Take Profit Order What It Is and How to Use It

A Take Profit Order (TPO) is a pre-set instruction to automatically close a trade when it reaches a specific profit target. It is a cornerstone of disciplined trading, designed to lock in gains and remove emotion from the exit process. For active traders in the US, UK, Canada, and Australia, mastering the TPO is essential for consistent risk management across markets like the NYSE, NASDAQ, and FTSE.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A pre-set order to automatically sell a security when it reaches a specific profitable price. |

| Also Known As | Profit Target, TPO, Limit Sell Order (when used for profit-taking). |

| Main Used In | Stock Trading, Forex, Crypto, Futures, CFD Trading |

| Key Takeaway | It automates profit-taking, enforces discipline, and helps protect gains from a sudden market reversal. |

| Related Concepts |

What is a Take Profit Order

A Take Profit Order (TPO) is an automated instruction you place with your broker to close a profitable position once the market price hits a predetermined level. Think of it as a pre-programmed “cash-out” button. Instead of constantly watching the charts and deciding when to sell, you set your desired profit target in advance. Once the asset’s price rises to that level, the TPO order is triggered, and your trade is closed, securing your profit.

Imagine you’re driving to a specific destination, your profit target. The Take Profit Order is your GPS’s “Arrived” notification. You don’t keep driving aimlessly past your destination hoping to find a better one; you stop exactly where you planned, ensuring you successfully complete your journey.

Key Takeaways

The Core Concept Explained

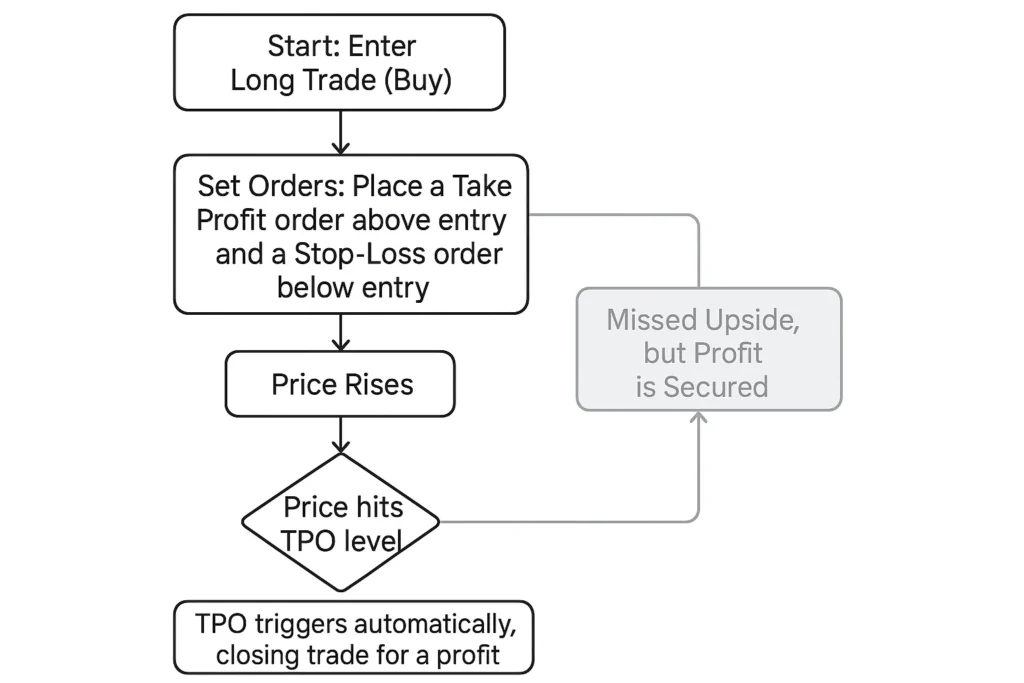

The core function of a TPO is to translate a trading plan into an automated action. When you enter a trade, you have a hypothesis about where the price might go. The TPO is the execution of the profitable part of that hypothesis.

- For a Long Trade (Buy): You set a TPO above your entry price. When the market’s Bid Price rises to meet your TPO’s limit price, the order executes.

- For a Short Trade (Sell): You set a TPO below your entry price. When the market’s Ask Price falls to meet your TPO’s limit price, the order executes.

A TPO is essentially a type of Limit Order that is used specifically for exiting a position at a profit.

How to Set a Take Profit Order

While there is no universal formula, setting a TPO is a strategic decision often based on a trader’s Risk-Reward Ratio. The most common method involves relating the profit target to the risk taken in the trade.

The Risk-Reward Method

This method ensures that the potential profit from a trade justifies the potential loss.

- Identify Your Stop-Loss: First, determine where you will place your stop-loss order (the price at which you’ll exit for a loss if the trade goes against you).

- Calculate Risk per Share/Unit: Risk = Entry Price – Stop-Loss Price

- Set Profit Target Based on Ratio: Choose a Risk-Reward Ratio (e.g., 1:2, 1:3) and calculate your Take Profit price.

