US100 Technical Analysis - Key Levels and Trading Outlook

Market Overview

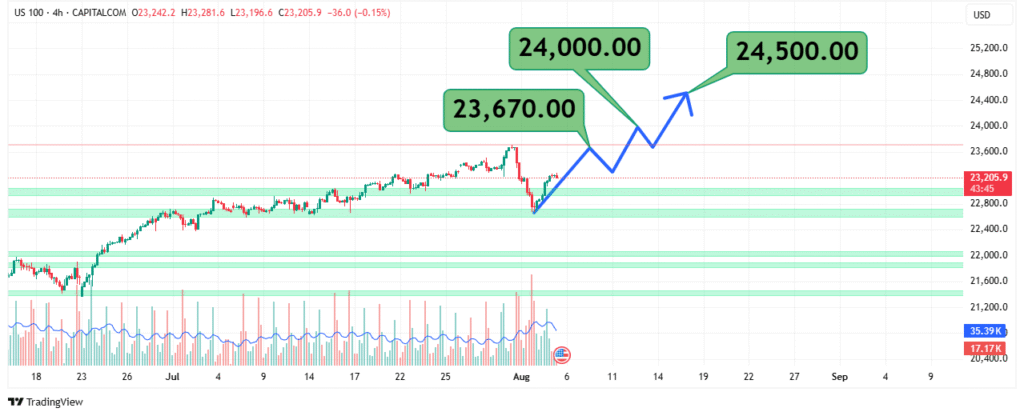

The US100 (Nasdaq 100) is currently trading at 23,205.9, down 0.15% in the 4-hour session, with prices fluctuating between 23,196.6 and 23,281.6. The index is consolidating near a critical support-resistance zone, suggesting a potential breakout or reversal in the coming sessions.

Key Technical Observations

1. Price Structure & Trend

- Immediate Resistance: 23,670.00 (Recent swing high)

- Key Support: 23,000.00 (Psychological level)

- Higher Timeframe Resistance: 24,000.00 (Major hurdle for bulls)

- The price is trapped in a tight range (23,200–23,670), indicating indecision.

2. Moving Averages (Trend Confirmation)

- 50 EMA: Acting as dynamic resistance near 23,500.

- 200 EMA: Long-term support at 22,800.

- A break above the 50 EMA could signal short-term bullish momentum.

3. Momentum Indicators

- RSI (14): Neutral (~45–50), no clear overbought/oversold signal.

- MACD: Flat near the zero line, suggesting consolidation.

Trading Strategies

Bullish Scenario (Breakout Trade)

- Trigger: A decisive 4-hour close above 23,670 with rising volume.

- Targets:

- 24,000.00 (Psychological resistance).

- 24,400.00 (Next supply zone).

- Stop-Loss: Below 23,000.00 (Key support).

Bearish Scenario (Breakdown Trade)

- Trigger: A drop below 23,000.00 with increasing selling pressure.

- Targets:

- 22,800.00 (200 EMA support).

- 22,400.00 (Next demand zone).

- Stop-Loss: Above 23,500.00 (50 EMA resistance).

Key Levels to Watch

| Resistance | Support |

|---|---|

| 23,670.00 | 23,000.00 |

| 24,000.00 | 22,800.00 |

| 24,400.00 | 22,400.00 |

Final Verdict

The US100 is at a critical juncture, with the 23,000–23,670 range dictating the next major move. Traders should wait for a confirmed breakout or breakdown before taking positions.