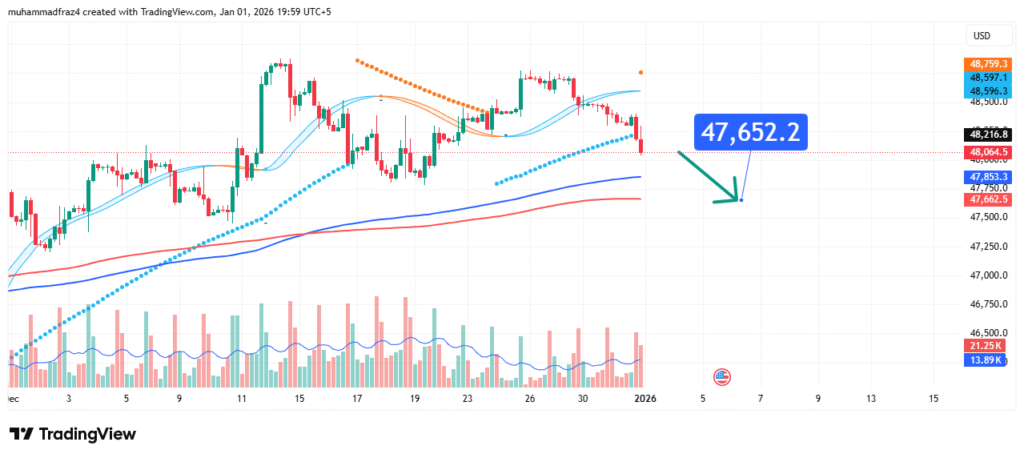

Dow Jones (DJIA) Price Forecast Targeting a Pullback to $47,652

The Dow Jones Industrial Average (DJIA)

Current Market Structure and Price Action

The broader market structure remains bullish with a series of higher highs and higher lows. However, the price is currently interacting with a strong resistance zone between 48,500 USD and 48,597 USD (as per the data: 48,597.1, 48,596.3). Recent price action failing to sustain a break above this region indicates seller presence and potential buyer exhaustion. The immediate move from the current price (~48,064 USD) down towards our target suggests a breakdown from a short-term consolidation, seeking the next layer of significant support.

Identification of the Key Support Zone

The most critical technical element for this bearish setup is the strong Support Zone between 47,500 USD and 47,700 USD. The strength of this zone is derived from:

- Historical & Projected Confluence: The provided data shows a dense cluster of significant levels here: 47,853.5, 47,750.0, 47,650.5, and 47,500.0. This creates a high-density support area.

- Primary Target: Our analysis pinpoints 47,652 USD as the precise target within this zone, acting as a likely point for a price reaction or temporary halt in the bearish move.

- Market Psychology: This area represents a point where dip-buyers and profit-takers from earlier swings may re-enter, providing initial support.

Below this, the secondary strong support zone lies between 46,500 USD and 46,750 USD (data: 46,750.3, 46,750.0, 46,500.0).

Technical Targets and Rationale

Our analysis identifies the following price targets for this bearish scenario:

Primary Target (PT1): 47,652 USD

This is our core prediction level. It sits firmly within the primary support confluence zone and represents a key level where buying interest is anticipated to emerge initially.

Secondary Target (PT2): 46,500 – 46,750 USD Zone

This is a more substantial support area, defined by multiple data points. A break below PT1 would shift focus here for a deeper correction.

Prediction: We forecast that the price will reject from the current resistance area and move down towards PT1 at 47,652 USD. The price reaction at this level will be crucial; a strong bounce could reaffirm the broader bull trend, while a breakdown would target the PT2 zone.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bearish thesis is invalidated if the price achieves a sustained daily close above 48,600 USD. This level represents a clear break above the recent swing high and resistance cluster, negating the immediate downside structure and signaling a continuation of the bullish impulse.

- Position Sizing: Any short positions or hedges taken based on this analysis should be sized so that a loss triggered at the invalidation level above 48,600 USD represents a small, pre-defined percentage of your total trading capital (typically 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Interest Rate Sensitivity: The DJIA, as a basket of major US companies, remains highly sensitive to Federal Reserve interest rate expectations and Treasury yield movements.

- Q3 Earnings Season: Ongoing corporate earnings reports are driving individual component volatility, which aggregates to index-level movements.

- Macroeconomic Data: Upcoming releases on inflation, employment, and GDP will be critical for shaping market sentiment and confirming or contradicting this technical outlook.

These factors contribute to a cautious and potentially volatile sentiment, which can fuel the sharp corrective moves our technical analysis anticipates.

Conclusion

The Dow Jones (DJIA) is at a short-term technical inflection point following its rally. The weight of evidence suggests a bearish resolution for a corrective wave, targeting a move to our primary target at 47,652 USD. Traders should monitor for a confirmed breakdown below immediate supports and manage risk diligently by respecting the key invalidation level above 48,600 USD. The reaction at the 47,652 target zone will be paramount for determining whether this is a shallow pullback or the beginning of a deeper correction.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.