House Affordability Calculator, What's Your Home Buying Power

Last updated:

House Affordability Calculator

Fill in the details below to calculate how much house you can afford

Your total pre-tax household income

Car loans, credit cards, student loans, etc.

Cash available for down payment

6.5%

Current mortgage interest rate

30 years

Length of mortgage

1.2%

Local property tax rate

Estimated annual home insurance premium

Your Results

Maximum Home Price:

$0

Monthly Mortgage Payment:

$0

Monthly Property Tax:

$0

Monthly Insurance:

$0

Total Monthly Payment:

$0

Debt-to-Income Ratio:

0%

Payment breakdown visualization will appear here

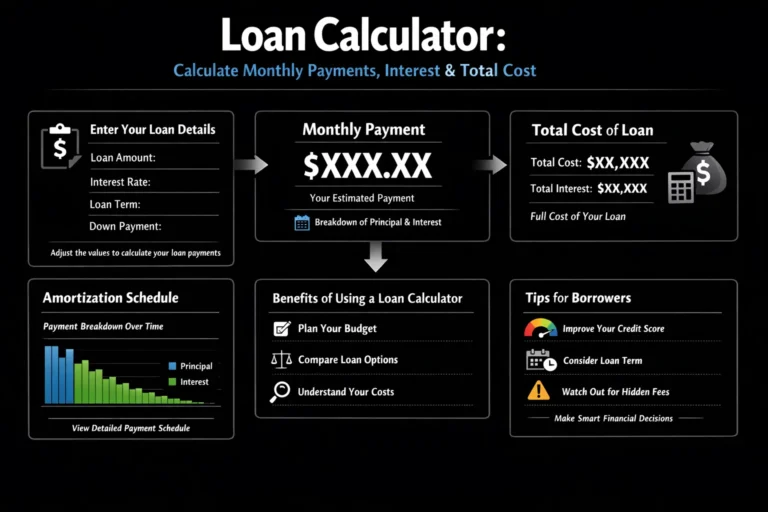

How to Use the House Affordability Calculator

- Enter your annual gross income – This is your total household income before taxes

- Input your monthly debt payments – Include car loans, credit card minimums, student loans, etc.

- Specify your down payment amount – The cash you have available for a down payment

- Adjust the interest rate slider – Based on current mortgage rates in your area

- Set the loan term – Typically 15 or 30 years

- Adjust property tax rate – Based on local tax rates

- Enter home insurance estimate – Annual premium for homeowners insurance

- Click Calculate – See your maximum affordable home price and monthly payment breakdown

How House Affordability is Calculated

The calculator uses the 28/36 rule, a standard lending guideline:

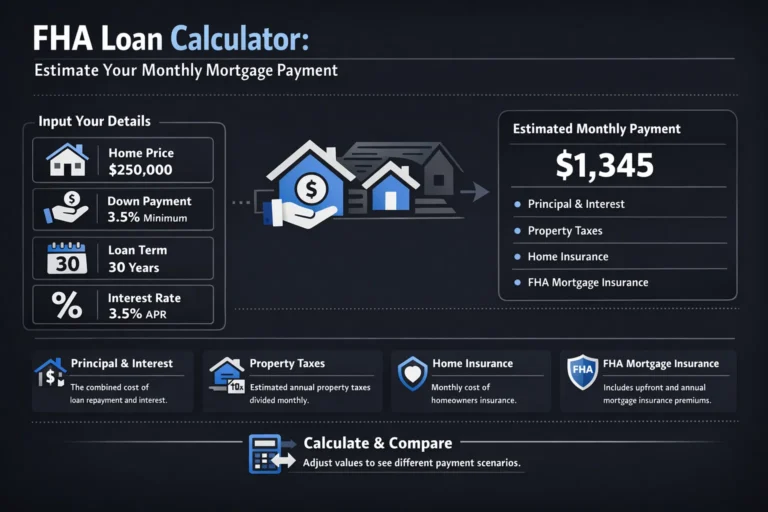

- 28% Front-End Ratio: Your total monthly housing costs (mortgage, taxes, insurance) should not exceed 28% of your gross monthly income

- 36% Back-End Ratio: Your total monthly debt payments (including housing) should not exceed 36% of your gross monthly income

The calculation considers:

- Mortgage principal and interest

- Property taxes

- Homeowners insurance

- Your existing monthly debt obligations

How to Apply These Results to Your Financial Strategy

- If your results are lower than expected: Consider increasing your down payment, paying down existing debt, or looking at more affordable neighborhoods

- If your results are higher than expected: Make sure you’re accounting for maintenance costs (1-2% of home value annually) and unexpected expenses

- Remember: Just because you can afford a certain price doesn’t mean you should spend that much

Important Considerations

- This calculator provides estimates, not guarantees of loan approval

- It doesn’t account for private mortgage insurance (PMI) if your down payment is less than 20%

- Closing costs (typically 2-5% of home price) are not included

- Home maintenance, utilities, and HOA fees are not factored in

- Consult with a mortgage professional for personalized advice

Frequently Asked Questions

How accurate is this calculator?

It provides a good estimate based on standard lending guidelines, but actual loan approval depends on credit score, employment history, and lender-specific criteria.

Should I use gross or net income?

Lenders typically use gross income (before taxes) for affordability calculations.

What if I have irregular income?

If you’re self-employed or have variable income, lenders may use a 2-year average or require additional documentation.

How much should I put down as a down payment?

While 20% avoids PMI, many programs allow as little as 3–5% down for qualified buyers.

Does this include property taxes and insurance?

Yes, the calculator factors in both based on your inputs.

Other Financial Calculators You Might Find Useful

- Mortgage Payment Calculator

- Rent vs Buy Calculator

- Debt-to-Income Ratio Calculator

- Home Equity Calculator

- Refinance Calculator

This calculator is designed to help homebuyers in the US, UK, Canada, and Australia understand how much house they can afford based on their financial situation, following local lending practices and financial conventions.