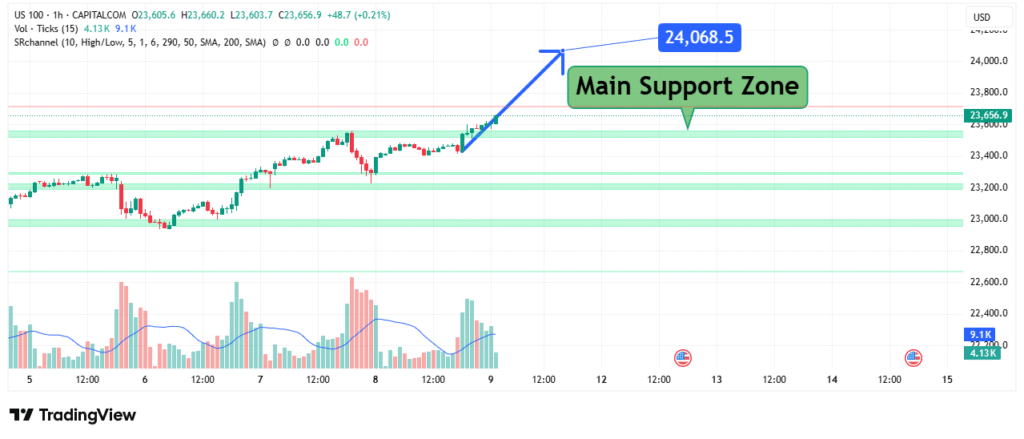

US100 Eyes 24,068 Target Technical Setup Reveals Next Breakout Level

The US100 (Nasdaq 100) index shows strong technical positioning on its 1-hour chart, currently trading at 23,656.9 (+0.21%) as it approaches our key target of 24,068. This analysis breaks down the critical levels and market structure driving this bullish setup, providing traders with actionable insights.

Current Market Position and Price Action

The index displays constructive price action:

- Current Price: 23,656.9 (+48.7 points, +0.21%)

- Session Range: 23,603.7 (low) to 23,660.2 (high)

- Volume: Moderate at 4.13K-9.1K ticks

- Immediate Support: 23,600 holding firm

The steady ascent with higher lows suggests accumulation, while the 0.21% gain on balanced volume indicates sustainable momentum rather than overextended buying.

Critical Price Levels and Market Structure

Support Framework (Bullish Foundation):

- Primary Support: 23,600 (today’s low)

- Strong Support Zone: 23,400-23,600 (multiple touch points)

- Major Floor: 23,000 (psychological level)

Resistance Pathway to Target:

- Immediate Resistance: 23,800 (recent swing high)

- Key Breakout Level: 24,000 (psychological barrier)

- Primary Target: 24,068.5 (marked “Main Support Zone” on chart)

- Extension Potential: 24,200 upon target achievement

The 24,068.5 level holds particular significance as it’s identified as the “Main Support Zone” – often such flipped resistance levels become strong targets when broken.

Technical Indicators and Momentum Signals

Several technical factors confirm the bullish outlook:

- Moving Averages: SMA (50) above SMA (200) confirms uptrend

- Price Channels: The “Sichannel” shows upward expansion

- Volume Profile: Balanced volume supports organic growth

- Momentum: Consistent higher highs/lows pattern

The index has maintained its upward trajectory since bouncing from 23,400 support, showing no signs of exhaustion at current levels.

Pathway to 24,068 Target: Key Scenarios

Base Case (Bullish Continuation):

- Initial Move: Break above 23,800 resistance

- Confirmation: Sustained trading above 24,000

- Target Achievement: Test of 24,068.5

- Extension Potential: 24,200 if momentum persists

Alternative Scenario (Consolidation):

- Temporary Pause: Pullback to 23,600 support

- Rebound Potential: Strong bids expected at 23,400

- Upside Resumption: Continued path to target

Risk Scenario (Unlikely Currently):

- Warning Sign: Breakdown below 23,400

- Invalidation Level: Close below 23,200

- Bearish Shift: Would delay target achievement

Strategic Trading Approach

For traders targeting 24,068:

- Entry Strategies:

- Aggressive: Current levels (23,650) with tight stop

- Conservative: Wait for break above 23,800

- Stop Placement:

- Below 23,600 for aggressive entries

- Below 23,400 for conservative positions

- Profit-Taking:

- First target at 24,000

- Final target at 24,068

- Consider partial profits at 23,800

Key Market Drivers to Monitor

- Tech Earnings: Nasdaq components’ performance

- Fed Policy: Interest rate expectations

- Market Sentiment: Risk appetite indicators

- Volume Confirmation: Increasing volume on breakout

Conclusion: Confident Path to Target

The US100 demonstrates all the technical characteristics of an index preparing for another leg higher. With solid support at 23,600 and clear resistance levels overhead, the path to our 24,068 target appears well-defined. Traders should watch for the break above 23,800 as confirmation of accelerating momentum, while maintaining proper risk management in case of unexpected volatility.