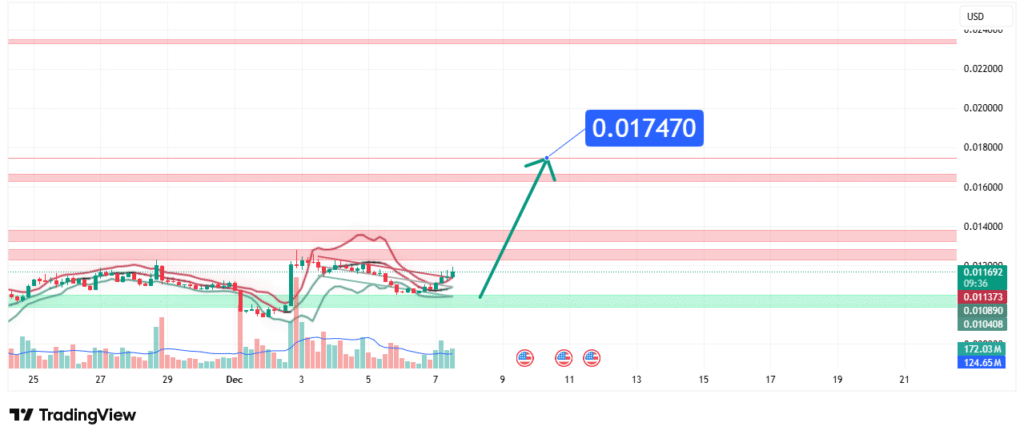

Pengu Price Forecast 46% Rally Potential from Key Support

Pengu’s price has successfully defended a crucial support zone after a sharp pullback, suggesting that seller exhaustion may be setting in and a counter-trend rally could be imminent. This price action points to a developing bullish reversal bias from the oversold region. Our analysis projects a move towards a primary target of $0.0017, which represents the recent consolidation breakdown level and a key Fibonacci retracement area. This prediction is based on a confluence of technical factors, including a bullish divergence on momentum oscillators, a hold at a multi-touch support level, and a potential double bottom pattern.

Current Market Structure and Price Action

The short-term market structure is bearish following the breakdown from the $0.0017 area. However, the price is now showing signs of basing and potential reversal as it interacts with strong historical support. The price is currently consolidating tightly above the $0.0011 – $0.0012 support zone, indicating a balance between buyers and sellers after the downtrend. Recent price action has shown multiple bullish rejection wicks (hammers) and a potential double bottom formation near the $0.00116 level, signaling that buyers are actively defending this area and a bounce is increasingly likely.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone between $0.0011 and $0.0012. The strength of this zone is derived from:

- Historical Significance: This zone has acted as a launchpad for multiple rallies in late November and early December, as seen on the chart. It represents a high-volume node where price has historically found demand.

- Technical Confluence: The zone aligns with the 0.786 Fibonacci retracement level of the prior up-move and a key psychological level, adding significant technical weight.

- Market Psychology: For memecoins, holding above key, round-number psychological supports like $0.0010 is crucial for maintaining trader sentiment and preventing panic selling.

This confluence makes it a high-probability level for a bullish reaction and the start of a relief rally.

Technical Target(s) and Rationale

Our analysis identifies the following price target(s):

Primary Target (PT1): $0.0017

This level represents the previous consolidation zone and the breakdown point. A return to this level would constitute a full retracement of the recent impulsive decline, turning prior resistance into new support. It also aligns with the 50% Fibonacci retracement level of the entire corrective move from the higher high. Achieving this target would represent a ~46% gain from current levels.

Secondary Target (PT2): $0.0020 (Psychological & Previous High)

This is a more ambitious target, acting as a key psychological resistance and the area of the previous local high. A decisive break and close above $0.0017 would open the path for a test of this level.

Prediction: We forecast that the price will hold the $0.0011-$0.0012 support zone and initiate a bullish reversal, moving towards PT1 at $0.0017 as the first major objective.

Risk Management Considerations

Extreme caution is advised due to the volatile nature of memecoins. A professional strategy is defined by its strict risk management.

- Invalidation Level (Stop-Loss): The entire bullish reversal thesis is invalidated if the price achieves a 4-hour close below $0.00105. This level is just below the key support confluence and represents a failure of the historical demand zone, which would likely trigger a new wave of selling towards lower supports.

- Position Sizing: Given the high risk, any positions taken should be extremely small, sized so that a loss represents a tiny fraction of your total capital (e.g., 0.5-1%). Never invest more than you can afford to lose.

Fundamental Backdrop

The technical setup for a memecoin is almost entirely framed by sentiment and market dynamics:

- Broader Memecoin Sentiment: Pengu’s price is heavily dependent on the overall risk appetite for speculative crypto assets. A positive shift in sentiment towards majors like Bitcoin can spill over into altcoins and memecoins.

- Community & Social Momentum: For memecoins, community engagement on platforms like Twitter and Telegram is a key driver. Any resurgence in social activity or notable influencer mentions could be the catalyst for the predicted bounce.

- Exchange Listings & Liquidity: Monitoring for new centralized exchange (CEX) listings or increases in decentralized exchange (DEX) liquidity can provide fundamental support for price moves.

Conclusion

Pengu is at a critical support level where historical buying interest has emerged. The weight of technical evidence suggests a bullish reversal is possible, targeting a move to $0.0017. Traders should monitor for a confirmed break above the immediate resistance near $0.0013 as initial confirmation. Risk management is paramount; always respect the key invalidation level at $0.00105. The reaction at the $0.0017 target will be crucial for determining if this is a dead cat bounce or the start of a more significant recovery.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. Memecoins are highly volatile and speculative assets. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.