10 Best Trading Platforms to Start Investing in 2026

Taking control of your financial future starts with choosing the right broker. This guide cuts through the noise to review the best trading platforms and investment apps available today. We help you find the perfect fit for your goals, whether you’re a new investor in the US, UK, or Canada, looking to buy your first stock or build a diversified portfolio for the long term.

What are Trading Platforms

A trading platform is a software system provided by financial intermediaries, like brokers, that allows investors and traders to place orders and manage their portfolios through financial markets. Think of it as your gateway to the world of investing. Modern platforms do much more than just execute trades; they provide real-time quotes, advanced charting tools, in-depth research, and educational resources, all designed to help you make informed investment decisions. The best trading platforms for beginners combine a user-friendly interface with low costs and robust learning materials to help you start your journey with confidence.

Key Takeaways

Goal-Based Platform Selection

| Your Primary Goal | Best Platform Type | Key Feature to Look For |

|---|---|---|

| Long-Term Investing | Robo-Advisor or Traditional Broker | Automated investing, low-cost index funds, retirement accounts (IRA, SIPP) |

| Active Stock Trading | Advanced Brokerage | Powerful charting tools, real-time data, low per-trade commissions |

| Learning & First-Time Investing | Beginner-Friendly App | Intuitive design, educational content, fractional shares, no minimums |

| All-in-One Finance | Neo-Broker/Fintech App | Integrated banking, spending tracking, and investing in one place |

For investors in the UK, ensure the platform offers a Stocks and Shares ISA and SIPP for tax-efficient investing and supports GBP deposits without high forex fees. US users should prioritize platforms with IRA options (Roth and Traditional) and seamless integration with major US banks.

A 5-Step Framework for Picking Your Platform

Don’t just pick the most popular app. Use this structured framework to make an informed decision that aligns with your personal financial situation and goals.

- Audit Your Goals & Style: Are you a long-term buy-and-hold investor or an interested active trader? Your answer will immediately narrow the field. Long-term investors may prefer Vanguard or Fidelity, while active traders might look at Webull or E*TRADE.

- Scrutinize the Full Fee Structure: Go beyond “$0 commissions.” Look for account fees, inactivity fees, wire transfer fees, and especially the spreads on forex and crypto if you plan to trade those. Check the broker’s official fee schedule.

- Test the User Experience: Download the app or explore the web platform via a demo account if available. Is it intuitive? Can you find what you need quickly? A confusing interface will discourage you from engaging with your investments.

- Evaluate the Learning Resources: As a beginner, education is your most valuable asset. Does the platform offer articles, videos, webinars, or a glossary? TD Ameritrade and Fidelity are standouts here.

- Confirm Asset Availability & Account Types: Ensure the platform offers the specific investments you want (e.g., certain OTC stocks, specific ETFs) and the right account types for your needs (e.g., Roth IRA for US investors, SIPP for UK investors).

Top 10 Trading Platforms of 2026

We’ve analyzed the most popular platforms on the market to bring you unbiased, detailed reviews. Here are our top 10 picks for 2026, broken down by their strengths, ideal user, and key features to help you find the best online broker for your needs.

1. Fidelity Investments

Overall Score: 5/5

Best For: Comprehensive investing and retirement planning for all levels of investors.

Pricing: $0 stock/ETF trades. No account fees for accounts without a minimum.

A titan in the investment world, Fidelity has successfully evolved to compete with modern fintech apps while retaining its powerful research and fund management strengths. It offers an all-in-one solution for beginners and experts alike.

Key Features:

- $0 commission trading on US stocks, ETFs, and options.

- Extensive research from over 20 third-party providers.

- Powerful, yet intuitive, mobile and web platforms.

- Industry-leading retirement planning and educational tools.

- Fractional shares trading (called “Stocks by the Slice”).

- Excellent Research & Tools Unmatched depth of analysis and educational content.

- Zero Minimums & Fees Truly accessible to beginners with no account minimums and zero commission trades.

- Top-Tier Customer Service Renowned for its high-quality, 24/7 customer support.

- Can Feel Overwhelming The sheer number of features might intimidate absolute beginners at first glance.

- Limited International Trading Not the best platform for investors looking to frequently trade on non-US exchanges.

Why We Picked It: We chose Fidelity for the #1 spot because it masterfully balances powerful tools for advanced investors with an increasingly intuitive and fee-free experience for beginners. Its commitment to education and top-notch customer support makes it a safe and rewarding place to start and grow your investing journey.

