A stock broker is the essential intermediary that provides access, execution, and custody services for your investments....

Finance Terms

A derivative is a versatile financial contract whose value is tied to an underlying asset like a...

The 0x Protocol is the foundational, open-source infrastructure that enables efficient and trustless peer-to-peer trading of digital...

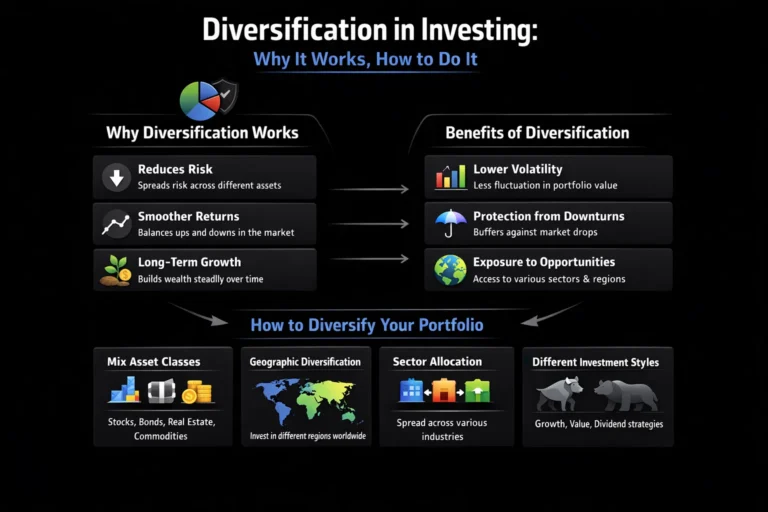

Last updated: Table of Contents Diversification is the foundational principle of not putting all your eggs in...

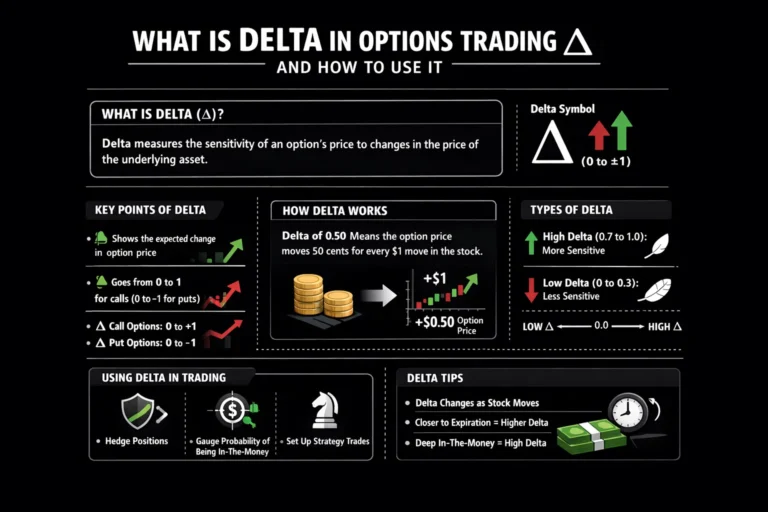

Delta is the indispensable compass for navigating options markets, quantifying both the directional risk of a single...

