What is a Stock Broker, What They Do, Types, How to Choose

A stock broker is your licensed gateway to the world’s financial markets, executing your buy and sell orders for stocks, bonds, and other securities. Choosing the right broker is one of the most critical decisions an investor makes, as it directly impacts your costs, access to tools, and ultimately, your investment success. For investors in the US, UK, Canada, and Australia, navigating the plethora of brokerage options from traditional giants to sleek fintech apps, it is the essential first step on your wealth-building journey.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A licensed professional or firm that acts as an intermediary to execute buy/sell orders for securities on behalf of clients. |

| Also Known As | Brokerage Firm, Investment Broker, Trading Platform |

| Main Used In | Stock Trading, Portfolio Management, Retirement Planning (IRA, 401k), Options and Futures Trading |

| Key Takeaway | Your broker is your primary financial marketplace partner; their fees, platform, and services must align with your strategy. |

| Formula | N/A |

| Related Concepts |

What is a Stock Broker

Think of a stock broker as your personal concierge to the global financial markets. You can’t walk onto the floor of the New York Stock Exchange (NYSE) or NASDAQ and shout an order yourself. You need a licensed intermediary, the broker, who has direct access to these exchanges. In the digital age, this “broker” is most often a sophisticated online platform or app that transmits your instructions in milliseconds. I remember placing my first trade over a decade ago through a clunky website; today, it happens with a tap on my phone, but the fundamental role of the broker remains unchanged: to facilitate your access and safeguard your assets.

Pro Tip: Don’t confuse a “broker” with a “financial advisor.” A broker executes trades. An advisor (who may also be a broker) provides holistic financial planning. Many firms offer both services, but understanding this distinction is key to knowing what you’re paying for.

Key Takeaways

The Core Concept Explained

At its heart, a stock broker’s role is one of access, execution, and custody. They provide you with a trading platform (access), they route your order to the best available market or exchange to get it filled (execution), and they securely hold your cash and purchased securities in a brokerage account (custody). When you hear terms like “PFOF” (Payment for Order Flow), it refers to how some brokers make money by routing your orders to specific market makers, which can impact the price you get. A high-quality broker prioritizes best execution, getting you the best possible price, over the kickbacks they might receive.

Types of Stock Brokers

The brokerage landscape has evolved into several distinct models. Understanding these types is the first step in narrowing down your search.

1. Full-Service Brokers

These are the traditional, white-glove firms (e.g., Morgan Stanley, Goldman Sachs in the US; Barclays Wealth in the UK). They offer comprehensive financial planning, investment advice, retirement planning, tax strategies, and estate planning, alongside trade execution. You’re assigned a dedicated financial advisor.

- Best For: High-net-worth individuals, investors who want hands-off professional management, and those with complex financial situations.

- Cost: High. Fees come as a percentage of assets under management (AUM, typically 1-2% annually), hefty commissions, and account maintenance fees.

2. Discount/Online Brokers

Pioneered by firms like Charles Schwab and E*TRADE (now part of Morgan Stanley), these brokers democratized investing by offering dramatically lower commissions and, later, commission-free trading. They provide robust platforms and tools but little to no personalized advice.

- Best For: Self-directed investors who do their own research but want a powerful platform, educational resources, and access to a wide range of products.

- Cost: Low to zero commissions. May have fees for specific transactions or data subscriptions.

3. Robo-Advisors

A hybrid tech-driven model (e.g., Betterment, Wealthfront). You answer questions about your goals and risk tolerance, and an algorithm builds and manages a diversified ETF portfolio for you. Automatic rebalancing and tax-loss harvesting are standard features.

- Best For: Beginners, passive investors, and anyone who wants a simple, low-cost, hands-off approach to investing.

- Cost: Low. Typically an AUM fee of 0.25%-0.50% per year.

4. Direct Trading Platforms & Apps

The new wave of fintech (e.g., Robinhood, Webull, eToro). They focus on a sleek, mobile-first user experience, often incorporating social or gamified elements. They popularized commission-free trading but may have revenue models centered around PFOF, crypto trading, or subscription tiers.

- Best For: Mobile-first traders, beginners starting with small amounts, and those interested in fractional shares or cryptocurrencies.

- Cost: Often $0 commissions for stocks/ETFs. Be mindful of other potential costs like spreads, subscription fees for advanced features, or crypto transaction fees.

Pro Tip: I started with a direct trading app for its simplicity but quickly moved to a more established discount broker as my portfolio grew and I needed more advanced tools like in-depth charting and options analysis. Your broker should grow with you.

Services Offered by Brokers

Modern brokers are financial hubs. When evaluating one, look beyond just the commission schedule.