Link: Open an Account on Fidelity.com

2. Charles Schwab

Overall Score: 4.9/5

Best For: New investors and those who want a seamless banking-and-investing experience.

Pricing: $0 stock/ETF trades. No account fees.

Like Fidelity, Schwab is a full-featured giant that offers a fantastic all-in-one ecosystem, including its own high-yield bank, making it easy to manage your entire financial life.

Key Features:

- $0 commissions on online equity/ETF trades.

- Integrated banking with no-fee checking account.

- Robust StreetSmart Edge platform for active traders.

- Extensive educational library (Schwab Learning Center).

- Fractional shares on S&P 500 stocks.

- Superior Banking Integration The seamless link between Schwab Bank and brokerage accounts is best-in-class.

- Excellent Customer Support Consistently high-rated, in-person branch support available in many locations.

- Powerful for All Levels Offers both simple guided investing and advanced active trading tools.

- Fractional Shares are Limited Only available for S&P 500 stocks, unlike competitors that offer it more broadly.

- Platform Can Be Dated While functional, some parts of the main interface feel less modern than newer fintech apps.

Why We Picked It: Its seamless integration with banking services and a stellar user experience across web and mobile make it a top contender for anyone wanting a primary financial relationship.

Link: Learn More at CharlesSchwab.com

3. Interactive Brokers (IBKR Lite)

Overall Score: 4.7/5

Best For: Serious investors and traders who want access to global markets.

Pricing: $0 commission on US listed stocks and ETFs (with IBKR Lite).

Long known as the platform for professionals, Interactive Brokers now offers a “Lite” version that provides access to its incredible range of markets and assets with zero commissions, competing directly with other brokers.

Key Features:

- Access to over 150 markets in 33 countries.

- Advanced trading tools and real-time data.

- Low margin rates.

- Ability to trade a vast array of asset classes.

- Unmatched Global Access The best platform for trading international stocks and ETFs directly.

- Extremely Low Margin Rates Far cheaper borrowing costs than any competitor.

- Powerful Trading Platform The TWS platform is a powerhouse for serious technical traders.

- Complex Interface The Trader Workstation (TWS) platform has a very steep learning curve and is overwhelming for beginners.

- Customer Service Can Be Slow Geared towards professionals, its support may not be as hand-holding as other brokers.

Why We Picked It: For the investor who dreams of trading on international exchanges or wants a platform they will never outgrow, IBKR Lite is an unbeatable value.

Link: Start Trading with Interactive Brokers

4. E*TRADE (by Morgan Stanley)

Overall Score: 4.6/5

Best For: Active traders who love powerful platforms but also want a great mobile experience.

Pricing: $0 stock/ETF trades. Options are $0.65 per contract.

ETRADE boasts two best-in-class trading platforms: a user-friendly web and app experience for beginners, and its powerful ETRADE Desktop platform for seasoned traders.

Key Features:

- Two robust, well-designed platforms for different skill levels.

- Strong screeners for stocks, ETFs, and options.

- Large library of educational videos and content.

- No account minimums.

- Best-of-Both-Worlds Platforms Effortlessly switch between a simple mobile app and a professional-grade desktop platform.

- Excellent Options Trading Tools A favorite among options traders for its powerful analysis and easy-to-use trade ticket.

- Great Research & Education High-quality, proprietary and third-party research.

- Brand Transition The ongoing merger with Charles Schwab creates some uncertainty about the long-term future of the E*TRADE brand and platforms.

- Higher Options Fees While stock trades are free, its $0.65 per-contract fee is higher than some competitors.

Why We Picked It: Its dual-platform approach successfully caters to both new and active investors without compromising on either experience.

Link: Get Started with E*TRADE

5. TD Ameritrade (Transitioning to Charles Schwab)

Overall Score: 4.6/5

Best For: Investors who value elite education and think-or-swim trading platforms.

Pricing: $0 stock/ETF trades.

While officially merging with Charles Schwab, TD Ameritrade’s platforms and services remain top-tier, especially its legendary thinkorswim platform, loved by active traders.

Key Features:

- The acclaimed thinkorswim trading platform.

- Unparalleled educational resources and live daily webcasts.

- Paper trading simulator to practice strategies.

- $0 commissions and no account minimums.

