Government bonds are among the safest investment vehicles available, offering both stability and a relatively predictable return. For individuals new to investing or considering to expand their portfolio, comprehending what government bonds are, how they work, and their advantages is vital. In this article, we’ll cover everything from the basics to more advanced insights about government bonds, helping you make well-informed decisions about whether they fit your investment strategy.

Key Takeaways

What Are Government Bonds?

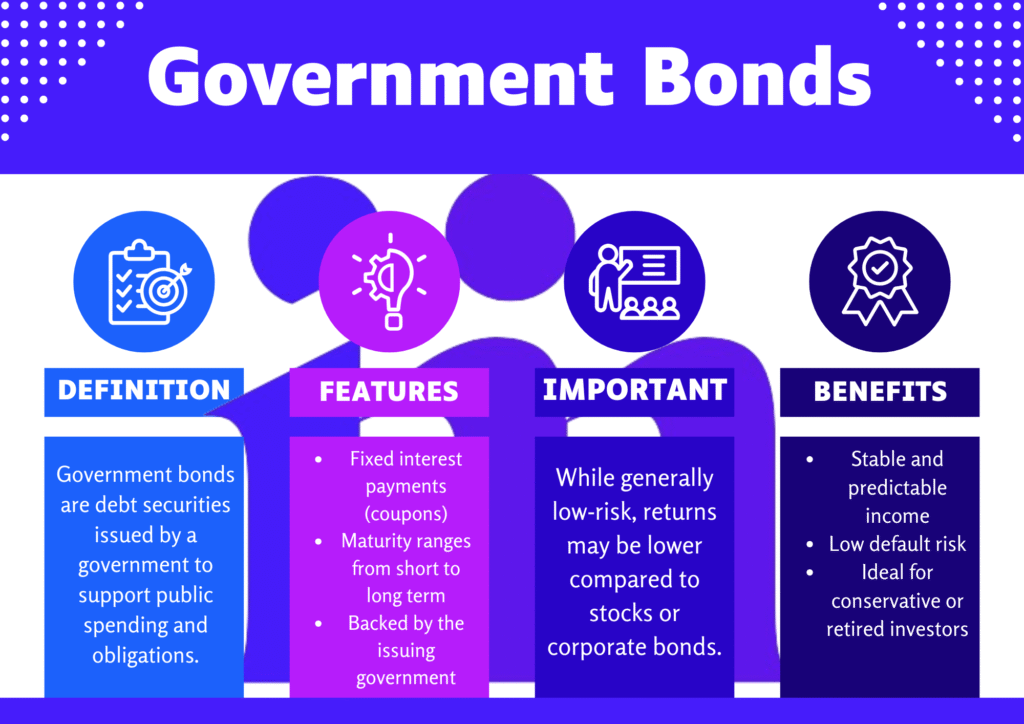

Government bonds are fixed-income securities issued by a government to fund public expenditures, such as infrastructure, healthcare, or education. When investors buy government bonds, they are fundamentally lending capital to the government in replacement for periodic interest payments (coupon expenses) and the profit of the bond’s face value (par value) at development.

Governments issue bonds to secure funding from the public and, in return, offer a fixed interest rate making them attractive to conservative investors. These bonds may be issued by central governments (e.g., U.S. Treasury securities) or sub-national entities such as states or municipalities.

U.S. Treasury securities are so trusted that banks use them as collateral. Due to their low default risk and high liquidity, government bonds particularly Treasuries are accepted globally as benchmark “risk-free” assets, used by financial institutions to secure loans and maintain regulatory capital.

How Government Bonds Work

Here’s a breakdown of how government bonds operate:

- Issuance: When a government needs to raise funds, it issues bonds through auctions or direct sales. Each bond comprises a face value (the quantity repaid at development), a stable interest rate (coupon), and a traditional maturity date.

- Interest Payments (Coupons): Investors receive regular interest payments typically semiannually or annually based on the bond’s coupon rate. For instance, a $1,000 bond with a 5% yearly coupon pays 50 usd in interest every year.

- Maturity: Bonds have a well-defined term, which can extend from a few months to numerous decades. At maturity, the government refunds the face cost to the bondholder.

- Secondary Market Trading: While many investors hold government bonds to maturity, they can also be bought and sold on secondary markets. Bond prices in these markets fluctuate based on interest rates, economic conditions, and the issuing government’s credit rating.

- Credit Ratings: The creditworthiness of the issuing government significantly impacts the bond’s interest rate. Bonds from highly rated governments (like the U.S. or Germany) offer lower yields due to minimal default risk, whereas lower-rated governments must offer higher yields to attract investors.