- Trading Platform & Tools: Is the platform intuitive and stable? Does it offer advanced charting, real-time data, screeners, and backtesting capabilities? For active traders, platform reliability is non-negotiable.

- Account Types: Do they offer the accounts you need? This includes standard taxable accounts, retirement accounts (IRA in the US, ISA/SIPP in the UK, RRSP/TFSA in Canada, Superannuation in Australia), and custodial accounts for minors.

- Investment Products: What can you actually trade? Stocks and ETFs are standard. Also check for mutual funds, bonds, options, futures, foreign exchange (forex), and cryptocurrencies if you’re interested.

- Research & Education: Access to third-party research reports (Morningstar, CFRA), company financials, news feeds, and educational webinars can be invaluable, especially for newer investors.

- Customer Support: Test their support. Are they accessible via phone, chat, email? What are their hours? In my experience, the quality of support during a market panic or a technical glitch separates great brokers from mediocre ones.

- Cash Management: Features like automatic sweep into money market funds, bill pay, debit cards, and competitive interest rates on uninvested cash.

Tax Implications & Account Types: What Every Investor Must Know

Choosing the right account type isn’t just about access—it’s a critical tax strategy that can save you thousands.

Tax Treatment

- Capital Gains: Short-term (<1 year) taxed at ordinary income rates. Long-term taxed at preferential rates (0%, 15%, or 20% in US)

- Dividends: Qualified dividends taxed at capital gains rates; non-qualified as ordinary income

- Interest: Taxed as ordinary income

Best For

- Goals less than 5 years away

- Supplemental income investing

- Access to funds before retirement age

My Experience

I keep my dividend growth portfolio in a taxable account to take advantage of qualified dividend rates and the ability to tax-loss harvest individual positions—something you can’t do as easily in retirement accounts.

Traditional IRA/401k

- Contributions are tax-deductible

- Growth is tax-deferred

- Withdrawals taxed as ordinary income

- Required Minimum Distributions (RMDs) at 73

Roth IRA/401k

- Contributions are after-tax

- Growth is tax-free

- Qualified withdrawals are tax-free

- No RMDs during your lifetime

529 Plans (US)

Purpose: Education savings

Tax Benefit: Tax-free growth for qualified education expenses

New (2024): Unused funds up to $35,000 can roll into Roth IRA

Health Savings Account (HSA)

Purpose: Medical expenses

Tax Benefit: Triple tax-advantaged: deductible contributions, tax-free growth, tax-free withdrawals for medical

Pro Move: Invest HSA funds for long-term growth; pay medical out-of-pocket now

ISAs (UK) & TFSAs (Canada)

Purpose: General tax-free savings

Tax Benefit: No tax on dividends, interest, or capital gains

Limits: Annual contribution limits apply (£20,000 UK ISA, $7,000 CAD TFSA for 2024)

Year-End Tax Checklist for Investors

How to Choose the Right Stock Broker for You

Don’t just pick the one with the flashiest ad. Follow this systematic approach to find your perfect match.

Step 1: Define Your Investor Profile

Are you a passive long-term investor, an active trader, or somewhere in between? Your activity level is the single biggest determinant.

Step 2: Prioritize Your Needs

Make a list. Is low cost #1? Or is it research tools? Maybe it’s access to international markets or excellent mobile app functionality.

Step 3: Check for Safety and Regulation

- US: Verify registration with the SEC and FINRA. Check for SIPC protection (covers up to $500,000 in securities).

- UK: Check the Financial Services Register for FCA authorization. Your money is protected by the FSCS up to £85,000.

- Canada: Check registration with provincial securities commissions and IIROC membership. Covered by CIPF.

- Australia: Verify an Australian Financial Services (AFS) license from ASIC.

Step 4: Compare the Fee Structure

Look at:

- Trading commissions (stock/ETF, options, mutual funds)

- Account maintenance or inactivity fees

- Data subscription fees (for real-time quotes, Level II data)

- Transfer fees (ACAT fees)

- Margin interest rates (if you plan to borrow)

Step 5: Test the Platform

Most reputable brokers offer a demo or “paper trading” account. Use it! Test the order entry process, explore the charts, and see if the layout works for you.

Step 6: Read Independent Reviews

Don’t rely solely on the broker’s marketing. Seek out reviews from established financial publications like The Wall Street Journal, Investopedia, or NerdWallet for balanced perspectives.

International Investor’s Guide: Navigating Global Markets

If you’re investing from outside your home country or want access to international markets, these considerations are crucial:

Residency Requirements & KYC

Most brokers require proof of residency. For example, opening a US account typically requires a Social Security Number or ITIN. Non-residents may need to use specialized international accounts.

