Auction Market What It Is, How It Works, and Why It Matters

An auction market is the fundamental mechanism that powers the world’s major stock exchanges, determining security prices through the open competition of buyers and sellers. It is the purest form of price discovery, where the highest bid meets the lowest ask to create a transaction. For investors in the US, UK, Canada, and Australia, understanding this process is key to navigating exchanges like the NYSE, NASDAQ, LSE, and ASX.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A market structure where buyers enter competitive bids and sellers enter competitive offers simultaneously. |

| Also Known As | Double Auction System, Open Outcry (historical) |

| Main Used In | Stock Trading, Futures Trading, Options Trading, Crypto Exchanges |

| Key Takeaway | It provides transparent price discovery and high liquidity by matching the highest bid price with the lowest ask price. |

| Related Concepts |

What is an Auction Market

An auction market is a centralized trading system where all buyers and sellers publicly announce the prices at which they are willing to buy (bid) or sell (ask) a security, as well as the quantities they desire. A transaction occurs when a buyer’s bid price matches a seller’s ask price. Think of it like a massive, continuous, digital auction for thousands of assets happening every second of the trading day. Unlike a dealer market, where you trade with a market maker who sets the price, an auction market facilitates trades directly between participants, creating a highly transparent and competitive environment.

Key Takeaways

The Core Concept Explained

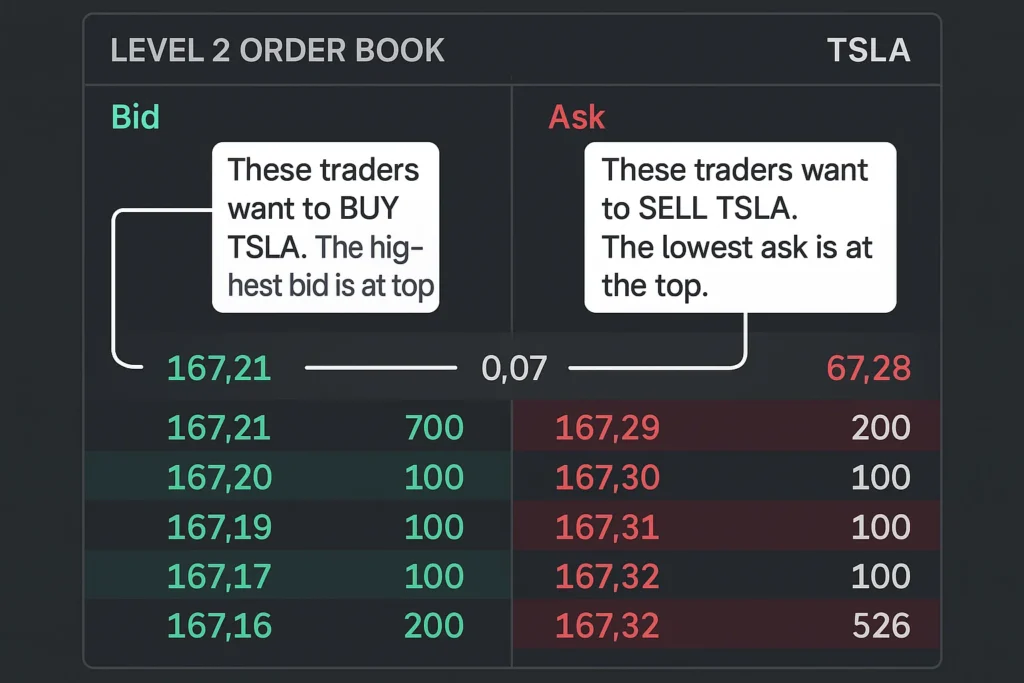

The core of an auction market is the order book, a real-time, electronic list of all buy and sell orders for a specific security. The mechanics are simple:

- Bids: Buy orders. They are ranked from highest to lowest price.

- Asks (or Offers): Sell orders. They are ranked from lowest to highest price.

The highest bid price and the lowest ask price are always at the top of the book. The actual market price is the price at which the last trade was executed, which occurs when a new order matches an existing order on the opposite side. For example, if a new market sell order comes in, it will immediately execute against the highest existing bid.

How an Auction Market Functions

Since an auction market is a process, it is identified by its structure and behavior rather than calculated with a formula. You know you are in an auction market if:

- There is a Centralized Exchange: Trades occur on a recognized platform like the New York Stock Exchange (NYSE) or the NASDAQ.

- You See a Transparent Order Book: Prices and order sizes are visible to all participants.

- Price is Set by Matching: The market price is not quoted by a dealer but is the result of a matched bid and ask.

Why Auction Markets Matter to Traders and Investors

Auction markets are the bedrock of modern finance because they create fair and efficient price discovery.

- For Traders: The order book provides critical data. The depth of bids and asks shows the strength of support and resistance levels. A large number of bids at a certain price might indicate a strong floor, while thin asks could signal a potential breakout.

- For Investors: It ensures they get the best possible prevailing price when executing a trade. The competitive nature means prices accurately reflect all publicly available information at that moment.

- For the Market: It provides liquidity, which is the lifeblood of financial markets. High liquidity means lower transaction costs (tighter bid-ask spreads) and the ability to enter or exit positions quickly without dramatically moving the price.

How to Use Auction Market Principles in Your Strategy

Understanding the auction process can directly improve your trading and investing decisions.

- Use Case 1: Placing Limit Orders vs. Market Orders: Instead of using a market order (which executes immediately at the current ask price), you can place a limit order to buy at a specific bid price. If the market auction drops to your price, your order will execute, potentially saving you money.

