.

How to Start Investing: A Step-by-Step Walkthrough

Step 1: Assess Your Financial Foundation and Set Clear Goals

Before investing a single dollar, conduct a thorough financial self-assessment. Calculate your net worth (assets minus liabilities) and review your monthly budget. The Consumer Financial Protection Bureau recommends having an emergency fund before investing. Determine your investment timeline:

- Short-term goals (1-3 years): Down payment, vacation, emergency fund completion

- Medium-term goals (3-10 years): Home renovation, education, business startup

- Long-term goals (10+ years): Retirement, financial independence, legacy building

Pro Tip: Use the 50/30/20 budget rule as a starting point: 50% for needs, 30% for wants, and 20% for savings and investments. Even if you start with just 5% for investments, the habit matters most.

Step 2: Understand Different Investment Options and Asset Classes

Familiarize yourself with the four main asset classes:

- Stocks: Ownership shares in companies (higher risk, higher potential return)

- Bonds: Loans to governments or corporations (lower risk, steady income)

- Real Estate: Physical property or REITs (moderate risk, inflation hedge)

- Cash/Cash Equivalents: Savings accounts, money market funds (lowest risk, lowest return)

For beginners, mutual funds and Exchange-Traded Funds (ETFs) provide instant diversification. According to the Investment Company Institute, as of 2023, there were over 7,400 mutual funds and 2,800 ETFs in the United States alone.

Common Mistake to Avoid: Don’t chase “hot tips” or invest in complex products you don’t understand. Stick to broad-market index funds when starting.

Step 3: Open and Fund Your First Investment Account

Choose between these common account types:

- Taxable Brokerage Account: Flexible, no contribution limits, taxable

- Retirement Accounts (US): 401(k) (employer-sponsored), IRA/Roth IRA (individual)

- Retirement Accounts (Canada): RRSP (tax-deferred), TFSA (tax-free)

- Retirement Accounts (UK): Workplace pension, SIPP, ISA

How to Choose a Brokerage:

- Compare fees (commission, account maintenance, expense ratios)

- Review minimum investment requirements

- Evaluate educational resources

- Check mobile app ratings and usability

- Consider customer service availability

Example Setup: If you’re 30 years old with moderate risk tolerance, you might start with: $500 initial investment in a Roth IRA (if eligible), choosing a target-date fund for 2055, and setting up automatic monthly contributions of $100.

Step 4: Build Your First Diversified Portfolio

Diversification is your best defense against risk. For beginners, consider these simple portfolio models:

The Three-Fund Portfolio (Boglehead Approach):

- Total US Stock Market Index Fund (50%)

- Total International Stock Market Index Fund (30%)

- Total Bond Market Fund (20%)

Age-Based Rule of Thumb: Some advisors suggest “100 minus your age” as the percentage to put in stocks. A 30-year-old would have 70% stocks, 30% bonds.

How to Execute Your First Investment:

- Log into your brokerage account

- Navigate to the trading section

- Search for your chosen fund symbol (e.g., VTI for Vanguard Total Stock Market)

- Select “Buy” and choose “Shares” or “Dollar Amount”

- Review order and submit

Step 5: Implement Dollar-Cost Averaging and Set Up Automation

Dollar-cost averaging (DCA) means investing a fixed amount regularly regardless of market conditions. This eliminates emotional decision-making and often produces better results than trying to time the market.

How to Set Up Automatic Investments:

- Determine your monthly investment amount (start with what’s comfortable)

- In your brokerage account, find “Automatic Investments” or “Recurring Investments”

- Set the frequency (weekly, bi-weekly, or monthly)

- Choose the date (shortly after payday works best)

- Select the funds/ETFs and allocation percentages

- Review and activate

Example: If you invest $200 monthly into an S&P 500 index fund:

- Month 1: Market high, you buy fewer shares at $50/share = 4 shares

- Month 2: Market low, you buy more shares at $40/share = 5 shares

- Average cost: $44.44/share (better than timing perfectly)

How to Implement Your Investment Strategy in Real Life

Theory becomes powerful when applied. Let’s translate these principles into actionable steps for different life situations.

