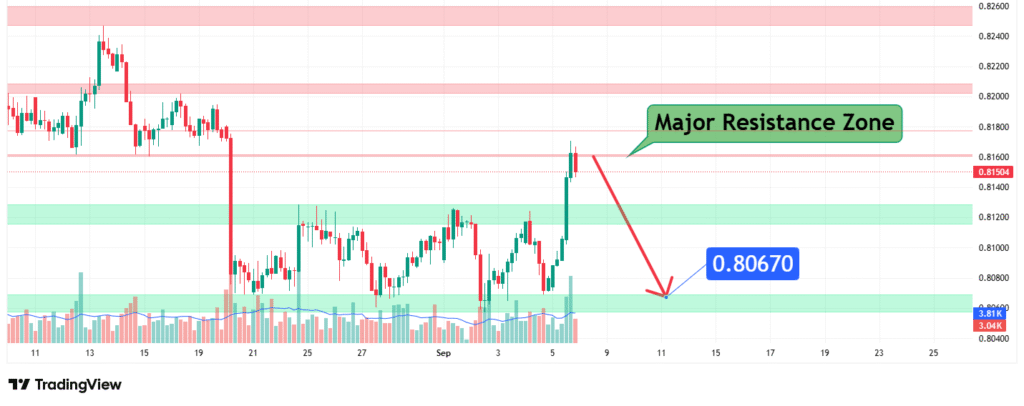

NZDCAD Price Analysis Bearish Setup Targeting 0.8000 USD

NZDCAD has rallied into a major resistance zone around 0.8150 – 0.8170 but is showing signs of exhaustion. The recent bullish move has stalled, with sellers expected to take control. Our bearish projection points towards a primary target of 0.8000, with intermediate support expected around 0.8067.

This analysis is based on the rejection from a strong resistance area, a bearish reaction in price action, and historical market structure.

Current Market Structure and Price Action

- NZDCAD has staged a sharp rally from early September lows near 0.8070, climbing back into the 0.8150 resistance zone.

- The market has repeatedly failed to sustain momentum above this level, confirming it as a major supply area.

- The rejection candle near resistance suggests buyer exhaustion, reinforcing a bearish bias.

Key Resistance and Support Zones

- Resistance Zone: 0.8150 – 0.8170

- Historical rejection levels.

- Price action confirms sellers are defending this area.

- Intermediate Support: 0.8067

- Marked as a near-term liquidity zone where price may pause.

- Primary Bearish Target: 0.8000

- A key psychological round number.

- Historically a strong support level, making it a logical downside target.

Technical Targets and Rationale

- Primary Target (PT1): 0.8067

- Short-term reaction level and intraday support.

- Secondary Target (PT2): 0.8000

- Stronger historical support zone and psychological level.

- Bears are likely to extend momentum into this area once 0.8067 is broken.

Risk Management Considerations

- Invalidation Level: A daily close above 0.8170 invalidates the bearish thesis.

- Stop-Loss Placement: Conservative traders should place stops slightly above 0.8180, beyond the resistance zone.

- Position Sizing: Risk per trade should be kept at 1–2% of account equity.

Fundamental Backdrop

While this outlook is primarily technical, the NZDCAD pair remains sensitive to:

- Oil Prices: CAD is heavily influenced by crude oil; strong oil prices may support CAD strength.

- RBNZ & BoC Policy: Divergence in monetary policy between the Reserve Bank of New Zealand and the Bank of Canada could drive volatility.

- Global Risk Sentiment: Shifts in risk appetite often affect commodity currencies like NZD and CAD.

Conclusion

NZDCAD is currently testing a major resistance zone around 0.8150. Price action indicates a bearish reversal setup, with sellers expected to push the pair lower towards 0.8067 and ultimately 0.8000. Traders should monitor for confirmation of breakdown and manage risk around the 0.8170 invalidation level.

Prediction: NZDCAD is likely to reach 0.8000 USD in the coming days.

Chart Source: TradingView

Disclaimer: This analysis is for educational purposes only and not financial advice. Trading involves significant risk of loss. Conduct your own research before making investment decisions.