- Use Case 2: Gauging Market Sentiment: By reading the Level 2 order book (a deeper view of all bids and asks), you can see if there is more buying or selling pressure. A wall of large buy orders suggests strong demand, while large sell orders indicate supply is overwhelming demand.

To effectively analyze the auction market’s order book, you need a brokerage platform with advanced Level 2 data features. We’ve reviewed the best platforms for active traders to help you choose the right one.

- Transparency: All participants can see the prices and sizes of outstanding orders.

- Fair Price Discovery: Prices are set by the collective market, not a single intermediary.

- High Liquidity: Centralizing orders creates deep pools of buyers and sellers.

- Efficiency: Orders are matched and executed electronically in milliseconds.

- Requires Liquidity: For very small or illiquid stocks, the bid-ask spread can be very wide, making trading costly.

- No Guarantee of Execution: A limit order may never be executed if the market price never reaches your bid/ask level.

- Market Impact: Large institutional orders can “walk the book,” meaning a large buy order will consume all available asks at successively higher prices, causing the price to rise significantly during the execution.

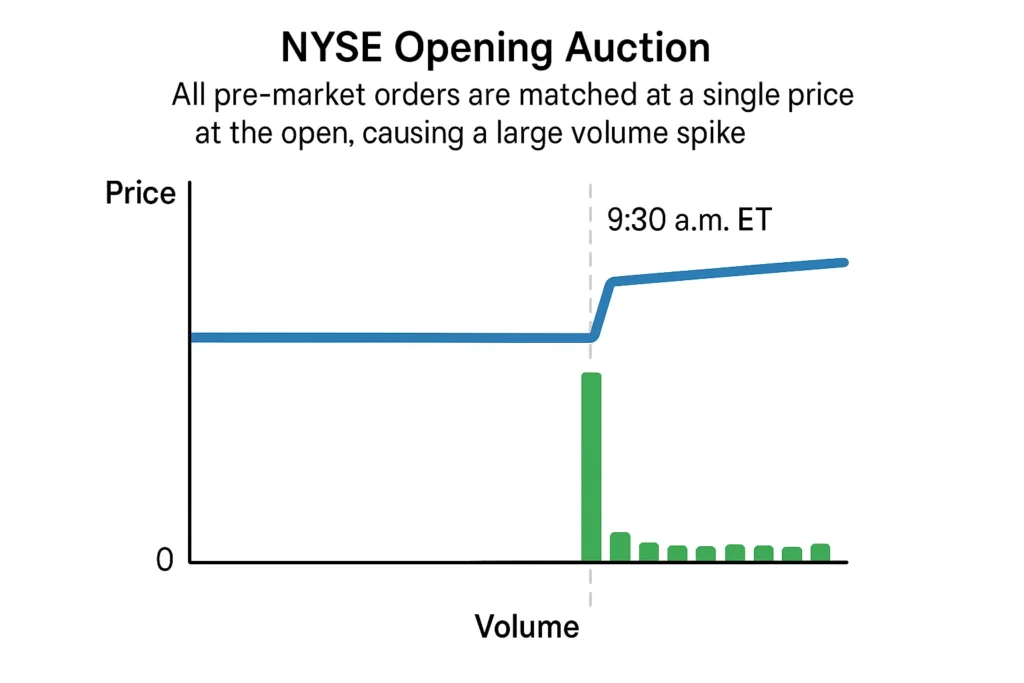

Auction Market in the Real World: The Opening Bell

The most iconic example of an auction market in action is the NYSE Opening Auction. Before the market opens, orders for a stock pile up. Instead of opening trading at the previous day’s close, the exchange uses an auction process to determine the official opening price.

- How it works: From 4:00 a.m. to 9:30 a.m. ET, investors can submit market-on-open and limit-on-open orders. The exchange’s system aggregates all these orders and calculates the single price that will maximize the number of shares that can be traded. This price becomes the opening print, which is often accompanied by huge volume as all the accumulated orders are matched at once.

- Why it matters: This auction ensures an orderly and fair market open based on all pre-market news and events, rather than a chaotic price jump at the first trade.

Auction Market vs Dealer Market

The primary alternative to an auction market is a dealer market (or over-the-counter market).

| Feature | Auction Market (e.g., NYSE, NASDAQ) | Dealer Market (e.g., Forex, OTC Stocks) |

|---|---|---|

| How price is set | By matching public bids and asks | By a market maker or dealer |

| Transparency | High (order book is visible) | Low (prices are quoted, not always visible) |

| Counterparty | Other traders | The dealer/market maker |

| Liquidity Source | Collective orders of participants | Capital committed by the dealer |

Conclusion

The auction market is not an abstract concept but the very engine that drives the public financial markets. Understanding that every stock price you see is the result of a continuous, transparent bidding process empowers you to make more informed decisions. While it offers unparalleled fairness and liquidity, be mindful of its limitations with illiquid assets and the impact of large orders. By using limit orders and learning to interpret order flow, you can actively participate in this auction rather than just reacting to it. Start by exploring the order book for your favorite stocks on your brokerage platform, it’s the auction in real-time.

Ready to participate in the market’s auction? Your first step is choosing a broker. We’ve meticulously reviewed and ranked the best online brokers for beginners and active traders to help you find the platform that fits your strategy.

Related Terms

- Bid-Ask Spread: The difference between the bid and ask price; a key cost of trading.

- Market Order: An order to buy or sell immediately at the best available current market price.

- Limit Order: An order to buy or sell only at a specified price or better.

- Liquidity: The ease with which an asset can be bought or sold.

- Price Discovery: The process of determining the price of an asset in the marketplace.

Frequently Asked Questions

Recommended Resources

How did this post make you feel?

Thanks for your reaction!