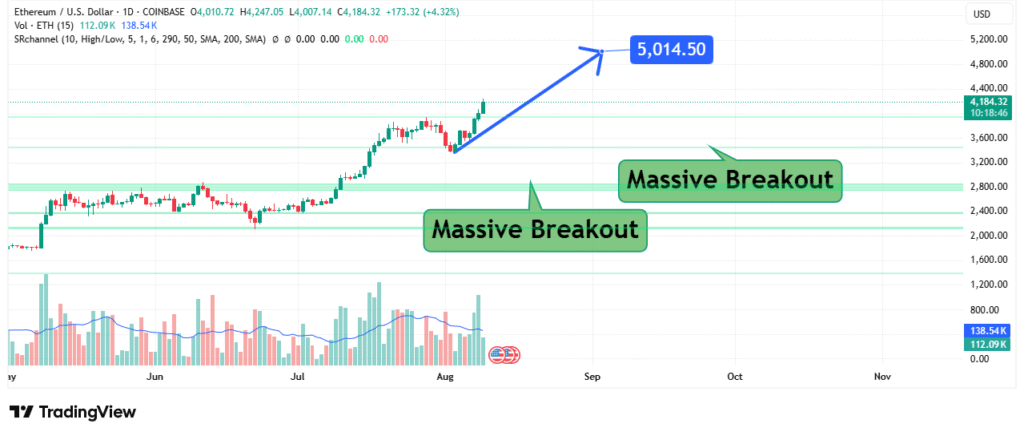

Ethereum Breakout Targets $5K New All-Time High Ahead

Ethereum (ETH) is showing a strong bullish pattern, with technical indicators pointing toward a potential surge to the $5,000 mark, a level that would match and potentially exceed its previous all-time high. According to recent price action and volume patterns, Ethereum has confirmed a massive breakout from key resistance zones, signaling momentum for further upside.

Current Price Action

At the time of writing, Ethereum is trading at $4,184.32, up 4.32% in the last 24 hours. This move follows a decisive breakout from the $3,200 resistance zone, which had previously acted as a consolidation barrier. The breakout was supported by strong buying volume, indicating increased market confidence.

Technical Analysis

1. Breakout Confirmation

The chart clearly marks two significant massive breakout levels:

- $2,400 Zone: This was the first breakout level, ending a prolonged consolidation phase.

- $3,200 Zone: The second and more critical breakout, which has set the stage for the current bullish rally.

Once Ethereum breached the $3,200 mark, buyers stepped in aggressively, pushing prices above $4,100.

2. Momentum Indicators

- Volume Surge: A sharp increase in trading volume accompanies the rally, suggesting strong institutional and retail participation.

- Moving Averages: Short-term moving averages are trending upward, while the price remains well above the 50-day and 200-day SMAs, a classic bullish signal.

- SR Channels: The SR Channel structure highlights diminishing overhead resistance until the $5,000 target zone.

3. Target Projection

Based on the breakout trajectory, Ethereum could reach $5,014.50 in the coming weeks. This projection is supported by:

- Measured Move Theory: The vertical distance from the last consolidation zone projects into the $5K target range.

- Psychological Resistance: $5,000 is both a technical and psychological milestone that traders often target during strong rallies.

Market Sentiment

Ethereum’s bullish sentiment is further strengthened by:

- Institutional Adoption: Continued ETH accumulation by funds and custodians.

- Network Upgrades: Anticipation of upcoming Ethereum network improvements that enhance scalability and efficiency.

- Macro Factors: A more favorable risk-on environment in broader crypto markets.

Key Levels to Watch

- Immediate Support: $4,000: holding above this level is critical for maintaining bullish momentum.

- Next Resistance: $4,500: a minor resistance before the final push to $5K.

- Major Target: $5,014.50: potential new all-time high if bullish momentum persists.

Risks to the Bullish Scenario

While the outlook is bullish, traders should remain cautious:

- Macro Volatility: Global economic uncertainty could trigger risk-off moves in crypto.

- Overbought Conditions: Short-term pullbacks are possible as momentum indicators heat up.

- Regulatory Developments: Negative policy changes could impact sentiment.

Conclusion

Ethereum’s price structure is aligning perfectly with a bullish breakout narrative. If the $4,000–$4,200 support zone holds and buying momentum continues, a rally toward $5,000 seems increasingly probable. For traders and investors, the coming weeks could present one of the most significant price surges in Ethereum’s history.