Hyper Liquid Bullish Setup Targeting a 30% Rally to $49

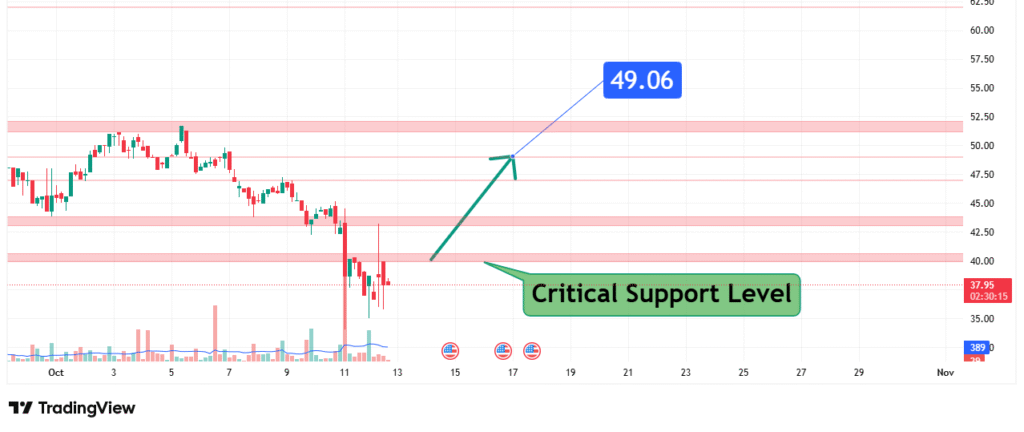

Hyper Liquid’s (HYPE) price has been consolidating and respecting a critical support level throughout October. This price action suggests a strong bullish bias is forming as it gathers energy for its next move. Our analysis projects a breakout and a subsequent move towards a primary target of $49.06. This prediction is based on a confluence of technical factors, primarily the defense of a key support zone and the potential for a significant upward impulse wave.

Current Market Structure and Price Action

The current market structure for HYPE is bullish, characterized by a strong upward move preceding the current consolidation phase. The price is now interacting with a crucial support level that has been tested and respected multiple times throughout the month, as seen on the provided chart. This consolidation near the highs, rather than a deep retracement, indicates underlying strength and accumulation. The series of small-bodied candles and repeated bounces from this support indicate that selling pressure is being absorbed, and a potential breakout to the upside is imminent.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone that has defined the price action for the latter half of October. The strength of this zone is derived from:

- Historical Significance: This level has acted as a springboard for multiple bounce attempts, creating a clear floor for the price. Each test has been met with buying interest, solidifying its importance.

- Technical Confluence: While not visible on the minimalist chart, this level often aligns with key technical indicators like the 20-day Exponential Moving Average (EMA) or a 50% Fibonacci retracement level in a broader context, adding to its significance.

- Market Psychology: This area represents a point where sellers are exhausted and buyers see value, creating a collective belief that the asset is fairly priced at this level, leading to a concentration of buy orders.

This confluence makes it a high-probability level for a strong bullish reaction.

Technical Target and Rationale

Our analysis identifies the following price target:

Primary Target (PT1): $49.06

This target is not an arbitrary number; it represents a key psychological and technical resistance level. It is the level that marked the peak of the previous significant rally. A break above the current consolidation would likely target this previous major swing high. Furthermore, this aligns with a measured move strategy; the impulse wave into consolidation suggests a subsequent wave of similar magnitude could project a price towards the $49 area.

Prediction: We forecast that the price will break above the current consolidation range and move towards our primary target at $49.06, representing an approximate 30% gain from the current price.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a sustained daily close (preferably on a 4-hour or daily chart) below the critical support zone that has been tested throughout October. A clear break and close below this level would indicate a failure of the bullish structure and could lead to a deeper correction.

- Position Sizing: Any long positions taken in anticipation of this move should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%). Given the target of $49.06 and a stop below support, a favorable risk-to-reward ratio is achievable.

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- DeFi and L2 Narrative: Hyper Liquid operates in the competitive yet rapidly growing Decentralized Finance (DeFi) and Layer-2 (L2) scaling space. Positive developments in this sector can have a ripple effect on related assets.

- Overall Crypto Sentiment: The asset’s performance is still heavily correlated with major cryptocurrencies like Bitcoin and Ethereum. A bullish macro environment for crypto would provide a strong tailwind for this prediction.

- Project-Specific Developments: Traders should monitor for any announcements regarding protocol upgrades, partnerships, or increases in Total Value Locked (TVL) on Hyper Liquid, which could act as a catalyst for the projected move.

Conclusion

Hyper Liquid (HYPE) is at a technical inflection point. The weight of evidence, based on the defense of a critical support level and the structure of the consolidation, suggests a bullish resolution, targeting a move to $49.06. Traders should monitor for a confirmed breakout above the recent consolidation highs and manage risk diligently by respecting the key invalidation level below the critical support. The reaction at the $49.06 target zone will be crucial for determining if further gains are possible or if a period of profit-taking will ensue.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.