- For a Long Trade: Take Profit Price = Entry Price + (Risk × Reward Multiple)

- For a Short Trade: Take Profit Price = Entry Price – (Risk × Reward Multiple)

Example Calculation: A US Stock Trade

Let’s say you buy shares of Apple (AAPL) listed on the NASDAQ.

- Input Values:

- Entry Price: $170.00

- Stop-Loss Price: $165.00

- Desired Risk-Reward Ratio: 1:3

- Calculation:

- Risk per Share = $170.00 – $165.00 = $5.00

- Take Profit Price = $170.00 + ($5.00 × 3) = $170.00 + $15.00 = $185.00

- Interpretation: By setting your TPO at $185, you are risking $5 per share to make a target profit of $15 per share. If the trade is successful, your gain will be three times your potential loss.

Why Take Profit Orders Matter to Traders and Investors

- For Traders: It systematically captures profits at technically logical levels, such as prior resistance or overbought signals identified by indicators like the Relative Strength Index (RSI). This prevents the common pitfall of watching a profitable trade turn negative due to hesitation or greed.

- For Investors: While long-term investors may use TPOs less frequently, they are invaluable for taking partial profits on a position that has become overvalued or has reached a target price, allowing them to rebalance their portfolio.

- For Everyone: It is the foundation of position sizing and pre-trade planning. Knowing your exact exit point in advance allows you to calculate how much capital to allocate to a trade to stay within your risk management parameters.

How to Use a Take Profit Order in Your Strategy

Use Case 1: Trading a Breakout

You buy a stock after it breaks above a key resistance level at $50. Your hypothesis is that it will rise to the next resistance level. You place your TPO just below that next resistance at $59, ensuring you capture the majority of the move before the price potentially reverses.

Use Case 2: Using a Risk-Reward Ratio in Forex

You go long on the EUR/USD pair at 1.0750 with a stop-loss at 1.0720 (30 pips risk). Aiming for a 1:2 risk-reward, you set your TPO at 1.0810 (60 pips profit). This defines your trade objectively from the start.

To start implementing Take Profit and Stop-Loss orders seamlessly, you need a brokerage platform with reliable order execution. We’ve tested the top platforms for active traders; see our review of the Best Online Brokers for Active Trading to find the right one for you.

The Psychology of the Take Profit

Understanding the mental battle is key to using TPOs effectively.

- Fighting FOMO (Fear Of Missing Out): The hardest part of using a TPO is watching the price continue to rise after your order executes. A disciplined trader understands that profit is profit, and no one can consistently catch the absolute top. The TPO ensures you capture a predictable portion of a move, which is the hallmark of a sustainable strategy.

- Backtesting for Confidence: The fear of a “premature” TPO diminishes when you backtest your strategy. If your historical data shows that your TPO placement is profitable over dozens of trades, you can trust the process, not your gut feeling in the moment. This turns the TPO from a constraint into a confident, system-based action.

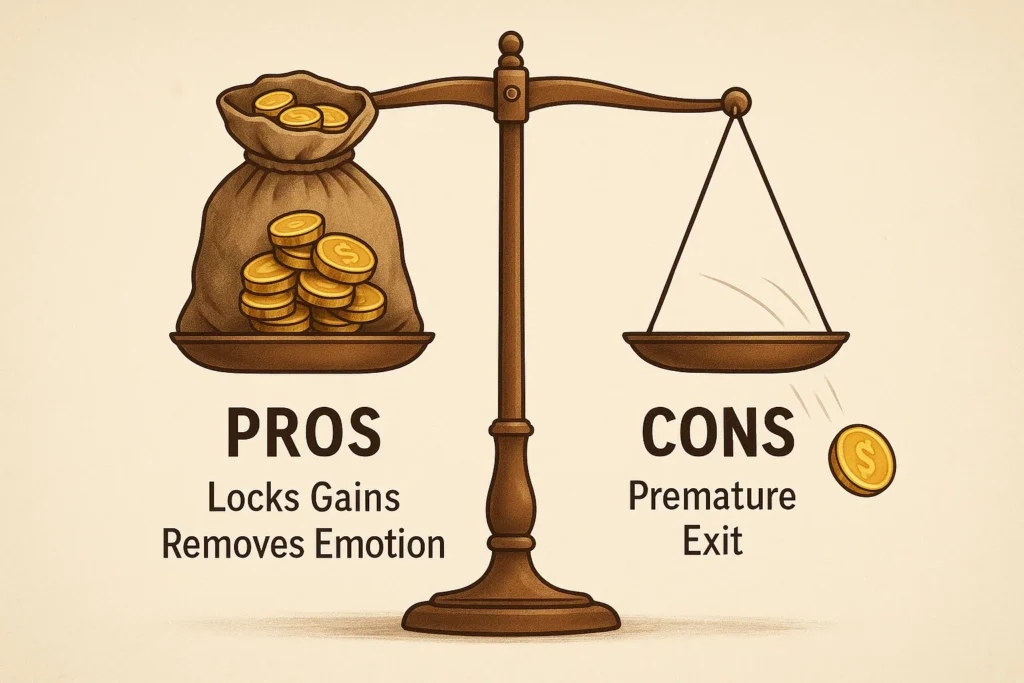

- Removes Emotion: Automates the most psychologically difficult part of trading, taking profits.