Currency & Tax Complexity

Currency conversion fees can eat 1-3% per trade. You’ll also face tax reporting in multiple jurisdictions (like filing W-8BEN forms for the IRS as a non-US resident).

- Multi-currency accounts: Some brokers let you hold multiple currencies to avoid repeated conversions

- Withholding taxes: Dividends from foreign stocks often have taxes withheld at source

- Local reporting: Ensure your broker provides necessary tax documents for your home country

Regional Market Access

Not all brokers provide equal access. A broker strong in US markets might offer limited access to European or Asian exchanges.

Solution: For truly global access, consider specialized brokers like Interactive Brokers or Saxo Bank that act as prime brokers to multiple exchanges worldwide.

Recommended Resource: The IRS International Taxpayer page is essential for understanding US tax obligations for non-residents.

- Market Access: Provides essential, regulated access to global stock exchanges and other markets you couldn’t reach on your own.

- Convenience & Speed: Modern apps and platforms allow you to manage your portfolio and execute trades from anywhere in seconds.

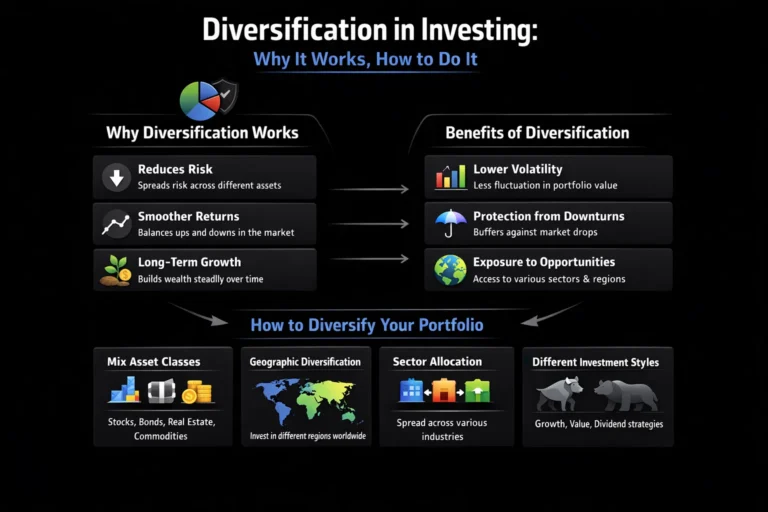

- Diversification Tools: Brokers offer easy access to thousands of ETFs and mutual funds, enabling cheap and instant portfolio diversification.

- Information & Research: Many provide powerful tools, real-time data, and third-party research to inform your investment decisions.

- Automation: Features like automatic investments, dividend reinvestment (DRIP), and robo-advisory services make disciplined investing effortless.

- Costs Add Up: Even with “zero commissions,” other fees (spreads, options contracts, currency conversion) can erode returns, especially for frequent traders.

- Over-trading Temptation: Easy access and gamified interfaces can encourage impulsive, speculative trading rather than long-term investing.

- Platform Dependency: Your ability to trade is tied to the broker’s tech. Outages during volatile markets, as we’ve seen with some apps, can be costly.

- Conflicts of Interest: Models relying on PFOF or promoting in-house products may not always align your best execution with their maximum profit.

- Information Overload: For beginners, the sheer volume of data, charts, and tools can be paralyzing rather than helpful.

Advanced Brokerage Tools: What Pros Look For

Beyond basic trading, these features separate professional-grade platforms from basic ones. Here’s what I’ve learned using various platforms over the years.

Technical Analysis & Charting

Basic Charting

All Brokers- Candlestick/bar/line charts

- Basic indicators (MA, RSI, MACD)

- Drawing tools (trendlines, Fibonacci)

Professional Charting

Thinkorswim, TradingStation- Custom indicator scripting (ThinkScript, EasyLanguage)

- Multi-timeframe analysis on one chart

- Market profile & footprint charts

- Backtesting capabilities

Institutional Tools

Bloomberg, Reuters Eikon- Real-time global market data

- Algorithmic trading integration

- Portfolio risk analytics

- News sentiment analysis

Execution & Order Types

| Order Type | Best For | Brokers with Best Execution | My Usage |

|---|---|---|---|

| Market Orders | Immediate execution at any price | All brokers | Only for highly liquid ETFs in calm markets |

| Limit Orders | Controlling entry/exit price | Interactive Brokers, Fidelity | My default for all equity trades |

| Stop-Loss Orders | Risk management | TD Ameritrade, Schwab | Essential for every position >$1,000 |

| Bracket Orders | Automated profit-taking & stop-loss | Thinkorswim, TradeStation | Used for all day trades |

| OCO (One-Cancels-Other) | Multiple contingency scenarios | Interactive Brokers, NinjaTrader | Advanced options strategies |

Execution Quality Matters More Than You Think

I tested identical limit orders on three brokers for SPY shares. Over 100 trades, Interactive Brokers’ price improvement saved me ~0.03% per trade versus a popular commission-free app. That’s $30 per $100,000 traded—adds up fast for active traders.