Scenario 1: The Recent College Graduate (Age 22)

- Income: $45,000 annually

- Goal: Start retirement savings early

- Action Plan:

- Contribute enough to 401(k) to get full employer match (if offered)

- Open Roth IRA and max out ($500/month to reach $6,000 annual limit)

- Choose target-date fund for 2065 or aggressive allocation (90% stocks/10% bonds)

- Set up automatic contributions from checking account

Scenario 2: The Mid-Career Professional (Age 40) Playing Catch-Up

- Income: $85,000 annually

- Goal: Accelerate retirement savings

- Action Plan:

- Max out 401(k) contribution ($22,500 annual limit for 2023)

- Consider “catch-up” contributions if over 50

- Implement 60/40 stock/bond allocation for moderate growth with stability

- Consider taxable brokerage for additional investments

Scenario 3: The Side Hustler with Irregular Income

- Income: Variable, $30,000-$50,000 annually

- Goal: Create investment system despite income fluctuations

- Action Plan:

- Open SEP IRA or Solo 401(k) for business income

- Set percentage-based investing (e.g., 20% of all income goes to investments)

- Build 6-month emergency fund due to income variability

- Use robo-advisor for automated rebalancing

Sarah, 28, started investing with just $50/month in a total stock market ETF. She increased her contributions by $25 with each raise. After 5 years, she’s investing $200/month and her portfolio has grown to $15,000 despite market fluctuations. Her secret? Consistency and automation.

Common Mistakes When Starting to Invest

Learning from others’ mistakes is cheaper than learning from your own. Here are the most common beginner errors and how to avoid them.

Pitfall 1: Trying to Time the Market

- The Mistake: Waiting for the “perfect” moment to invest, often missing gains

- The Solution: Implement dollar-cost averaging automatically. Historical data from DALBAR shows that market timers significantly underperform buy-and-hold investors.

Pitfall 2: Chasing Past Performance

- The Mistake: Investing in last year’s top-performing fund, which often reverts to mean

- The Solution: Choose broad market index funds with low expenses. The SPIVA scorecard consistently shows most active managers underperform their benchmarks over time.

Pitfall 3: Overreacting to Market Volatility

- The Mistake: Selling during downturns, locking in losses

- The Solution: Remember that downturns are normal. Since 1928, the S&P 500 has experienced a decline of 10% or more about once every 1.5 years on average. Develop an investment policy statement to reference during emotional times.

Pitfall 4: Neglecting Tax Efficiency

- The Mistake: Holding tax-inefficient investments in taxable accounts

- The Solution: Place bonds, REITs, and high-dividend stocks in tax-advantaged accounts. Keep tax-efficient index funds/ETFs in taxable accounts. IRS Publication 550 provides guidance on investment income and expenses.

Pitfall 5: Paying Too Much in Fees

- The Mistake: Not understanding how fees compound over decades

- The Solution: Compare expense ratios. A 1% fee difference over 30 years can consume over 25% of your potential returns according to the SEC’s compound return calculator.

The Psychology of Investing: Managing Your Mindset

Your biggest investment challenge isn’t the market—it’s your own psychology. Understanding behavioral finance principles can prevent costly emotional decisions.

Cognitive Biases to Recognize:

- Loss Aversion: Feeling losses twice as powerfully as gains (leads to selling winners too early and holding losers too long)

- Confirmation Bias: Seeking information that confirms existing beliefs (ignoring warning signs)

- Recency Bias: Overweighting recent events (believing current trends will continue indefinitely)

- Herd Mentality: Following the crowd (FOMO buying at peaks)

Practical Mindset Tools:

- The “Sleep Test”: If an investment keeps you awake at night, it’s too risky for you

- The “Newspaper Test”: Would you be comfortable seeing your investment strategy on the front page?

- The “10/10/10 Rule”: How will you feel about this decision in 10 days, 10 months, and 10 years?

Emotional Circuit Breakers:

- Implement a 24-hour cooling-off period before making significant changes

- Consult your investment policy statement before emotional decisions

- Talk to a fee-only financial advisor during high-stress periods

- Remember that markets have recovered from every decline in history

- Instant Diversification One fund provides exposure to hundreds or thousands of companies

- Lower Costs Expense ratios typically 0.03%-0.20% vs. 1%+ for actively managed funds

- Transparency Holdings are published daily, no style drift or manager changes

- Tax Efficiency Lower turnover generates fewer taxable capital gains distributions

- Proven Performance Consistently beats majority of active managers over 10+ year periods

- No Outperformance You’ll match the market, not beat it (which is actually fine for most)

- Limited Customization Less ability to exclude specific companies or sectors you disagree with

- Behavioral Challenges Still requires discipline to stay invested during market downturns

- Learning Curve Understanding why “simple” is sophisticated takes time and education

- Initial Overwhelm Paradox of choice with thousands of fund options can freeze decision-making

Taking Your Investing Knowledge to the Next Level

Once you’ve mastered the basics, these advanced concepts can further optimize your strategy.