- Industry-Leading thinkorswim Platform Arguably the best desktop and mobile platform for active traders and technical analysis.

- Superior Educational Content Live webcasts and a massive library of on-demand content are unmatched.

- Powerful Paper Trading The paperMoney simulator is fully integrated with thinkorswim, perfect for practice.

- Platform Merger Uncertainty The eventual migration to Schwab’s platform means you will likely have to switch platforms in the future.

- Can Be Overkill for Beginners The sheer power of thinkorswim can be intimidating for those who just want to buy a few stocks.

Why We Picked It: Its educational content and the power of thinkorswim are so good that it remains a benchmark in the industry, even during its transition.

Link: Explore TD Ameritrade

6. Vanguard

Overall Score: 4.5/5

Best For: Long-term, buy-and-hold investors focused on low-cost index funds and ETFs.

Pricing: $0 commission on Vanguard ETFs and stocks. $20 annual fee for brokerage accounts waived for e-delivery.

Vanguard is synonymous with low-cost, passive investing. Its platform is purpose-built for investors who believe in a simple, long-term strategy centered on Vanguard’s own industry-leading funds.

Key Features:

- The leader in low-cost mutual funds and ETFs.

- Client-owned structure, meaning profits are returned to investors via lower fees.

- Focused, no-frills interface for long-term planning.

- Excellent retirement planning tools.

- The Lowest-Cost Funds Vanguard’s own ETFs and mutual funds have the lowest expense ratios in the industry.

- Investor-Owned Structure Ensures the company’s interests are aligned with its clients.

- Philosophical Purity The entire platform is designed for successful long-term, passive investing.

- Less User-Friendly Platform The website and mobile app feel dated and are less intuitive than modern brokers.

- Limited Trading Tools Not designed for active traders; charting and research tools are basic.

- Fees for Non-Vanguard Funds Trading non-Vanguard mutual funds can incur a transaction fee.

Why We Picked It: For the pure, long-term index investor, no other platform aligns with their philosophy as perfectly as Vanguard.

Link: Invest with Vanguard

7. Webull

Overall Score: 4.3/5

Best For: Active mobile traders who want advanced charts and data for zero cost.

Pricing: $0 commission on stocks, ETFs, and options.

Webull is a mobile-first broker that packs an impressive amount of advanced tools—like extended-hours trading and in-depth technical analysis—into a clean, commission-free app.

Key Features:

- Advanced charting tools and technical indicators.

- Extended trading hours (4 AM – 8 PM ET).

- Free level 2 market data.

- IRA account options with no fees.

- Advanced Tools for Free Offers technical indicators and charting tools that rivals often charge for.

- Excellent Mobile Experience A clean, modern app that is both powerful and easy to navigate.

- 24/7 Trading for Crypto Allows trading of cryptocurrencies outside of traditional market hours.

- Limited Customer Support Primarily relies on email and chat; no phone support for urgent issues.

- No Mutual Funds or Fractional Shares for ETFs Cannot build a traditional mutual fund portfolio, and fractional shares are limited to stocks.

- Less Educational Content Not the best platform for beginners who need to learn the basics.

Why We Picked It: It offers a level of technical analysis and market data that is typically reserved for paid subscriptions, all for free.

Link: Download the Webull App

8. Robinhood

Overall Score: 4.0/5

Best For: Absolute beginners drawn to a simple, intuitive app for their first investments.

Pricing: $0 commission trading on stocks, ETFs, and options.

Robinhood revolutionized the industry with its commission-free model and sleek, minimalist mobile app. It’s designed to make buying and selling stocks as easy as using a social media app.

Key Features:

- Extremely simple and intuitive user interface.

- Commission-free trading of stocks, ETFs, options, and crypto.

- Fractional share investing.

- Cash management account with debit card.

- Unmatched Simplicity The easiest platform to understand and use for your first trade.

- Unified Cash Management The cash account acts like a high-yield savings account with a debit card.

- Fun and Engaging Design Uses confetti and other gamification elements that can make investing feel less intimidating.

- Limited Research & Tools Provides very basic fundamental data and almost no technical analysis tools.

- Past Regulatory Scrutiny The platform has faced fines and criticism from regulators concerning business practices.

- No Traditional IRAs Lacks common retirement accounts like Traditional and Roth IRAs.

Why We Picked It: Its simplicity is its superpower, lowering the barrier to entry for an entire generation of new investors.

