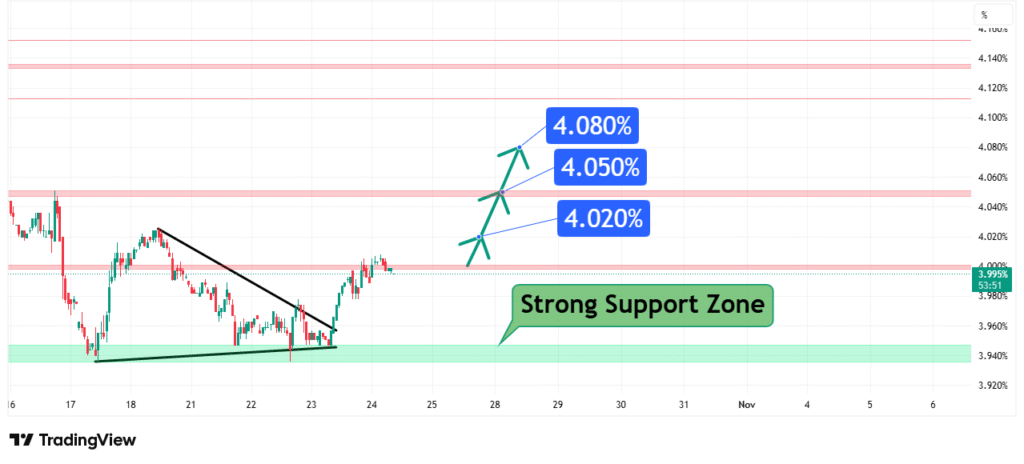

US 10-Year Yield Forecast Eyeing a Move Towards 4.050%-4.080%

The US 10-Year Yield has been consolidating firmly above a critical support zone between 3.920% and 3.960%. This price action suggests a bullish bias is forming as buyers defend this key area. Our analysis projects a move towards primary targets at 4.020%, 4.050%, and 4.080%. This prediction is based on a confluence of technical factors, including the defense of a strong support zone and the potential completion of a bullish consolidation pattern.

Current Market Structure and Price Action

The broader market structure for the 10-Year Yield has been bullish, characterized by a series of higher highs and higher lows since the lows of late October. The price is currently interacting with a crucial support zone and the psychological 4.000% level. Recent price action has shown a compression of volatility and a clear rejection of lower prices, as evidenced by the cluster of daily closes above 3.940%. This indicates that selling pressure is waning and a bullish resolution from this consolidation is likely.

Identification of the Key Support Zone

The most critical technical element is the Strong Support Zone between 3.920% and 3.960%. The strength of this zone is derived from:

- Historical Significance: This level acted as a consolidation area and swing low on multiple days in late October (29th, 30th, 31st), proving its importance.

- Technical Confluence: The zone aligns with the psychological magnet of the 4.000% level, adding to its significance from a market sentiment perspective.

- Market Psychology: This area represents a point where the conviction of buyers (yield bulls) has previously overwhelmed sellers, establishing a floor for the recent move.

This multi-touch confluence makes it a high-probability level for a bullish reaction and a potential launchpad for the next leg higher.

Technical Targets and Rationale

Our analysis identifies the following price targets, which represent our prediction for the upcoming move:

- Initial Target (PT1): 4.020%

- Rationale: This level represents the immediate resistance and the first logical profit-taking point after a breakout from the consolidation range.

- Primary Target (PT2): 4.050%

- Rationale: A more significant resistance level that capped the rally on November 1st. A break above this confirms bullish momentum.

- Extension Target (PT3): 4.080%

- Rationale: This is the most ambitious target, acting as the recent swing high from October 28th and the ultimate objective of this bullish setup.

Prediction: We forecast that the yield will hold above the strong support zone, break above the 4.020% resistance, and move sequentially towards our PT1, PT2, and PT3 targets.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bullish thesis is invalidated if the price achieves a daily close below the 3.920% support level. This level represents a clear break of the market structure that justified the prediction, indicating a failure of buyer support and a potential decline towards lower yields.

- Position Sizing: Any positions taken (e.g., shorting bond futures, buying yield-based ETFs) should be sized so that a loss triggered at the 3.920% invalidation level represents a small, pre-defined percentage of your total capital (e.g., 1-2%).

Fundamental Backdrop

The technical setup is framed by the current fundamental landscape:

- Federal Reserve Policy: Market participants are closely parsing every comment from the Fed for clues on the timing of potential interest rate cuts. Any hawkish tilt could fuel the bullish yield outlook.

- Economic Data: Upcoming inflation (CPI) and jobs (NFP) reports will be critical in shaping interest rate expectations and directly impacting Treasury yields.

- Government Debt Supply: Concerns over increasing Treasury issuance to fund the deficit can put upward pressure on yields, as the market absorbs more supply.

These factors contribute to a volatile but cautiously bullish sentiment surrounding yields, providing a fundamental tailwind for the technical setup.

Conclusion

The US 10-Year Yield is at a technical inflection point, coiling above a strong support base. The weight of evidence suggests a bullish resolution, targeting a move first to 4.020%, then to 4.050%, and ultimately challenging the 4.080% level. Traders should monitor for a confirmed break above 4.020% and manage risk diligently by respecting the key invalidation level at 3.920%. The reaction at the 4.080% target will be crucial for determining if a new, higher trading range can be established.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.