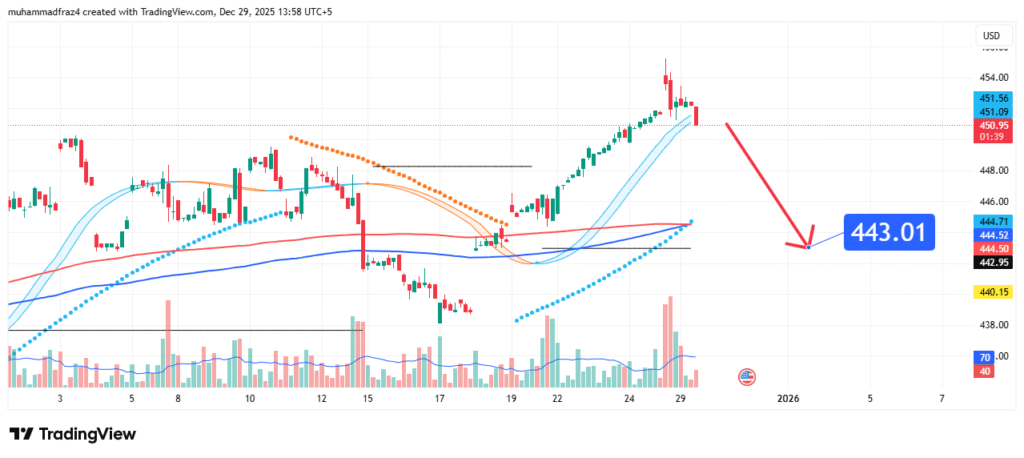

Corn (ZC) Price Forecast Breakdown to $443 in Sight

Corn’s price

Current Market Structure and Price Action

The broader market structure remains bearish, characterized by a series of lower highs and lower lows. The recent bounce from the $440 area was corrective in nature and has now been capped decisively at the $451 zone. On the 4-hour chart, this rejection is evident in a bearish engulfing pattern followed by consecutive red candles, indicating strong selling pressure. Price is now trading below a key short-term moving average cluster, reinforcing the bearish near-term momentum.

Identification of the Key Resistance Zone

The most critical technical element is the Strong Resistance Zone between $450.50 and $452.00. The strength of this zone is derived from:

- Historical Significance: This level marked a previous swing low in late September, which has now flipped into resistance—a classic bearish market structure shift.

- Technical Confluence: The zone aligns perfectly with the 61.8% Fibonacci retracement level of the recent down move from ~$460 to $440. Confluences with Fibonacci levels often provide powerful reversal points.

- Market Psychology: The round number of $450 acts as a psychological barrier. The failure to reclaim it signifies a lack of conviction from buyers.

This multi-layered resistance confluence made it a high-probability level for a bearish reaction, which is now playing out.

Technical Targets and Rationale

Our analysis identifies the following price targets:

Primary Target (PT1): $443.00

This is the immediate prior swing low from mid-October. In bearish trends, markets often retest and break previous lows. It also represents a minor psychological level.

Secondary Target (PT2): $438.00

This is a more significant target, representing the year-to-date low established earlier in October. A break below $443 would likely trigger sell-stops and increase bearish momentum, targeting this major support level.

Prediction: We forecast that the price will break below the recent consolidation support near $447 and accelerate towards PT1 at $443. A sustained breakdown with increasing volume would then open the path towards PT2 at $438.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bearish thesis is invalidated if the price achieves a daily close above $452.50. This level is above the key resistance confluence and would signify a false breakdown and a potential shift in structure back to neutral/bullish.

- Position Sizing: Any short positions or bearish spreads considered should be sized so that a loss triggered at the invalidation level above $452.50 represents a small, pre-defined percentage of your total trading capital (typically 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Harvest Pressure: The ongoing U.S. harvest is steadily increasing supply, a seasonally bearish factor that is weighing on prices.

- Demand Concerns: Export sales have been inconsistent, and global economic slowdown fears are dampening long-term demand prospects for grains.

- Dollar Strength: A resilient U.S. Dollar makes dollar-denominated commodities like corn more expensive for foreign buyers, potentially curbing demand.

These factors collectively contribute to the bearish-to-cautious sentiment surrounding the corn market, supporting the technical outlook for lower prices.

Conclusion

Corn is at a critical juncture following a confirmed rejection at a major resistance zone. The weight of evidence suggests a bearish resolution, targeting a decline to $443. Traders should monitor for a confirmed break below the $447 interim support and manage risk diligently by respecting the key invalidation level at $452.50. The reaction at the $443 target will be crucial for determining whether the downtrend will extend towards the $438 yearly low.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.