Link: Sign Up for Robinhood

9. Trading 212

Overall Score: 4.2/5

Best For: UK and European beginners interested in fractional shares and a simple interface.

Pricing: $0 commission. Makes money on CFDs, forex spreads, and stock lending.

This UK-based fintech platform has gained massive popularity for its clean design, zero-commission model, and robust fractional shares offering (“Pies” for automated investing).

Key Features:

- True zero-commission investing in stocks and ETFs.

- Advanced fractional shares and automated “Pie” investing.

- User-friendly mobile and web apps.

- No account minimums.

- Best “Pies” Feature The automated “Pie” investing for fractional shares is the best in the industry for passive, recurring investments.

- True Zero-Cost Investing No commissions, no account fees, and no FX fees on deposits under £2,000.

- Excellent UI/UX A very clean and modern interface that is easy for anyone to use.

- Limited Asset Universe Does not offer mutual funds, bonds, or options.

- Business Model Relies on CFDs The company’s primary revenue comes from its CFD business, which is a high-risk product.

- Waitlists are Common High demand often leads to new users being placed on a waiting list to open an account.

Why We Picked It: It’s arguably the best Robinhood-like experience for investors in the UK and Europe, with a strong focus on fractional investing.

Link: Join Trading 212

10. eToro

Overall Score: 4.0/5

Best For: Investors interested in social and copy trading.

Pricing: $0 commission on stock and ETF trades. Makes money on spreads, withdrawals, and non-trading fees.

eToro stands out with its unique social trading features, allowing you to see what other investors are doing and even automatically copy the trades of top performers.

Key Features:

- CopyTrader™ and CopyPortfolio™ features.

- Social news feed where users share ideas.

- Access to stocks, ETFs, crypto, and more.

- User-friendly interface for global investors.

- Unique Social Trading The CopyTrader feature is a revolutionary way to learn from and mimic experienced investors.

- Great for Crypto Trading Offers a wide range of cryptocurrencies alongside traditional assets.

- Strong Community Feel The social feed can be educational and motivating for new investors.

- Higher Non-Trading Fees Charges for withdrawals and currency conversions, which can eat into profits.

- Not a True “Buy & Hold” Platform The social and copy-trading features can encourage more frequent trading than a traditional buy-and-hold strategy.

- Limited Technical Analysis Charting tools are less advanced than those on dedicated trading platforms like Webull.

Why We Picked It: Its unique social investing ecosystem offers a completely different way to approach the markets, which can be educational and engaging for new investors.

Link: Discover eToro’s Social Features

Glossary of Common Platform Features

Understanding these terms will help you navigate any platform with confidence.

- Limit Order: An order to buy or sell a stock at a specific price or better. Gives you control over the price you pay/receive.

- Market Order: An order to buy or sell a stock immediately at the best available current market price. Execution is fast, but the price is not guaranteed.

- Extended-Hours Trading: Trading that occurs before the market opens (pre-market) or after it closes (after-hours). Offered by platforms like Webull and E*TRADE.

- Options Trading: A more advanced strategy that involves contracts giving the right to buy or sell a stock at a set price. Not for beginners.

- Margin Trading: Borrowing money from your broker to buy stocks. It amplifies gains and losses, representing significant risk.

- Dividend Reinvestment Plan (DRIP): A feature that automatically uses dividend payments to purchase more shares of the underlying stock, facilitating compound growth.

- Tax-Loss Harvesting: An automated feature (common in robo-advisors) that sells investments at a loss to offset taxes on gains and income. Some advanced platforms like Wealthfront offer this.