Automation & APIs

Basic Automation

- Recurring investments

- Dividend reinvestment (DRIP)

- Email/SMS alerts

Conditional Trading

- Conditional orders based on price/indicators

- Automated rebalancing

- Tax-loss harvesting (Betterment, Wealthfront)

API & Algorithmic Trading

- REST APIs for custom integration

- Python/R libraries

- Direct market access (DMA)

- Co-location services

⚠️ API Access Warning

Not all APIs are created equal. Some brokers offer read-only APIs. Others (like Interactive Brokers) offer full trading APIs but with complex documentation. Alpaca and TD Ameritrade (now Schwab) had developer-friendly APIs—check current status as mergers can disrupt API access.

Feature Priority Matrix

Essential for All

- Reliable execution

- Basic charting

- Good customer service

- Mobile app

Important for Active Traders

- Advanced order types

- Real-time data

- Low latency

- Professional platform

Nice-to-Have

- Backtesting

- API access

- Third-party integration

- Advanced analytics

Professional/Institutional

- Direct market access

- Co-location

- Custom reporting

- Prime brokerage services

A Tale of Two Brokers: The GameStop Saga

The GameStop (GME) short squeeze of January 2021 serves as a stark real-world lesson in how your choice of broker can directly impact your ability to act. During the peak volatility, several popular direct trading platforms like Robinhood restricted buying of GME and other “meme stocks,” allowing only sells. This was reportedly due to capital requirements from their clearinghouse. Meanwhile, many established discount brokers like Fidelity and Charles Schwab, with their own clearing operations, did not impose such blanket restrictions, though they did increase margin requirements.

The Lesson: This event highlighted a critical, often-overlooked aspect of a broker: their back-end operational and financial resilience. A broker’s dependency on third parties for clearing and settlement can become a single point of failure during extreme market stress. For serious investors, the infrastructure behind the shiny app matters as much as the app itself.

Stock Broker vs. Financial Advisor

This is the most common point of confusion. While roles can overlap (a “broker-dealer”), the core functions differ.

| Feature | Stock Broker (Execution-Focused) | Financial Advisor (Planning-Focused) |

|---|---|---|

| Primary Role | Execute buy/sell orders for securities. | Provide comprehensive financial planning and advice. |

| Regulatory Standard (USA) | Suitability. Recommendations must be suitable for you at the time of the transaction. | Fiduciary Duty (for RIAs). Must act in your best interest at all times. |

| Compensation Model | Commissions per trade, payment for order flow, spreads. | Fee-only (% of AUM), hourly fee, or flat retainer. (Fee-based advisors may also earn commissions). |

| Relationship | Transactional. You initiate trades. | Ongoing. They proactively manage your overall financial life. |

Conclusion

Ultimately, selecting a stock broker is about choosing your most important financial technology partner. It’s not a one-size-fits-all decision. A full-service broker’s hand-holding is worth the fee for some, while an active trader would find it stifling and expensive. By rigorously assessing your own needs, understanding the different types of brokerage services, and prioritizing safety and cost, you can move beyond the hype and choose a platform that empowers your specific financial journey. Remember, the goal isn’t to find the “best” broker in a vacuum, but the best broker for you.

Ready to put this knowledge into action? The next step is to compare specific platforms. We recommend starting your search with comprehensive, unbiased reviews from authoritative sources like Investopedia’s broker comparisons or the SEC’s investor education resources to make a fully informed choice.

Related Terms

- Investment Platform: The broader technology suite provided by a broker for managing investments.

- Robo-Advisor: An automated digital platform that provides algorithm-driven financial planning and investment management with minimal human supervision.

- Clearing House: An intermediary that validates and finalizes transactions between a buyer and seller, ensuring the smooth transfer of securities and cash. Brokers rely on them.

- SIPC Insurance: A crucial protection for investors in the US if a brokerage firm fails.

Frequently Asked Questions

Recommended Resources

- For Regulatory Checks (US): FINRA BrokerCheck – Verify the background of any broker or firm.

- For Investor Education (US): SEC Investor.gov – Unbiased educational material from the U.S. Securities and Exchange Commission.

- For In-Depth Broker Reviews: Investopedia’s Best Online Brokers – Comprehensive, regularly updated comparisons.

- For Understanding PFOF & Execution: The SEC’s Page on Order Execution – Official explanation of how orders are executed and the issues involved.