Tax-Loss Harvesting:

- Concept: Selling investments at a loss to offset capital gains taxes

- Implementation: Many robo-advisors automate this, or you can do it manually in December

- Caution: Beware of wash-sale rules (buying substantially identical security within 30 days)

Factor Investing:

- Beyond Market Beta: Adding exposure to factors like value, momentum, quality, or low volatility

- Beginner Approach: Consider multifactor ETFs (like QUAL, MTUM, USMV) for small tilts

- Resources: Research from firms like Dimensional Fund Advisors or academic papers on factor premiums

Portfolio Optimization:

- Modern Portfolio Theory: Balancing risk and return through mathematical optimization

- Practical Tool: Use free portfolio optimizers (like Portfolio Visualizer) to test allocations

- Advanced Concept: Efficient frontier – maximizing returns for a given level of risk

International Diversification:

- Beyond Home Bias: Most US investors are underweight international markets

- Current Allocation: Global market cap is approximately 60% US, 40% international

- Implementation: Add developed markets (EFA) and emerging markets (EEM) ETFs

External Resource: For deeper dives into these concepts, the CFA Institute provides excellent free resources, and academic papers on SSRN offer cutting-edge research.

Choosing the Right Account for Each Dollar

Different investment dollars belong in different accounts for maximum tax efficiency. Here’s a priority framework:

Account Funding Priority:

- 401(k) up to employer match (100% immediate return)

- High-interest debt repayment (>7% guaranteed return)

- HSA (if eligible) (Triple tax advantage: deductible, grows tax-free, tax-free withdrawals for medical)

- IRA/Roth IRA (Tax-advantaged space with investment control)

- 401(k) to annual limit (Additional tax-deferred growth)

- Taxable brokerage (Flexible but taxable)

Special Account Considerations:

- 529 Plans: For education savings, many states offer tax deductions

- UBTI/UTMA: For gifting to minors while maintaining some control

- Solo 401(k)/SEP IRA: For self-employed or side business income

- Mega Backdoor Roth: For high earners (if plan allows)

International Considerations:

- UK: ISA allowance (£20,000/year), Lifetime ISA for first-time home buyers

- Canada: TFSA contribution room accumulates, RRSP reduces taxable income

- Australia: Superannuation with concessional contributions

Resource: The IRS website provides detailed guides on each account type, contribution limits, and withdrawal rules.

Conclusion

You now possess the fundamental knowledge to begin your investment journey with confidence. Remember that perfection is the enemy of progress in investing—starting with something simple and consistent beats waiting for the perfect plan.

Your 7-Day Getting Started Checklist:

- Day 1: Calculate your emergency fund status and risk tolerance

- Day 2: Research and select a brokerage platform

- Day 3: Open your investment account

- Day 4: Determine your initial asset allocation

- Day 5: Make your first investment (even if it’s just $50)

- Day 6: Set up automatic recurring contributions

- Day 7: Schedule quarterly check-ins on your calendar

The most successful investors aren’t those with the highest IQs or most information—they’re the ones who start early, invest consistently, and stay the course through market cycles. Your future self will thank you for taking action today.

Ready to implement what you’ve learned? Many beginners find automated platforms helpful for starting. While we don’t endorse specific products, robo-advisors like Betterment and Wealthfront can help automate diversification and rebalancing. For a hands-on approach with more control, consider educational platforms like Fidelity’s Learning Center or Vanguard’s personal advisor services. Remember to always verify credentials through FINRA’s BrokerCheck before working with any financial professional.

How Beginner Investing Compares to Other Financial Strategies

| Feature | Beginner Investing (Passive) | Advanced/Active Investing |

|---|---|---|

| Primary Goal | Wealth accumulation through market participation | Market outperformance through skill/timing |

| Time Commitment | 1-2 hours monthly for monitoring and contributions | Daily or weekly research and position management |

| Risk Level | Market risk only (diversified) | Market risk + concentration risk + timing risk |

| Cost Structure | Low (0.03%-0.20% expense ratios) | Higher (1%+ management fees, trading commissions, taxes) |

| Success Rate | High (matches market returns) | Low (majority underperform over 10+ years) |

| Emotional Demand | Low (set-and-forget, behavioral aids built in) | High (requires discipline against fear/greed cycles) |