Real-World Example

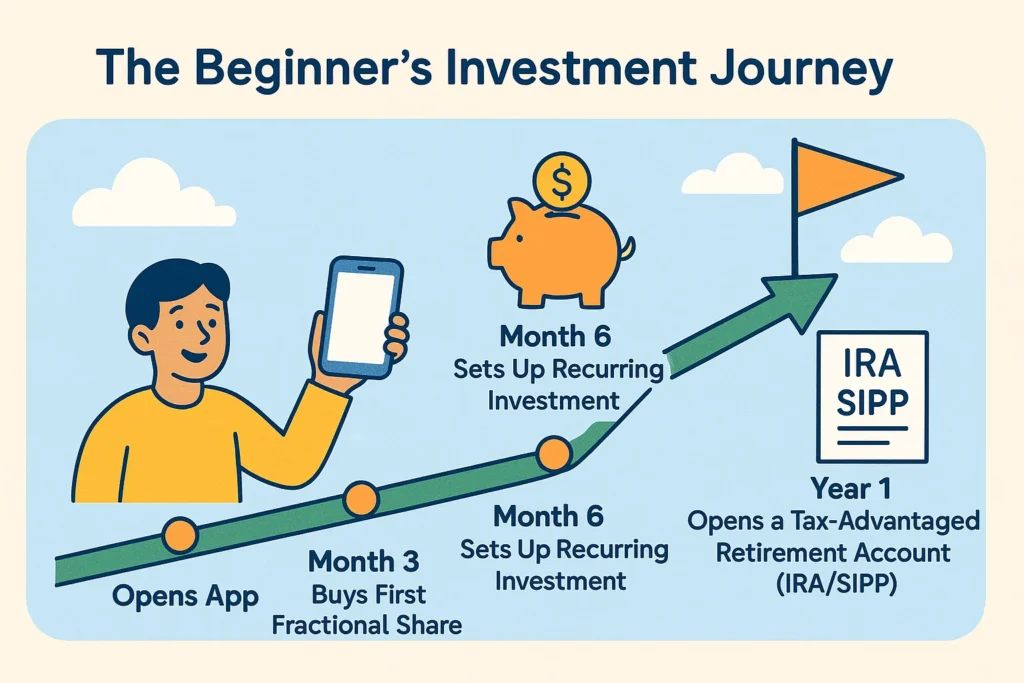

Alex, a 25-year-old marketing associate in the US earning $50,000 a year. He wanted to start investing but felt intimidated by complex charts and jargon. He started with just $100 using the Robinhood app. The simple interface allowed him to buy fractional shares of a company he believed in. After a few months, as his confidence grew, he opened a Fidelity account to access its deeper educational resources and start a Roth IRA for his retirement, taking advantage of its fractional shares to invest in a diversified portfolio of ETFs with his monthly contributions.

Trading Platforms vs Robo-Advisors

It’s important to understand how trading platforms differ from other financial tools you might encounter.

| Feature | Trading Platforms | Robo-Advisors |

|---|---|---|

| Primary Function | Self-Directed Trading & Analysis | Automated Investing & Portfolio Management |

| Hands-On Level | High (You make all decisions) | Low (Algorithm makes decisions for you) |

| Cost | Typically $0 commissions (for stocks/ETFs) | Annual management fee (e.g., 0.25% of AUM) |

| Best For | Investors who want control and enjoy the process | Investors who prefer a hands-off, set-and-forget approach |

Conclusion

Ultimately, the right trading platform is the one that empowers you to take that crucial first step and develop consistent investing habits. While the choice depends on your individual goals, risk tolerance, and comfort with technology, the current market offers exceptional options that are both free and user-friendly. The clarity and confidence gained from using a well-designed app to buy your first stock or ETF is invaluable. Start by opening an account with a platform that matches your current knowledge level, and remember that you can always expand to other brokers as your experience grows.

Ready to find your perfect trading platform? The best way to start is to pick one from our list above and open an account. Many have no minimum deposit, so you can begin with a small amount. Once you’ve chosen your platform, the next step is to develop a solid strategy.

Related Terms

- Broker-Dealer: A firm that buys and sells securities for its own account or on behalf of its customers. The companies listed above (Fidelity, Schwab, etc.) are broker-dealers.

- Fractional Shares: A portion of an equity stock that is less than one full share. This allows investors to buy into high-priced companies like Amazon with as little as $1.

- Exchange-Traded Fund (ETF): A type of security that tracks an index, sector, commodity, or other asset and can be bought or sold on a stock exchange like a regular stock. A core building block of modern portfolios.

- SIPC Insurance: The Securities Investor Protection Corporation protects customers if their brokerage firm fails. It does not protect against market losses. (UK Equivalent: FSCS protection).

Frequently Asked Questions

Recommended Resources

- How to Analyze a Stock for Beginners

- ETF vs. Mutual Fund: Which is Better for You?

- A Beginner’s Guide to Asset Allocation

- SEC’s Beginner’s Guide to Investing – Essential reading from the US regulator.

- FCA’s Guide to Investing – Crucial information for UK-based investors.

- Investopedia’s Stock Simulator – A great place to practice trading with virtual money.

- SIPC Insurance Coverage Explained – Understand how your assets are protected.