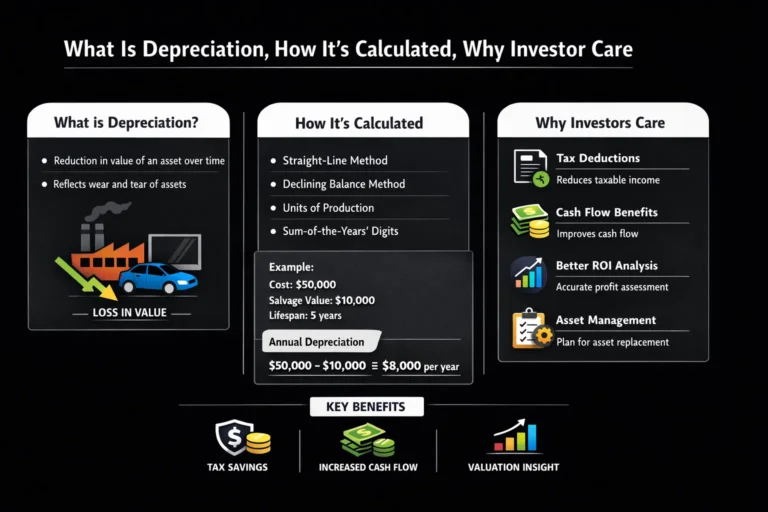

Depreciation is the systematic process of expensing the cost of a long-term tangible asset over its useful...

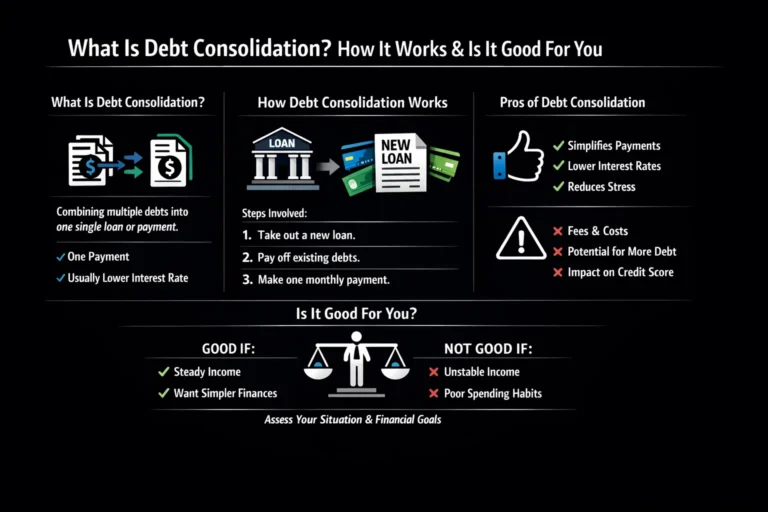

Debt consolidation is a strategic financial maneuver that streamlines multiple debts into a single loan, primarily aiming...

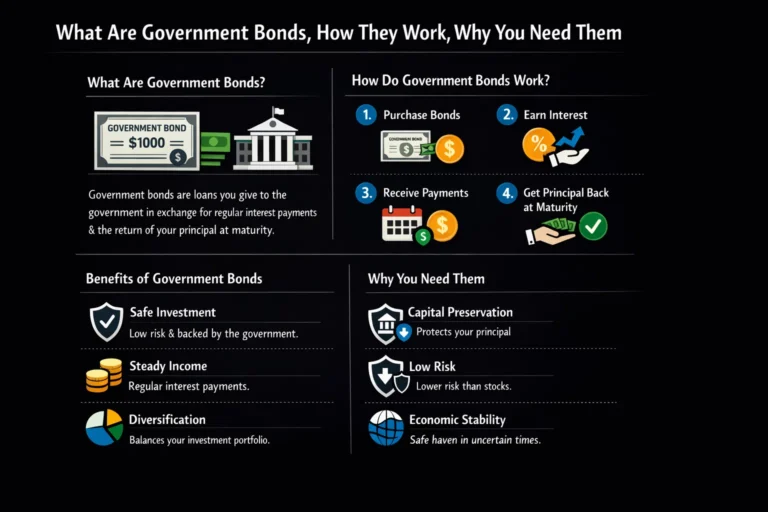

Government bonds are foundational debt instruments where investors loan money to national governments in exchange for regular...