Government bonds are not a one-size-fits-all solution. While they provide stability, they should complement not replace a well-diversified portfolio. Younger investors with longer time horizons may want to limit bond exposure in favor of higher-growth assets like stocks. Distribution should bring into line with your risk acceptance, investment timeline, and revenue requirements.

Types of Government Bonds

There are several types of government bonds, each designed to meet specific investor needs:

- Treasury Bonds (T-Bonds): Long-term debt securities issued by the U.S. government, typically used to finance federal spending and provide investors with steady interest income. Treasury with old age of 10 to 30 years. They pay semiannual interest and are regarded as extremely safe investments.

- Treasury Bills (T-Bills): Short-term securities with maturities of one year or less. They are delivered at a discount and converted at face value, with the modification representing the investor’s profit.

- Treasury Notes (T-Notes): Medium-term securities with maturities between 2 and 10 years. They give interest every six months and are sponsored by the full confidence and credit of the U.S. administration.

- Municipal Bonds: These are debt instruments issued by local or state governments to finance community-focused initiatives such as schools, roads, or public infrastructure. Differing on the authority, interest revenue from these bonds may be exempted from federal or state taxes.

- Savings Bonds: Long-term, non-marketable bonds issued to individual investors. They are designed to provide a safe and simple way to save for retirement or other long-term goals.

Reinvest bond interest payments to enhance compounding. Many investors oversight the occasion to reinvest coupon costs. By doing so either through bond ladders, mutual funds, or reinvestment programs you can compound returns over time and strengthen long-term yield, especially in a low-rate environment.

Benefits of Government Bonds

Government bonds suggest numerous advantages, mostly for risk-averse financiers:

- Safety and Stability: Backed by the government’s ability to tax and print currency, these bonds are among the most secure investment options especially those issued by developed economies.

- Predictable Income: Fixed interest payments provide a reliable stream of income, ideal for retirees and others seeking financial stability.

- Low Risk: Compared to equities or corporate bonds, government bonds carry significantly less credit and market risk.

- Portfolio Diversification: Including government bonds in your asset mix can reduce overall portfolio volatility. Bonds often perform well during market downturns, offering a hedge against equity risk.

- Tax Advantages: In some circumstances, interest from administration bonds such as U.S. Treasuries is excused from government and local revenue taxes, improving their after-tax revenues.

During the 2008 financial crisis, U.S. Treasury bond demand surged as investors fled from equities and corporate debt. The 10-year Treasury yield dropped below 2%, and Treasury ETFs like TLT saw record inflows. This showed how government bonds served as a critical safety net when market confidence collapsed.

Risks of Government Bonds

Despite their safety, government bonds do carry some risks:

- Interest Rate Risk: Bond charges move contrariwise with interest charges. If interest rates rise, the market value of existing bonds declines, which can affect investors who sell before maturity.

- Inflation Risk: Inflation decreases the acquiring power of stable interest expenses and principal, indicating to lower actual revenues.

- Credit Risk: While unlikely in developed economies, there’s a small risk of default, especially with bonds from emerging markets or financially unstable governments.

- Opportunity Cost: Investing in bonds may result in missed opportunities for higher returns from equities or other assets during periods of economic growth.

Prolonged-term government bonds are extremely subtle to interest rate variations. If interest rates rise significantly, a 30-year bond’s value can drop sharply, even if the issuer (like the U.S. government) is financially stable. This is called duration risk, and it’s especially important for retirees or income-focused investors to manage through bond ladders or shorter-term instruments.

Pros and Cons of Government Bonds

| Pros | Cons |

|---|---|

| ✔ Potential tax exemptions at the state or local level | ✘ Typically offer lower returns than equities or corporate bonds |

| ✔ Among the safest investment options available | ✘ Expanding interest rates can decrease bond market cost |

| ✔ Immovable interest payments offer stable income | ✘ Inflation can erode real value of fixed payments |

| ✔ Help balance portfolios during periods of stock market volatility | ✘ Capital tied up may miss out on higher-growth opportunities |

When I first began managing my own investment portfolio, government bonds felt underwhelming compared to the excitement of stocks. But over time especially during volatile market swings, I realized the true value of stability. Holding U.S. Treasury bonds through a market downturn taught me a critical lesson: capital preservation is just as important as growth. These bonds became a foundation for my asset allocation strategy, giving me the confidence to take calculated risks elsewhere in my portfolio. They’re not flashy, but when markets crash, they’re the part of my portfolio that helps me sleep at night.

Conclusion

Government bonds play a crucial role in the global financial system, offering a stable and low-risk investment option for both individuals and institutions. Whether you’re seeking reliable income, long-term capital preservation, or portfolio diversification, government bonds provide a dependable way to manage risk while pursuing your financial goals. By comprehending what government bonds are, how they operate, and the linked risks and advantages, you can craft knowledgeable decisions to support your investment approach.