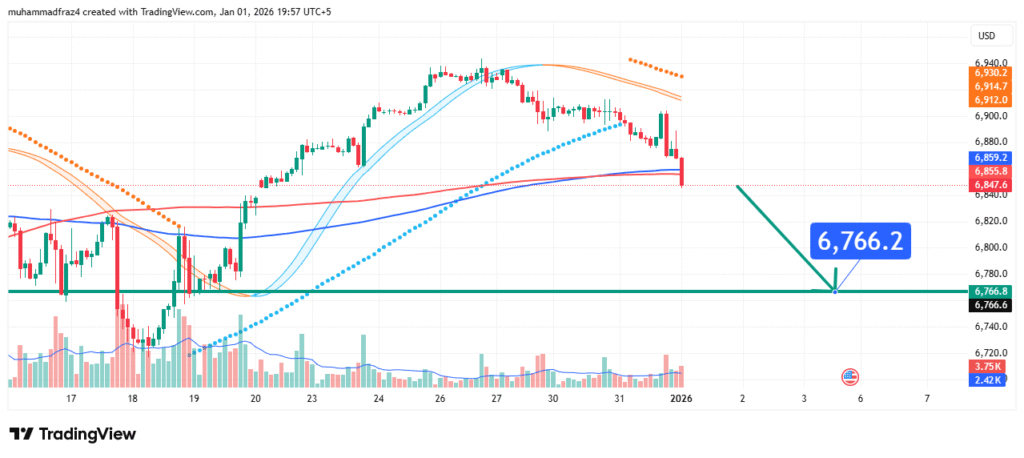

S&P 500 Price Forecast Eyeing a Deeper Correction to 6,766 Support

The S&P 500

Current Market Structure and Price Action

The immediate market structure has turned decisively bearish. The index has not only broken but is now trading below the key support zone (6,880-6,900), which has now become resistance. The current price (~6,847) is attempting to find footing at a minor interim level, but the momentum favors the sellers. The recent price action—a clear breakdown on likely increased volume—indicates that selling pressure is dominant and a test of the next major support band is imminent. The structure suggests a formation of lower highs and lower lows is now in play.

Identification of the Key Support Zone

The most critical technical element now is the next major Support Zone between 6,740 and 6,780 USD. The strength of this upcoming zone is derived from:

- Technical Confluence & Primary Target: Our core target of 6,766.3 USD sits squarely within this zone. The provided data shows a cluster of relevant levels here: 6,780.0, 6,766.3 (PT1), 6,760.2, and 6,750.0. This density creates a high-probability area for a potential pause or bounce in the downtrend.

- Market Psychology: After a sharp decline, round numbers and previous swing points (like 6,780 and 6,750) often attract the attention of value buyers and profit-takers from short positions, creating friction.

- Lack of Strong Support Until This Zone: The price path down from ~6,847 to ~6,766 shows relatively sparse support, suggesting the move could be swift until this confluence is reached.

Technical Targets and Rationale

Our analysis identifies the following price targets for this bearish scenario:

Primary Target (PT1): 6,766.3 USD

This is our precise prediction level, serving as the focal point within the next major support confluence zone (6,740-6,780). It represents a logical destination for this wave of selling based on the chart’s structural layout.

Secondary Target (PT2): 6,240.0 USD

This is a much more ambitious and significant support level, far below the current price. It would only come into play if a broader market correction unfolds, representing a full retracement of a larger prior advance. It is noted as a longer-term possibility rather than an immediate target.

Prediction: We forecast that the established bearish momentum will drive the price down to test PT1 at 6,766.3 USD. The intensity and volume of the selling as price approaches this zone will be critical in determining whether it holds or eventually gives way towards deeper targets like PT2.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bearish thesis is invalidated if the price stages a strong recovery and achieves a sustained daily close above 6,900 USD. This would represent a reclaiming of the broken support zone, signaling the breakdown was a false move (a “bear trap”) and would likely trigger a short squeeze, reversing the downtrend.

- Position Sizing: Any short exposure or protective strategies must be sized conservatively. The capital risked on this play should be such that a loss at the 6,900 invalidation level results in a minimal impact on your overall portfolio (strictly 1-2% or less).

Fundamental Backdrop

The technical breakdown is occurring within a significant fundamental context:

- Macroeconomic Crosscurrents: As the broadest gauge of US large-cap health, the S&P 500 is reacting to the aggregate outlook for earnings, economic growth, and financing costs in 2026. Sticky inflation or stronger-than-expected labor data could validate the bearish move.

- Sector Rotation: A breakdown often coincides with capital fleeing formerly leading sectors. Analysis of which S&P 500 sectors are leading the decline (e.g., Technology, Consumer Discretionary) can provide fundamental confirmation.

- Systemic Risk Re-assessment: A break of key technical levels can sometimes trigger a broader re-assessment of risk across institutional portfolios, leading to correlated selling pressure.

These factors contribute to a climate of caution and potential de-risking, which aligns with and can accelerate the technically-driven decline we are analyzing.

Conclusion

The S&P 500 is in a confirmed bearish phase following a critical technical breakdown. The weight of evidence points towards a continued descent to our primary target at 6,766.3 USD. Traders should approach any rallies with skepticism unless the 6,900 USD level is recaptured. Risk management is paramount—all positions must be guarded by a clear invalidation point above 6,900 USD. The market’s behavior at the 6,766 support zone will be instrumental in gauging the depth and duration of this correction.

Chart Source: TradingView (Created by muhammadfraz4)

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.