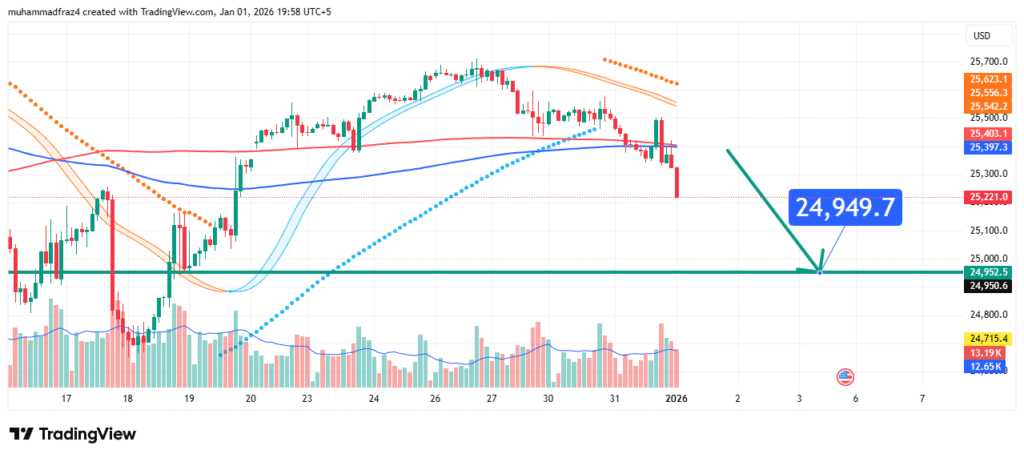

NASDAQ 100 Price Forecast Eyeing a Pullback to 24,949 Support

The NASDAQ 100

Current Market Structure and Price Action

The broader long-term structure may remain intact, but the immediate structure has turned bearish. The price has decisively broken below the immediate support cluster around 25,300-25,400 USD and is now trading near 25,221 USD. This move follows a clear rejection from the 25,600-25,700 resistance zone (data: 25,700.0, 25,622.1, 25,597.8), characterized by multiple failed attempts to push higher. The price is now accelerating downward, indicating increased selling pressure and a high probability of testing lower supports.

Identification of the Key Support Zone

The most critical technical element for this bearish setup is the major Support Confluence Zone between 24,900 and 25,000 USD. The strength of this zone is derived from:

- Technical & Psychological Confluence: This area contains a critical mass of significant levels from the provided data: 24,950.9 (near our target), 25,000.0 (key psychological round number), and 24,900.0.

- Primary Target: Our analysis pinpoints 24,949 USD as the precise target, representing the strongest point within this high-probability support cluster where price may find initial footing.

- Historical Significance: The chart shows this general area previously acted as support/resistance in early-to-mid December 2025, adding to its technical relevance.

A break below this primary zone would expose the next significant support level near 24,715.4 USD.

Technical Targets and Rationale

Our analysis identifies the following price targets for this bearish scenario:

Primary Target (PT1): 24,949 USD

This is our core prediction. It is the focal point within the major support confluence zone (24,900-25,000). A test and reaction at this level are highly probable for a retracement of the recent decline.

Secondary Target (PT2): 24,715.4 USD

This level represents a stronger, more defined swing low from the provided data. A decisive break below the PT1 confluence zone would signal intensified selling, likely targeting this previous structural level.

Prediction: We forecast that the current bearish momentum will drive the price down to test PT1 at 24,949 USD. The character of the price action (e.g., a sharp bounce vs. a slow consolidation) at this level will be vital for determining if a deeper move to PT2 is warranted.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bearish thesis is invalidated if the price rallies and achieves a sustained daily close above 25,560 USD (the lower bound of the recent resistance cluster). This would signify a recovery of the broken support-turned-resistance and a failure of the bearish breakdown, potentially reigniting the prior uptrend.

- Position Sizing: Any short positions or protective puts considered based on this outlook must be sized appropriately. The risk capital allocated should ensure that a loss triggered at the invalidation level above 25,560 USD constitutes a small, predetermined fraction of your total portfolio (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Valuation Concerns: As a tech-heavy index, the NASDAQ 100 is particularly sensitive to interest rate expectations and long-duration asset valuation models. Any hawkish shift in the 2026 rate outlook could pressure valuations.

- Mega-Cap Earnings: The performance of the “Magnificent 7” and other top constituents will be the primary fundamental driver. Disappointing forward guidance from key players could catalyze the technical move we anticipate.

- Market Sentiment: The transition into a new year often brings portfolio rebalancing and reassessment of risk, which can exacerbate technical moves as liquidity normalizes.

These factors contribute to an environment of heightened scrutiny and potential volatility, providing a plausible backdrop for a technical correction.

Conclusion

The NASDAQ 100 is in a confirmed short-term downtrend following its rejection at key resistance. The weight of evidence suggests a continued bearish move towards our primary target at 24,949 USD. Traders should monitor the price action as it approaches this high-confluence support zone. Risk must be managed meticulously by respecting the key invalidation level above 25,560 USD. The market’s reaction at the 24,949 target will provide critical clues for the index’s medium-term trajectory.

Chart Source: TradingView (Created by muhammadfraz4)

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.