- Enforces Discipline: Ensures you follow your pre-defined trading plan.

- Protects Profits: Locks in gains and prevents them from evaporating in a volatile market.

- Enables Advanced Strategies: Essential for hands-off strategies like swing trading or when you cannot watch the markets.

- Risk of Premature Exit: The price might hit your TPO and then continue moving strongly in your favor, causing you to miss out on additional profits (this is often called “leaving money on the table”).

- No Guarantee of Execution: In extremely fast markets or with low-liquidity assets, the price might “skip” over your TPO level, resulting in a fill at a less favorable price (slippage).

- Requires Accurate Analysis: A poorly placed TPO (too close or too far) can negatively impact your overall strategy’s profitability.

Advanced TPO Strategies

Move beyond the basic single TPO with these sophisticated approaches:

- Partial Profit Taking (Scaling Out): Instead of one TPO for your entire position, set multiple TPOs to exit in portions. For example, close 50% of your position at a 1:2 risk-reward target, another 25% at 1:4, and let the final 25% run with a trailing stop. This balances guaranteed profit-taking with the potential for larger wins.

- Time-Based TPOs: Some advanced platforms allow for “Good-‘Til-Cancelled (GTC)” or “Good-‘Til-Date (GTD)” TPOs. If your trade thesis is based on a specific event (like an earnings report), you might set a TPO that expires after a few days, ensuring the order doesn’t remain active if market conditions change fundamentally.

Take Profit Order in the Real World: A Crypto Case Study

The cryptocurrency market is known for its extreme volatility, making TPOs exceptionally valuable. Consider a trader during a Bitcoin (BTC) rally.

- The Situation: In Q4 2023, Bitcoin broke out from a consolidation zone around $28,000. A trader enters a long position at $29,000.

- The Plan: Based on technical analysis, the next major resistance was near $35,000. The trader sets a stop-loss at $27,000 (risking $2,000) and a TPO at $35,000 (targeting a $6,000 profit, a 1:3 risk-reward ratio).

- The Outcome: Bitcoin’s price surges and hits $35,000 a few weeks later. The TPO triggers automatically, closing the trade and securing a $6,000 profit. Subsequently, the price struggles at the $35,000 resistance, consolidates, and then pulls back to $32,000. The trader, thanks to the TPO, successfully captured the profit and avoided the pullback, demonstrating the order’s power in locking in gains during a volatile move.

Take Profit Order (TPO) vs Stop-Loss Order (SLL)

The most common point of confusion is between a Take Profit and a Stop-Loss Order.

| Feature | Take Profit (TPO) | Stop-Loss Order (SLL) |

|---|---|---|

| Primary Purpose | To lock in profits | To limit losses |

| Order Type | A type of Limit Order | A type of Stop Order |

| Placement (Long Trade) | Above entry price | Below entry price |

| Psychological Driver | Counters Greed | Counters Hope |

Conclusion

Ultimately, the Take Profit Order is more than just a button on a trading platform; it is a fundamental tool for disciplined capital preservation and systematic profit-taking. While its main limitation is the potential for exiting a trade early during a strong trend, its benefits in enforcing a strategy, removing destructive emotions like greed, and protecting your hard-earned gains are undeniable. By consistently incorporating TPOs into your trading plan alongside stop-loss orders, you transition from hoping for profits to strategically planning for them. Start by defining your risk-reward ratio for your next trade and set that TPO before you even click “buy.”

Ready to implement a disciplined trading strategy with Take Profit orders? The foundation of success is a reliable brokerage account. We’ve meticulously reviewed and ranked the Best Online Brokers for Beginner Traders to help you find a platform that makes risk management seamless.

Related Terms

- Stop-Loss Order (SLL): The complementary order to a TPO, designed to limit losses.

- Limit Order: An order to buy or sell at a specific price or better. A TPO is a sell-limit order for a long position.

- Trailing Stop-Loss: A dynamic stop-loss that follows the price up (for a long trade) as it increases, locking in profits while giving the trade room to grow.

- Risk-Reward Ratio: A key metric for setting TPO and stop-loss levels.

- Trading Plan: The overarching strategy that dictates where TPOs should be placed.

Frequently Asked Questions

Recommended Resources

- Advanced Swing Trading Strategies Using TPOs

- YouTube Video: How to Place a Take Profit Order on MetaTrader 4

- U.S. Securities and Exchange Commission (SEC): Limit Orders

- Investopedia: Take-Profit Order (T/P)

How did this post make you feel?

Thanks for your reaction!