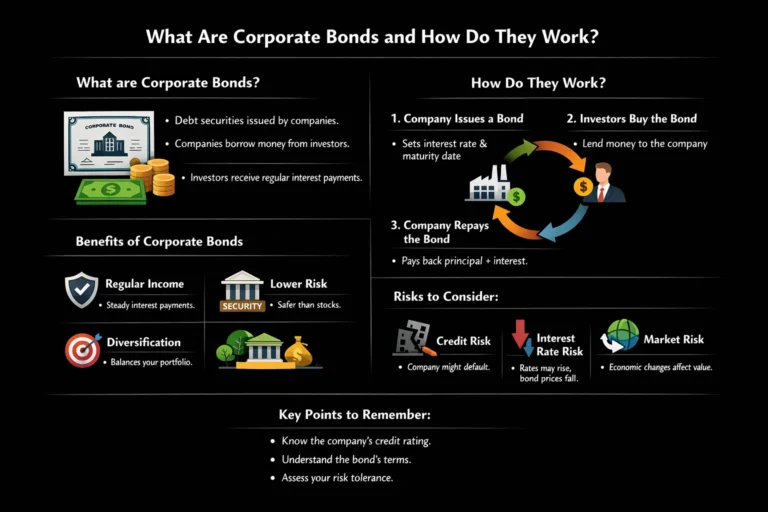

Corporate bonds are a fundamental asset class that allows investors to lend money to companies in exchange...

Index funds are a powerful, low-cost investment vehicle that allows individuals to own a small piece of...

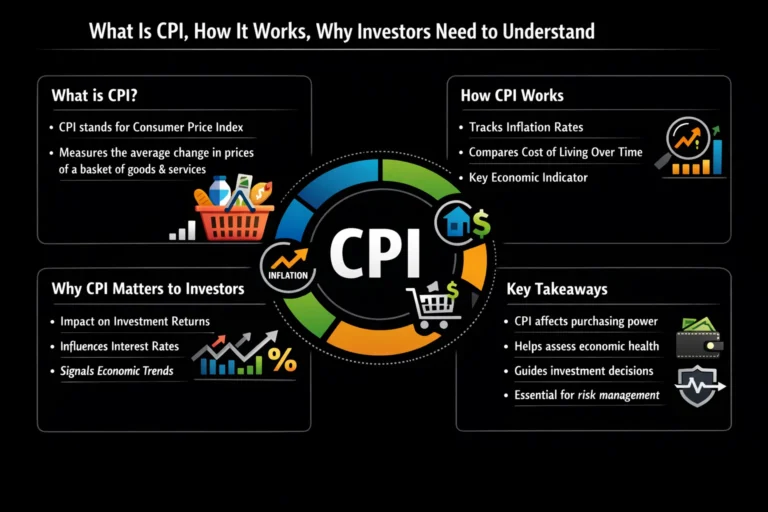

The Consumer Price Index (CPI) is the cornerstone metric for tracking inflation, measuring the average price change...

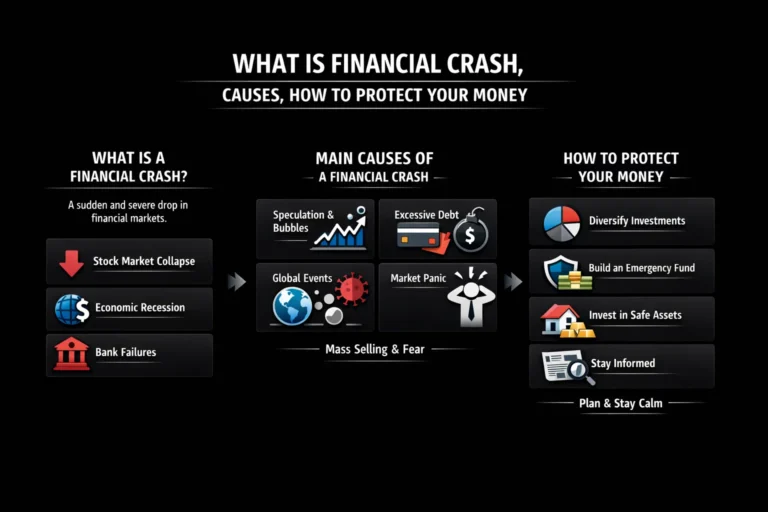

A financial crash is a rapid, severe, and systemic collapse in asset prices, fundamentally different from a...